A.M. Best Downgrades ICRs and Affirms FSR of Protective; Revises Outlooks to Negative

February 11 2009 - 4:23PM

Business Wire

A.M. Best Co. has affirmed the financial strength rating

(FSR) of A+ (Superior) and downgraded the issuer credit ratings

(ICR) to �aa-� from �aa� of the primary life/health subsidiaries of

Protective Life Corporation (Protective) (Birmingham, AL)

[NYSE: PL] led by Protective Life Insurance Company (PLIC)

(Brentwood, TN). Concurrently, A.M. Best has downgraded the ICR to

�a-� from �a� and debt ratings of Protective. In addition, A.M.

Best has downgraded the debt ratings of the outstanding notes

issued for the various funding agreement-backed securities (FABS)

programs of PLIC. The outlook for all ratings has been revised to

negative from stable. (See link below for a detailed listing of the

companies and ratings.)

The downgrades reflect the decline in PLIC�s risk-based capital

position during 2008 as a result of realized investment losses and

the accumulation of reserve strain from recently issued term and

universal life insurance business. The downgrades also reflect A.M.

Best�s expectation that near-term improvement in PLIC�s capital

ratio will be dampened by likely adverse investment experience and

by the build-up of excess statutory reserves as Protective issues

new business. Prior to the credit market freeze, PLIC�s capital

ratio benefited from capital market securitizations, whereby

external funding was raised, and statutory capital was subsequently

released, when blocks of excess reserves were securitized through

captive reinsurers.

The negative outlook reflects the likelihood of additional, and

possibly significant, investment losses as indicated by

Protective�s net unrealized loss position. With the severe credit

spread widening that occurred during fourth quarter 2008,

Protective�s GAAP net unrealized losses as of December 31, 2008

totaled nearly $1.7 billion or approximately two-thirds of gross

stockholders� equity. The negative outlook also recognizes the

limitations on Protective�s financial flexibility as a result of

its current level of leverage combined with the ongoing turmoil in

the financial markets. Protective�s all-in financial

leverage�senior debt plus hybrids�is slightly over 30% and near the

upper end of the range for its ratings. Additionally, Protective�s

future earnings may be reduced due to a smaller contribution from

the stable value segment as the stable value market has been

hampered by the credit freeze. Protective�s ratio of deferred

acquisition costs to equity has risen significantly over the past

year and may pressure the ratings should the ratio remain elevated

for an extended period.

Offsetting these negative rating factors are Protective�s

diversified revenue and profit sources, broad distribution

capabilities and its strong track record of effectively integrating

acquired insurance companies and blocks of business. Despite the

net loss for 2008, A.M. Best notes that Protective�s business mix

of primarily traditional life insurance provides for greater

earnings stability than other companies that have large equity

market exposures. The stable, recurring premiums associated with

Protective�s seasoned block of life business are a source of

strength, and the block contains significant embedded profits. A.M.

Best also notes that Protective has sufficient liquidity in cash,

short-term holdings and expected asset cash flows to meet scheduled

maturities without the need for asset sales, stable value liability

sales or external debt funding. Additionally, Protective does not

have a significant corporate debt maturity until 2013.

For a complete listing of Protective Life Corporation�s FSRs,

ICRs and debt ratings, please visit

www.ambest.com/press/021102protective.pdf.

The principal methodologies used in determining these ratings,

including any additional methodologies and factors, which may have

been considered, can be found at

www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is a global full-service

credit rating organization dedicated to serving the financial and

health care service industries, including insurance companies,

banks, hospitals and health care system providers. For more

information, visit www.ambest.com.

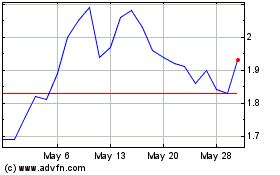

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2024 to Jul 2024

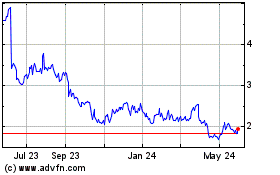

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jul 2023 to Jul 2024