Google Builds Motorola Moat - Tactical Trading

August 14 2011 - 8:00PM

Zacks

By the time you read this, you will undoubtedly have heard the big

investment news of the day: Google's (GOOG) $12.5 billion all-cash

acquisition of Motorola Mobility Holdings (MMI). Agreeing to a

take-out share price of $40, the deal is a 63% premium over MMI's

Friday close, and about $1 billion in market cap over its all-time

high.

This is a great lesson in why we pay insane

triple-digit P/E multiples for companies -- or, in the case of MMI,

big "P" for companies with no "E" at all.

What I mean is that we all know that even a great

business concept or growth story can become a bomb of an

investment. But even when earnings visibility is scarce, you never

know when some whale will sweep in and gobble up the asset for some

unseen potential.

Actually, in MMI's case, lots of people probably

saw the potential of this deal because of the technology and

intellectual property "connections" the two companies shared. It's

just that if you were an MMI investor, you had no real guarantee

Google would finally step up.

GOOG Builds a Moat

Here's what I wrote about MMI CEO Sanjay Jha in

June...

Jha thinks the phone will always be the ultimate

device for consumers and business people because it is the one we

carry with us at all times. It is the "digital hub" of people's

lives as he calls it. And therefore he believes that the biggest

opportunities in his industry are the "convergent capabilities" of

computing and communications in a single, handheld device.

Google management probably saw the potential of

someone else scooping up this key partner at much higher prices,

and that possibility posed a real threat to their mobile

strategy.

Why? Because MMI is all about intellectual property

that gives Google a fighting chance to compete with Apple (AAPL).

With over 25,000 technology patents in the MMI vault (over 17k

granted, 7k pending), Google says the acquisition will enable them

to "supercharge the Android ecosystem and will enhance competition

in mobile computing."

Protecting a Big Bet

Peter Kafka, writing for Dow Jones website

AllThingsD.com, gave us some excellent play-by-play of the

conference call this morning. I share some highlights here because

they give great flavor to the "star wars" world of mobile-comm

gadget competition.

Larry Page, Google CEO, said that MMI chief Jha

"made a big bet" by using Android as the sole MMI development

platform a few years ago. Page mentioned the MMI patent portfolio,

"which will help protect" Google from their big mobile competitors,

including Microsoft (MSFT).

Page and Android division head Andy Rubin fielded

several questions about the business dynamics of a platform

provider acquiring a device manufacturing partner. They both said

that it changes nothing, noting that MMI would be run as a separate

business and that it would gain no special advantages over other

Android partners like Samsung.

Rubin, who Page reminded everyone was the

inspiration in 2005 behind the open-source platform for mobile

devices, said this is about "protecting the ecosystem, and

extending it as well."

Asked about FTC hurdles, foreign regulators, and

the perception of anti-trust if no other bidders were considered,

Google Corporate Development head David Drummond acknowledged the

need for regulatory approval in Europe as well as the US.

"We believe this is a pro-competitive

transaction."

Kafka summed up Drummond's additional comments

thus: Android has added competition, user choice, and so

"protecting that ecosystem" is pro-consumer "almost by

definition."

Scale vs. Innovation

MMI CEO Jha knows a thing or three about

competition in the mobile-comm wars. In June, I wrote "Apple Empire

in Danger?" after I saw an interview with Jha talking about

"internal" threats to the dominator of handset magic.

Here's how I described his views then...

"What are Apple's vulnerabilities?" This was the

question posed to Sanjay Jha, CEO of Motorola Mobility this week by

Fortune's Geoff Colvin, Senior Editor-At-Large, on CNNMoney. Jha

first praised and admired the success of Apple in delivering

world-class products. Then he spoke broadly about the challenges of

any giant tech success, saying that "scale and innovation very

often don't mix."

He explained this decline-and-fall thesis by

focusing on what tends to happen when a company is faced with

defending its large market share and its competitive advantages.

"Defensive actions very often set in and middle management begins

to drive the culture and strategy of a company. Not speaking about

Apple in particular, but with the scale that comes with that level

of success, very often is in itself the beginning of a decline

sometimes."

Jha was diplomatic and enlightening in his

analysis. And maybe curiously foreshadowing of his position versus

Apple. Now, he's tied to the other monster of innovation.

And I bet, Sanjay Jha has a new bet now: that he

can continue to innovate despite Google's size and money.

Some eyes may be on Research In Motion (RIMM) now

as a possible acquisition target with its shadow-of-former-self $13

billion market cap.

I'm more interested to see how the empire (aka,

Apple) strikes back.

Kevin Cook is a Senior Stock Strategist for

Zacks.com

APPLE INC (AAPL): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

MOTOROLA MOBLTY (MMI): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

RESEARCH IN MOT (RIMM): Free Stock Analysis Report

Zacks Investment Research

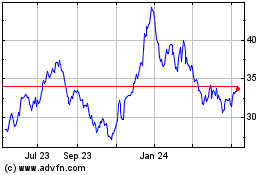

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jun 2024 to Jul 2024

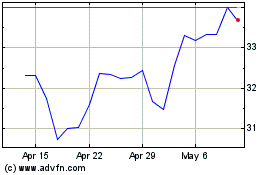

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jul 2023 to Jul 2024