Seneca Resources Corporation Provides Initial Results from recent Marcellus Shale Drilling

May 19 2009 - 11:43AM

Business Wire

Seneca Resources Corporation (�Seneca�), a wholly owned

subsidiary of National Fuel Gas Company (NYSE: NFG) (�National

Fuel� or the �Company�), today announced that a Marcellus Shale

well operated by its joint-venture partner, EOG Resources, was flow

tested at an average rate of over 3.0 million cubic feet per day

(�MMcfd�) for 7 days. Seneca holds a 50 percent working interest

and a 60 percent net revenue interest in the well.

Matthew D. Cabell, President of Seneca, stated, �This flow test

confirms our expectations for the potential of our Marcellus Shale

position, most of which is fee mineral acreage, where we pay no

royalty. This is a tremendous opportunity for Seneca, and as the

primary focus of our E&P activities, we expect the Marcellus

Shale to provide significant growth in production and reserves for

many years. We are currently fracture-stimulating another well and

expect flare testing to begin by the end of the month. Later in the

summer, we expect to discuss the results from that next well, and,

once we have more data-in-hand, we may be in a position to discuss

an estimate for the range of Marcellus Shale resource potential

across our extensive acreage position.� Seneca plans to operate 10

vertical wells and two to three horizontal wells in fiscal 2009,

and participate in another eight to 10 wells to be operated by EOG

Resources.

David F. Smith, Chief Executive Officer of National Fuel, added,

�This successful well completion and the initial flow rates confirm

the Marcellus Shale opportunity across our acreage. We will

continue to focus our efforts � and our resources � on the

Appalachian region in general and the Marcellus Shale in

particular. Seneca will continue to expand drilling in this play

through both our joint venture with EOG Resources and our

Seneca-operated horizontal drilling program that will begin this

July. Along with Seneca�s activities, our Midstream Company is

already designing and building infrastructure projects to transport

both Seneca and third-party production; and our Pipeline and

Storage segment looks to expand its services to move natural gas

produced from this vast resource to adjacent markets.�

Seneca, the exploration and production segment of National Fuel,

explores for, develops and purchases natural gas and oil reserves

in California, the Appalachian region and in the Gulf Coast region

of Texas and Louisiana. Currently, Seneca�s efforts are focused on

evaluating, exploring and developing reserves in the Appalachian

basin, economically producing reserves in California and exploiting

opportunities in the shallow waters of the Gulf of Mexico.

Additional information about Seneca and National Fuel is available

at www.nationalfuelgas.com or through the Company�s investor

information service at 1-800-334-2188.

Certain statements contained herein, including those regarding

estimated future earnings, and statements that are identified by

the use of the words �anticipates,� �estimates,� �expects,�

�forecasts,� �intends,� �plans,� �predicts,� �projects,�

�believes,� �seeks,� �will,� �may� and similar expressions, are

�forward-looking statements� as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

risks and uncertainties, which could cause actual results or

outcomes to differ materially from those expressed in the

forward-looking statements. The Company�s expectations, beliefs and

projections contained herein are expressed in good faith and are

believed to have a reasonable basis, but there can be no assurance

that such expectations, beliefs or projections will result or be

achieved or accomplished. In addition to other factors, the

following are important factors that could cause actual results to

differ materially from those discussed in the forward-looking

statements: financial and economic conditions, including the

availability of credit, and their effect on the Company�s ability

to obtain financing on acceptable terms for working capital,

capital expenditures and other investments; occurrences affecting

the Company�s ability to obtain financing under credit lines or

other credit facilities or through the issuance of commercial

paper, other short-term notes or debt or equity securities,

including any downgrades in the Company�s credit ratings and

changes in interest rates and other capital market conditions;

changes in economic conditions, including global, national or

regional recessions, and their effect on the demand for, and

customers� ability to pay for, the Company�s products and services;

the creditworthiness or performance of the Company�s key suppliers,

customers and counterparties; economic disruptions or uninsured

losses resulting from terrorist activities, acts of war, major

accidents, fires, hurricanes, other severe weather, pest

infestation or other natural disasters; changes in actuarial

assumptions, the interest rate environment and the return on

plan/trust assets related to the Company�s pension and other

post-retirement benefits, which can affect future funding

obligations and costs and plan liabilities; changes in demographic

patterns and weather conditions; changes in the availability and/or

price of natural gas or oil and the effect of such changes on the

accounting treatment of derivative financial instruments or the

valuation of the Company�s natural gas and oil reserves;

impairments under the SEC�s full cost ceiling test for natural gas

and oil reserves; uncertainty of oil and gas reserve estimates;

factors affecting the Company�s ability to successfully identify,

drill for and produce economically viable natural gas and oil

reserves, including among others geology, lease availability,

weather conditions, shortages, delays or unavailability of

equipment and services required in drilling operations, and the

need to obtain governmental approvals and permits and comply with

environmental laws and regulations; significant differences between

the Company�s projected and actual production levels for natural

gas or oil; changes in the availability and/or price of derivative

financial instruments; changes in the price differentials between

oil having different quality and/or different geographic locations,

or changes in the price differentials between natural gas having

different heating values and/or different geographic locations;

inability to obtain new customers or retain existing ones;

significant changes in competitive factors affecting the Company;

changes in laws and regulations to which the Company is subject,

including tax, environmental, safety and employment laws and

regulations; governmental/regulatory actions, initiatives and

proceedings, including those involving acquisitions, financings,

rate cases (which address, among other things, allowed rates of

return, rate design and retained natural gas), affiliate

relationships, industry structure, franchise renewal, and

environmental/safety requirements; unanticipated impacts of

restructuring initiatives in the natural gas and electric

industries; significant differences between the Company�s projected

and actual capital expenditures and operating expenses and

unanticipated project delays or changes in project costs or plans;

the nature and projected profitability of pending and potential

projects and other investments, and the ability to obtain necessary

governmental approvals and permits; ability to successfully

identify and finance acquisitions or other investments and ability

to operate and integrate existing and any subsequently acquired

business or properties; significant changes in tax rates or

policies or in rates of inflation or interest; significant changes

in the Company�s relationship with its employees or contractors and

the potential adverse effects if labor disputes, grievances or

shortages were to occur; changes in accounting principles or the

application of such principles to the Company; the cost and effects

of legal and administrative claims against the Company or activist

shareholder campaigns to effect changes at the Company; increasing

health care costs and the resulting effect on health insurance

premiums and on the obligation to provide other post-retirement

benefits; or increasing costs of insurance, changes in coverage and

the ability to obtain insurance. The Company disclaims any

obligation to update any forward-looking statements to reflect

events or circumstances after the date hereof.

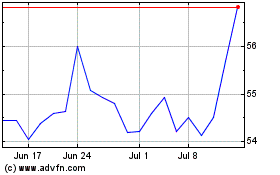

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Aug 2024 to Sep 2024

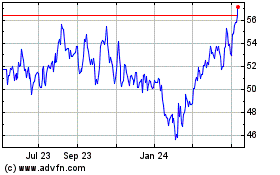

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Sep 2023 to Sep 2024