M&A Deals Lift Sentiment - Analyst Blog

August 15 2011 - 5:05AM

Zacks

There is a tug of war between two competing visions of the economy:

one is looking for a recession, while the other is expecting the

economy to continue chugging along in positive territory. Last

week's see-saw movement in the stock market was essentially a

reflection of this tension.

I don't think we are heading towards a recession, though it may be

awhile before this issue gets settled. There is enough momentum in

the economy's underlying fundamentals to keep it from going into

negative territory. Last week's positive retails sales and jobless

claims numbers, coupled with the recent pullback in oil prices, are

indicative that consumer spending has likely improved from the

second-quarter's anemic pace.

We have a busy economic calendar this week, though few of the

reports can give us definitive answers on the recession question.

The two regional manufacturing surveys this week, the Empire State

this morning and Philly Fed on Thursday, come close to providing a

preview of the national ISM manufacturing report for August.

The New York Fed's Empire State survey came in weaker than expected

this morning, for the third monthly negative reading in as many

months. All the major sub-components of the index were in the

negative territory, though the employment component remained

modestly positive. While this report pertains to New York State

only, it does provide some evidence that conditions in the

manufacturing sector are difficult.

In corporate news, we have a number of M&A deal announcements

this morning. The most important of these is

Google's (GOOG) acquisition of

Motorola

Mobility (MMI) for $12.5 billion in cash, a 63% premium to

MMI's Friday closing price. This deal gives Google a complete

platform, from software to hardware, to more effectively compete in

the mobile handset space.

In other deal announcements,

Transocean (RIG) is

aquiring Norway's Aker Drilling for $1.43 billion in cash. Aker

owns two ultra-deepwater drilling rigs and has two other units

under construction.

Time Warner Cable (TWC) is

acquiring Carlyle-owned cable operator Insight Communications for

about $3 billion.

The second quarter reporting season is almost over, though we still

have a number of the retailers to report. We got a mixed report

this morning from

Lowe's (LOW), beating on EPS but

coming short on revenue.

Home Depot (HD) reports

on Tuesday.

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

HOME DEPOT (HD): Free Stock Analysis Report

LOWES COS (LOW): Free Stock Analysis Report

MOTOROLA MOBLTY (MMI): Free Stock Analysis Report

TRANSOCEAN LTD (RIG): Free Stock Analysis Report

TIME WARNER CAB (TWC): Free Stock Analysis Report

Zacks Investment Research

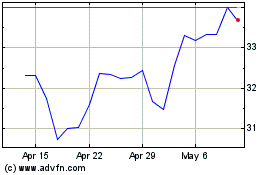

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jun 2024 to Jul 2024

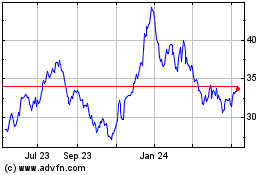

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jul 2023 to Jul 2024