National Fuel Gas Company (“National Fuel” or the “Company”)

(NYSE:NFG) today announced consolidated earnings for the second

quarter of fiscal 2010 and for the six-months ended March 31,

2010.

HIGHLIGHTS

- Earnings for the second quarter

were $80.4 million or $0.97 per share, an increase of $6.9 million

or $0.05 per share from the second quarter of fiscal 2009.

- Compared to the prior year’s

second quarter, production of crude oil and natural gas increased

nearly 1.7 billion cubic feet equivalent (“Bcfe”), or 16.6%, to

11.8 Bcfe. Appalachian production increased 1.5 Bcfe or 68.7%, of

which 1.3 Bcfe came from the Marcellus Shale. The Company’s

production forecast for the entire 2010 fiscal year has been

narrowed to a range between 46 and 51 Bcfe. The previous forecast

range had been between 44 and 51 Bcfe.

- Seneca-operated Marcellus

production into Midstream’s Covington Gathering System continued to

increase during the quarter. The current daily gross production

from the Seneca-operated Marcellus wells is 30 million cubic feet

per day (“MMCFD”) with six wells flowing.

- Seneca’s joint-venture partner,

EOG Resources, Inc., has completed a pipeline interconnection with

Dominion Transmission, Inc. and has commenced sustained production

from the joint-venture wells in Clearfield County.

- The Pipeline and Storage segment

of the Company has entered into additional contracts with customers

with respect to interstate pipeline projects to transport Marcellus

production. The Company recently announced the signing of precedent

agreements for substantial capacity on Supply Corporation’s

Northern Access expansion project and Empire’s Tioga County

Extension Project.

- The Company is narrowing its

GAAP earnings guidance range for fiscal 2010 to a range of $2.45 to

$2.70 per share. The previous earnings guidance had been a range

between $2.40 to $2.70 per share. This guidance assumes flat NYMEX

pricing of $5.00 per Million British Thermal Units (“MMBtu”) for

natural gas and $75.00 per barrel (“Bbl”) for crude oil for

unhedged production for the remainder of the fiscal year.

- A conference call is scheduled

for Friday, May 7, 2010, at 11 a.m. Eastern Time.

MANAGEMENT COMMENTS

David F. Smith, Chairman, President and Chief Executive Officer

of National Fuel Gas Company, stated: “Throughout the second

quarter, the growth opportunities presented by the Marcellus Shale

continued to become more evident. Not only has our Exploration and

Production segment been able to increase production by 17% over the

prior year, but the Pipeline and Storage segment has reached

several major milestones in broadening markets for Appalachian gas

production. These new markets will help both Seneca and other

Marcellus producers alleviate some of the current regional

infrastructure constraints.”

“As we continue to move forward and execute our Appalachian

strategy, we are excited about the growth potential present in the

Marcellus. With the financial strength provided by the stable and

predictable earnings of our regulated businesses, we intend to

capitalize on these opportunities and position National Fuel Gas

Company as an industry leader in the Appalachian Basin.”

“With all of the focus on developing the gas-oriented Marcellus,

it is important to note that Seneca’s oil and gas balance has

provided significant protection from the recent sustained decrease

in natural gas commodity prices. With oil accounting for 40 percent

of the total production this quarter, Seneca’s earnings benefited

from the strength of oil prices, as well as from the increase in

natural gas production.”

“As I have said before, National Fuel’s ability to successfully

execute the large number of opportunities available to us will

provide benefits for our shareholders, customers and

employees.”

SUMMARY OF RESULTS

National Fuel had consolidated earnings for the quarter ended

March 31, 2010, of $80.4 million or $0.97 per share, compared to

the prior year’s second quarter earnings of $73.5 million, or $0.92

per share, an increase of $6.9 million or $0.05 per share. (Note:

all references to earnings per share are to diluted earnings per

share, all amounts are stated in U.S. dollars, and all amounts used

in the discussion of earnings and operating results before items

impacting comparability (“Operating Results”) are after tax, unless

otherwise noted).

Consolidated earnings for the six months ended March 31, 2010,

of $144.9 million, or $1.76 per share, increased $114.1 million, or

$1.38 per share, from the same period in the prior year, where

earnings were $30.8 million, or $0.38 per share.

Three Months Six Months Ended March 31, Ended

March 31, 2010 2009 2010 2009 (in thousands except

per share amounts)

Reported GAAP earnings $ 80,428 $ 73,484

$ 144,927 $ 30,806

Items impacting

comparability1: Impairment of oil and gas

producing properties 108,207 Impairment of investment in

partnership 1,085 Gain on life insurance policies (2,312 )

Operating Results $ 80,428 $ 73,484 $

144,927 $ 137,786

Reported GAAP earnings per

share $ 0.97 $ 0.92 $ 1.76 $ 0.38

Items impacting

comparability1: Impairment of oil and gas

producing properties 1.35 Impairment of investment in partnership

0.01 Gain on life insurance policies (0.03 )

Operating Results $ 0.97 $ 0.92 $ 1.76 $ 1.71

1 See discussion of these individual items below.

As outlined in the table above, certain items included in GAAP

earnings impacted the comparability of the Company’s financial

results when comparing the six months ended March 31, 2010, to the

comparable period in fiscal 2009. Excluding these items, Operating

Results for the six months ended March 31, 2010 of $144.9 million,

or $1.76 per share, increased $7.1 million, or $0.05 per share from

the same period in the prior year, where Operating Results were

$137.8 million, or $1.71 per share. Items impacting comparability

will be discussed in more detail within the discussion of segment

earnings below.

DISCUSSION OF RESULTS BY SEGMENT

(The following discussion of earnings for each segment is

summarized in a tabular form at pages 10 through 13 of this report.

It may be helpful to refer to those tables while reviewing this

discussion.)

Exploration and Production

Segment

The Exploration and Production segment operations are carried

out by Seneca Resources Corporation (“Seneca”). Seneca explores

for, develops and purchases natural gas and oil reserves in

California, in the Appalachian region, and in the Gulf of

Mexico.

The Exploration and Production segment’s earnings in the second

quarter of fiscal 2010 of $27.4 million, or $0.33 per share,

increased $9.3 million, or $0.10 per share, when compared with the

prior year’s second quarter. The increase was mainly due to

increased natural gas production and higher crude oil prices

realized after hedging.

Overall production for the current quarter of 11.8 Bcfe

increased nearly 1.7 Bcfe, or 16.6 percent compared to the prior

year’s second quarter. Production increased 68.7 percent in

Appalachia due to higher production mainly from Marcellus wells. In

the Gulf of Mexico, production increased by 7.7 percent.

In addition to the higher production, higher crude oil prices

realized after hedging contributed to the increase in earnings.

Lower natural gas prices realized after hedging reduced earnings.

For the quarter ended March 31, 2010, the weighted average oil

price received by Seneca (after hedging) was $77.29 per Bbl, an

increase of $20.90 per Bbl from the prior year’s quarter. The

weighted average natural gas price received by Seneca (after

hedging) for the quarter ended March 31, 2010, was $6.54 per

thousand cubic feet (“Mcf”), a decrease of $0.99 per Mcf.

Several other items also impacted earnings; including higher

lease operating expenses (“LOE”) (mainly due to higher steam fuel

cost and the operating costs associated with the July 2009

acquisition of the Ivanhoe assets in California, and the costs to

transport Marcellus production in Appalachia) and higher depletion

expense (due mainly to the increase in production). Earnings were

also impacted by lower other operating expenses. A bad debt charge

related to a customer’s bankruptcy filing and the recognition of

actual plugging costs in excess of amounts previously accrued in

the prior year’s second quarter did not recur in the current

year.

The Exploration and Production segment’s earnings of $57.2

million, or $0.69 per share, for the six months ended March 31,

2010, compares to a loss of $65.5 million, or $0.82 per share, for

the six months ended March 31, 2009. The increase was mainly due to

the non-cash impairment charge of $108.2 million taken in the first

quarter of fiscal 2009 to write down the value of Seneca’s oil and

natural gas producing properties. Seneca uses the full cost method

of accounting for determining the book value of its oil and natural

gas properties. This accounting method requires that Seneca perform

a quarterly “ceiling test” to compare the present value of future

revenues from its oil and natural gas reserves based on period end

spot prices (the “ceiling”) with the book value of those reserves

at the balance sheet date. If the book value of the reserves

exceeds the ceiling calculation, a non-cash impairment charge must

be recorded in order to reduce the book value of the reserves to

the calculated ceiling. The impairment at December 31, 2008 was

mainly driven by a significant decrease in commodity prices. At

March 31, 2010, the ceiling exceeded the book value of Seneca’s oil

and gas properties by approximately $290 million.

Excluding the impact of the ceiling test charge in the prior

year’s first quarter, Operating Results for the six months ended

March 31, 2010, of $57.2 million or $0.69 per share increased $14.4

million, or $0.16 per share, from the prior year. The increase was

primarily due to higher natural gas production and higher crude oil

prices realized after hedging.

Overall production for the six months ended March 31, 2010

increased 18.5 percent to 23.3 Bcfe, an increase of 3.6 Bcfe

compared to the prior year’s six month period. Production increased

58.7 percent in Appalachia mainly due to Marcellus production that

came on-line during the first and second quarters of the current

fiscal year, and higher production from upper Devonian wells. In

the Gulf of Mexico, production increased by 23.1 percent due to

production from a new discovery that came on-line late in the

second quarter of fiscal 2009.

In addition to overall higher production, higher crude oil

prices realized after hedging contributed to the increase in

Operating Results. Lower natural gas prices realized after hedging

reduced Operating Results. For the six months ended March 31, 2010,

the weighted average oil price received by Seneca (after hedging)

was $75.86 per Bbl, an increase of $15.50 per Bbl from the prior

year’s six month period. The weighted average natural gas price

received by Seneca (after hedging) for the six months ended March

31, 2010, was $6.42 per Mcf, a decrease of $1.76 per Mcf.

Other items impacting Operating Results for the six months ended

March 31, 2010, were higher depletion expense (mainly due to the

increase in production) and higher LOE (mainly due to higher steam

fuel cost and the operating costs associated with the July 2009

acquisition of the Ivanhoe assets in California, and the costs to

transport Marcellus production in Appalachia).

Pipeline and Storage

Segment

The Pipeline and Storage segment operations are carried out by

National Fuel Gas Supply Corporation (“Supply Corporation”) and

Empire Pipeline, Inc. (“Empire”). The Pipeline and Storage segment

provides natural gas transportation and storage services to

affiliated and non-affiliated companies through an integrated

system of pipelines and underground natural gas storage fields in

western New York and western Pennsylvania.

The Pipeline and Storage segment’s earnings of $12.4 million,

for the quarter ended March 31, 2010, decreased $2.7 million when

compared with the same period in the prior fiscal year.

Transportation revenues for both Supply Corporation and Empire

decreased in the current quarter compared to the second quarter of

2009. Persistent strong Niagara/Chippawa basis prices have caused

shippers to evaluate lower cost supply sources, and certain

shippers have reduced their imports of natural gas from Canada.

This has resulted in some contract terminations on Supply

Corporation from Niagara and available firm capacity on Empire from

Chippawa remaining unsold. In order to offset these lower shipping

volumes, Supply Corporation’s Northern Access expansion project and

Empire’s Tioga County Extension Project have been designed to

utilize that available capacity to provide producers of Marcellus

gas a transportation path from the Marcellus supply basins to

Canadian and other northeastern markets.

Higher operating and interest expense also decreased earnings

for the current quarter. An increase in efficiency gas revenue due

to higher prices and retained volumes during the current quarter

partially offset the decrease in earnings for the quarter.

The Pipeline and Storage segment’s earnings of $22.8 million,

for the six months ended March 31, 2010, decreased $9.6 million

when compared with the six months ended March 31, 2009. The

decrease in earnings for the current six month period was due to

higher operating expenses (mainly due to increased pension and

operating expenses, and preliminary survey costs associated with

the Tioga County Extension Project planned to move Marcellus

production to Chippawa), higher property taxes and interest expense

and a lower allowance for funds used during construction (“AFUDC”)

for the current six month period.

Utility Segment

The Utility segment operations are carried out by National Fuel

Gas Distribution Corporation (“Distribution”), which sells or

transports natural gas to customers located in western New York and

northwestern Pennsylvania. The Utility segment’s earnings of $33.3

million, for the quarter ended March 31, 2010, compares to earnings

of $32.8 million, for the quarter ended March 31, 2009.

In the New York Division, earnings decreased $1.0 million. The

decrease is primarily due to higher interest expense and the impact

of certain regulatory adjustments, partially offset by lower

operating expenses. In the Pennsylvania Division, earnings

increased $1.5 million due to lower operating expenses and a lower

effective tax rate, partially offset by higher interest expense. In

addition, in Pennsylvania, the impact on earnings of lower customer

usage due to customer conservation efforts more than offset the

positive impact of colder weather during the current quarter.

The Utility segment’s earnings of $56.3 million for the six

months ended March 31, 2010, increased from earnings of $54.9

million for the six months ended March 31, 2009. Earnings in

Distribution’s New York Division for the six months ended March 31,

2010, of $36.0 million decreased $0.5 million compared to the prior

year. Higher interest expense more than offset the impact of lower

operating expenses during the six-month period.

For the six months ended March 31, 2010, earnings in

Distribution’s Pennsylvania Division of $20.3 million increased

$1.9 million compared to the prior year. Lower operating expenses

and a lower effective tax rate more than offset higher interest

expense and lower customer usage.

Energy Marketing

National Fuel Resources, Inc. (“NFR”) comprises the Company’s

Energy Marketing segment. NFR markets natural gas to industrial,

wholesale, commercial, public authority and residential customers

primarily in western and central New York and northwestern

Pennsylvania, offering competitively priced natural gas to its

customers.

The Energy Marketing segment’s earnings for the quarter ended

March 31, 2010, of $6.0 million increased $0.4 million compared to

the second quarter of the prior year. Earnings for the six months

ended March 31, 2010, in the Energy Marketing segment of $7.1

million increased $0.9 million compared to the prior year. The

increase in the quarter and year to date earnings is due to higher

margin and lower operating expenses compared to the same periods in

fiscal 2009.

Corporate and All

Other

The Corporate and All Other category includes the following

active, wholly owned subsidiaries of the Company: Highland Forest

Resources, Inc., a corporation that markets high quality hardwoods

from New York and Pennsylvania land holdings; Horizon LFG, Inc., a

corporation engaged through subsidiaries, in the purchase,

processing, transportation and sale of landfill gas; Horizon Power,

Inc., a corporation that develops and owns independent electric

generation facilities that are fueled by natural gas or landfill

gas, and National Fuel Gas Midstream Corporation, formed to build,

own and operate natural gas processing and pipeline gathering

facilities in the Appalachian region.

Earnings in the Corporate and All Other category for the quarter

ended March 31, 2010, were $1.4 million, a decrease of $0.4 million

compared to the prior year’s second quarter earnings of $1.8

million. The decrease in earnings was mainly due to higher interest

expense and higher income taxes. Higher margins from the timber

operations (mainly due to lower prices paid for purchased logs and

stumpage), higher margins in the landfill gas operations and higher

interest income partially offset the decrease in earnings.

Earnings in the Corporate and All Other category for the six

months ended March 31, 2010, were $1.6 million, a decrease of $1.2

million when compared to the prior year’s earnings. The

comparability of the results for the six months ended March 31,

2010, was impacted by a $2.3 million gain recognized on

corporate-owned executive life insurance policies and a $1.1

million impairment in the value of Horizon Power’s 50 percent

investment in Energy Systems North East, LLC in the prior year’s

first quarter. Excluding these items, Operating Results were flat.

Higher margins from the timber operations (mainly due to lower

prices paid for purchased logs and stumpage), higher margins in the

landfill gas operations and higher interest income were offset by

higher interest expense and higher income taxes.

EARNINGS GUIDANCE

The Company is narrowing its earnings guidance for fiscal 2010

to reflect actual results for the six months ended March 31, 2010,

as well as the change in the lower end of the production guidance

range for the fiscal year. The revised GAAP earnings range is $2.45

to $2.70 per share. The previous guidance range had been $2.40 to

$2.70 per share. This includes oil and gas production for fiscal

2010 for the Exploration and Production segment in a range between

46 and 51 Bcfe, hedges currently in place, and NYMEX equivalent

flat commodity pricing on non-hedged volumes exclusive of basis

differential of $5.00 per MMBtu for natural gas and $75.00 per Bbl

for crude oil.

EARNINGS TELECONFERENCE

The Company will host a conference call on Friday, May 7, 2010,

at 11 a.m. Eastern Time to discuss this announcement. There are two

ways to access this call. For those with Internet access, visit the

investor relations page at National Fuel’s website at investor.nationalfuelgas.com. For those

without Internet access, access is also provided by dialing

(toll-free) 1-866-356-3377, and using the passcode “87921204.” For

those unable to listen to the live conference call, a replay will

be available at approximately 2 p.m. Eastern Time at the same

website link and by phone at (toll free) 888-286-8010 using

passcode “94473740.” Both the webcast and telephonic replay will be

available until the close of business on Friday, May 14, 2010.

National Fuel is an integrated energy company with $5.0 billion

in assets comprised of the following four operating segments:

Exploration and Production, Pipeline and Storage, Utility, and

Energy Marketing. Additional information about National Fuel is

available on its Internet website:

http://www.nationalfuelgas.com or through its investor

information service at 1-800-334-2188.

Certain statements contained herein, including those regarding

estimated future earnings, and statements that are identified by

the use of the words “anticipates,” “estimates,” “expects,”

“forecasts,” “intends,” “plans,” “predicts,” “projects,”

“believes,” “seeks,” “will,” “may” and similar expressions, are

“forward-looking statements” as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

risks and uncertainties, which could cause actual results or

outcomes to differ materially from those expressed in the

forward-looking statements. The Company’s expectations, beliefs and

projections contained herein are expressed in good faith and are

believed to have a reasonable basis, but there can be no assurance

that such expectations, beliefs or projections will result or be

achieved or accomplished. In addition to other factors, the

following are important factors that could cause actual results to

differ materially from those discussed in the forward-looking

statements: financial and economic conditions, including the

availability of credit, and their effect on the Company’s ability

to obtain financing on acceptable terms for working capital,

capital expenditures and other investments; occurrences affecting

the Company’s ability to obtain financing under credit lines or

other credit facilities or through the issuance of commercial

paper, other short-term notes or debt or equity securities,

including any downgrades in the Company’s credit ratings and

changes in interest rates and other capital market conditions;

changes in economic conditions, including global, national or

regional recessions, and their effect on the demand for, and

customers’ ability to pay for, the Company’s products and services;

the creditworthiness or performance of the Company’s key suppliers,

customers and counterparties; economic disruptions or uninsured

losses resulting from terrorist activities, acts of war, major

accidents, fires, hurricanes, other severe weather, pest

infestation or other natural disasters; changes in demographic

patterns and weather conditions; changes in the availability and/or

price of natural gas or oil and the effect of such changes on the

accounting treatment of derivative financial instruments or the

valuation of the Company’s natural gas and oil reserves;

impairments under the SEC’s full cost ceiling test for natural gas

and oil reserves; uncertainty of oil and gas reserve estimates;

factors affecting the Company’s ability to successfully identify,

drill for and produce economically viable natural gas and oil

reserves, including among others geology, lease availability,

weather conditions, shortages, delays or unavailability of

equipment and services required in drilling operations,

insufficient gathering, processing and transportation capacity, and

the need to obtain governmental approvals and permits and comply

with environmental laws and regulations; significant differences

between the Company’s projected and actual production levels for

natural gas or oil; changes in the availability and/or price of

derivative financial instruments; changes in the price

differentials between oil having different quality and/or different

geographic locations, or changes in the price differentials between

natural gas having different heating values and/or different

geographic locations; changes in laws and regulations to which the

Company is subject, including those involving taxes, safety,

employment, climate change, other environmental matters, and

exploration and production activities such as hydraulic fracturing;

the nature and projected profitability of pending and potential

projects and other investments, and the ability to obtain necessary

governmental approvals and permits; significant differences between

the Company’s projected and actual capital expenditures and

operating expenses, and unanticipated project delays or changes in

project costs or plans; inability to obtain new customers or retain

existing ones; significant changes in competitive factors affecting

the Company; governmental/regulatory actions, initiatives and

proceedings, including those involving acquisitions, financings,

rate cases (which address, among other things, allowed rates of

return, rate design and retained natural gas), affiliate

relationships, industry structure, franchise renewal, and

environmental/safety requirements; unanticipated impacts of

restructuring initiatives in the natural gas and electric

industries; ability to successfully identify and finance

acquisitions or other investments and ability to operate and

integrate existing and any subsequently acquired business or

properties; changes in actuarial assumptions, the interest rate

environment and the return on plan/trust assets related to the

Company’s pension and other post-retirement benefits, which can

affect future funding obligations and costs and plan liabilities;

significant changes in tax rates or policies or in rates of

inflation or interest; significant changes in the Company’s

relationship with its employees or contractors and the potential

adverse effects if labor disputes, grievances or shortages were to

occur; changes in accounting principles or the application of such

principles to the Company; the cost and effects of legal and

administrative claims against the Company or activist shareholder

campaigns to effect changes at the Company; increasing health care

costs and the resulting effect on health insurance premiums and on

the obligation to provide other post-retirement benefits; or

increasing costs of insurance, changes in coverage and the ability

to obtain insurance. The Company disclaims any obligation to update

any forward-looking statements to reflect events or circumstances

after the date hereof.

NATIONAL FUEL GAS

COMPANY RECONCILIATION OF CURRENT AND PRIOR YEAR GAAP

EARNINGS QUARTER ENDED MARCH 31, 2010 Exploration

& Pipeline & Energy Corporate / (Thousands of Dollars)

Production Storage Utility Marketing

All Other Consolidated

Second quarter 2009 GAAP earnings $ 18,107 $ 15,186 $ 32,819

$ 5,579 $ 1,793 $ 73,484

Drivers of operating results Higher (lower) crude oil prices

10,588 10,588 Higher (lower) natural gas prices (4,606 ) (4,606 )

Higher (lower) natural gas production 9,617 9,617 Higher (lower)

crude oil production (1,724 ) (1,724 ) Lower (higher) lease

operating expenses (2,183 ) (2,183 ) Higher (lower)

transportation revenues (1,448 ) (1,448 ) Higher (lower) efficiency

gas revenues 2,029 2,029 Lower (higher) operating expenses 762

(1,576 ) 2,031 95 1,312 Lower (higher) depreciation / depletion

(3,477 ) 605 (2,872 ) Lower (higher) property, franchise and other

taxes (466 ) (466 ) Usage (1,239 ) (1,239 ) Colder weather

in Pennsylvania 313 313 Regulatory true-up adjustments (378 ) (378

) Higher (lower) margins 172 1,056 1,228 Higher

(lower) interest income (209 ) (236 ) 2,249 1,804 (Higher) lower

interest expense 551 (1,295 ) (1,498 ) (2,421 ) (4,663 )

(Higher) lower income tax expense 2,137 (1,311 ) 826 All

other / rounding (43 ) (351 )

(912 ) 123 (11 ) (1,194 )

Second quarter 2010 GAAP earnings $ 27,383

$ 12,448 $ 33,273 $ 5,969

$ 1,355 $ 80,428

NATIONAL FUEL GAS COMPANY RECONCILIATION OF

CURRENT AND PRIOR YEAR GAAP EARNINGS PER SHARE QUARTER ENDED

MARCH 31, 2010 Exploration & Pipeline & Energy

Corporate / Production Storage Utility

Marketing All Other Consolidated

Second

quarter 2009 GAAP earnings $ 0.23 $ 0.19 $ 0.41 $ 0.07 $ 0.02 $

0.92

Drivers of operating results Higher (lower)

crude oil prices 0.13 0.13 Higher (lower) natural gas prices (0.06

) (0.06 ) Higher (lower) natural gas production 0.12 0.12 Higher

(lower) crude oil production (0.02 ) (0.02 ) Lower (higher) lease

operating expenses (0.03 ) (0.03 ) Higher (lower)

transportation revenues (0.02 ) (0.02 ) Higher (lower) efficiency

gas revenues 0.02 0.02 Lower (higher) operating expenses 0.01 (0.02

) 0.02 - 0.01 Lower (higher) depreciation / depletion (0.04 ) 0.01

(0.03 ) Lower (higher) property, franchise and other taxes (0.01 )

(0.01 ) Usage (0.02 ) (0.02 ) Colder weather in Pennsylvania

- - Regulatory true-up adjustments - - Higher (lower)

margins - 0.01 0.01 Higher (lower) interest income - - 0.03

0.03 (Higher) lower interest expense - (0.02 ) (0.02 ) (0.03 )

(0.07 ) (Higher) lower income tax expense 0.03 (0.01 ) 0.02

All other / rounding (0.01 ) -

(0.02 ) -

(0.03 )

Second quarter 2010 GAAP earnings $ 0.33

$ 0.15 $ 0.40 $ 0.07

$ 0.02 $ 0.97

NATIONAL FUEL GAS COMPANY

RECONCILIATION OF CURRENT AND PRIOR YEAR GAAP EARNINGS

SIX MONTHS ENDED MARCH 31, 2010 Exploration &

Pipeline & Energy Corporate / (Thousands of Dollars) Production

Storage Utility Marketing All Other

Consolidated

Six months ended March 31, 2009 GAAP

earnings $ (65,450 ) $ 32,362 $ 54,907 $ 6,178 $ 2,809 $ 30,806

Items impacting comparability: Gain on life insurance

policies (2,312 ) (2,312 ) Impairment of investment in partnership

1,085 1,085 Impairment of oil and gas properties 108,207

108,207

Six months ended March 31, 2009

operating results 42,757 32,362 54,907 6,178 1,582 137,786

Drivers of operating results Higher (lower) crude oil

prices 16,324 16,324 Higher (lower) natural gas prices (15,506 )

(15,506 ) Higher (lower) natural gas production 20,371 20,371

Higher (lower) crude oil production (1,205 ) (1,205 ) Lower

(higher) lease operating expenses (1,550 ) (1,550 ) Lower

(higher) operating expenses (2,150 ) 4,253 182 2,285 Lower (higher)

depreciation / depletion (3,976 ) (3,976 ) Lower (higher) property,

franchise and other taxes (1,032 ) (1,032 ) Usage (2,180 )

(2,180 ) Colder weather in Pennsylvania - Regulatory true-up

adjustments - Higher (lower) margins 547 2,940 3,487

Lower AFUDC * (2,780 ) (2,780 ) Higher (lower) interest income

(1,013 ) (225 ) 3,210 1,972 Lower (higher) interest expense 1,166

(3,199 ) (3,226 ) (3,836 ) (9,095 ) (Higher) lower income

tax expense 3,506 (2,462 ) 1,044 All other / rounding

(205 ) (174 ) (974 ) 154

181 (1,018 )

Six

months ended March 31, 2010 GAAP earnings $ 57,163

$ 22,802 $ 56,286 $ 7,061

$ 1,615 $ 144,927 * AFUDC = Allowance

for Funds Used During Construction

NATIONAL FUEL GAS COMPANY RECONCILIATION OF

CURRENT AND PRIOR YEAR GAAP EARNINGS PER SHARE SIX MONTHS

ENDED MARCH 31, 2010 Exploration & Pipeline &

Energy Corporate / Production Storage Utility

Marketing All Other Consolidated

Six months

ended March 31, 2009 GAAP earnings $ (0.82 ) $ 0.40 $ 0.68 $

0.08 $ 0.04 $ 0.38

Items impacting comparability: Gain on

life insurance policies (0.03 ) (0.03 ) Impairment of investment in

partnership 0.01 0.01 Impairment of oil and gas properties

1.35

1.35

Six months ended March 31, 2009

operating results 0.53 0.40 0.68 0.08 0.02 1.71

Drivers of operating results Higher (lower) crude oil prices

0.20 0.20 Higher (lower) natural gas prices (0.19 ) (0.19 ) Higher

(lower) natural gas production 0.25 0.25 Higher (lower) crude oil

production (0.01 ) (0.01 ) Lower (higher) lease operating expenses

(0.02 ) (0.02 ) Lower (higher) operating expenses (0.03 )

0.05 - 0.02 Lower (higher) depreciation / depletion (0.05 ) (0.05 )

Lower (higher) property, franchise and other taxes (0.01 ) (0.01 )

Usage (0.03 ) (0.03 ) Colder weather in Pennsylvania -

Regulatory true-up adjustments - Higher (lower) margins 0.01

0.04 0.05 Lower AFUDC * (0.03 ) (0.03 ) Higher (lower)

interest income (0.01 ) - 0.04 0.03 Lower (higher) interest expense

0.01 (0.04 ) (0.04 ) (0.05 ) (0.12 ) (Higher) lower income

tax expense 0.04 (0.03 ) 0.01 All other / rounding

(0.02 ) (0.01 ) (0.02 ) -

- (0.05 )

Six months ended

March 31, 2010 GAAP earnings $ 0.69 $ 0.28

$ 0.68 $ 0.09 $ 0.02 $

1.76 * AFUDC = Allowance for Funds Used During

Construction

NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES (Thousands of Dollars,

except per share amounts) Three Months Ended Six Months Ended March

31, March 31, (Unaudited) (Unaudited)

SUMMARY OF OPERATIONS

2010 2009 2010 2009 Operating Revenues $ 671,380 $ 804,645

$ 1,128,392 $ 1,411,808 Operating

Expenses: Purchased Gas 334,430 485,468 507,217 814,201 Operation

and Maintenance 117,019 118,928 211,516 219,816 Property, Franchise

and Other Taxes 20,454 20,372 39,113 39,134 Depreciation, Depletion

and Amortization 46,891 41,714 91,846 84,056 Impairment of Oil and

Gas Producing Properties - - -

182,811 518,794 666,482 849,692 1,340,018

Operating Income 152,586 138,163 278,700 71,790 Other

Income (Expense): Income from Unconsolidated Subsidiaries 672 974

1,073 2,092 Impairment of Investment in Partnership - - - (1,804 )

Other Income 1,266 947 1,622 5,827 Interest Income 326 1,005 1,480

2,898 Interest Expense on Long-Term Debt (22,061 ) (17,545 )

(44,124 ) (35,601 ) Other Interest Expense (2,006 )

(2,849 ) (3,390 ) (2,474 ) Income Before

Income Taxes 130,783 120,695 235,361 42,728 Income Tax

Expense 50,355 47,211 90,434

11,922

Net Income Available for

Common Stock $ 80,428 $ 73,484 $ 144,927 $

30,806

Earnings Per Common Share: Basic $ 0.99

$ 0.92 $ 1.79 $ 0.39 Diluted $ 0.97

$ 0.92 $ 1.76 $ 0.38

Weighted

Average Common Shares: Used in Basic Calculation

81,175,261 79,514,793 80,866,311

79,400,660 Used in Diluted Calculation

82,569,323 80,129,743 82,347,254

80,156,407

NATIONAL FUEL GAS

COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS (Unaudited) March 31, September 30,

(Thousands of Dollars) 2010 2009

ASSETS

Property, Plant and Equipment $ 5,413,119 $ 5,184,844 Less -

Accumulated Depreciation, Depletion and Amortization

2,118,594 2,051,482 Net Property, Plant

and Equipment 3,294,525 3,133,362

Current Assets: Cash and Temporary Cash Investments

426,804 408,053 Cash Held in Escrow 2,000 2,000 Hedging Collateral

Deposits 13,657 848 Receivables - Net 226,566 144,466 Unbilled

Utility Revenue 38,634 18,884 Gas Stored Underground 14,696 55,862

Materials and Supplies - at average cost 27,754 24,520 Other

Current Assets 50,593 68,474 Deferred Income Taxes 40,600

53,863 Total Current Assets

841,304 776,970 Other Assets:

Recoverable Future Taxes 138,435 138,435 Unamortized Debt Expense

13,683 14,815 Other Regulatory Assets 521,917 530,913 Deferred

Charges 4,876 2,737 Other Investments 79,219 78,503 Investments in

Unconsolidated Subsidiaries 13,713 14,940 Goodwill 5,476 5,476

Intangible Assets 20,637 21,536 Fair Value of Derivative Financial

Instruments 48,850 44,817 Other 3,153

6,625 Total Other Assets 849,959

858,797 Total Assets $ 4,985,788 $ 4,769,129

CAPITALIZATION AND LIABILITIES Capitalization:

Comprehensive Shareholders' Equity Common Stock, $1 Par Value

Authorized - 200,000,000 Shares; Issued and Outstanding -

81,258,186 Shares and 80,499,915 Shares, Respectively $ 81,258 $

80,500 Paid in Capital 627,871 602,839 Earnings Reinvested in the

Business 1,038,869 948,293 Total

Common Shareholders' Equity Before Items of Other Comprehensive

Loss 1,747,998 1,631,632 Accumulated Other Comprehensive Loss

(38,902 ) (42,396 ) Total Comprehensive

Shareholders' Equity 1,709,096 1,589,236 Long-Term Debt, Net of

Current Portion 1,049,000 1,249,000

Total Capitalization 2,758,096

2,838,236 Current and Accrued Liabilities: Notes

Payable to Banks and Commercial Paper - - Current Portion of

Long-Term Debt 200,000 - Accounts Payable 109,145 90,723 Amounts

Payable to Customers 64,336 105,778 Dividends Payable 27,222 26,967

Interest Payable on Long-Term Debt 30,512 32,031 Customer Advances

2,715 24,555 Customer Security Deposits 19,426 17,430 Other

Accruals and Current Liabilities 110,174 18,875 Fair Value of

Derivative Financial Instruments 16,632

2,148 Total Current and Accrued Liabilities 580,162

318,507 Deferred Credits:

Deferred Income Taxes 720,584 663,876 Taxes Refundable to Customers

67,053 67,046 Unamortized Investment Tax Credit 3,638 3,989 Cost of

Removal Regulatory Liability 121,954 105,546 Other Regulatory

Liabilities 87,215 120,229 Pension and Other Post-Retirement

Liabilities 414,479 415,888 Asset Retirement Obligations 92,461

91,373 Other Deferred Credits 140,146

144,439 Total Deferred Credits 1,647,530

1,612,386 Commitments and Contingencies

- - Total Capitalization and

Liabilities $ 4,985,788 $ 4,769,129

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) Six

Months Ended March 31, (Thousands of Dollars) 2010

2009 Operating Activities: Net Income Available for Common

Stock $ 144,927 $ 30,806 Adjustments to Reconcile Net Income to Net

Cash Provided by Operating Activities: Impairment of Oil and Gas

Producing Properties - 182,811 Depreciation, Depletion and

Amortization 91,846 84,056 Deferred Income Taxes 41,796 (80,857 )

Income from Unconsolidated Subsidiaries, Net of Cash Distributions

1,228 808 Impairment of Investment in Partnership - 1,804 Excess

Tax Benefits Associated with Stock-Based Compensation Awards

(13,437 ) (5,927 ) Other 6,270 8,997 Change in: Hedging Collateral

Deposits (12,809 ) (22,194 ) Receivables and Unbilled Utility

Revenue (101,881 ) (149,895 ) Gas Stored Underground and Materials

and Supplies 37,932 79,128 Unrecovered Purchased Gas Costs - 34,782

Prepayments and Other Current Assets 31,318 16,954 Accounts Payable

12,179 (45,186 ) Amounts Payable to Customers (41,442 ) 18,897

Customer Advances (21,840 ) (31,189 ) Customer Security Deposits

1,996 968 Other Accruals and Current Liabilities 90,498 215,281

Other Assets 11,285 2,399 Other Liabilities (535 )

(4,301 ) Net Cash Provided by Operating Activities

$ 279,331 $ 338,142 Investing

Activities: Capital Expenditures ($230,530 ) ($181,158 ) Net

Proceeds from Sale of Oil and Gas Producing Properties - 60 Other

(115 ) (595 ) Net Cash Used in

Investing Activities ($230,645 )

($181,693 ) Financing Activities: Excess Tax Benefits

Associated with Stock-Based Compensation Awards $ 13,437 $ 5,927

Reduction of Long-Term Debt - (100,000 ) Dividends Paid on Common

Stock (54,096 ) (51,556 ) Proceeds From Issuance of Common Stock

10,724 6,989 Net Cash

Used In Financing Activities ($29,935 )

($138,640 ) Net Increase in Cash and Temporary Cash Investments

18,751 17,809 Cash and Temporary Cash Investments at Beginning of

Period 408,053 68,239

Cash and Temporary Cash Investments at March 31 $ 426,804

$ 86,048

NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES SEGMENT OPERATING RESULTS AND

STATISTICS (UNAUDITED) Three Months Ended Six

Months Ended (Thousands of Dollars, except per share amounts) March

31, March 31,

EXPLORATION AND PRODUCTION

SEGMENT

2010 2009 Variance 2010 2009 Variance

Operating Revenues $ 109,158 $ 87,077 $

22,081 $ 215,511 $ 183,790 $

31,721 Operating Expenses: Operation and Maintenance:

General and Administrative Expense 8,858 8,525 333 17,347 15,617

1,730 Lease Operating Expense 15,688 12,555 3,133 27,932 25,169

2,763 All Other Operation and Maintenance Expense 2,149 3,644

(1,495 ) 4,333 6,274 (1,941 ) Property, Franchise and Other Taxes

(Lease Operating Expense) 2,652 2,426 226 5,004 5,381 (377 )

Depreciation, Depletion and Amortization 25,891 20,543 5,348 49,803

43,687 6,116 Impairment of Oil and Gas Producing Properties

- - - -

182,811 (182,811 )

55,238 47,693 7,545

104,419 278,939

(174,520 ) Operating Income (Loss) 53,920 39,384

14,536 111,092 (95,149 ) 206,241 Other Income (Expense):

Interest Income 156 479 (323 ) 309 1,868 (1,559 ) Other Interest

Expense (7,885 ) (8,733 ) 848

(15,753 ) (17,547 ) 1,794

Income (Loss) Before Income Taxes 46,191 31,130

15,061 95,648 (110,828 ) 206,476 Income Tax Expense (Benefit)

18,808 13,023

5,785 38,485 (45,378 )

83,863 Net Income (Loss) $ 27,383 $

18,107 $ 9,276 $ 57,163 $

(65,450 ) $ 122,613 Net Income (Loss) Per

Share (Diluted) $ 0.33 $ 0.23 $ 0.10

$ 0.69 $ (0.82 ) $ 1.51

Three Months Ended Six Months Ended March 31, March

31,

PIPELINE AND STORAGE SEGMENT

2010 2009 Variance 2010 2009 Variance

Revenues from External Customers $ 40,971 $ 39,846 $ 1,125 $ 75,475

$ 75,113 $ 362 Intersegment Revenues 20,565

21,156 (591 ) 40,822

41,993 (1,171 ) Total Operating

Revenues 61,536 61,002

534 116,297 117,106

(809 ) Operating Expenses: Purchased

Gas 135 115 20 72 129 (57 ) Operation and Maintenance 20,130 17,708

2,422 37,162 33,855 3,307 Property, Franchise and Other Taxes 4,988

4,269 719 10,096 8,509 1,587 Depreciation, Depletion and

Amortization 8,883 9,813

(930 ) 17,722 17,666

56 34,136 31,905

2,231 65,052

60,159 4,893 Operating

Income 27,400 29,097 (1,697 ) 51,245 56,947 (5,702 ) Other

Income (Expense): Interest Income 21 384 (363 ) 52 398 (346 ) Other

Income 147 230 (83 ) 245 3,017 (2,772 ) Other Interest Expense

(6,581 ) (4,588 ) (1,993 )

(13,177 ) (8,255 ) (4,922 )

Income Before Income Taxes 20,987 25,123 (4,136 ) 38,365

52,107 (13,742 ) Income Tax Expense 8,539

9,937 (1,398 ) 15,563

19,745 (4,182 ) Net Income $

12,448 $ 15,186 $ (2,738 ) $ 22,802

$ 32,362 $ (9,560 ) Net Income

Per Share (Diluted) $ 0.15 $ 0.19 $

(0.04 ) $ 0.28 $ 0.40 $ (0.12 )

NATIONAL FUEL

GAS COMPANY AND SUBSIDIARIES SEGMENT OPERATING

RESULTS AND STATISTICS (UNAUDITED) Three Months

Ended Six Months Ended (Thousands of Dollars, except per share

amounts) March 31, March 31,

UTILITY SEGMENT

2010 2009 Variance 2010 2009 Variance

Revenues from External Customers $ 348,593 $ 502,016 $ (153,423 ) $

580,997 $ 851,653 $ (270,656 ) Intersegment Revenues 6,149

5,846 303

10,662 10,399 263

Total Operating Revenues 354,742

507,862 (153,120 ) 591,659

862,052 (270,393 )

Operating Expenses: Purchased Gas 212,197 359,588 (147,391 )

339,587 601,484 (261,897 ) Operation and Maintenance 58,441 63,070

(4,629 ) 103,427 112,683 (9,256 ) Property, Franchise and Other

Taxes 12,267 13,206 (939 ) 23,002 24,332 (1,330 ) Depreciation,

Depletion and Amortization 10,077 9,937

140 19,997

19,661 336 292,982

445,801 (152,819 ) 486,013

758,160 (272,147 )

Operating Income 61,760 62,061 (301 ) 105,646 103,892 1,754

Other Income (Expense): Interest Income 136 123 13 854 919 (65 )

Other Income 243 237 6 512 512 - Other Interest Expense

(9,331 ) (7,026 ) (2,305 )

(18,054 ) (13,092 ) (4,962 )

Income Before Income Taxes 52,808 55,395 (2,587 ) 88,958 92,231

(3,273 ) Income Tax Expense 19,535

22,576 (3,041 ) 32,672

37,324 (4,652 ) Net Income $ 33,273

$ 32,819 $ 454 $ 56,286

$ 54,907 $ 1,379 Net Income Per

Share (Diluted) $ 0.40 $ 0.41 $ (0.01 )

$ 0.68 $ 0.68 $ -

Three Months Ended Six Months Ended March 31, March 31,

ENERGY MARKETING SEGMENT

2010 2009 Variance 2010 2009 Variance

Operating Revenues $ 158,537 $ 163,545

$ (5,008 ) $ 230,273 $ 278,551 $

(48,278 ) Operating Expenses: Purchased Gas 147,166 152,438

(5,272 ) 215,769 264,888 (49,119 ) Operation and Maintenance 1,542

1,688 (146 ) 2,876 3,156 (280 ) Property, Franchise and Other Taxes

7 9 (2 ) 17 15 2 Depreciation, Depletion and Amortization 11

9 2 21

20 1

148,726 154,144 (5,418 )

218,683 268,079

(49,396 ) Operating Income 9,811 9,401 410 11,590 10,472

1,118 Other Income (Expense): Interest Income 8 24 (16 ) 14

27 (13 ) Other Income 30 67 (37 ) 46 110 (64 ) Other Interest

Expense (9 ) (60 ) 51

(15 ) (195 ) 180

Income Before Income Taxes 9,840 9,432 408 11,635 10,414 1,221

Income Tax Expense 3,871 3,853

18 4,574 4,236

338 Net Income $ 5,969 $

5,579 $ 390 $ 7,061 $ 6,178

$ 883 Net Income Per Share (Diluted) $

0.07 $ 0.07 $ - $ 0.09

$ 0.08 $ 0.01

NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES SEGMENT OPERATING RESULTS AND

STATISTICS (UNAUDITED) Three Months Ended Six

Months Ended (Thousands of Dollars, except per share amounts) March

31, March 31,

ALL OTHER

2010 2009 Variance 2010 2009 Variance

Revenues from External Customers $ 13,903 $ 11,929 $ 1,974 $ 25,707

$ 22,254 $ 3,453 Intersegment Revenues -

1,194 (1,194 ) -

3,516 (3,516 ) Total Operating Revenues

13,903 13,123 780

25,707 25,770

(63 ) Operating Expenses: Purchased Gas 1,506 1,397

109 3,004 3,357 (353 ) Operation and Maintenance 7,847 9,871 (2,024

) 13,583 19,404 (5,821 ) Property, Franchise and Other Taxes 469

392 77 853 756 97 Depreciation, Depletion and Amortization

1,854 1,237 617

3,954 2,675 1,279

11,676 12,897

(1,221 ) 21,394 26,192

(4,798 ) Operating Income (Loss) 2,227 226

2,001 4,313 (422 ) 4,735 Other Income (Expense): Income from

Unconsolidated Subsidiaries 672 974 (302 ) 1,073 2,092 (1,019 )

Impairment of Investment in Partnership - - - - (1,804 ) 1,804

Interest Income 28 241 (213 ) 57 490 (433 ) Other Income 12 10 2 40

12 28 Other Interest Expense (540 ) (587 )

47 (1,082 ) (1,360 )

278 Income (Loss) Before Income Taxes

2,399 864 1,535 4,401 (992 ) 5,393 Income Tax Expense (Benefit)

825 (1,043 ) 1,868

1,663 (2,032 ) 3,695

Net Income (Loss) $ 1,574 $ 1,907

$ (333 ) $ 2,738 $ 1,040 $ 1,698

Net Income (Loss) Per Share (Diluted) $ 0.02

$ 0.02 $ (0.00 ) $ 0.03 $ 0.02

$ 0.01

NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES SEGMENT OPERATING RESULTS AND

STATISTICS (UNAUDITED) Three Months Ended Six

Months Ended (Thousands of Dollars, except per share amounts) March

31, March 31,

CORPORATE

2010 2009 Variance 2010 2009 Variance

Revenues from External Customers $ 218 $ 232 $ (14 ) $ 429 $ 447 $

(18 ) Intersegment Revenues 1,003 1,055

(52 ) 1,542 2,058

(516 ) Total Operating Revenues 1,221

1,287 (66 ) 1,971

2,505 (534 )

Operating Expenses: Operation and Maintenance 3,507 3,048 459 6,667

5,967 700 Property, Franchise and Other Taxes 71 70 1 141 141 -

Depreciation, Depletion and Amortization 175

175 - 349

347 2 3,753

3,293 460 7,157

6,455 702

Operating Loss (2,532 ) (2,006 ) (526 ) (5,186 ) (3,950 ) (1,236 )

Other Income (Expense): Interest Income 22,379 18,706 3,673

45,061 39,689 5,372 Other Income 834 403 431 779 2,176 (1,397 )

Interest Expense on Long-Term Debt (22,061 ) (17,545 ) (4,516 )

(44,124 ) (35,601 ) (8,523 ) Other Interest Expense (62 )

(807 ) 745 (176 )

(2,518 ) 2,342 Income (Loss)

Before Income Taxes (1,442 ) (1,249 ) (193 ) (3,646 ) (204 ) (3,442

) Income Tax Benefit (1,223 ) (1,135 )

(88 ) (2,523 ) (1,973 )

(550 ) Net Income (Loss) $ (219 ) $ (114 ) $ (105 ) $

(1,123 ) $ 1,769 $ (2,892 ) Net Income

(Loss) Per Share (Diluted) $ - $ - $ -

$ (0.01 ) $ 0.02 $ (0.03 )

Three Months Ended Six Months Ended March 31, March

31,

INTERSEGMENT ELIMINATIONS

2010 2009 Variance 2010 2009 Variance

Intersegment Revenues $ (27,717 ) $ (29,251 ) $ 1,534

$ (53,026 ) $ (57,966 ) $ 4,940

Operating Expenses: Purchased Gas (26,574 ) (28,070 ) 1,496 (51,215

) (55,657 ) 4,442 Operation and Maintenance (1,143 )

(1,181 ) 38 (1,811 )

(2,309 ) 498 (27,717 )

(29,251 ) 1,534 (53,026 )

(57,966 ) 4,940 Operating Income

- - - - - - Other Income (Expense): Interest Income (22,402

) (18,952 ) (3,450 ) (44,867 ) (40,493 ) (4,374 ) Other Interest

Expense 22,402 18,952

3,450 44,867 40,493

4,374 Net Income $ -

$ - $ - $ - $ -

$ - Net Income Per Share (Diluted) $ -

$ - $ - $ - $ -

$ -

NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES SEGMENT INFORMATION

(Continued) (Thousands of Dollars) Three Months

Ended Six Months Ended March 31, March 31, (Unaudited) (Unaudited)

Increase Increase 2010 2009 (Decrease) 2010 2009 (Decrease)

Capital Expenditures: Exploration and

Production $ 143,249

(1)

$ 30,751

(3)

$ 112,498 $ 190,986

(1)(2)

$ 117,161

(3)

$ 73,825 Pipeline and Storage 8,491 10,719

(4)

(2,228 ) 15,478 30,220

(4)(5)

(14,742 ) Utility 13,573 12,234 1,339 25,525 25,823 (298 ) Energy

Marketing 95 9 86 99 11

88 Total Reportable Segments 165,408 53,713

111,695 232,088 173,215 58,873 All Other 2,851 22 2,829 3,837

(2)

74 3,763 Corporate 107 14 93 134 45 89 Eliminations -

- - - (344 ) 344 Total

Capital Expenditures $ 168,366 $ 53,749 $ 114,617 $ 236,059

$ 172,990 $ 63,069

(1) Amount for the quarter and six

months ended March 31, 2010 includes $15.3 million of accrued

capital expenditures, the majority of which was in the Appalachian

region. This amount has been excluded from the Consolidated

Statement of Cash Flows at March 31, 2010 since it represents a

non-cash investing activity at that date.

(2) Capital expenditures for the

Exploration and Production segment for the six months ended March

31, 2010 exclude $9.1 million of capital expenditures, the majority

of which was in the Appalachian region. Capital expenditures for

All Other for the six months ended March 31, 2010 exclude $0.7

million of capital expenditures related to the construction of the

Midstream Covington Gathering System. Both of these amounts were

accrued at September 30, 2009 and paid during the six months ended

March 31, 2010. These amounts were excluded from the Consolidated

Statement of Cash Flows at September 30, 2009 since they

represented non-cash investing activities at that date. These

amounts have been included in the Consolidated Statement of Cash

Flows at March 31, 2010.

(3) Amount for the quarter and six

months ended March 31, 2009 includes $7.7 million of accrued

capital expenditures, the majority of which was in the Appalachian

region. This amount has been excluded from the Consolidated

Statement of Cash Flows at March 31, 2009 since it represents a

non-cash investing activity at that date.

(4) Amount for the quarter and six

months ended March 31, 2009 includes $0.9 million of accrued

capital expenditures related to the Empire Connector project. This

amount has been excluded from the Consolidated Statement of Cash

Flows at March 31, 2009 since it represents a non-cash investing

activity at that date.

(5) Amount for the six months

ended March 31, 2009 excludes $16.8 million of capital expenditures

related to the Empire Connector project accrued at September 30,

2008 and paid during the six months ended March 31, 2009. This

amount was excluded from the Consolidated Statement of Cash Flows

at September 30, 2008 since it represented a non-cash investing

activity at that date. The amount has been included in the

Consolidated Statement of Cash Flows at March 31, 2009.

DEGREE DAYS

Percent Colder (Warmer) Than:

Three Months Ended March 31

Normal 2010 2009

Normal Last Year Buffalo, NY 3,327

3,241 3,391 (2.6 ) (4.4 ) Erie, PA 3,142 3,163 3,176 0.7 (0.4 )

Six

Months Ended March 31

Buffalo, NY 5,587 5,487 5,704 (1.8 ) (3.8 ) Erie, PA 5,223

5,211 5,243 (0.2 ) (0.6 )

NATIONAL

FUEL GAS COMPANY AND SUBSIDIARIES

EXPLORATION AND PRODUCTION

INFORMATION

Three Months Ended Six Months Ended March 31, March

31, Increase Increase 2010 2009 (Decrease) 2010 2009 (Decrease)

Gas Production/Prices:

Production (MMcf) Gulf Coast 2,643 2,065 578 5,333 3,811 1,522 West

Coast 930 1,027 (97 ) 1,926 2,049 (123 ) Appalachia 3,542

2,059 1,483 6,344 3,910

2,434 Total Production 7,115 5,151

1,964 13,603 9,770 3,833

Average Prices (Per Mcf) Gulf Coast $ 6.02 $ 4.61 $ 1.41 $ 5.42 $

5.72 $ (0.30 ) West Coast 5.79 4.22 1.57 5.19 4.62 0.57 Appalachia

5.97 5.87 0.10 5.57 7.13 (1.56 ) Weighted Average 5.96 5.03 0.93

5.46 6.05 (0.59 ) Weighted Average after Hedging 6.54 7.53 (0.99 )

6.42 8.18 (1.76 )

Oil Production/Prices:

Production (Thousands of Barrels) Gulf Coast 109 166 (57 ) 255 294

(39 ) West Coast 661 648 13 1,345 1,330 15 Appalachia 9

12 (3 ) 20 27 (7 ) Total

Production 779 826 (47 ) 1,620

1,651 (31 ) Average Prices (Per Barrel) Gulf Coast $

89.22 $ 40.43 $ 48.79 $ 79.81 $ 47.26 $ 32.55 West Coast 73.16

36.60 36.56 71.72 42.45 29.27 Appalachia 73.80 43.55 30.25 79.67

58.10 21.57 Weighted Average 75.41 37.47 37.94 73.09 43.56 29.53

Weighted Average after Hedging 77.29 56.39 20.90 75.86 60.36 15.50

Total Production (Mmcfe) 11,789 10,107

1,682 23,323 19,676 3,647

Selected Operating Performance

Statistics:

General & Administrative Expense per Mcfe (1) $ 0.75 $ 0.84 $

(0.09 ) $ 0.74 $ 0.79 $ (0.05 ) Lease Operating Expense per Mcfe

(1) $ 1.56 $ 1.48 $ 0.08 $ 1.41 $ 1.55 $ (0.14 ) Depreciation,

Depletion & Amortization per Mcfe (1) $ 2.20 $ 2.03 $ 0.17 $

2.14 $ 2.22 $ (0.08 )

(1) Refer to page 17 for the

General and Administrative Expense, Lease Operating Expense and

Depreciation, Depletion, and Amortization Expense for the

Exploration and Production segment.

NATIONAL FUEL GAS

COMPANY AND SUBSIDIARIES

EXPLORATION AND PRODUCTION

INFORMATION

Hedging Summary for the Remaining Six Months of Fiscal

2010

SWAPS

Volume Average Hedge Price

Oil 0.9 MMBBL $74.58 / BBL Gas 7.8 BCF $6.90 / MCF

Hedging Summary for Fiscal 2011

SWAPS

Volume Average Hedge Price

Oil 1.2 MMBBL $69.58 / BBL Gas 15.0 BCF $6.99 / MCF

Hedging Summary for Fiscal 2012

SWAPS

Volume Average Hedge Price

Oil 0.7 MMBBL $67.63 / BBL Gas 11.2 BCF $7.23 / MCF

Gross Wells in Process of

Drilling

Six Months Ended March 31,

2010

East Marcellus Upper Total

Gulf West

Shale Devonian

Company Wells in Process - Beginning

Period Exploratory 0.00 0.00 14.00 (1) 22.00 36.00

Developmental 0.00 0.00 14.00 (1) 68.00 82.00

Wells

Commenced Exploratory 1.00 0.00 7.00 11.00 19.00 Developmental

0.00 29.00 23.00 54.00 106.00

Wells Completed Exploratory

0.00 0.00 6.00 4.00 10.00 Developmental 0.00 27.00 9.00 75.00

111.00

Wells Plugged & Abandoned Exploratory 0.00 0.00

1.00 0.00 1.00 Developmental 0.00 0.00 0.00 2.00 2.00

Wells

Sold Exploratory 0.00 0.00 0.00 1.00 1.00 Developmental 0.00

0.00 0.00 0.00 0.00

Wells in Process - End of Period

Exploratory 1.00 0.00 14.00 28.00 43.00 Developmental 0.00 2.00

28.00 45.00 75.00 (1) Gross exploratory wells were decreased

by 11 and developmental wells were increased by 11.

Net Wells in Process of

Drilling

Six Months Ended March 31,

2010

East Marcellus Upper Total

Gulf West

Shale Devonian

Company Wells in Process - Beginning

Period Exploratory 0.00 0.00 13.00 (2) 20.00 33.00

Developmental 0.00 0.00 8.50 (2) 67.00 75.50

Wells Commenced

Exploratory 0.29 0.00 7.00 11.00 18.29 Developmental 0.00 26.72

14.72 54.00 95.44

Wells Completed Exploratory 0.00 0.00 5.00

3.00 8.00 Developmental 0.00 25.36 6.50 75.00 106.86

Wells

Plugged & Abandoned Exploratory 0.00 0.00 1.00 0.00 1.00

Developmental 0.00 0.00 0.00 2.00 2.00

Wells Sold

Exploratory 0.00 0.00 0.00 1.00 1.00 Developmental 0.00 0.00 0.00

0.00 0.00

Wells in Process - End of Period Exploratory 0.29

0.00 14.00 27.00 41.29 Developmental 0.00 1.36 16.72 44.00 62.08

(2) Net exploratory wells were decreased by 6.50 and

developmental wells were increased by 6.50.

NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES Pipeline & Storage

Throughput - (millions of cubic feet - MMcf) Three

Months Ended Six Months Ended March 31, March 31, Increase Increase

2010 2009 (Decrease) 2010 2009 (Decrease) Firm

Transportation - Affiliated 43,587 47,255 (3,668 ) 73,763 80,989

(7,226 ) Firm Transportation - Non-Affiliated 68,559 86,217 (17,658

) 119,022 154,736 (35,714 ) Interruptible Transportation 1,804

1,256 548 2,559 2,875 (316 ) 113,950 134,728 (20,778 )

195,344 238,600 (43,256 )

Utility Throughput - (MMcf)

Three Months Ended Six Months Ended March 31, March 31, Increase

Increase 2010 2009 (Decrease) 2010 2009 (Decrease) Retail

Sales: Residential Sales 26,413 28,366 (1,953 ) 43,237 46,533

(3,296 ) Commercial Sales 4,256 4,852 (596 ) 6,746 7,762 (1,016 )

Industrial Sales 288 302 (14 ) 446 445 1 30,957 33,520

(2,563 ) 50,429 54,740 (4,311 ) Off-System Sales 2,554 1 2,553

2,910 513 2,397 Transportation 24,366 24,256 110 41,427

41,729 (302 ) 57,877 57,777 100 94,766 96,982 (2,216 )

Energy Marketing Volumes Three Months Ended Six

Months Ended March 31, March 31, Increase Increase 2010 2009

(Decrease) 2010 2009 (Decrease) Natural Gas (MMcf) 23,996

22,689 1,307 38,097 35,825 2,272

NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES FISCAL 2010 EARNINGS GUIDANCE AND

SENSITIVITIES Earnings

per share sensitivity to changes Fiscal 2010 (Diluted

earnings per share guidance*)

from NYMEX prices used in guidance* ^ $1 change per

MMBtu gas $5 change per Bbl oil Range IncreaseDecrease

IncreaseDecrease Consolidated Earnings

$2.45 - $2.70

+ $0.05 - $0.05 + $0.03 - $0.03 *

Please refer to forward looking statement footnote beginning at

page 8 of this document.

^ This sensitivity table is

current as of May 6, 2010 and only considers revenue from the

Exploration and Production segment's crude oil and natural gas

sales. This revenue is based upon pricing used in the Company's

earnings forecast. For the last two quarters of its fiscal 2010

earnings forecast, the Company is utilizing flat NYMEX equivalent

commodity pricing, exclusive of basis differential, of $5 per MMBtu

for natural gas and $75 per Bbl for crude oil. The sensitivities

will become obsolete with the passage of time, changes in Seneca's

production forecast, changes in basis differential, as additional

hedging contracts are entered into, and with the settling of hedge

contracts at their maturity.

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES

Quarter Ended March 31

(unaudited)

2010 2009 Operating Revenues $ 671,380,000 $ 804,645,000

Net Income Available for Common Stock $ 80,428,000 $

73,484,000 Earnings Per Common Share: Basic $ 0.99 $ 0.92

Diluted $ 0.97 $ 0.92 Weighted Average Common Shares: Used

in Basic Calculation 81,175,261 79,514,793 Used in

Diluted Calculation 82,569,323 80,129,743

Six Months Ended March 31

(unaudited)

Operating Revenues $ 1,128,392,000 $ 1,411,808,000

Net Income Available for Common Stock $ 144,927,000 $ 30,806,000

Earnings Per Common Share: Basic $ 1.79 $ 0.39 Diluted $

1.76 $ 0.38 Weighted Average Common Shares: Used in Basic

Calculation 80,866,311 79,400,660 Used in Diluted

Calculation 82,347,254 80,156,407

Twelve Months Ended March 31

(unaudited)

Operating Revenues $ 1,774,436,000 $ 2,358,048,000

Net Income Available for Common Stock $ 214,829,000 $ 133,926,000

Earnings Per Common Share: Basic $ 2.67 $ 1.67 Diluted $

2.63 $ 1.64 Weighted Average Common Shares: Used in Basic

Calculation 80,380,789 80,252,366 Used in Diluted

Calculation 81,749,193 81,882,711

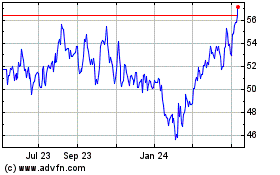

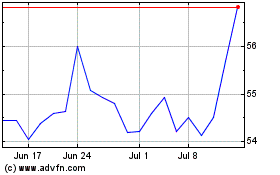

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Jun 2024 to Jul 2024

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Jul 2023 to Jul 2024