Methode Electronics, Inc. (NYSE:MEI), a global manufacturer of

electronic component and subsystem devices, today announced its

fourth quarter and fiscal 2008 year-end results for the period

ended May 3, 2008. Due to the timing of Methode�s fiscal calendar,

the fiscal year ended May 3, 2008 represents 53 weeks of results

and the fiscal year ended April 28, 2007 represents 52 weeks of

results. For the fiscal 2008 fourth quarter, Methode reported net

sales of $154.4 million, and net income of $12.9 million, or $0.35

per share. This compares with fiscal 2007 fourth quarter net sales

of $130.9 million, and net income of $12.1 million, or $0.34 per

share. Net sales increased $23.5 million in the fourth quarter of

fiscal 2008. This increase was primarily driven by North American

automotive price increases of $10.4 million on previously

marginally profitable and unprofitable products, which Methode had

decided to exit at the expiration of its manufacturing commitment.

At the request of the customer, Methode agreed to continue

producing at higher prices until the customer is able to transfer

the products to other suppliers. Methode currently expects to

discontinue producing these products during fiscal 2009.

Translating foreign sales using a weaker U.S. dollar contributed

$4.0 million to the fourth quarter sales growth. Methode also

benefited from organic growth from its European and Asian

operations. The fourth quarter of fiscal 2008 includes a $4.7

million, $2.8 million after tax or $0.08 per share, charge relating

to the restructuring of our U.S. based automotive operations and

the decision to discontinue producing certain legacy electronic

interconnect products. Last year�s fourth quarter included a $0.2

million charge related to the closure of the Scotland automotive

facility. Cost of products sold was $115.1 million in the fourth

quarter of fiscal 2008 compared to $101.4 million in the fourth

quarter of fiscal 2007. The increase is primarily due to higher

sales. As a percentage of net sales, cost of products sold was 74.6

percent in the fourth quarter of fiscal 2008, compared to 77.4

percent in the fiscal 2007 fourth quarter. The margins improved

primarily due to the above-mentioned North American automotive

price increases. Selling and administrative expense was $16.0

million in the fourth quarter of fiscal 2008 compared to $13.4

million in the fourth quarter of fiscal 2007. The increase is

primarily related to the TouchSensor and Value Engineered Products

(VEP) acquisitions. Selling and administrative expense as a

percentage of net sales was 10.4 percent in the fourth quarter of

fiscal 2008 compared to 10.2 percent in the fourth quarter of

fiscal 2007. Methode�s fiscal 2008 fourth quarter effective tax

rate was 17.5 percent compared to 18.2 percent in the fourth

quarter of fiscal 2007. This primarily reflects higher earnings in

lower tax rate jurisdictions in Malta and China, and the

recognition of tax credit utilization in Malta. For the 2008 fiscal

year, Methode reported net sales of $551.1 million and net income

of $39.8 million, or $1.07 per share, compared to the 2007 fiscal

year with net sales of $448.4 million and net income of $26.1

million, or $0.72 per share. The $102.7 million increase in net

sales is in part attributable to the TouchSensor and VEP

acquisitions. Automotive sales were positively impacted by the

afore-mentioned price increases by $20.7 million. Translating

foreign sales using a weaker U.S. dollar contributed $10.5 million

to the fiscal 2008 sales growth. Fiscal year 2008 sales also

benefited from organic growth from Methode�s European and Asian

operations. Fiscal 2008 includes a $5.2 million, $3.1 million after

tax or $0.08 per share, charge relating to the restructuring of our

U.S. based automotive operations and the decision to discontinue

producing certain legacy electronic interconnect products. Fiscal

2007 included a $2.0 million, both before and after tax or $0.06

per share, charge related to the closing of the Scotland automotive

facility. Cost of products sold increased $68.5 million, or 19.0

percent, to $428.4 million for fiscal 2008 compared to $359.9

million for fiscal 2007. The increase is primarily due to higher

sales. Consolidated cost of products sold, as a percentage of net

sales, was 77.7 percent for fiscal 2008 compared to 80.3 percent

for fiscal 2007. This is primarily due to the North American

automotive price increases previously discussed. Selling and

administrative expenses increased $11.3 million, or 22.5 percent,

to $61.5 million for fiscal 2008 compared to $50.2 million for

fiscal 2007. Selling and administrative expenses, as a percentage

of net sales, were 11.2 percent for both fiscal 2008 and 2007. Of

the $11.3 million increase, $3.3 million relates to the TouchSensor

and VEP businesses. The majority of the additional expense relates

to additional global support staff, increased long-term incentive

compensation primarily due to higher amortizable share prices,

increased research and development, and higher professional fees.

Methode�s fiscal 2008 effective tax rate was 19.7 percent compared

to 27.4 percent in fiscal 2007. This primarily reflects higher

earnings in lower tax rate jurisdictions in Malta and China, and

the recognition of tax credit utilization in Malta. Commenting on

the year�s results, Donald W. Duda, President and Chief Executive

Officer, said, �Methode passed a significant milestone in the 2008

fiscal year. For the first time in the Company�s 62-year history,

sales topped the half billion-dollar mark. During what some believe

was one of the most difficult economic years in decades, Methode

performed commendably. We have further transitioned away from many

unprofitable and low profit legacy products, restructured our

Automotive and Interconnect segments to improve profitability, and

acquired new businesses to further expand our Power Product

offerings.� �While we do not believe the United States economic

turmoil is behind us, we do have confidence that Methode has made

great strides to position itself as a global manufacturer of

user-interfaces, sensors, switches, controls and power solutions.

We believe our ability to manufacture products worldwide, at

automotive quality standards, will enable Methode to serve the

needs of our growing multinational customer base.� Business Outlook

Methode will be geographically expanding its global footprint in

fiscal 2009 as its Power Products segment plans to establish a

facility in Northern Africa. We expect this to enable the Power

Products segment to further penetrate the European market. In

addition, during fiscal 2008, Methode acquired Value Engineered

Products and Tribotek, both included in the Power Products segment.

These acquisitions provide Methode with thermal management and

high-power interconnect products, allowing the Power Products

segment to offer more complete power solutions to the market. As

the Interconnect segment transitions away from lower margin legacy

products, new products, such as, TouchSensor�s field-effect

user-interface panels, are expected to penetrate industrial,

automotive and other transportation markets. These products are

also being introduced into the European appliance market. In

addition, other Methode technologies, such as, specialty inks and

carbon fiber, will be targeting markets that include defense,

security, and medical devices and equipment markets. In the

Automotive segment, Methode anticipates continued declines in

production volumes from the Detroit 3, to significantly offset the

expected growth from our Asian and European operations. Overall,

Automotive segment sales in fiscal 2009 are expected to decrease

compared to fiscal 2008. In addition, higher raw material prices,

higher oil prices, currency fluctuations and consumer confidence

will affect the Automotive segment. Because of the difficult

economic market, and in particular, the unpredictable sales of the

Company�s largest automotive customers, Methode is discontinuing

its practice of providing sales and earnings per share guidance.

Conference Call As previously announced, the Company will conduct a

conference call led by its Chief Executive Officer, Donald W. Duda,

and Chief Financial Officer, Douglas A. Koman, on July 17, 2008 at

10:00 a.m. Central Time. You may participate on the conference call

by dialing 1-877-407-8031 for domestic callers or 201-689-8031 for

international callers. Methode also invites you to listen to the

webcast of this call by visiting the Company's website at

www.methode.com and entering the "Investor Relations" page and then

clicking on the "Webcast" icon. For those who cannot listen to the

live broadcast, a replay, as well as an MP3 download will be

available shortly after the call. A replay of the call will be

available for seven days, by dialing 877-660-6853 for domestic

callers or 201-612-7415 for international callers, both using

playback account number 286 and conference ID number 288989. About

Methode Electronics Methode Electronics, Inc. (NYSE:MEI) is a

global manufacturer of component and subsystem devices with

manufacturing, design and testing facilities in the United States,

Malta, Mexico, United Kingdom, Germany, Czech Republic, China and

Singapore. We design, manufacture and market devices employing

electrical, electronic, wireless, sensing and optical technologies

to control and convey signals through sensors, user-interfaces,

interconnections and controls. We manage our business on a segment

basis, with those segments being Automotive, Interconnect, Power

Products and Other. Our components are in the primary end markets

of the automobile, computer, information processing and networking

equipment, voice and data communication systems, consumer

electronics, appliances, aerospace vehicles and industrial

equipment industries. Further information can be found at Methode's

website at www.methode.com. Forward-Looking Statements This press

release contains certain forward-looking statements, which reflect

management�s expectations regarding future events and operating

performance and speak only as of the date hereof. These

forward-looking statements are subject to the safe harbor

protection, provided under the securities laws. Methode undertakes

no duty to update any forward-looking statement to conform the

statement to actual results or changes in Methode�s expectations on

a quarterly basis or otherwise. The forward-looking statements in

this press release involve a number of risks and uncertainties. The

factors that could cause actual results to differ materially from

our expectations are detailed in Methode�s filings with the

Securities and Exchange Commission, such as our annual and

quarterly reports. Such factors may include, without limitation,

the following: (1) dependence on a small number of large customers

within the automotive industry; (2) rising oil prices could affect

our automotive customers future results; (3) the seasonal and

cyclical nature of some of our businesses (4) dependence on the

automotive industry; (5) dependence on the appliance, computer and

communications industries; (6) intense pricing pressures in the

automotive industry; (7) increases in raw materials prices; and (8)

customary risks related to conducting global operations. Methode

Electronics, Inc. � � Financial Highlights (In thousands, except

per share data, unaudited) � � Three Months Ended May 3, April 28,

2008 2007 � Net sales $154,360 $130,928 Other income 893 576 Cost

of products sold 115,088 101,377 Restructuring 4,709 166 Selling

and administrative expenses 15,999 13,365 Impairment of assets

1,472 377 Amortization of intangibles 1,786 1,586 Income from

operations 16,199 14,633 Interest, net 625 650 Other, net (1,166 )

(459 ) Income before income taxes 15,658 14,824 Income taxes 2,739

2,692 Net income 12,919 12,132 Basic earnings per common share

$0.35 $0.34 Diluted earnings per common share $0.34 $0.33 Average

Number of Common Shares Outstanding: Basic 37,108 36,459 Diluted

37,365 36,916 Methode Electronics, Inc. Financial Highlights (In

thousands, except per share data, unaudited) � � Fiscal Year Ended

May 3, April 28, 2008 2007 � Net sales $551,073 $448,427 Other

income 1,879 1,596 Cost of products sold 428,355 359,914

Restructuring 5,159 2,027 Selling and administrative expenses

61,550 50,182 Impairment of assets 1,472 377 Amortization of

intangibles 6,013 4,708 Income from operations 50,403 32,815

Interest, net 2,324 3,428 Other, net (3,250 ) (468 ) Income before

income taxes and cumulative effect of accounting change 49,477

35,775 Income taxes 9,723 9,792 Income before cumulative effect of

accounting change 39,754 25,983 Cumulative effect of accounting

change - 101 Net income 39,754 26,084 Basic earnings per common

share $1.07 $0.72 Diluted earnings per common share $1.06 $0.71

Average Number of Common Shares Outstanding: Basic 37,069 36,328

Diluted 37,493 36,643 Methode Electronics, Inc. Financial

Highlights (In thousands, except per share data, unaudited) Summary

Balance Sheets � May 3, � April 28, 2008 2007 � Cash $ 104,716 $

60,091 Accounts receivable - net 85,805 79,180 Inventories 55,949

54,479 Other current assets 14,758 15,691 Total Current Assets

261,228 209,441 � Property, plant and equipment - net 90,280 86,857

Goodwill 54,476 51,520 Intangible assets - net 41,282 43,680 Other

assets 23,365 20,242 Total Assets $ 470,631 $ 411,740 � Accounts

payable $ 42,810 $ 41,041 Other current liabilities 34,313 31,420

Total Current Liabilities 77,123 72,461 � Other liabilities 20,723

15,070 Shareholders' equity 372,785 324,209 Total Liabilities and

Shareholders' Equity $ 470,631 $ 411,740 Methode Electronics, Inc.

Financial Highlights Summary Statements of Cash Flows (In

thousands, unaudited) � � Fiscal Year Ended May 3, � April 28, 2008

2007 Operating Activities: Net income $ 39,754 $ 26,084 Provision

for depreciation 22,146 18,915 Amortization of intangibles 6,013

4,708 Impairment of assets 1,472 377 Amortization of stock awards

and stock options 3,359 2,897 Changes in operating assets and

liabilities 8,803 1,754 Other (2,544 ) (131 ) Net Cash Provided by

Operating Activities 79,003 54,604 � Investing Activities:

Purchases of property, plant and equipment (20,018 ) (10,667 )

Proceeds from sale of building 960 800 Acquisitions of businesses

(9,647 ) (63,168 ) Joint venture dividend (1,000 ) - Other (852 )

(1,020 ) Net Cash Used in Investing Activities (30,557 ) (74,055 )

� Financing Activities: Repurchase of common stock (1,249 ) (3,596

) Proceeds from exercise of stock options 1,298 7,208 Tax benefit

from stock options and awards 383 1,175 Dividends (7,575 ) (7,472 )

Net Cash Used in Financing Activities (7,143 ) (2,685 ) � Effect of

foreign exchange rate changes on cash 3,322 � 581 � � Increase

(Decrease) in Cash and Cash Equivalents 44,625 (21,555 ) � Cash and

Cash Equivalents at Beginning of Period 60,091 � 81,646 � � Cash

and Cash Equivalents at End of Period $ 104,716 � $ 60,091 �

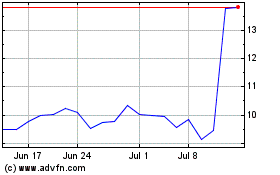

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From May 2024 to Jun 2024

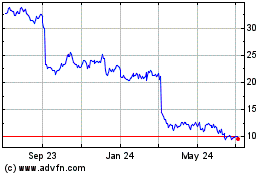

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Jun 2023 to Jun 2024