US Credit Markets Absorbed $3.33 Billion Of New Issuance Monday

November 28 2011 - 8:21PM

Dow Jones News

Corporate-bond issuers were able to take advantage of favorable

market conditions in the U.S. Monday before newfound optimism

fizzled out in the afternoon.

No fewer than seven deals hit the U.S. credit markets as issuers

waiting for an opportune moment finally got their chance to meet

investors willing to take some risk.

High-grade new issuance totaled $3.33 billion Monday. Last week,

due to heightened concerns boiling in Europe and a holiday

interruption, no high-yield borrowers had entered the primary

market.

One syndicate manager said more deals are ready in the pipeline

for the remainder of this week, but he noted credit didn't perform

as well as equities Monday, so it is unclear how much will come

through the system.

"I imagine we're back in day-to-day mode for the time being," he

said.

Tesco PLC (TSCO.LN, TSCDY), the UK retail-grocery giant, was the

largest corporate issuer Monday with a $1 billion private

placement. The two-part borrowing included 2% coupon, three-year

bonds priced to yield 2.036%, reflecting a risk premium to

Treasurys of 165 basis points, and 2.70% coupon, five-year notes

priced to yield 2.723%, offering a spread of 180 basis points over

Treasurys. A basis point is one-hundredth of a percentage

point.

The bonds were rated A3 by Moody's Investors Service and A-minus

by Standard & Poor's and Fitch Ratings.

Knoxville, Tenn.-based Scripps Networks Interactive Inc (SNI)

marketed $500 million in five-year notes priced to yield 2.726%,

for a risk premium to Treasurys of 180 basis points, according to a

person familiar with the deal.

Canadian Pacific Railway Co. (CP, CP.T) sold a $500 million deal

evenly structured with 10-year and 30-year maturities. The 10-year

portion was sold at 2.75 percentage points over Treasurys and the

30-year bonds were being sold at 3.0 percentage points over

Treasurys, according to a person familiar with the deal.

Long-term investors also mopped up a rare 50-year bond deal from

DTE Energy Co. (DTE). The bonds featured a 6.50% coupon. Favorable

conditions allowed the Detroit, Mich., electric-and-natural-gas

provider to borrow $280 million, compared with an original

projection of $150 million.

The bonds are junior subordinated debentures due in 2061, with

credit ratings of Baa3 from Moody's Investors Service, an

equivalent BBB-minus from Standard & Poor's, and a BB-plus

rating--just below investment grade--from Fitch Ratings.

National Fuel Gas Co. (NFG) increased the size of its 10-year

bond offering by $150 million to $500 million. The 4.90% coupon

bonds were priced to yield 4.917%, a spread to Treasurys of 295

basis points.

According to data provider Dealogic, that coupon is the lowest

ever on a 10-year deal for National Fuel.

Other deals in Monday's market included a $250 million offering

from PG&E Corp. (PCG), also known as Pacific Gas &

Electric, which priced 30-year bonds at a yield of 4.521%--its

lowest ever for that maturity.

AGCO Corp. (AGCO) also sold $300 million of 5.875% coupon bonds

maturing in 10 years, at par. That too is the issuer's lowest yield

ever at that tenor, according to Dealogic.

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

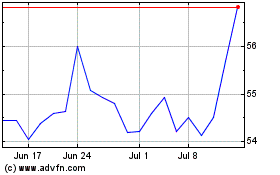

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Jun 2024 to Jul 2024

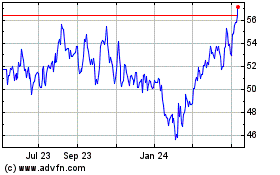

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Jul 2023 to Jul 2024