National Fuel Gas Company (�National Fuel� or the �Company�)

(NYSE:NFG) today announced record earnings for the second quarter

of fiscal 2008 and for the six-months ended March 31, 2008.

HIGHLIGHTS Reported GAAP earnings for the second quarter increased

over 21% to $95.0 million or $1.11 per share, an increase of $16.6

million, or $0.19 per share. Increased earnings in the Exploration

and Production segment provided the bulk of the increase. Higher

average commodity prices realized and increased natural gas

production were the main drivers of the higher earnings. Quarterly

operating results before items impacting comparability were $94.4

million or $1.10 per share, an increase of $21.3 million, or $0.24

per share, from the prior year�s second quarter. Operating results

increased in all segments from the prior year�s second quarter. The

Company is increasing and narrowing its GAAP earnings guidance for

fiscal 2008 earnings to a range of $2.90 to $3.00 per share. It had

previously been in the range of $2.60 to $2.80 per share. A

conference call is scheduled for Friday, May 2, 2008, at 11:00 a.m.

Eastern Time. MANAGEMENT COMMENTS David F. Smith, Chief Executive

Officer and President of National Fuel Gas Company stated: �This

was another solid quarter for the Company. Our GAAP earnings of

$1.11 per share and our operating results of $1.10 per share are

the highest achieved in the second quarter in our history. While

these record earnings were driven in large part by increased

production and higher average commodity prices that were realized

in our Exploration and Production segment, operating results were

up in all segments.� �We recognize, however, that the higher prices

for all energy sources will have a negative impact on the customers

of our Utility segment. We are pleased to be in a position to offer

our New York customers the benefits of our Conservation Incentive

Program that was implemented during our most recent rate

proceeding. With projected energy costs to remain high during the

next heating season, it is important for our utility customers to

take steps now to conserve during next winter.� �We are also

pleased to report continued progress toward achieving an in-service

date of November 2008 for the Empire Connector pipeline. It is our

intent to continue to grow this important segment of our regulated

business to enhance the stable and consistent base of earnings that

these assets provide.� �In our other growth segment, Exploration

and Production, we are increasing our capital spending,

particularly in Appalachia, where we will continue to accelerate

our conventional upper Devonian drilling program and, additionally,

devote increased capital to extract the potential of the Marcellus

Shale.� SUMMARY OF RESULTS National Fuel had consolidated earnings

for the quarter ended March 31, 2008, of $95.0 million, an increase

of $16.6 million, or $0.19 per share, from the prior year�s second

quarter of $78.4 million or $0.92 per share (note: all references

to earnings per share are to diluted earnings per share, all

amounts are stated in U.S. dollars and all amounts used in the

earnings and operating results discussions are after tax unless

otherwise noted). Consolidated earnings for the six months ended

March 31, 2008, of $165.6 million, or $1.93 per share, increased

$32.6 million, or $0.36 per share, from the same period in the

prior year, where earnings were $133.0 million, or $1.57 per share.

� Three Months � Six Months Ended March 31, Ended March 31, 2008 �

2007 2008 � 2007 (in thousands except per share amounts) Reported

GAAP earnings $ 95,004 $ 78,447 $ 165,608 $ 132,967 Items impacting

comparability1: Income from discontinued operations (2,967) (6,799)

Gain on sale of turbine (586) (586) Resolution of purchased gas

contingency (2,344) (2,344) Discontinuation of hedge accounting

(1,888) � � � � Operating results $ 94,418 $ 73,136 $ 165,022 $

121,936 � Reported GAAP earnings per share $ 1.11 $ 0.92 $ 1.93 $

1.57 Items impacting comparability1: Income from discontinued

operations (0.03) (0.08) Gain on sale of turbine (0.01) (0.01)

Resolution of purchased gas contingency (0.03) (0.03)

Discontinuation of hedge accounting (0.02) � � � � Earnings

excluding these items $ 1.10 $ 0.86 $ 1.92 $ 1.44 1 See discussion

of these individual items below. As outlined in the table above,

certain items included in GAAP earnings impacted the comparability

of the Company�s operating results when comparing the quarter and

six months ended March 31, 2008, to the comparable periods in

fiscal 2007. Excluding these items, operating results for the

current second quarter of $94.4 million, or $1.10 per share,

increased $21.3 million, or $0.24 per share. Excluding these items,

operating results for the six months ended March 31, 2008 of $165.0

million, or $1.92 per share, increased $43.1 million, or $0.48 per

share. Items impacting comparability will be discussed in more

detail within the discussion of segment earnings below. DISCUSSION

OF RESULTS BY SEGMENT (The following discussion of earnings for

each segment is summarized in a tabular form in this report. It may

be helpful to refer to those tables while reviewing this

discussion.) Exploration and Production Segment The Exploration and

Production segment operations are carried out by Seneca Resources

Corporation (�Seneca�). Seneca explores for, develops and purchases

natural gas and oil reserves in California, in the Appalachian

region, and in the Gulf Coast regions of Texas, Louisiana and

Alabama. Seneca previously had Canadian Exploration and Production

operations, which it sold on August 31, 2007. As a result of that

sale, the Company has presented the Canadian operations as

discontinued operations. The Exploration and Production segment�s

earnings in the second quarter of fiscal 2008 of $34.6 million, or

$0.40 per share, increased $14.8 million, or $0.17 per share, when

compared with the prior year�s second quarter. Excluding earnings

from discontinued operations discussed below, operating results in

the Exploration and Production segment increased $17.7 million, or

$0.20 per share, for the second quarter of fiscal 2008. The

increase was primarily due to higher crude oil and natural gas

prices realized after hedging and was also impacted by higher

production. For the quarter ended March 31, 2008, the weighted

average oil price received by Seneca (after hedging) was $78.54 per

barrel (�Bbl�), an increase of $30.59 per Bbl, or 63.8 percent,

from the prior year�s quarter. The weighted average natural gas

price received by Seneca (after hedging) for the quarter ended

March 31, 2008, was $9.21 per thousand cubic feet (�Mcf�), an

increase of $1.98 per Mcf, or 27.4 percent. Overall production for

the quarter was 10.4 billion cubic feet equivalent (�Bcfe�), an

increase of 0.4 Bcfe compared to the prior year�s quarter. A 13.1

percent increase in natural gas production more than offset a drop

in crude oil production. The increase in natural gas production

occurred mostly in the Appalachian region, where production was up

0.5 billion cubic feet, or 37 percent, over the prior year�s

quarter as a result of Seneca�s continued development of its Upper

Devonian acreage position. The decrease in crude oil production

occurred mostly in the Gulf Division and was attributable to the

natural decline curve of Seneca�s properties. Other items impacting

operating results for the quarter were higher depletion expense,

lease operating expenses (�LOE�), general and administrative

expenses and mark-to-market adjustments to recognize hedge

ineffectiveness on certain derivative financial instruments used to

hedge prices on Seneca�s oil and gas production. The increase in

depletion expense was caused by a $0.27 increase in the per unit

depletion rate, which was mainly due to the reduction in proved

reserves in California, primarily in the Midway Sunset field at the

end of fiscal 2007. That reduction resulted from an audit by

Netherland, Sewell & Associates which determined that reduced

performance from certain wells in the field supported a reduction

in proved reserves. The increase in LOE is due to the High Island

24L well that began production in October 2007, higher steaming

costs in California, and an increase in the number of producing

properties in Appalachia, where approximately 20 wells are being

added each month. The Exploration and Production segment�s earnings

of $68.6 million, or $0.80 per share, for the six months ended

March 31, 2008, increased $28.1 million, or $0.32 per share, when

compared with the six months ended March 31, 2007. Excluding

earnings from discontinued operations, operating results for the

six months ended March 31, 2008, increased $34.9 million, or $0.40

per share, from the prior year. The increase was primarily due to

higher crude oil and natural gas prices realized after hedging and

was also significantly impacted by higher production. For the six

months ended March 31, 2008, the weighted average oil price

received by Seneca (after hedging) was $75.44 per Bbl, an increase

of $29.58 per Bbl, or 64.5 percent, from the prior year�s six month

period. The weighted average natural gas price received by Seneca

(after hedging) for the six months ended March 31, 2008, was $8.55

per Mcfe, an increase of $1.38, or 19.2 percent. Overall production

for the six months ended March 31, 2008, was 21.1 Bcfe, an increase

of 1.1 Bcfe, compared to the prior year�s six month period. An

increase in natural gas production more than offset a decline in

crude oil production. Higher interest income and lower interest

expense during the current six month period also contributed to the

increase in operating results. Other items impacting operating

results for the six months ended March 31, 2008, were higher

depletion expense, LOE, general and administrative expenses, state

income taxes and mark-to-market adjustments to recognize hedge

ineffectiveness on certain derivative financial instruments used to

hedge prices on Seneca�s oil and gas production. The increase in

depletion expense is due to higher production and a higher per unit

rate as discussed above. Similar to the quarterly results described

above, the increase in LOE is due to the High Island 24L well that

began production in October 2007, higher steaming costs in

California, and an increase in the number of producing properties

in Appalachia, where approximately 20 wells are being added each

month. Pipeline and Storage Segment The Pipeline and Storage

segment operations are carried out by National Fuel Gas Supply

Corporation (�Supply Corporation�) and Empire State Pipeline

(�Empire�). These companies provide natural gas transportation and

storage services to affiliated and non-affiliated companies through

an integrated system of pipelines and underground natural gas

storage fields in western New York and western Pennsylvania. The

Pipeline and Storage segment�s earnings of $15.6 million, or $0.18

per share, for the quarter ended March 31, 2008, increased $1.7

million, or $0.02 per share, when compared with the same period in

the prior fiscal year. The increase is primarily due to higher

transportation and storage revenues and higher efficiency gas

revenue. The increase in transportation and storage revenue is

mainly due to additional contracts and higher rates for these

services. The increase in efficiency gas revenues is due to both

higher natural gas prices and higher retained volumes compared to

the prior year�s quarter. An increase in the allowance for funds

used during construction (�AFUDC�) resulting from the construction

of the Empire Connector also contributed to the increase in

earnings for the quarter. Partially offsetting the increased

earnings were higher depreciation and operating expenses. The

Pipeline and Storage segment�s earnings of $28.4 million, or $0.33

per share, for the six months ended March 31, 2008, increased $0.8

million when compared with the six months ended March 31, 2007. The

comparability of the results for the six months ended March 31,

2008, is impacted by a $1.9 million gain associated with the

prepayment in the first quarter of 2007 of the project financing

debt for the Empire State Pipeline. Excluding that gain, operating

results increased $2.7 million for the six months ended March 31,

2008, mainly due to higher transportation and storage revenues and

higher efficiency gas revenues. Higher AFUDC and lower depreciation

expense also contributed to the increase in operating results.

Higher operating expenses and interest expense during the six month

period partially offset those items. Utility Segment The Utility

segment operations are carried out by National Fuel Gas

Distribution Corporation (�Distribution�), which sells or

transports natural gas to customers located in western New York and

northwestern Pennsylvania. The Utility segment�s earnings of $34.2

million, or $0.40 per share for the quarter ended March 31, 2008,

increased $0.7 million, or $0.01 per share, however the results are

not directly comparable to the prior year�s second quarter due to a

rate design change in the New York Division discussed below. In the

New York Division, earnings decreased $0.1 million or less than

$0.01 per share. On December 21, 2007, the New York Public Service

Commission issued an order allowing Distribution to increase annual

revenues by $1.8 million. In addition to the revenue increase, the

order approved a rate design change, which allows Distribution to

recover a greater amount of its cost in the minimum bill amount.

This results in shifting over $6.5 million of revenue from the

second quarter and spreading it to the third and fourth quarters of

the fiscal year. As a result of this change, earnings for the

second quarter of fiscal 2008 decreased from the second quarter of

fiscal 2007. The impact of the rate order was mostly offset by a

routine regulatory adjustment and lower expenses for bad debts and

postretirement benefits. In the Pennsylvania Division, earnings

increased $0.8 million due to an increase in customer usage per

account and lower bad debt expense partially offset by warmer

weather compared to the prior year quarter. The Utility segment�s

earnings of $54.4 million, or $0.64 per share, for the six months

ended March 31, 2008, increased $3.8 million, or $0.04 per share,

compared to the six months ended March 31, 2007. Earnings in

Distribution�s New York Division for the six months ended March 31,

2008, of $35.9 million increased $0.8 million or $0.01 per share,

compared to the prior year. The increase is mainly due to an

increase in customer usage per account, a routine regulatory

adjustment, and lower bad debt and postretirement benefits

expenses. The impact of these items more than offset the impact on

earnings of the rate design change included in the rate order

discussed above. For the six months ended March 31, 2008, earnings

in Distribution�s Pennsylvania Division of $18.5 million, or $0.22

per share, increased $3.0 million, or $0.03 per share, compared to

the prior year. Earnings increased primarily due to an increase in

base rates, higher usage per customer and a decrease in bad debt

expense. On January 1, 2007, Distribution implemented a Settlement

Agreement approved by the Pennsylvania Public Utility Commission

that provided for a $14.3 million (before tax) annual base rate

increase. Warmer weather during the six months ended March 31,

2008, partially offset the increase in base rates. Energy Marketing

National Fuel Resources, Inc. (�NFR�) comprises the Company�s

Energy Marketing segment. NFR markets natural gas to industrial,

commercial, public authority and residential customers in western

and central New York and northwestern Pennsylvania, offering

competitively priced energy and energy management services to its

customers. The Energy Marketing segment�s earnings for the quarter

ended March 31, 2008, of $5.6 million, or $0.07 per share,

decreased $1.1 million, or $0.01 per share, compared to the second

quarter of last year. The comparability of the quarterly results is

impacted by a $2.3 million reversal of an accrual for purchased gas

expense for which a contingency was resolved during the second

quarter of 2007. Excluding this item, operating results for the

quarter increased $1.3 million primarily due to a nearly nine

percent increase in sales throughput during the quarter.

Additionally NFR benefited from the profitable sale of certain gas

held as inventory and from the marketing flexibility that it

derives from its contracts for significant storage capacity.

Earnings for the six months ended March 31, 2008, in the Energy

Marketing segment of $6.6 million, or $0.07 per share, decreased

$0.6 million, or $0.01 per share, from the prior period. The

comparability of the results is impacted by a $2.3 million reversal

of an accrual for purchased gas expense noted above. Excluding this

item, operating results for the six months ended March 31, 2008,

increased $1.7 million, or $0.02 per share, compared to the prior

year mainly due to increased sales throughput and the factors

discussed above. Timber Segment The Timber segment operations are

carried out by Highland Forest Resources, Inc. (�Highland�) and

Seneca�s Northeast Division. This segment markets high quality

hardwoods from its New York and Pennsylvania land holdings, and

owns two sawmill/dry kiln operations in northwestern Pennsylvania.

The Timber segment�s earnings for the quarter ended March 31, 2008

of $3.9 million, or $0.05 per share, increased $0.7 million, or

$0.01 per share from the prior year�s second quarter due to higher

margins. Much of the current quarter�s harvest was from low or no

basis Company-owned property. This resulted in an increase in gross

margins from the prior year�s quarter. Earnings for the six months

ended March 31, 2008, of $4.3 million, increased $0.9 million from

the prior year�s earnings. The increase is due to higher volumes of

lumber and log sales. In addition, harvesting from Company-owned

property resulted in higher margins during the six months ended

March 31, 2008. Corporate and All Other Other direct, wholly-owned

subsidiaries of the Company include: Horizon LFG, Inc., a

corporation engaged through subsidiaries in the purchase,

processing, transportation and sale of landfill gas; and Horizon

Power, Inc., a corporation that develops and owns independent

electric generation facilities which are fueled with natural gas or

landfill gas. Earnings in the Corporate and All Other category for

the quarter ended March 31, 2008, were $1.1 million, a slight

decrease compared to the prior year�s second quarter earnings of

$1.4 million. The comparability of the quarterly results is

impacted by a $0.6 million gain on the sale of a gas-powered

turbine the Company had previously planned to use in the

development of a co-generation plant. Excluding this item,

operating results for the quarter decreased $0.8 million. Higher

margins from the landfill gas operations and lower interest expense

were more than offset by lower interest income and higher operating

expenses mainly related to the proxy contest initiated by a

shareholder. Earnings in the Corporate and All Other category for

the six months ended March 31, 2008, were $3.4 million, a decrease

of $0.2 million when compared to the prior year�s earnings. The

comparability of the results for the six months ended March 31,

2008, is impacted by the $0.6 million gain on the sale of the

turbine described above. Excluding this item, operating results

decreased $0.8 million. Higher margins from the landfill gas

operations, higher income from unconsolidated subsidiaries, lower

interest expense and a lower effective tax rate were more than

offset by lower interest income and higher operating expenses

mainly related to the proxy contest noted above. Discontinued

Operations On August 31, 2007, Seneca completed the sale of its

Canadian subsidiary. As a result of that sale, the Company has

presented the Canadian operations as discontinued operations.

Earnings in the second quarter of fiscal 2007 include earnings from

discontinued operations of $3.0 million. There were no earnings

from discontinued operations in the second quarter of fiscal 2008.

Earnings for the six months ended March 31, 2007, include earnings

from discontinued operations of $6.8 million. There were no

earnings from discontinued operations for the six months ended

March 31, 2008. EARNINGS GUIDANCE The Company is increasing and

narrowing its GAAP earnings guidance for fiscal 2008 earnings to a

range of $2.90 to $3.00 per share. Earnings guidance had previously

been in the range of $2.60 to $2.80 per share. The narrowing of the

range is possible because the most sensitivity to earnings variance

in the Utility segment typically occurs during the first two fiscal

quarters, which are now completed. The increase in the guidance is

a result of higher than forecast crude oil prices realized by

Seneca during the three months ended March 31, 2008, combined with

the certainty of pricing on planned commodity sales in both the

Pipeline and Storage and the Exploration and Production segments,

which are now hedged. In addition, the revised earnings per share

guidance reflects a lower weighted average number of shares to be

outstanding for the remainder of the fiscal year as a result of

shares repurchased pursuant to the Company�s share repurchase

program. This guidance is still based on the July 24, 2007, NYMEX

commodity pricing incorporated in the Company�s original guidance.

To the extent that actual pricing during the remainder of the

fiscal year varies from those July 24, 2007, prices, the fiscal

year earnings will be affected as detailed in the earnings

sensitivity table in this release. EARNINGS TELECONFERENCE The

Company will host a conference call on Friday, May 2, 2008, at 11

a.m. (Eastern Time) to discuss this announcement. There are two

ways to access this call. For those with Internet access, visit the

investor relations page at National Fuel�s Web site at

investor.nationalfuelgas.com. For those without Internet access,

access is also provided by dialing (toll-free) 1-866-271-5140, and

using the passcode �75887151.� For those unable to listen to the

live conference call, a replay will be available approximately one

hour after the conclusion of the call at the same Web site link and

by phone at (toll free) 888-286-8010 using passcode �39987735.�

Both the webcast and telephonic replay will be available until the

close of business on Friday, May 9, 2008. National Fuel is an

integrated energy company with $4.2 billion in assets comprised of

the following five operating segments: Exploration and Production,

Pipeline and Storage, Utility, Energy Marketing, and Timber.

Additional information about National Fuel is available on its

Internet Web site: http://www.nationalfuelgas.com or through its

investor information service at 1-800-334-2188. Certain statements

contained herein, including those regarding estimated future

earnings, and statements that are identified by the use of the

words �anticipates,� �estimates,� �expects,� �forecasts,�

�intends,� �plans,� �predicts,� �projects,� �believes,� �seeks,�

�will,� �may� and similar expressions, are �forward-looking

statements� as defined by the Private Securities Litigation Reform

Act of 1995. Forward-looking statements involve risks and

uncertainties, which could cause actual results or outcomes to

differ materially from those expressed in the forward-looking

statements. The Company�s expectations, beliefs and projections

contained herein are expressed in good faith and are believed to

have a reasonable basis, but there can be no assurance that such

expectations, beliefs or projections will result or be achieved or

accomplished. In addition to other factors, the following are

important factors that could cause actual results to differ

materially from those discussed in the forward-looking statements:

changes in economic conditions, including economic disruptions

caused by terrorist activities, acts of war or major accidents;

changes in demographic patterns and weather conditions, including

the occurrence of severe weather such as hurricanes; changes in the

availability and/or price of natural gas or oil and the effect of

such changes on the accounting treatment of derivative financial

instruments or the valuation of the Company�s natural gas and oil

reserves; uncertainty of oil and gas reserve estimates; ability to

successfully identify, drill for and produce economically viable

natural gas and oil reserves; significant changes from expectations

in the Company�s actual production levels for natural gas or oil;

changes in the availability and/or price of derivative financial

instruments; changes in the price differentials between various

types of oil; inability to obtain new customers or retain existing

ones; significant changes in competitive factors affecting the

Company; changes in laws and regulations to which the Company is

subject, including changes in tax, environmental, safety and

employment laws and regulations; governmental/regulatory actions,

initiatives and proceedings, including those involving

acquisitions, financings, rate cases (which address, among other

things, allowed rates of return, rate design and retained gas),

affiliate relationships, industry structure, franchise renewal, and

environmental/safety requirements; unanticipated impacts of

restructuring initiatives in the natural gas and electric

industries; significant changes from expectations in actual capital

expenditures and operating expenses and unanticipated project

delays or changes in project costs or plans; the nature and

projected profitability of pending and potential projects and other

investments, and the ability to obtain necessary governmental

approvals and permits; occurrences affecting the Company�s ability

to obtain funds from operations, from borrowings under our credit

lines or other credit facilities or from issuances of other

short-term notes or debt or equity securities to finance needed

capital expenditures and other investments, including any

downgrades in the Company�s credit ratings; ability to successfully

identify and finance acquisitions or other investments and ability

to operate and integrate existing and any subsequently acquired

business or properties; impairments under the SEC�s full cost

ceiling test for natural gas and oil reserves; significant changes

in tax rates or policies or in rates of inflation or interest;

significant changes in the Company�s relationship with its

employees or contractors and the potential adverse effects if labor

disputes, grievances or shortages were to occur; changes in

accounting principles or the application of such principles to the

Company; the cost and effects of legal and administrative claims

against the Company; changes in actuarial assumptions and the

return on assets with respect to the Company�s retirement plan and

post-retirement benefit plans; increasing health care costs and the

resulting effect on health insurance premiums and on the obligation

to provide post-retirement benefits; or increasing costs of

insurance, changes in coverage and the ability to obtain insurance.

The Company disclaims any obligation to update any forward-looking

statements to reflect events or circumstances after the date

hereof. NATIONAL FUEL GAS COMPANY RECONCILIATION OF CURRENT AND

PRIOR YEAR GAAP EARNINGS QUARTER ENDED MARCH 31, 2008 � �

Exploration & � Pipeline & � � Energy � � Corporate / �

(Thousands of Dollars) Production* � Storage � Utility � Marketing

� Timber � All Other � Consolidated � Second quarter 2007 GAAP

earnings $ 19,801 $ 13,936 $ 33,444 $ 6,706 $ 3,200 $ 1,360 $

78,447 Items impacting comparability: Income from discontinued

operations (2,967) (2,967) Resolution of a purchased gas

contingency � � � � � � � (2,344) � � � � � � (2,344) Second

quarter 2007 operating results 16,834 13,936 33,444 4,362 3,200

1,360 73,136 � Drivers of operating results Higher crude oil prices

15,016 15,016 Higher natural gas prices 7,485 7,485 Higher natural

gas production 3,169 3,169 Lower crude oil production (1,521)

(1,521) Derivative mark to market adjustment (1,093) (1,093) Higher

lease operating costs (3,356) (3,356) � Higher transportation and

storage revenues 979 979 Higher efficiency gas revenues 1,040 1,040

Lower (higher) operating costs (1,922) (438) 3,023 (1,374) (711)

Lower (higher) depreciation / depletion (2,311) (398) 348 (250)

(2,611) � Usage 1,483 1,483 Warmer weather in Pennsylvania (537)

(537) Base rate decrease in New York (4,279) (4,279) Regulatory

true-up adjustment 528 528 � Higher margins 1,224 984 307 2,515 �

Higher AFUDC** 442 442 Higher (lower) interest income 487 (1,253)

(766) Lower interest expense 1,219 1,233 2,452 � All other /

rounding � 565 � � 57 � � 154 � � 61 � � (51) � � 261 � � 1,047 �

Second quarter 2008 operating results 34,572 15,618 34,164 5,647

3,883 534 94,418 Items impacting comparability: Gain on Sale of

Turbine � � � � � � � � � � � 586 � � 586 Second quarter 2008 GAAP

earnings $ 34,572 � $ 15,618 � $ 34,164 � $ 5,647 � $ 3,883 � $

1,120 � $ 95,004 � � * Includes discontinued operations ** AFUDC =

Allowance for Funds Used During Construction NATIONAL FUEL GAS

COMPANY RECONCILIATION OF CURRENT AND PRIOR YEAR GAAP EARNINGS PER

SHARE QUARTER ENDED MARCH 31, 2008 � � Exploration & � Pipeline

& � � Energy � � Corporate / � Production* � Storage � Utility

� Marketing � Timber � All Other � Consolidated � Second quarter

2007 GAAP earnings $ 0.23 $ 0.16 $ 0.39 $ 0.08 $ 0.04 $ 0.02 $ 0.92

Items impacting comparability: Income from discontinued operations

(0.03) (0.03) Resolution of a purchased gas contingency � � � � � �

� (0.03) � � � � � � (0.03) Second quarter 2007 operating results

0.20 0.16 0.39 0.05 0.04 0.02 0.86 � Drivers of operating results

Higher crude oil prices 0.18 0.18 Higher natural gas prices 0.09

0.09 Higher natural gas production 0.04 0.04 Lower crude oil

production (0.02) (0.02) Derivative mark to market adjustment

(0.01) (0.01) Higher lease operating costs (0.04) (0.04) � Higher

transportation and storage revenues 0.01 0.01 Higher efficiency gas

revenues 0.01 0.01 Lower (higher) operating costs (0.02) (0.01)

0.04 (0.02) (0.01) Lower (higher) depreciation / depletion (0.03) -

- - (0.03) � Usage 0.02 0.02 Warmer weather in Pennsylvania (0.01)

(0.01) Base rate decrease in New York (0.05) (0.05) Regulatory

true-up adjustment 0.01 0.01 � Higher margins 0.01 0.01 - 0.02 �

Higher AFUDC** 0.01 0.01 Higher (lower) interest income 0.01 (0.01)

- Lower interest expense 0.01 0.01 0.02 � All other / rounding �

(0.01) � � - � � - � � 0.01 � � - � � - � � - � Second quarter 2008

operating results 0.40 0.18 0.40 0.07 0.05 - 1.10 Items impacting

comparability: Gain on Sale of Turbine � � � � � � � � � � � 0.01 �

� 0.01 Second quarter 2008 GAAP earnings $ 0.40 � $ 0.18 � $ 0.40 �

$ 0.07 � $ 0.05 � $ 0.01 � $ 1.11 � � * Includes discontinued

operations ** AFUDC = Allowance for Funds Used During Construction

NATIONAL FUEL GAS COMPANY RECONCILIATION OF CURRENT AND PRIOR YEAR

GAAP EARNINGS SIX MONTHS ENDED MARCH 31, 2008 � � Exploration &

� Pipeline & � � Energy � � Corporate / � (Thousands of

Dollars) Production* � Storage � Utility � Marketing � Timber � All

Other � Consolidated � Six months ended March 31, 2007 GAAP

earnings $ 40,523 $ 27,624 $ 50,618 $ 7,198 $ 3,417 $ 3,587 $

132,967 Items impacting comparability: Income from discontinued

operations (6,799) (6,799) Resolution of a purchased gas

contingency (2,344) (2,344) Discontinuance of hedge accounting � �

� (1,888) � � � � � � � � � � (1,888) Six months ended March 31,

2007 operating results 33,724 25,736 50,618 4,854 3,417 3,587

121,936 � Drivers of operating results Higher crude oil prices

30,314 30,314 Higher natural gas prices 10,406 10,406 Higher

natural gas production 6,454 6,454 Lower crude oil production

(1,423) (1,423) Derivative mark to market adjustment (1,267)

(1,267) Higher lease operating costs (4,872) (4,872) � Higher

transportation and storage revenues 2,403 2,403 Higher efficiency

gas revenues 833 833 Lower (higher) operating costs (2,264) (1,147)

2,884 (3,745) (4,272) Lower (higher) depreciation / depletion

(5,857) 371 (365) (5,851) � Usage 3,366 3,366 Warmer weather in

Pennsylvania (1,208) (1,208) Base rate decrease in New York (4,279)

(4,279) Base rate increase in Pennsylvania 2,006 2,006 Regulatory

true-up adjustment 712 712 � Higher margins 1,721 1,564 282 3,567 �

Income from unconsolidated subsidiaries 736 736 � Higher AFUDC**

800 800 Higher (lower) interest income 1,542 (742) 800 Lower

(higher) interest expense 2,391 (345) 2,017 4,063 � (Higher) lower

income tax expense (930) 393 (537) � All other / rounding � 376 � �

(254) � � 281 � � 27 � � (336) � � 241 � � 335 � Six months ended

March 31, 2008 operating results 68,594 28,397 54,380 6,602 4,280

2,769 165,022 Items impacting comparability: Gain on Sale of

Turbine � � � � � � � � � � � 586 � � 586 Six months ended March

31, 2008 GAAP earnings $ 68,594 � $ 28,397 � $ 54,380 � $ 6,602 � $

4,280 � $ 3,355 � $ 165,608 � � * Includes discontinued operations

** AFUDC = Allowance for Funds Used During Construction NATIONAL

FUEL GAS COMPANY RECONCILIATION OF CURRENT AND PRIOR YEAR GAAP

EARNINGS PER SHARE SIX MONTHS ENDED MARCH 31, 2008 � � Exploration

& � Pipeline & � � Energy � � Corporate / � Production* �

Storage � Utility � Marketing � Timber � All Other � Consolidated �

Six months ended March 31, 2007 GAAP earnings $ 0.48 $ 0.33 $ 0.60

$ 0.08 $ 0.04 $ 0.04 $ 1.57 Items impacting comparability: Income

from discontinued operations (0.08) (0.08) Resolution of a

purchased gas contingency (0.03) (0.03) Discontinuance of hedge

accounting � � � (0.02) � � � � � � � � � � (0.02) Six months ended

March 31, 2007 operating results 0.40 0.31 0.60 0.05 0.04 0.04 1.44

� Drivers of operating results Higher crude oil prices 0.35 0.35

Higher natural gas prices 0.12 0.12 Higher natural gas production

0.08 0.08 Lower crude oil production (0.02) (0.02) Derivative mark

to market adjustment (0.01) (0.01) Higher lease operating costs

(0.06) (0.06) � Higher transportation and storage revenues 0.03

0.03 Higher efficiency gas revenues 0.01 0.01 Lower (higher)

operating costs (0.03) (0.01) 0.03 (0.04) (0.05) Lower (higher)

depreciation / depletion (0.07) - - (0.07) � Usage 0.04 0.04 Warmer

weather in Pennsylvania (0.01) (0.01) Base rate decrease in New

York (0.05) (0.05) Base rate increase in Pennsylvania 0.02 0.02

Regulatory true-up adjustment 0.01 0.01 � Higher margins 0.02 0.02

- 0.04 � Income from unconsolidated subsidiaries 0.01 0.01 � Higher

AFUDC** 0.01 0.01 Higher (lower) interest income 0.02 (0.01) 0.01

Lower (higher) interest expense 0.03 - 0.02 0.05 � (Higher) lower

income tax expense (0.01) - (0.01) � All other / rounding � - � �

(0.02) � � - � � - � � (0.01) � � 0.01 � � (0.02) Six months ended

March 31, 2008 operating results 0.80 0.33 0.64 0.07 0.05 0.03 1.92

Items impacting comparability: Gain on Sale of Turbine � � � � � �

� � � � � 0.01 � � 0.01 Six months ended March 31, 2008 GAAP

earnings $ 0.80 � $ 0.33 � $ 0.64 � $ 0.07 � $ 0.05 � $ 0.04 � $

1.93 � * Includes discontinued operations ** AFUDC = Allowance for

Funds Used During Construction NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES � (Thousands of Dollars, except per share amounts) � �

� � Three Months Ended Six Months Ended March 31, March 31,

(Unaudited) (Unaudited) SUMMARY OF OPERATIONS 2008 2007 2008 2007

Operating Revenues $ 885,853 $ 798,100 $ 1,454,121 $ 1,288,758 �

Operating Expenses: Purchased Gas 531,438 476,904 809,448 719,843

Operation and Maintenance 120,584 120,408 223,040 215,112 Property,

Franchise and Other Taxes 21,398 19,989 39,070 36,940 Depreciation,

Depletion and Amortization � 42,412 � 38,395 � 86,533 � 77,802

715,832 655,696 1,158,091 1,049,697 � Operating Income 170,021

142,404 296,030 239,061 � Other Income (Expense): Income from

Unconsolidated Subsidiaries 1,030 942 3,305 2,173 Interest Income

2,177 636 5,270 1,721 Other Income 2,080 2,526 3,334 3,241 Interest

Expense on Long-Term Debt (16,289) (17,888) (32,577) (33,931) Other

Interest Expense � (2,285) � (1,516) � (3,010) � (3,366) � Income

from Continuing Operations Before Income Taxes 156,734 127,104

272,352 208,899 � Income Tax Expense � 61,730 � 51,624 � 106,744 �

82,731 � Income from Continuing Operations 95,004 75,480 165,608

126,168 � Income from Discontinued Operations, Net of Tax � - �

2,967 � - � 6,799 � Net Income Available for Common Stock $ 95,004

$ 78,447 $ 165,608 $ 132,967 � Earnings Per Common Share: Basic:

Income from Continuing Operations $ 1.14 $ 0.91 $ 1.98 $ 1.53

Income from Discontinued Operations � - � 0.04 � - � 0.08 Net

Income Available for Common Stock $ 1.14 $ 0.95 $ 1.98 $ 1.61 �

Diluted: Income from Continuing Operations $ 1.11 $ 0.89 $ 1.93 $

1.49 Income from Discontinued Operations � - � 0.03 � - � 0.08 Net

Income Available for Common Stock $ 1.11 $ 0.92 $ 1.93 $ 1.57 �

Weighted Average Common Shares: Used in Basic Calculation �

83,406,242 � 82,895,087 � 83,509,268 � 82,786,027 Used in Diluted

Calculation � 85,385,944 � 85,033,127 � 85,603,033 � 84,891,742

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS (Unaudited) � � March 31, September 30, (Thousands of

Dollars) � 2008 � 2007 � ASSETS Property, Plant and Equipment $

4,593,980 $ 4,461,586 Less - Accumulated Depreciation, Depletion

and Amortization � 1,650,715 � � 1,583,181 Net Property, Plant and

Equipment � 2,943,265 � � 2,878,405 � Current Assets: Cash and

Temporary Cash Investments 216,412 124,806 Cash Held in Escrow -

61,964 Hedging Collateral Deposits 2,354 4,066 Receivables - Net

363,872 172,380 Unbilled Utility Revenue 75,084 20,682 Gas Stored

Underground 19,512 66,195 Materials and Supplies - at average cost

37,618 35,669 Unrecovered Purchased Gas Costs 1,421 14,769 Other

Current Assets 30,854 45,057 Deferred Income Taxes � 41,253 � �

8,550 Total Current Assets � 788,380 � � 554,138 � Other Assets:

Recoverable Future Taxes 83,620 83,954 Unamortized Debt Expense

11,101 12,070 Other Regulatory Assets 133,881 137,577 Deferred

Charges 5,314 5,545 Other Investments 83,754 85,902 Investments in

Unconsolidated Subsidiaries 16,605 18,256 Goodwill 5,476 5,476

Intangible Assets 27,505 28,836 Prepaid Pension and Post-Retirement

Benefit Costs 59,331 61,006 Fair Value of Derivative Financial

Instruments - 9,188 Other � 4,843 � � 8,059 Total Other Assets �

431,430 � � 455,869 Total Assets $ 4,163,075 � $ 3,888,412 �

CAPITALIZATION AND LIABILITIES Capitalization: Comprehensive

Shareholders' Equity Common Stock, $1 Par Value Authorized -

200,000,000 Shares; Issued and Outstanding - 81,636,429 Shares and

83,461,308 Shares, Respectively $ 81,636 $ 83,461 Paid in Capital

580,811 569,085 Earnings Reinvested in the Business � 1,008,084 � �

983,776 Total Common Shareholder Equity Before Items of Other

Comprehensive Loss 1,670,531 1,636,322 Accumulated Other

Comprehensive Loss � (41,867) � � (6,203) Total Comprehensive

Shareholders' Equity 1,628,664 1,630,119 Long-Term Debt, Net of

Current Portion � 899,000 � � 799,000 Total Capitalization �

2,527,664 � � 2,429,119 � Current and Accrued Liabilities: Notes

Payable to Banks and Commercial Paper - - Current Portion of

Long-Term Debt 100,000 200,024 Accounts Payable 149,595 109,757

Amounts Payable to Customers 4,985 10,409 Dividends Payable 25,307

25,873 Interest Payable on Long-Term Debt 18,158 18,158 Customer

Advances - 22,863 Other Accruals and Current Liabilities 213,087

36,062 Fair Value of Derivative Financial Instruments � 64,595 � �

16,200 Total Current and Accrued Liabilities � 575,727 � � 439,346

� Deferred Credits: Deferred Income Taxes 593,375 575,356 Taxes

Refundable to Customers 14,033 14,026 Unamortized Investment Tax

Credit 5,042 5,392 Cost of Removal Regulatory Liability 99,924

91,226 Other Regulatory Liabilities 92,343 76,659 Post-Retirement

Liabilities 62,372 70,555 Asset Retirement Obligations 76,357

75,939 Other Deferred Credits � 116,238 � � 110,794 Total Deferred

Credits � 1,059,684 � � 1,019,947 Commitments and Contingencies � -

� � - Total Capitalization and Liabilities $ 4,163,075 � $

3,888,412 NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF CASH FLOWS (Unaudited) � � Six Months Ended March 31,

(Thousands of Dollars) � 2008 � 2007 � Operating Activities: Net

Income Available for Common Stock $ 165,608 $ 132,967 Adjustments

to Reconcile Net Income to Net Cash Provided by Operating

Activities: Depreciation, Depletion and Amortization 86,533 84,886

Deferred Income Taxes 12,817 21,803 Income from Unconsolidated

Subsidiaries, Net of Cash Distributions 1,651 (960) Excess Tax

Benefits Associated with Stock-Based Compensation Awards (16,275)

(13,689) Other (194) 3,818 Change in: Hedging Collateral Deposits

1,712 17,642 Receivables and Unbilled Utility Revenue (245,912)

(196,094) Gas Stored Underground and Materials and Supplies 44,734

47,243 Unrecovered Purchased Gas Costs 13,347 (992) Prepayments and

Other Current Assets 15,878 28,659 Accounts Payable 39,838 34,417

Amounts Payable to Customers (5,424) (13,339) Customer Advances

(22,863) (29,417) Other Accruals and Current Liabilities 192,787

163,928 Other Assets 18,127 (3,765) Other Liabilities � � 4,504 � �

(2,434) Net Cash Provided by Operating Activities � $ 306,868 � $

274,673 � Investing Activities: Capital Expenditures ($144,707)

($132,313) Investment in Partnership - (3,300) Cash Held in Escrow

58,397 - Net Proceeds from Sale of Oil and Gas Producing Properties

2,313 2,330 Other � � 1,557 � � (339) Net Cash Used in Investing

Activities � � ($82,440) � � ($133,622) � Financing Activities:

Excess Tax Benefits Associated with Stock-Based Compensation Awards

$ 16,275 $ 13,689 Shares Repurchased under Repurchase Plan

(108,941) (43,344) Reduction of Long-Term Debt (24) (23,207)

Dividends Paid on Common Stock (51,896) (49,808) Proceeds From

Issuance of Common Stock � � 11,764 � � 14,604 Net Cash Used In

Financing Activities � � ($132,822) � � ($88,066) Effect of

Exchange Rates on Cash � � - � � (787) Net Increase in Cash and

Temporary Cash Investments 91,606 52,198 Cash and Temporary Cash

Investments at Beginning of Period � � 124,806 � � 69,611 Cash and

Temporary Cash Investments at March 31 � $ 216,412 � $ 121,809

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES � SEGMENT OPERATING

RESULTS AND STATISTICS (UNAUDITED) � � Three Months Ended � Six

Months Ended (Thousands of Dollars, except per share amounts) March

31, March 31, EXPLORATION AND PRODUCTION SEGMENT � 2008 � � 2007 �

Variance � 2008 � � 2007 � Variance Operating Revenues $ 114,720 �

$ 78,554 � $ 36,166 $ 222,675 � $ 153,680 � $ 68,995 � � � �

Operating Expenses: Purchased Gas - - - - - - Operation and

Maintenance: General and Administrative Expense 7,171 4,491 2,680

12,752 8,706 4,046 Lease Operating Expense 14,421 11,336 3,085

26,148 21,543 4,605 All Other Operation and Maintenance Expense

2,284 2,006 278 4,018 4,582 (564) Property, Franchise and Other

Taxes (Lease Operating Expense) 3,074 997 2,077 4,876 1,986 2,890

Depreciation, Depletion and Amortization � 22,804 � � 19,248 � �

3,556 � 46,849 � � 37,838 � � 9,011 � 49,754 � � 38,078 � � 11,676

� 94,643 � � 74,655 � � 19,988 � Operating Income 64,966 40,476

24,490 128,032 79,025 49,007 � Other Income (Expense): Interest

Income 3,144 2,395 749 7,032 4,661 2,371 Other Income (65) - (65)

18 - 18 Other Interest Expense � (11,073) � � (12,949) � � 1,876 �

(22,218) � � (25,897) � � 3,679 � Income from Continuing Operations

Before Income Taxes 56,972 29,922 27,050 112,864 57,789 55,075

Income Tax Expense � 22,400 � � 13,088 � � 9,312 � 44,270 � �

24,065 � � 20,205 Income from Continuing Operations 34,572 16,834

17,738 68,594 33,724 34,870 � Income from Discontinued Operations,

Net of Tax � - � � 2,967 � � (2,967) � - � � 6,799 � � (6,799) �

Net Income $ 34,572 � $ 19,801 � $ 14,771 $ 68,594 � $ 40,523 � $

28,071 � Income from Continuing Operations Per Share (Diluted) $

0.40 $ 0.20 $ 0.20 $ 0.80 $ 0.40 $ 0.40 Income from Discontinued

Operations, Net of Tax, Per - - Share (Diluted) � - � � 0.03 � �

(0.03) � - � � 0.08 � � (0.08) Net Income Per Share (Diluted) $

0.40 � $ 0.23 � $ 0.17 $ 0.80 � $ 0.48 � $ 0.32 � � Three Months

Ended Six Months Ended March 31, March 31, PIPELINE AND STORAGE

SEGMENT � 2008 � � 2007 � Variance � 2008 � � 2007 � Variance

Revenues from External Customers $ 37,934 $ 34,952 $ 2,982 $ 69,817

$ 64,761 $ 5,056 Intersegment Revenues � 20,861 � � 20,884 � � (23)

� 41,209 � � 41,252 � � (43) Total Operating Revenues � 58,795 � �

55,836 � � 2,959 � 111,026 � � 106,013 � � 5,013 � Operating

Expenses: Purchased Gas (14) 2 (16) (8) (11) 3 Operation and

Maintenance 18,417 17,744 673 34,415 32,647 1,768 Property,

Franchise and Other Taxes 4,259 4,335 (76) 8,532 8,613 (81)

Depreciation, Depletion and Amortization � 8,176 � � 7,563 � � 613

� 16,285 � � 16,855 � � (570) � 30,838 � � 29,644 � � 1,194 �

59,224 � � 58,104 � � 1,120 � Operating Income 27,957 26,192 1,765

51,802 47,909 3,893 � Other Income (Expense): Interest Income 70 39

31 165 123 42 Other Income 731 80 651 1,421 264 1,157 Interest

Expense on Long-Term Debt (16) (10) (6) (31) 1,829 (1,860) Other

Interest Expense � (2,552) � � (2,741) � � 189 � (5,588) � �

(5,028) � � (560) � Income Before Income Taxes 26,190 23,560 2,630

47,769 45,097 2,672 Income Tax Expense � 10,572 � � 9,624 � � 948 �

19,372 � � 17,473 � � 1,899 Net Income $ 15,618 � $ 13,936 � $

1,682 $ 28,397 � $ 27,624 � $ 773 � Net Income Per Share (Diluted)

$ 0.18 � $ 0.16 � $ 0.02 � $ 0.33 � $ 0.33 � $ - NATIONAL FUEL GAS

COMPANY AND SUBSIDIARIES � SEGMENT OPERATING RESULTS AND STATISTICS

(UNAUDITED) � � Three Months Ended � Six Months Ended (Thousands of

Dollars, except per share amounts) March 31, March 31, UTILITY

SEGMENT 2008 � 2007 � Variance 2008 � 2007 � Variance Revenues from

External Customers $ 522,730 � $ 501,473 � $ 21,257 $ 849,855 � $

790,256 � $ 59,599 Intersegment Revenues � 6,114 � � 5,941 � � 173

� 10,413 � � 9,970 � � 443 Total Operating Revenues � 528,844 � �

507,414 � � 21,430 � 860,268 � � 800,226 � � 60,042 � Operating

Expenses: Purchased Gas 378,187 352,864 25,323 597,310 539,225

58,085 Operation and Maintenance 62,796 67,448 (4,652) 113,778

118,215 (4,437) Property, Franchise and Other Taxes 13,531 14,107

(576) 24,629 25,298 (669) Depreciation, Depletion and Amortization

� 9,786 � � 10,321 � � (535) � 19,827 � � 20,100 � � (273) �

464,300 � � 444,740 � � 19,560 � 755,544 � � 702,838 � � 52,706 �

Operating Income 64,544 62,674 1,870 104,724 97,388 7,336 � Other

Income (Expense): Interest Income 164 177 (13) 362 462 (100) Other

Income 259 368 (109) 604 653 (49) Other Interest Expense � (7,654)

� � (7,269) � � (385) � (14,905) � � (14,646) � � (259) � Income

Before Income Taxes 57,313 55,950 1,363 90,785 83,857 6,928 Income

Tax Expense � 23,149 � � 22,506 � � 643 � 36,405 � � 33,239 � �

3,166 Net Income $ 34,164 � $ 33,444 � $ 720 $ 54,380 � $ 50,618 �

$ 3,762 � Net Income Per Share (Diluted) $ 0.40 � $ 0.39 � $ 0.01 $

0.64 � $ 0.60 � $ 0.04 � � Three Months Ended Six Months Ended

March 31, March 31, ENERGY MARKETING SEGMENT 2008 � 2007 � Variance

2008 � 2007 � Variance Operating Revenues $ 191,263 � $ 163,338 � $

27,925 $ 277,982 � $ 246,656 � $ 31,326 � Operating Expenses:

Purchased Gas 180,723 151,027 29,696 264,652 232,282 32,370

Operation and Maintenance 1,439 1,218 221 2,785 2,512 273 Property,

Franchise and Other Taxes 14 24 (10) 23 35 (12) Depreciation,

Depletion and Amortization � 11 � � 7 � � 4 � 22 � � 14 � � 8 �

182,187 � � 152,276 � � 29,911 � 267,482 � � 234,843 � � 32,639 �

Operating Income 9,076 11,062 (1,986) 10,500 11,813 (1,313) � Other

Income (Expense): Interest Income 63 78 (15) 87 140 (53) Other

Income 74 181 (107) 133 317 (184) Other Interest Expense � (44) � �

(125) � � 81 � (127) � � (252) � � 125 � Income Before Income Taxes

9,169 11,196 (2,027) 10,593 12,018 (1,425) Income Tax Expense �

3,522 � � 4,490 � � (968) � 3,991 � � 4,820 � � (829) Net Income $

5,647 � $ 6,706 � $ (1,059) $ 6,602 � $ 7,198 � $ (596) � Net

Income Per Share (Diluted) $ 0.07 � $ 0.08 � $ (0.01) $ 0.07 � $

0.08 � $ (0.01) NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES �

SEGMENT OPERATING RESULTS AND STATISTICS (UNAUDITED) � � Three

Months Ended � Six Months Ended (Thousands of Dollars, except per

share amounts) March 31, March 31, TIMBER SEGMENT 2008 � 2007 �

Variance 2008 � 2007 � Variance Operating Revenues $ 17,424 � $

18,184 � $ (760) $ 30,324 � $ 29,947 � $ 377 � � � � Operating

Expenses: Operation and Maintenance 8,684 10,969 (2,285) 18,643

20,111 (1,468) Property, Franchise and Other Taxes 430 426 4 827

819 8 Depreciation, Depletion and Amortization 1,267 � 883 � 384

2,813 � 2,251 � 562 10,381 � 12,278 � (1,897) 22,283 � 23,181 �

(898) � Operating Income 7,043 5,906 1,137 8,041 6,766 1,275 �

Other Income (Expense): Interest Income 189 296 (107) 579 612 (33)

Other Income - - - - 21 (21) Other Interest Expense (790) � (791) �

1 (1,650) � (1,594) � (56) � Income Before Income Taxes 6,442 5,411

1,031 6,970 5,805 1,165 Income Tax Expense 2,559 � 2,211 � 348

2,690 � 2,388 � 302 Net Income $ 3,883 � $ 3,200 � $ 683 $ 4,280 �

$ 3,417 � $ 863 � Net Income Per Share (Diluted) $ 0.05 � $ 0.04 �

$ 0.01 $ 0.05 � $ 0.04 � $ 0.01 � � Three Months Ended Six Months

Ended March 31, March 31, ALL OTHER 2008 � 2007 � Variance 2008 �

2007 � Variance Revenues from External Customers $ 1,619 $ 1,403 $

216 $ 3,169 $ 3,079 $ 90 Intersegment Revenues 3,099 � 2,090 �

1,009 5,812 � 4,287 � 1,525 Total Operating Revenues 4,718 � 3,493

� 1,225 8,981 � 7,366 � 1,615 � Operating Expenses: Purchased Gas

2,510 1,822 688 4,712 3,650 1,062 Operation and Maintenance 1,056

950 106 2,114 1,755 359 Property, Franchise and Other Taxes 17 28

(11) 40 48 (8) Depreciation, Depletion and Amortization 196 � 197 �

(1) 393 � 393 � - 3,779 � 2,997 � 782 7,259 � 5,846 � 1,413 �

Operating Income 939 496 443 1,722 1,520 202 � Other Income

(Expense): Income from Unconsolidated Subsidiaries 1,030 942 88

3,305 2,173 1,132 Interest Income 28 4 24 43 7 36 Other Income 912

12 900 921 25 896 Other Interest Expense (142) � (667) � 525 (429)

� (1,337) � 908 � Income Before Income Taxes 2,767 787 1,980 5,562

2,388 3,174 Income Tax Expense 1,075 � 320 � 755 1,532 � 935 � 597

Net Income $ 1,692 � $ 467 � $ 1,225 $ 4,030 � $ 1,453 � $ 2,577 �

Net Income Per Share (Diluted) $ 0.02 � $ 0.01 � $ 0.01 $ 0.05 � $

0.02 � $ 0.03 NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES � SEGMENT

OPERATING RESULTS AND STATISTICS (UNAUDITED) � � Three Months Ended

� Six Months Ended (Thousands of Dollars, except per share amounts)

March 31, March 31, CORPORATE 2008 � 2007 � Variance 2008 � 2007 �

Variance Revenues from External Customers $ 163 � $ 196 � $ (33) $

299 � $ 379 � $ (80) Intersegment Revenues � 961 � � 912 � � 49 �

1,922 � � 1,764 � � 158 Total Operating Revenues � 1,124 � � 1,108

� � 16 � 2,221 � � 2,143 � � 78 � Operating Expenses: Operation and

Maintenance 5,383 5,262 121 10,525 7,011 3,514 Property, Franchise

and Other Taxes 73 72 1 143 141 2 Depreciation, Depletion and

Amortization � 172 � � 176 � � (4) � 344 � � 351 � � (7) � 5,628 �

� 5,510 � � 118 � 11,012 � � 7,503 � � 3,509 � Operating Loss

(4,504) (4,402) (102) (8,791) (5,360) (3,431) � Other Income

(Expense): Interest Income 20,186 22,138 (1,952) 42,890 44,067

(1,177) Other Income 169 1,885 (1,716) 237 1,961 (1,724) Interest

Expense on Long-Term Debt (16,273) (17,878) 1,605 (32,546) (35,760)

3,214 Other Interest Expense � (1,697) � � (1,465) � � (232) �

(3,981) � � (2,963) � � (1,018) � Income (Loss) Before Income Taxes

(2,119) 278 (2,397) (2,191) 1,945 (4,136) Income Tax Benefit �

(1,547) � � (615) � � (932) � (1,516) � � (189) � � (1,327) Net

Income (Loss) $ (572) � $ 893 � $ (1,465) $ (675) � $ 2,134 � $

(2,809) � Net Income (Loss) Per Share (Diluted) $ (0.01) � $ 0.01 �

$ (0.02) $ (0.01) � $ 0.02 � $ (0.03) � � Three Months Ended Six

Months Ended March 31, March 31, INTERSEGMENT ELIMINATIONS 2008 �

2007 � Variance 2008 � 2007 � Variance Intersegment Revenues $

(31,035) � $ (29,827) � $ (1,208) $ (59,356) � $ (57,273) � $

(2,083) � Operating Expenses: Purchased Gas (29,968) (28,811)

(1,157) (57,218) (55,303) (1,915) Operation and Maintenance �

(1,067) � � (1,016) � � (51) � (2,138) � � (1,970) � � (168) �

(31,035) � � (29,827) � � (1,208) � (59,356) � � (57,273) � �

(2,083) � Operating Income - - - - - - � Other Income (Expense):

Interest Income (21,667) (24,491) 2,824 (45,888) (48,351) 2,463

Other Interest Expense � 21,667 � � 24,491 � � (2,824) � 45,888 � �

48,351 � � (2,463) � Net Income $ - � $ - � $ - $ - � $ - � $ - �

Net Income Per Share (Diluted) $ - � $ - � $ - $ - � $ - � $ -

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES � SEGMENT INFORMATION

(Continued) (Thousands of Dollars) � � Three Months Ended � Six

Months Ended March 31, March 31, (Unaudited) (Unaudited) � � � �

Increase Increase 2008 2007 (Decrease) 2008 2007 (Decrease) �

Capital Expenditures: Exploration and Production $ 34,195 $ 38,677

$ (4,482) $ 64,861 $ 75,919 $ (11,058) Pipeline and Storage 31,739

5,201 26,538 57,110 10,153 46,957 Utility 11,188 12,679 (1,491)

23,896 25,558 (1,662) Energy Marketing 7 8 (1) 15 17 (2) Timber �

161 � 401 � (240) � 1,144 � 1,207 � (63) Total Reportable Segments

77,290 56,966 20,324 147,026 112,854 34,172 All Other 53 55 (2) 53

84 (31) Corporate 27 (610) 637 35 (572) 607 Eliminations � (2,407)

� - � (2,407) � (2,407) � - � (2,407) Total Expenditures from

Continuing Operations 74,963 56,411 18,552 144,707 112,366 32,341

Discontinued Operations � - � 10,600 � (10,600) � - � 19,947 �

(19,947) Total Capital Expenditures $ 74,963 $ 67,011 $ 7,952 $

144,707 $ 132,313 $ 12,394 � � DEGREE DAYS � Percent Colder

(Warmer) Than: Three Months Ended March 31 Normal 2008 2007 Normal

Last Year � Buffalo, NY 3,364 3,264 3,327 (3.0) (1.9) Erie, PA

3,176 3,104 3,152 (2.3) (1.5) � Six Months Ended March 31 �

Buffalo, NY 5,624 5,358 5,274 (4.7) 1.6 Erie, PA 5,257 4,975 5,030

(5.4) (1.1) NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES � � � � � �

EXPLORATION AND PRODUCTION INFORMATION � Three Months Ended Six

Months Ended March 31, March 31, Increase Increase 2008 2007

(Decrease) 2008 2007 (Decrease) � Gas Production/ Prices: �

Production (MMcf) Gulf Coast 3,022 2,893 129 5,849 5,616 233 West

Coast 977 920 57 2,004 1,865 139 Appalachia � 1,828 � 1,339 � 489 �

3,744 � 2,732 � 1,012 Total Production from Continuing Operations

5,827 5,152 675 11,597 10,213 1,384 Canada - Discontinued

Operations � - � 1,856 � (1,856) � - � 3,577 � (3,577) Total

Production � 5,827 � 7,008 � (1,181) � 11,597 � 13,790 � (2,193) �

Average Prices (Per Mcf) Gulf Coast $ 9.50 $ 6.42 $ 3.08 $ 8.36 $

6.48 $ 1.88 West Coast 7.93 6.95 0.98 7.34 6.51 0.83 Appalachia

8.90 7.39 1.51 8.15 7.30 0.85 Weighted Average for Continuing

Operations 9.05 6.77 2.28 8.12 6.71 1.41 Weighted Average after

Hedging for Continuing Operations 9.21 7.23 1.98 8.55 7.17 1.38

Canada - Discontinued Operations N/M 5.87 N/M N/M 6.12 N/M � Oil

Production/ Prices: Production (Thousands of Barrels) Gulf Coast

128 174 (46) 285 376 (91) West Coast 599 599 - 1,227 1,190 37

Appalachia � 28 � 31 � (3) � 65 � 58 � 7 Total Production from

Continuing Operations 755 804 (49) 1,577 1,624 (47) Canada -

Discontinued Operations � - � 61 � (61) � - � 117 � (117) Total

Production � 755 � 865 � (110) � 1,577 � 1,741 � (164) � Average

Prices (Per Barrel) Gulf Coast $ 99.75 $ 57.21 $ 42.54 $ 94.31 $

56.84 $ 37.47 West Coast 88.45 49.99 38.46 85.04 50.55 34.49

Appalachia 90.15 57.88 32.27 86.73 58.76 27.97 Weighted Average for

Continuing Operations 90.43 51.86 38.57 86.78 52.30 34.48 Weighted

Average after Hedging for Continuing Operations 78.54 47.95 30.59

75.44 45.86 29.58 Canada - Discontinued Operations N/M 49.98 N/M

N/M 46.45 N/M � Total Production from Continuing Operations (Mmcfe)

10,357 9,976 381 21,059 19,957 1,102 Total Canadian Production

(Mmcfe) � - � 2,222 � (2,222) � - � 4,279 � (4,279) Total

Production (Mmcfe) � 10,357 � 12,198 � (1,841) � 21,059 � 24,236 �

(3,177) � Selected Operating Performance Statistics: General &

Administrative Expense per Mcfe (1) $ 0.69 $ 0.45 $ 0.24 $ 0.61 $

0.44 $ 0.17 Lease Operating Expense per Mcfe (1) $ 1.69 $ 1.24 $

0.45 $ 1.47 $ 1.18 $ 0.29 Depreciation, Depletion &

Amortization per Mcfe (1) $ 2.20 $ 1.93 $ 0.27 $ 2.22 $ 1.90 $ 0.32

� � (1) Refer to page 17 for the General and Administrative

Expense, Lease Operating Expense and Depreciation, Depletion, and

Amortization Expense for the Exploration and Production segment.

Amounts exclude discontinued operations of Canada. � N/M = Not

meaningful NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES � � � �

EXPLORATION AND PRODUCTION INFORMATION � Hedging Summary for Fiscal

2008 � SWAPS Volume Average Hedge Price Oil 0.8 MMBBL $65.72 / BBL

Gas 7.7 BCF $8.54 / MCF � Hedging Summary for Fiscal 2009 � SWAPS

Volume Average Hedge Price Oil 1.0 MMBBL $73.87 / BBL Gas 9.5 BCF

$9.31 / MCF � Hedging Summary for Fiscal 2010 � SWAPS Volume

Average Hedge Price Oil 0.2 MMBBL $84.00 / BBL Gas 0.4 BCF $10.54 /

MCF � � Gross Wells in Process of Drilling Six Months Ended March

31, 2008 Total Gulf West East Company � Wells in Process -

Beginning Period Exploratory 2.00 0.00 21.00 23.00 Developmental

0.00 4.00 69.00 73.00 Wells Commenced Exploratory 2.00 1.00 6.00

9.00 Developmental 0.00 29.00 75.00 104.00 Wells Completed

Exploratory 1.00 0.00 5.00 6.00 Developmental 0.00 30.00 103.00

133.00 Wells Plugged & Abandoned Exploratory 0.00 0.00 1.00

1.00 Developmental 0.00 1.00 0.00 1.00 Wells Sold Exploratory 2.00

0.00 0.00 2.00 Developmental 0.00 0.00 0.00 0.00 Wells in Process -

End of Period Exploratory 1.00 1.00 21.00 23.00 Developmental 0.00

2.00 41.00 43.00 Net Wells in Process of Drilling � � � � Six

Months Ended March 31, 2008 Total Gulf West East Company � Wells in

Process - Beginning Period Exploratory 1.30 0.00 20.00 21.30

Developmental 0.00 4.00 68.00 72.00 Wells Commenced Exploratory

0.84 1.00 6.00 7.84 Developmental 0.00 29.00 74.00 103.00 Wells

Completed Exploratory 0.29 0.00 5.00 5.29 Developmental 0.00 30.00

102.00 132.00 Wells Plugged & Abandoned Exploratory 0.00 0.00

1.00 1.00 Developmental 0.00 1.00 0.00 1.00 Wells Sold Exploratory

1.30 0.00 0.00 1.30 Developmental 0.00 0.00 0.00 0.00 Wells in

Process - End of Period Exploratory 0.55 1.00 20.00 21.55

Developmental 0.00 2.00 40.00 42.00 NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES � � Pipeline & Storage Throughput - (millions of

cubic feet - MMcf) Three Months Ended � Six Months Ended March 31,

March 31, � � Increase � � Increase 2008 2007 (Decrease) 2008 2007

(Decrease) Firm Transportation - Affiliated 48,817 51,016 (2,199)

80,152 80,746 (594) Firm Transportation - Non-Affiliated 73,142

69,615 3,527 134,689 114,312 20,377 Interruptible Transportation

1,221 932 289 2,304 1,927 377 123,180 121,563 1,617 217,145 196,985

20,160 � Utility Throughput - (MMcf) Three Months Ended Six Months

Ended March 31, March 31, Increase Increase 2008 2007 (Decrease)

2008 2007 (Decrease) Retail Sales: Residential Sales 28,136 29,372

(1,236) 45,263 46,050 (787) Commercial Sales 4,986 5,428 (442)

7,863 8,296 (433) Industrial Sales 323 323 - 446 514 (68) 33,445

35,123 (1,678) 53,572 54,860 (1,288) Off-System Sales 2,048 - 2,048

3,080 - 3,080 Transportation 26,054 24,723 1,331 43,881 40,576

3,305 61,547 59,846 1,701 100,533 95,436 5,097 � Energy Marketing

Volumes Three Months Ended Six Months Ended March 31, March 31,

Increase Increase 2008 2007 (Decrease) 2008 2007 (Decrease) Natural

Gas (MMcf) 21,707 19,935 1,772 32,548 31,049 1,499 � � Timber Board

Feet (Thousands) Three Months Ended Six Months Ended March 31,

March 31, Increase Increase 2008 2007 (Decrease) 2008 2007

(Decrease) Log Sales 3,589 3,025 564 5,613 4,734 879 Green Lumber

Sales 2,792 2,380 412 5,223 3,910 1,313 Kiln-Dried Lumber Sales

3,353 3,794 (441) 7,100 6,952 148 9,734 9,199 535 17,936 15,596

2,340 NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES FISCAL 2008

EARNINGS GUIDANCE AND SENSITIVITIES � � � � � � Earnings per share

sensitivity to changes Fiscal 2008 (Diluted earnings per share

guidance*) from NYMEX prices used in guidance* (1) � $1 change per

MMBtu gas $5 change per Bbl oil Range Increase � Decrease Increase

� Decrease � Consolidated Earnings $2.90 - $3.00 + $0.02 - $0.02 +

$0.03 - $0.03 NYMEX Settlement Prices at July 24, 2007 � � Natural

Gas Oil ($ per MMBtu) ($ per Bbl) � Apr-08 $ 7.713 $ 72.59 May-08 $

7.678 $ 72.48 Jun-08 $ 7.768 $ 72.39 Jul-08 $ 7.866 $ 72.29 Aug-08

$ 7.939 $ 72.19 Sep-08 $ 7.994 $ 72.09 � Average $ 7.826 $ 72.34 *

Please refer to forward looking statement footnote at page 8 of

this document. � (1) This sensitivity table is current as of May 1,

2008 and only considers revenue from the Exploration and Production

segment's crude oil and natural gas sales. The sensitivities will

become obsolete with the passage of time, changes in Seneca's

production forecast, changes in basis differential, as additional

hedging contracts are entered into, and with the settling of NYMEX

hedge contracts at their maturity. � � NATIONAL FUEL GAS COMPANY

AND SUBSIDIARIES � � � Quarter Ended March 31 (unaudited) � 2008 �

2007 � Operating Revenues $ 885,853,000 $ 798,100,000 � Income from

Continuing Operations $ 95,004,000 $ 75,480,000 Income from

Discontinued Operations, Net of Tax � - � 2,967,000 Net Income

Available for Common Stock $ 95,004,000 $ 78,447,000 � Earnings Per

Common Share: Basic: Income from Continuing Operations $ 1.14 $

0.91 Income from Discontinued Operations � - � 0.04 Net Income

Available for Common Stock $ 1.14 $ 0.95 � Diluted: Income from

Continuing Operations $ 1.11 $ 0.89 Income from Discontinued

Operations � - � 0.03 Net Income Available for Common Stock $ 1.11

$ 0.92 � Weighted Average Common Shares: Used in Basic Calculation

� 83,406,242 � 82,895,087 Used in Diluted Calculation � 85,385,944

� 85,033,127 � � Six Months Ended March 31 (unaudited) � Operating

Revenues $ 1,454,121,000 $ 1,288,758,000 � Income from Continuing

Operations $ 165,608,000 $ 126,168,000 Income from Discontinued

Operations, Net of Tax � - � 6,799,000 Net Income Available for

Common Stock $ 165,608,000 $ 132,967,000 � Earnings Per Common

Share: Basic: Income from Continuing Operations $ 1.98 $ 1.53

Income from Discontinued Operations � - � 0.08 Net Income Available

for Common Stock $ 1.98 $ 1.61 � Diluted: Income from Continuing

Operations $ 1.93 $ 1.49 Income from Discontinued Operations � - �

0.08 Net Income Available for Common Stock $ 1.93 $ 1.57 � Weighted

Average Common Shares: Used in Basic Calculation � 83,509,268 �

82,786,027 Used in Diluted Calculation � 85,603,033 � 84,891,742 �

� Twelve Months Ended March 31 (unaudited) � Operating Revenues $

2,204,929,000 $ 1,966,473,000 � Income from Continuing Operations $

241,115,000 $ 192,372,000 Income (Loss) from Discontinued

Operations, Net of Tax � 128,981,000 � (57,327,000) Net Income

Available for Common Stock $ 370,096,000 $ 135,045,000 � Earnings

Per Common Share: Basic: Income from Continuing Operations $ 2.89 $

2.31 Income (Loss) from Discontinued Operations � 1.54 � (0.69) Net

Income Available for Common Stock $ 4.43 $ 1.62 � Diluted: Income

from Continuing Operations $ 2.82 $ 2.25 Income (Loss) from

Discontinued Operations � 1.50 � (0.67) Net Income Available for

Common Stock $ 4.32 $ 1.58 � Weighted Average Common Shares: Used

in Basic Calculation � 83,502,281 � 83,232,743 Used in Diluted

Calculation � 85,610,528 � 85,352,796

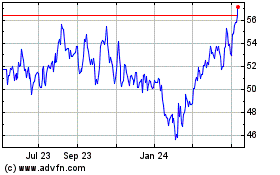

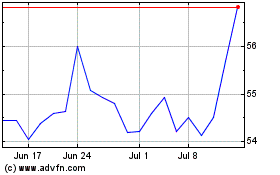

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Aug 2024 to Sep 2024

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Sep 2023 to Sep 2024