SAN FRANCISCO (Dow Jones) -- Apple Inc. (AAPL) is fighting a

multi-front patent war against competing makers of mobile devices,

demanding injunctions that would block sales of their products. But

the company has also indicated a willingness to cut deals with

competitors, according to people familiar with the matter.

The consumer-electronics company has put forth proposals to

Motorola Mobility Holdings Inc. (MMI) and Samsung Electronics Co.

(005930.SE, SSNHY) to settle some pending litigation in exchange

for royalty payments to license its patents, among other terms,

these people said.

This is not a new tactic; Apple had some discussions with

companies such as Samsung before initiating litigation, according

to statements made to a court in at least one suit.

Apple isn't attempting to offer patent licenses to all its

competitors or create a royalty business, one person familiar with

the matter said.

However, some people familiar with the situation see more reason

for Apple to consider legal settlements, following a mix of legal

victories and setbacks against smartphone makers that use Google

Inc.'s (GOOG) Android mobile operating system. Apple has targeted

these hardware makers rather than sue Google directly, and they

have responded with their own patent suits against Apple.

One factor is that Android has proliferated so widely that

shutting the software out of the market using injunctions is no

longer practical, one of the people said. Licensing is an

alternative that could add cost to Android development and make it

less appealing for manufacturers.

Apple, of Cupertino, Calif., has asked for between $5 and $15

per handset for some of its patents in one negotiation, or roughly

1% to 2.5% of net sales per device, another person familiar with

the matter said. Motorola, for its part, has been criticized for

asking for 2.5% of net sales per device for its wireless patents

from Apple.

None of the people could confirm if settlement talks are

currently taking place, but say this is part of an ongoing

process.

Any offer to license patents would seem to oppose statements

from co-founder Steve Jobs, who died in October.

In his authorized biography, Jobs said he would "spend every

penny" of Apple's money to fight against competitors that he said

had copied the company's technology for smartphones and tablets. He

had particularly harsh words for Google, which is buying Motorola

Mobility for $12.5 billion.

Apple, moreover, has more cash than its competitors and little

need to seek revenue from them. The company would seem to have more

incentive to hold out for court orders that could block sales of

competitors' products, or force them to modify their designs to

remove features found to infringe Apple patents.

In some cases, Apple said it has tried to head off litigation.

The company told an Australian court last year that Jobs had begun

discussions with Samsung in the summer of 2010, in part because of

the close relationship between the companies. But those talks broke

down when Samsung released its first Android-based tablet, the

Galaxy Tab, in the fall of 2010.

Apple has been considered by its legal adversaries to be

stubborn and unwilling to reach agreements. Two people involved

with litigation with Motorola said Apple had been asked by a German

court to resubmit numerous proposals for a licensing deal for

Motorola's patents. These people added that it took roughly 10

submissions before one was deemed appropriate by the court.

There is a lot at risk, however. Apple, for example, relies on

Samsung to manufacture parts for its mobile devices, such as

microprocesssors and memory chips.

Other considerations include the fact that winning an injunction

against individual products may not end Apple's legal efforts,

since competitors have many different devices waiting in the wings

to be sold, the people familiar with the matter said. By contrast,

so much of Apple's sales are generated by current iPhone and iPad

tablet models that any injunction won by competitors could have a

more devastating impact on the company, they added.

In addition, there are questions about the extent of the legal

leverage Apple can gain with its current strategy. The company has

chosen to mainly sue rivals under relatively narrow patents that

cover specific features of its products, such as software that can

detect useful information, like a phone number in an email, and

make a call when a device is tapped. Many such features could be

removed or modified to allow shipments of a handset to continue in

the event of a court order.

By comparison, some of Apple's rivals are wielding broader

patents that may have been deemed essential for creating wireless

communication devices. Apple had been an outspoken critic of the

practice, saying opponents shouldn't use such patents to seek

injunctions.

However, these patents often lead to successful claims for

royalty payments from defendants. So one possible goal for Apple in

any negotiations is to use its own patents as bargaining chips to

reduce any potential royalties it might face as a result of such

"essential" patents. Another common motivation is to show judges

presiding over patent litigation that a company is not being

unreasonable, and will negotiate in good faith to settle suits.

Apple's position has been bolstered by wins in some crucial

cases, such as an ITC decision that said some Android-based phones

made by HTC (HTCXF, 2498.TW) had infringed on the data-tapping

patent. Recently, a German court said Apple had won an injunction

against all Motorola devices that infringed a patent on how they

manage photos.

However, some rulings have not gone in Apple's favor. Last

month, Apple temporarily suspended sales of some iPhones and iPads

in Germany because Motorola had enforced an injunction it was given

by a local court over a standards-essential wireless technology

patent. Apple also recently lost a bid for an injunction against

Motorola in a German court over a patent widely known as "slide to

unlock," which describes software for gaining access to the phone

by dragging an image across the screen.

Motorola also recently enforced an injunction that stopped Apple

from delivering messages from its Mobile Me and iCloud email

services using near-instant transmission technologies, known by the

term "push." Apple said it has implemented a stop-gap measure for

German customers so that they automatically receive their email by

another method.

-By Ian Sherr, Dow Jones Newswires; 415-439-6455;

ian.sherr@dowjones.com

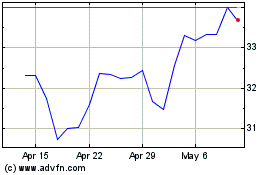

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From May 2024 to Jun 2024

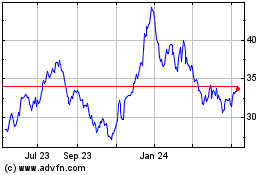

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jun 2023 to Jun 2024