National Fuel Gas Company Announces Sale of Its Landfill Gas Business

September 03 2010 - 4:04PM

Business Wire

National Fuel Gas Company (“National Fuel” or the “Company”)

(NYSE: NFG) announces the closing of the sale of its landfill gas

business to Toro Energy GP II, LLC, Toro Energy Holdings II, LP and

another undisclosed buyer.

The sale is expected to result in a non-recurring gain in the

Company’s fourth quarter, which closes on September 30, 2010.

Because of this transaction, the Company is today updating its GAAP

earnings guidance for fiscal 2010 to a range of $2.65 to $2.75 per

share (from the most recent guidance of $2.60 to $2.70 per

share).

“With the sale of our landfill gas business, we continue to make

progress on the strategy of divesting our smaller, non-core assets.

This transaction, coupled with the previously announced agreement

to sell our sawmill operations, demonstrates our commitment to

National Fuel’s core businesses, including the development of the

Marcellus Shale and the construction of key pipeline infrastructure

projects throughout the Appalachian region,” said David F. Smith,

Chairman and Chief Executive Officer.

The Company’s landfill gas operation was maintained under

National Fuel’s wholly owned subsidiary Horizon LFG, Inc., which

owned and operated seven short-distance landfill gas pipeline

companies that purchase, process, transport and resell landfill gas

to customers in six states. Ewing Bemiss & Co. was the

Company’s exclusive adviser on the transaction.

National Fuel is an integrated energy company with $4.9 billion

in assets distributed among the following four operating segments:

Exploration and Production, Pipeline and Storage, Utility and

Energy Marketing. Additional information about National Fuel is

available on its website at investor.nationalfuelgas.com or through

its investor information service at 1-800-334-2188.

Certain statements contained herein, including those that are

identified by the use of the words “anticipates,” “estimates,”

“expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,”

“believes,” “seeks,” “will,” “may” and similar expressions, are

“forward-looking statements” as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

risks and uncertainties, which could cause actual results or

outcomes to differ materially from those expressed in the

forward-looking statements. The Company’s expectations, beliefs and

projections contained herein are expressed in good faith and are

believed to have a reasonable basis, but there can be no assurance

that such expectations, beliefs or projections will result or be

achieved or accomplished. In addition to other factors, the

following are important factors that could cause actual results to

differ materially from those discussed in the forward-looking

statements: financial and economic conditions, including the

availability of credit, and their effect on the Company’s ability

to obtain financing on acceptable terms for working capital,

capital expenditures and other investments; occurrences affecting

the Company’s ability to obtain financing under credit lines or

other credit facilities or through the issuance of commercial

paper, other short-term notes or debt or equity securities,

including any downgrades in the Company’s credit ratings and

changes in interest rates and other capital market conditions;

changes in economic conditions, including global, national or

regional recessions, and their effect on the demand for, and

customers’ ability to pay for, the Company’s products and services;

the creditworthiness or performance of the Company’s key suppliers,

customers and counterparties; economic disruptions or uninsured

losses resulting from terrorist activities, acts of war, major

accidents, fires, hurricanes, other severe weather, pest

infestation or other natural disasters; changes in demographic

patterns and weather conditions; changes in the availability and/or

price of natural gas or oil and the effect of such changes on the

accounting treatment of derivative financial instruments or the

valuation of the Company’s natural gas and oil reserves;

impairments under the SEC’s full cost ceiling test for natural gas

and oil reserves; uncertainty of oil and gas reserve estimates;

factors affecting the Company’s ability to successfully identify,

drill for and produce economically viable natural gas and oil

reserves, including among others geology, lease availability,

weather conditions, shortages, delays or unavailability of

equipment and services required in drilling operations,

insufficient gathering, processing and transportation capacity, and

the need to obtain governmental approvals and permits and comply

with environmental laws and regulations; significant differences

between the Company’s projected and actual production levels for

natural gas or oil; changes in the availability and/or price of

derivative financial instruments; changes in the price

differentials between oil having different quality and/or different

geographic locations, or changes in the price differentials between

natural gas having different heating values and/or different

geographic locations; changes in laws and regulations to which the

Company is subject, including those involving derivatives, taxes,

safety, employment, climate change, other environmental matters,

and exploration and production activities such as hydraulic

fracturing; the nature and projected profitability of pending and

potential projects and other investments, and the ability to obtain

necessary governmental approvals and permits; significant

differences between the Company’s projected and actual capital

expenditures and operating expenses, and unanticipated project

delays or changes in project costs or plans; inability to obtain

new customers or retain existing ones; significant changes in

competitive factors affecting the Company; governmental/regulatory

actions, initiatives and proceedings, including those involving

derivatives, acquisitions, financings, rate cases (which address,

among other things, allowed rates of return, rate design and

retained natural gas), affiliate relationships, industry structure,

franchise renewal, and environmental/safety requirements;

unanticipated impacts of restructuring initiatives in the natural

gas and electric industries; ability to successfully identify and

finance acquisitions or other investments and ability to operate

and integrate existing and any subsequently acquired business or

properties; changes in actuarial assumptions, the interest rate

environment and the return on plan/trust assets related to the

Company’s pension and other post-retirement benefits, which can

affect future funding obligations and costs and plan liabilities;

significant changes in tax rates or policies or in rates of

inflation or interest; significant changes in the Company’s

relationship with its employees or contractors and the potential

adverse effects if labor disputes, grievances or shortages were to

occur; changes in accounting principles or the application of such

principles to the Company; the cost and effects of legal and

administrative claims against the Company or activist shareholder

campaigns to effect changes at the Company; increasing health care

costs and the resulting effect on health insurance premiums and on

the obligation to provide other post-retirement benefits; or

increasing costs of insurance, changes in coverage and the ability

to obtain insurance. The Company disclaims any obligation to update

any forward-looking statements to reflect events or circumstances

after the date hereof.

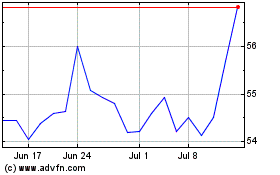

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From May 2024 to Jun 2024

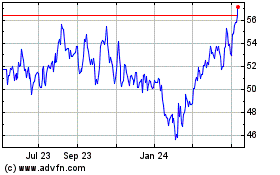

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Jun 2023 to Jun 2024