Protective Life Corporation (NYSE: PL) today reported results

for the second quarter of 2009. Net income for the second quarter

of 2009 was $90.8 million, or $1.16 per average diluted share,

compared to net income of $38.2 million, or $0.53 per average

diluted share, in the second quarter of 2008. Operating income,

after-tax, for the second quarter of 2009 was $80.9 million, or

$1.03 per average diluted share, compared to $68.6 million, or

$0.96 per average diluted share, in the second quarter of 2008.

John D. Johns, Protective’s Chairman, President and Chief

Executive Officer commented:

“In a very challenging economic environment, we are pleased to

report a record level of net income in the quarter and a near

record level of operating income. Positive developments in the

quarter included: a significant improvement in book value per

share; favorable mortality; a significant reversal in fair value

accounting items; positive sales momentum in the Life Marketing,

Annuities and Asset Protection segments; a lower level of credit

impairments; low levels of delinquencies in our commercial real

estate mortgage portfolio; continued accelerated prepayment of our

non-agency residential mortgage-backed securities (“RMBS”); and a

significant improvement in our statutory capital ratio.

Our major challenges in the quarter included: the drag on

earnings resulting from carrying approximately $1.5 billion of

excess liquidity in our operating companies and continued downward

credit migration in our prime jumbo RMBS portfolio.

Notwithstanding the favorable developments we experienced in the

quarter and growing evidence that conditions in the credit markets

are improving, we expect to see challenging conditions in the

overall economy during the remainder of the year. For the balance

of the year, our focus will be on prudently investing excess

liquidity in higher yielding investments; taking advantage of

disruptions in the marketplace to recruit talent and expand the

depth and breadth of our distributor relationships, especially with

respect to our universal life and annuity product lines; sharpening

the focus of our risk management programs; and managing capital

deployment and credit exposures.”

Net income for the second quarter of 2009 included:

- Net realized investment gains,

after tax, of $9.9 million, or $0.13 per average diluted share,

compared to net realized investment losses, after tax, of $30.4

million, or $0.43 per average diluted share, in the second quarter

of 2008

- Pre-tax other-than-temporary

impairments of $41.0 million, or $0.34 per diluted share, are

included in the $0.13 per share of net realized investment gains in

the second quarter of 2009

Operating income for the second quarter of 2009 included $26.2

million of net positive items, on a pre-tax basis:

Positive Items:

- Positive fair value changes of

$22.6 million on a portfolio of securities designated for

trading

- Positive fair value changes of

$7.0 million in the Annuities segment

- Positive $3.9 million of

unlocking and Guaranteed Minimum Death Benefit (“GMDB”) reserve

changes in the Annuities segment

- Other income of $0.3 million

resulting from the early retirement of funding agreements in the

Stable Value Products segment

Negative Items:

- Life Marketing segment income

was reduced by $5.3 million for non-recurring reserve and

reinsurance adjustments

- Expenses of $2.3 million

associated with consolidation activity, including Life Marketing

segment expenses of $1.1 million, Asset Protection segment expenses

of $0.8 million and Corporate & Other segment expenses of $0.4

million

Business Segment Results

The table below sets forth business segment operating income

(loss) before income tax for the periods shown:

Operating Income (Loss) Before Income Tax ($ in thousands)

2Q2009 2Q2008 $

Chg % Chg Life Marketing $ 37,179 $ 38,127 $ (948 ) -2.5

% Acquisitions 35,041 34,514 527 1.5 % Annuities 21,495 9,487

12,008 126.6 % Stable Value Products 16,976 17,545 (569 ) -3.2 %

Asset Protection 4,656 6,664 (2,008 ) -30.1 % Corporate & Other

9,648 (2,093 ) 11,741 n/m

$ 124,995 $ 104,244 $ 20,751

19.9 %

In the Life Marketing and Asset Protection segments, pre-tax

operating income equals segment income before income tax for all

periods. In the Stable Value Products, Annuities, Acquisitions and

Corporate & Other segments, operating income (loss) excludes

realized investment gains (losses), periodic settlements on

derivatives, and related amortization of DAC and VOBA. A

reconciliation of operating income before income tax to income

before income tax is included below:

($ in thousands)

2Q2009 2Q2008

$ Chg % Chg Operating income before income

tax $ 124,995 $ 104,244 $

20,751 19.9 % Realized investment gains

(losses) Stable Value Products (400 ) 1,823 (2,223 ) n/m Annuities

925 1,095 (170 ) -15.5 % Acquisitions 11,409 (3,824 ) 15,233 n/m

Corporate & Other 3,510 (44,568 ) 48,078 n/m Less: Periodic

settlements on derivatives Corporate & Other 1,163 1,786 (623 )

-34.9 %

Related amortization of deferred

policy acquisition costs and value of businesses acquired

Annuities (670 ) 40 (710 ) n/m Acquisitions (272 )

(535 ) 263 -49.2 %

Income before income tax

$ 140,218 $ 57,479

$ 82,739 143.9 %

Income (loss) before income tax, unlike operating income (loss)

before income tax, does not exclude realized gains (losses), net of

the related amortization of DAC and VOBA, and participating income

from real estate ventures. Income before income tax for the

Acquisitions segment was $46.7 million for the second quarter of

2009 compared to $31.2 million for the second quarter of 2008.

Income before income tax for the Annuities segment was $23.1

million for the second quarter of 2009 compared to $10.5 million

for the second quarter of 2008. Income before income tax for the

Stable Value segment was $16.6 million for the second quarter of

2009 compared to $19.4 million for the second quarter of 2008.

Income before income tax for the Corporate & Other segment was

$12.0 million for the second quarter of 2009 compared to a loss

before income tax of $48.4 million for the second quarter of

2008.

Sales

The Company uses sales statistics to measure the relative

progress of its marketing efforts. The Company derives these

statistics from various sales tracking and administrative systems

and not from its financial reporting systems or financial

statements. These statistics measure only one of many factors that

may affect future business segments’ profitability, and therefore

are not intended to be predictive of future profitability.

The table below sets forth business segment sales for the

periods shown:

($ in millions)

2Q2009

2Q2008 $ Chg % Chg Life Marketing $ 39.7 $

41.1 $ (1.4 ) -3.4 % Annuities 609.7 552.2 57.5 10.4 % Stable Value

Products - 587.8 (587.8 ) n/m Asset Protection 76.2 119.6 (43.4 )

-36.3 %

Review of Business Segment Results

Life Marketing

Life Marketing segment pre-tax operating income was $37.2

million in the second quarter of 2009 compared to $38.1 million in

the second quarter of 2008. The decrease was primarily due to lower

investment income on the term insurance block, negative reserve and

reinsurance adjustments and higher operating expenses, primarily

due to our consolidation activity. These reductions to income were

offset by $9.9 million of favorable mortality in the current

quarter, or a $10.6 million more favorable impact to pre-tax

operating earnings, when compared to the second quarter of

2008.

Sales were $39.7 million in the second quarter of 2009, down

3.4% compared to $41.1 million in the second quarter of 2008. Term

insurance sales in the current quarter were $26.1 million compared

to $26.9 million in the prior year’s quarter. Universal life

insurance sales (including variable universal life) in the current

quarter were $13.6 million compared to $14.2 million in the second

quarter of 2008.

Acquisitions

Acquisitions segment pre-tax operating income was $35.0 million

in the second quarter of 2009 compared to $34.5 million in the

second quarter of 2008, primarily due to lower operating expenses

and improved mortality results of $2.6 million, partially offset by

expected runoff of the blocks of business.

Annuities

Annuities segment pre-tax operating income was $21.5 million in

the second quarter of 2009 compared to $9.5 million in the second

quarter of 2008. The current quarter included $7.0 million of

positive fair value changes, representing an increase of $5.3

million compared to the prior year’s quarter. The variance of $5.3

million compared to the prior year’s quarter includes a $7.0

million favorable variance on embedded derivatives associated with

the variable annuity guaranteed minimum withdrawal benefit (“GMWB”)

rider, partially offset by a $1.7 million unfavorable variance on

the equity indexed annuity product line. Positive unlocking and

GMDB reserve changes improved earnings by $3.9 million in the

current quarter. The segment experienced wider spreads and

continued growth in the SPDA and MVA lines during the second

quarter. Annuity account values were $9.3 billion as of June 30,

2009, an increase of 14.1% over the prior year. Net cash flows for

the segment remained positive during the quarter.

Sales in the second quarter of 2009 were $609.7 million compared

to $552.2 million in the second quarter of 2008. The increase was

primarily due to an increase in variable annuity sales resulting

from market dislocation and growth in our distribution channels.

Variable annuity sales were $177.3 million in the second quarter of

2009 compared to $115.4 million in the second quarter of 2008.

Fixed annuity sales were $432.4 million in the second quarter of

2009 compared to $436.8 million in the prior year’s quarter.

Stable Value

Products

Stable Value Products segment pre-tax operating income was $17.0

million in the second quarter of 2009 compared to $17.5 million in

the second quarter of 2008. The decrease was a result of a decline

in average account values, partially offset by higher operating

spreads. Included in the operating income during the second quarter

of 2009 was $0.3 million of other income resulting from the early

retirement of funding agreements. Excluding this $0.3 million

operating gain, the spread increased 23 basis points to 157 basis

points for the three months ended June 30, 2009, compared to the

prior year’s quarter. Deposit balances as of June 30, 2009 were

$4.1 billion.

There were no sales during the three months ended June 30, 2009

compared to $587.8 million in the previous year’s quarter.

Asset

Protection

Asset Protection segment pre-tax operating income was $4.7

million in the second quarter of 2009 compared to $6.7 million in

the second quarter of 2008. The decrease was primarily the result

of a $4.6 million decrease in service contract income due to

significantly lower sales volume and higher loss ratios. The

current quarter included $0.8 million of consolidation related

expenses.

Sales in the second quarter of 2009 were $76.2 million, down

$43.4 million, or 36.3%, compared to the second quarter of 2008,

driven by the negative impact in all product lines of lower volume

of automobile and marine units sold.

Corporate &

Other

This segment consists primarily of net investment income on

capital, interest expense on debt, various other items not

associated with the other segments and ancillary run-off lines of

business. Corporate & Other segment pre-tax operating income

was $9.6 million in the second quarter of 2009 compared to a $2.1

million loss in the second quarter of 2008. The improvement in the

current quarter was primarily due to mark-to-market adjustments on

a portfolio of securities designated for trading, with a market

value of approximately $328.2 million as of June 30, 2009. The

mark-to-market on this trading portfolio positively impacted income

by $22.6 million for the three months ended June 30, 2009, an $18.3

million more favorable impact than in the prior year’s quarter.

Offsetting this positive mark-to-market change was lower investment

income resulting from reduced yields on a large balance of cash and

short-term investments.

Investments

- Total cash and investments were

$27.9 billion as of June 30, 2009. This includes $2.0 billion of

cash and short-term investments.

- Our net unrealized loss position

was $1.8 billion, prior to tax and DAC offsets, and $1.0 billion,

after tax and DAC offsets.

- During the second quarter of

2009, we recorded $41.0 million of pre-tax credit related loss

other-than-temporary impairments. In addition, $7.9 million of

pre-tax non-credit related losses were recorded as a component of

other comprehensive income.

- Problem loans and foreclosed

properties represented 0.4% of our commercial mortgage loan

portfolio as of June 30, 2009.

Net Realized Investment/Derivative Activity ($

per average diluted share)

2Q 2009 2Q 2008

Impairments/Credit related losses $ (0.34 ) $ (0.73 ) Modco net

activity 0.07 0.05 Net realized gains (excl. Modco) 0.11 0.12

Interest rate related derivatives 0.23 0.04 Credit default swaps

0.06 0.12 All other - (0.03 )

Total

$ 0.13 $ (0.43 )

Operating income differs from the GAAP

measure, net income, in that it excludes realized investment gains

(losses) and related amortization. The tables below reconcile

operating income to net income:

Consolidated Results 2Q 2009 2Q

2008 ($ in thousands; net of income tax)

After-tax Operating Income $ 80,862 $ 68,581

Realized investment gains (losses)

and related amortization

Investments 83,051 (72,746 ) Derivatives (73,156 )

42,349

Net Income $ 90,757

$ 38,184

($ per average diluted share; net

of income tax)

2Q 2009 2Q 2008 After-tax Operating

Income $ 1.03 $ 0.96

Realized investment gains (losses)

and related amortization

Investments 1.06 (1.02 ) Derivatives (0.93 ) 0.59

Net Income $ 1.16 $

0.53

For information relating to non-GAAP

measures (operating income, share owners’ equity per share

excluding other comprehensive income (loss), operating return on

average equity, and net income (loss) return on average equity) in

this press release, please refer to the disclosure at the end of

this press release. All per share results used throughout this

press release are presented on a diluted basis, unless otherwise

noted.

Rolling Twelve Months Ended June 30,

2009 2008 Operating Income Return on

Average Equity 10.4 % 10.2 % Net Income (Loss) Return on

Average Equity (0.1 )% 8.3 %

Operating income return on average equity and net

income return on average equity are measures used by management

to evaluate the Company’s performance. Operating income return on

average equity for the twelve months ended June 30, 2009 was

calculated by dividing operating income for this period by the

average ending balance of share owners’ equity (excluding

accumulated other comprehensive income (loss)) for the five most

recent quarters. Net income(loss) return on average equity for the

twelve months ended June 30, 2009, was calculated by dividing net

income (loss) for this period by the average ending balance of

share owners’ equity (excluding accumulated other comprehensive

income (loss)) for the five most recent quarters.

Reconciliation of Share Owners' Equity, Excluding

Accumulated Other Comprehensive Income (Loss) ($ in thousands)

As of June 30, 2009 2008

Total share owners' equity $ 1,628,375 $ 2,081,742 Less:

Accumuluated other comprehensive income (loss) (1,031,719 )

(486,222 )

Total share owners' equity excluding

accumulated other comprehensive income (loss) $

2,660,094 $ 2,567,964

Reconciliation of Share Owners'

Equity per Share, Excluding Accumulated Other Comprehensive Income

(Loss) per Share

($ per common share oustanding)

As of

June 30, 2009 2008 Total share owners' equity

$ 19.03 $ 29.80 Less: Accumuluated other comprehensive income

(loss) (12.05 ) (6.96 )

Total share owners' equity

excluding accumulated other comprehensive income (loss)

$ 31.08 $ 36.76

2009 Guidance

Due to current market conditions and the potential impact of

fair value accounting on reported results, Protective will not

provide 2009 earnings guidance, but will discuss the outlook for

the remainder of the year during its second quarter 2009 earnings

call as scheduled below.

Conference Call

There will be a conference call for management to discuss the

quarterly results with analysts and professional investors on

August 5, 2009 at 9:00 a.m. Eastern. Analysts and professional

investors may access this call by dialing 1-800-299-7089

(international callers 1-617-801-9714) and entering the conference

passcode: 54845207. A recording of the call will be available from

12:00 p.m. Eastern August 5, 2009 until midnight August 19, 2009.

The recording may be accessed by calling 1-888-286-8010

(international callers 1-617-801-6888) and entering the passcode:

10651887.

The public may access a live webcast of the call, along with a

call presentation, on the Company’s website at www.protective.com

in the Analyst/Investor section. A recording of the webcast will

also be available from 12:00 p.m. Eastern August 5, 2009 until

midnight August 19, 2009.

Supplemental financial information is also available on the

Company’s website at www.protective.com in the Analyst/Investor

section under Financial Information/Quarterly & Other

Reports.

Information Relating to Non-GAAP Measures

Throughout this press release, GAAP refers to accounting

principles generally accepted in the United States of America.

Consolidated and segment operating income (loss) are defined

as income (loss) before income tax excluding net realized

investment gains (losses) net of the related amortization of

deferred policy acquisition costs (“DAC”),and value of businesses

acquired (“VOBA”), and participating income from real estate

ventures. Periodic settlements of derivatives associated with

corporate debt and certain investments and annuity products are

included in realized gains (losses) but are considered part of

consolidated and segment operating income because the derivatives

are used to mitigate risk in items affecting consolidated and

segment operating income (loss). Management believes that

consolidated and segment operating income (loss) provides relevant

and useful information to investors, as it represents the basis on

which the performance of the Company’s business is internally

assessed. Although the items excluded from consolidated and segment

operating income (loss) may be significant components in

understanding and assessing the Company’s overall financial

performance, management believes that consolidated and segment

operating income (loss) enhances an investor’s understanding of the

Company’s results of operations by highlighting the income (loss)

attributable to the normal, recurring operations of the Company’s

business. As prescribed by GAAP, certain investments are recorded

at their market values with the resulting unrealized gains (losses)

affected by a related adjustment to DAC and VOBA, net of income

tax, reported as a component of share owners’ equity. The market

values of fixed maturities increase or decrease as interest rates

change. The Company believes that an insurance company’s share

owners’ equity per share may be difficult to analyze without

disclosing the effects of recording accumulated other comprehensive

income (loss), including unrealized gains (losses) on

investments.

Calculation of Operating Income

Return on Average Equity

Rolling Twelve Months Ended

June 30, 2009

$ in thousands

Twelve Three Months Ended Months

Ended NUMERATOR: 9/30/2008 12/31/2008

3/31/2009 6/30/2009 6/30/2009 Net

Income (Loss) $ (100,008 ) $ (15,913 ) $ 22,135 $ 90,757 $

(3,029 ) Net of:

Realized investment gains

(losses), net of income tax

Investments (228,215 ) (60,407 ) (85,585 ) 82,439 (291,768 )

Derivatives 66,543 (10,574 ) 47,675 (72,400 ) 31,244

Related amortization of DAC and

VOBA, net of income tax

457 (632 ) (51 ) 612 386 Add back:

Derivative gains related to Corp.

debt and investments, net of income tax

1,245 1,020 1,455

756 4,476

Operating Income $

62,452 $ 56,720 $ 61,551 $ 80,862

$ 261,585 Share-Owners'

Accumulated Equity Excluding Other

Accumulated Other Share-Owners' Comprehensive

Comprehensive DENOMINATOR: Equity Income

(Loss) Income (Loss) June 30, 2008 $ 2,081,742 $

(486,222 ) $ 2,567,964 September 30, 2008 1,524,655 (928,205 )

2,452,860 December 31, 2008 761,095 (1,667,056 ) 2,428,151 March

31, 2009 783,178 (1,660,204 ) 2,443,382 June 30, 2009 1,628,375

(1,031,719 ) 2,660,094 Total $ 12,552,451

Average

$ 2,510,490

Operating Income Return on Average Equity 10.4

%

Calculation of Net Income

(Loss) Return on Average Equity

Rolling Twelve Months Ended

June 30, 2009

$ in thousands

Twelve Three Months Ended Months

Ended NUMERATOR: 9/30/2008 12/31/2008

3/31/2009 6/30/2009 6/30/2009 Net

Income (Loss) $ (100,008 ) $ (15,913 ) $ 22,135 $ 90,757

$ (3,029 )

Share-Owners' Accumulated

Equity Excluding Other Accumulated Other

Share-Owners' Comprehensive Comprehensive

DENOMINATOR: Equity Income (Loss) Income

(Loss) June 30, 2008 $ 2,081,742 $ (486,222 ) $

2,567,964 September 30, 2008 1,524,655 (928,205 ) 2,452,860

December 31, 2008 761,095 (1,667,056 ) 2,428,151 March 31, 2009

783,178 (1,660,204 ) 2,443,382 June 30, 2009 1,628,375 (1,031,719 )

2,660,094 Total $ 12,552,451

Average

$ 2,510,490 Net Income

(Loss) Return on Average Equity -0.1 %

Forward-Looking Statements

This release and the supplemental financial information provided

includes “forward-looking statements” which express expectations of

future events and/or results. All statements based on future

expectations rather than on historical facts are forward-looking

statements that involve a number of risks and uncertainties, and

the Company cannot give assurance that such statements will prove

to be correct. The factors which could affect the Company’s future

results include, but are not limited to, general economic

conditions and the following known risks and uncertainties: the

Company is exposed to the risks of natural disasters, pandemics,

malicious and terrorist acts that could adversely affect the

Company’s operations; the Company operates in a mature, highly

competitive industry, which could limit its ability to gain or

maintain its position in the industry and negatively affect

profitability; a ratings downgrade or other negative action by a

ratings organization could adversely affect the Company; the

Company’s policy claims fluctuate from period to period resulting

in earnings volatility; the Company’s results may be negatively

affected should actual experience differ from management’s

assumptions and estimates which by their nature are imprecise and

subject to changes and revision over time; the use of reinsurance,

and any change in the magnitude of reinsurance, introduces

variability in the Company’s statements of income; the Company

could be forced to sell investments at a loss to cover policyholder

withdrawals; interest rate fluctuations could negatively affect the

Company’s spread income or otherwise impact its business,

including, but not limited to, the volume of sales, the

profitability of products, investment performance, and asset

liability management; equity market volatility could negatively

impact the Company’s business, particularly with respect to the

Company’s variable products, including an increase in the rate of

amortization of DAC and estimated cost of providing minimum death

benefit and minimum withdrawal benefit guarantees relating to the

variable products; insurance companies are highly regulated and

subject to numerous legal restrictions and regulations, including,

but not limited to, restrictions relating to premium rates, reserve

requirements, marketing practices, advertising, privacy, policy

forms, reinsurance reserve requirements, acquisitions, and capital

adequacy, and the Company cannot predict whether or when regulatory

actions may be taken that could adversely affect the Company or its

operations; changes to tax law or interpretations of existing tax

law could adversely affect the Company, including, but not limited

to, the demand for and profitability of its insurance products and

the Company’s ability to compete with non-insurance products; the

Company may be required to establish a valuation allowance against

its deferred tax assets, which could materially adversely affect

the Company’s results of operations, financial condition and

capital position; financial services companies are frequently the

targets of litigation, including, but not limited to, class action

litigation, which could result in substantial judgments, and the

Company, like other financial services companies, in the ordinary

course of business is involved in litigation and arbitration;

publicly held companies in general and the financial services

industry in particular are sometimes the target of law enforcement

investigations and the focus of increased regulatory scrutiny; the

Company’s ability to maintain competitive unit costs is dependent

upon the level of new sales and persistency of existing business,

and a change in persistency may result in higher claims and/or

higher or more rapid amortization of deferred policy acquisition

costs and thus higher unit costs and lower reported earnings; the

Company’s investments, including, but not limited to, the Company’s

invested assets, derivative financial instruments and commercial

mortgage loan portfolio, are subject to market, credit, and

regulatory risks, and these risks could be heightened during

periods of extreme volatility or disruption in financial and credit

markets; the Company may not realize its anticipated financial

results from its acquisitions strategy, which is dependent on

factors such as the availability of suitable acquisitions, the

availability of capital to fund acquisitions and the realization of

assumptions relating to the acquisition; the Company may not be

able to achieve the expected results from its recent acquisition;

the Company is dependent on the performance of others, including,

but not limited to, distributors, third-party administrators, fund

managers, reinsurers and other service providers, and, as with all

financial services companies, its ability to conduct business is

dependent upon consumer confidence in the industry and its

products; the Company’s reinsurers could fail to meet assumed

obligations, increase rates, or be subject to adverse developments

that could affect the Company, and the Company’s ability to compete

is dependent on the availability of reinsurance, which has become

more costly and less available in recent years, or other substitute

capital market solutions; the success of the Company’s captive

reinsurance program and related marketing efforts is dependent on a

number of factors outside the control of the Company, including,

but not limited to, continued access to capital markets, a

favorable regulatory environment, and the overall tax position of

the Company; computer viruses or network security breaches could

affect the data processing systems of the Company or its business

partners, and could damage the Company’s business and adversely

affect its financial condition and results of operations; the

Company’s ability to grow depends in large part upon the continued

availability of capital, which has been negatively impacted by

regulatory action and the volatility and disruption in the capital

and credit markets, and may be negatively impacted in the future by

an increase in guaranteed minimum death and withdrawal benefit

related policy liabilities in variable products resulting from

negative performance in the equity markets, and future marketing

plans are dependent on access to the capital markets through

securitization; and new GAAP and statutory accounting rules or

changes to existing GAAP and statutory accounting rules could

negatively impact the Company; the Company’s risk management

policies and procedures may leave it exposed to unidentified or

unanticipated risk, which could negatively affect our business or

result in losses; capital and credit market volatility or

disruption could adversely impact the Company’s financial condition

or results from operations in several ways, including but not

limited to the following: causing market price and cash flow

variability in the Company’s fixed income portfolio, defaults on

principal or interest payments by issuers of the Company’s fixed

income investments, other than temporary impairments of the

Company’s fixed income investments; adversely impacting the

Company’s ability to efficiently access the capital markets to

finance its reserve, capital and liquidity needs; difficult

conditions in the economy generally, including severe or extended

economic recession, could adversely affect the Company’s business

and results from operations; and there can be no assurance that the

actions of the U.S. Government or other governmental and regulatory

bodies for the purpose of stabilizing the financial markets will

achieve their intended effect; the Company may not be able to

protect its intellectual property and may be subject to

infringement claims; the Company could be adversely affected by an

inability to access its credit facility; the amount of statutory

capital the Company has and must hold to maintain its financial

strength and credit ratings and meet other requirements can vary

significantly and is sensitive to a number of factors; the Company

operates as a holding company and depends on the ability of its

subsidiaries to transfer funds to it to meet its obligations and to

pay dividends. Please refer to Part I, Item 1A, Risk Factors and

Cautionary Factors that may Affect Future Results of the Company’s

most recent Form 10-K and Part II, Item 1A, Risk Factors, of the

Company’s most recent Form 10-Q for more information about these

factors.

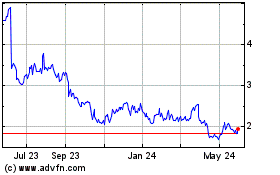

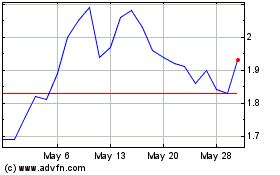

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jul 2023 to Jul 2024