Innovative New Term Life Insurance Policies Now Available from Protective Life and West Coast Life

November 17 2008 - 5:59PM

Business Wire

Protective Life Insurance Company and West Coast Life Insurance

Company announced the release of a two new innovative life

insurance policies designed to meet the changing needs of today�s

consumer. The Protective Term Income ProviderSM and the West Coast

Life Income Replacement TermSM are term life insurance policies

that provide a guaranteed income stream death benefit to designated

beneficiaries. Priced more affordably than traditional lump sum

term life products, Protective Term Income Provider and West Coast

Life Income Replacement Term give consumers the ability to help

their families satisfy immediate financial obligations and provide

for ongoing income needs. The Protective Term Income Provider and

West Coast Life Income Replacement Term allow policy holders to

select the amount, duration and frequency of guaranteed income

payments. Plus, the policies include the option to provide for an

initial lump sum distribution in order to help meet immediate needs

such as a mortgage, autos, tuition, and final expenses. �Industry

research shows that 66% of consumers purchase life insurance to

replace income,�* says John Deremo, Senior Vice President and Chief

Distribution Officer of Protective Life. �Our own focus groups

confirmed this finding and gave us additional insights into

consumers� concerns both about making sure their families can pay

off large debts, such as final expenses and mortgages, as well as

providing a secure, guaranteed source of income to pay for on-going

expenses of daily living. The Term Income Provider and Income

Replacement Term can provide a more complete solution to consumers�

needs. Plus, they give policyholders the ability to customize the

products to address their individual debt and income concerns.�

With the Protective Term Income Provider and West Coast Life Income

Replacement Term, consumers will enjoy premium cost-savings that

can range from 7% to 39% over traditional term life insurance

policies, depending upon the options selected. The savings makes it

affordable for families to purchase an adequate amount of coverage,

when it otherwise may not have been possible. Protective Term

Income Provider and West Coast Life Income Replacement Term offer

several options for customizing a policy. Level premium periods

include 10, 15, 20, 25 and 30 years with coverage amounts of

$100,000 or more. The purchaser can select the amount and duration

of the guaranteed income stream death benefit payments at the time

of issue. The payment periods range from 5 years to 30 years, and

the frequency of payments can be monthly, through electronic

transfers, or annually. An initial lump sum payment is also

available though an optional rider, which is available at an

additional cost. The beneficiary is allowed to commute future

benefit payments at an additional cost. �We feel the time is right

for the Term Income Provider and Income Replacement Term,� Deremo

continued. �They provide a great option for value-conscious

consumers at a time when we need it most. The products� value,

flexibility and simplicity should have very broad-based appeal.�

About Protective Life and West Coast Life Insurance Companies

Protective Life Corporation was established on a profound belief in

the American dream: provide quality products with excellent service

and success will follow. This unwavering commitment to treating

people the way we would like to be treated has been rewarded with

stable, long-term relationships and growth. Today, our employees

nationwide are dedicated every day to proving the wisdom of our

collective vision: Doing the right thing is smart business.�

Protective Life Corporation offers a broad portfolio of life and

specialty insurance and investment products through its insurance

company subsidiaries, Protective Life Insurance Company and West

Coast Life Insurance Company. *Source: LIMRA International�s

Finding New Customers. Who�s buying Individual Life and Why?

(2005). Policy form TL-16 and state variations thereof, is a term

life insurance policy issued by Protective Life Insurance Company,

2801 Highway 280 South, Birmingham, AL 35223. Product features and

availability may vary by state. Consult policy for benefits,

riders, limitations and exclusions. Subject to underwriting.

Subject to up to a two-year contestable and suicide period.

Benefits adjusted for misstatements of age or sex. In Montana,

unisex rates apply. Policy form WC-T16 and state variations

thereof, is a term life insurance policy issued by West Coast Life

Insurance Company, 343 Sansome Street, San Francisco, CA 94104.

Product features and availability may vary by state. Consult policy

for benefits, riders, limitations and exclusions. Subject to

underwriting. Subject to up to a two-year contestable and suicide

period. Benefits adjusted for misstatements of age or sex. In

Montana, unisex rates apply.

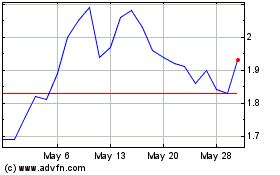

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From May 2024 to Jun 2024

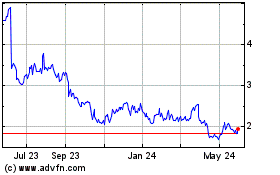

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2023 to Jun 2024