Nokia Corp.'s (NOK) share of the global handset market plunged

last year even as global handset sales soared, led by smartphones

based on Google Inc.'s (GOOG) Android platform, according to

research firm Gartner.

Worldwide handset sales to end users rose 32% in 2010 to 1.6

billion units, Gartner said. Smartphone sales rose 72% from a year

earlier to 297 million units as sales of Android-based devices

increased almost ten-fold to 67 million units.

But Nokia's share of the total handset market fell to 27.1% in

the fourth quarter from 36.6% a year earlier and for the full year

2010 its market share declined to 28.9% from 36.4% in 2009, Gartner

said. The figures come after research firm Canalys last week said

Android had toppled Nokia Corp.'s (NOK) Symbian as the world's most

widespread smartphone platform in the fourth quarter of 2010.

Still, according to Gartner's estimates, Symbian remained

slightly ahead of Android in the fourth quarter as the combined

Symbian sales of Nokia and smaller handset vendors like Japan's

Fujitsu Ltd. (6702.TO) and Sharp Corp. (6753.TO) kept unit volumes

ahead.

Android's rapid growth has put further pressure on Nokia, whose

Symbian platform has long been the market leader, and it

underscores the challenges the Finnish company faces as it tries to

regain its market dominance. Indeed, at a coming strategy update

Friday in London, Nokia's Chief Executive Stephen Elop is widely

expected to shake up the company's software strategy, perhaps

adopting Android or Microsoft Corp.'s (MSFT) Windows Phone 7 for at

least some its devices.

Even though Windows Phone 7 has a tiny market share compared

with Android, it may still be a better choice for Nokia because the

company would risk losing its identity and "commoditizing" its

business if it joined Android, Gartner research vice president

Carolina Milanesi told Dow Jones Newswires.

In the fourth quarter 2010, shipments of premium handsets such

as HTC Corp's (2498.TW) Desire, Samsung Electronics Co Ltd.'s

(005930.SE) Galaxy S and Motorola Mobility Holdings Inc.'s (MMI)

Droid X continued to drive Android sales, Gartner said.

Symbian's market share continued to decline in the fourth

quarter, to 32.6% compared with 37.6% for the full year 2010, the

research firm said.

Android, which had a fourth-quarter market share of 30.8%, will

probably overtake Symbian as the world's largest smartphone

platform in the second or third quarter this year, said

Milanesi.

Meanwhile, the wider availability of the iPhone 4 helped Apple

Inc. (AAPL) achieve a 16% share of the smartphone market in the

fourth quarter, Gartner said.

Shortages of components such as camera modules and touch screen

controllers hit the industry in the fourth quarter, and are likely

to persist into the second half of the current year, Gartner

said.

"Shortages will be a long-term consideration for mobile device

vendors, because other fast-growing categories of connected

consumer devices, such as media tablets, are competing for the same

components," Gartner said.

Sales of unbranded, or 'white-box' handsets exceeded 360 million

units in 2010, said Gartner.

Overall mobile phone shipments got a boost last year as large

numbers of emerging markets consumers shifted from second-hand or

black market handsets to legitimate white box devices, said

Milanesi, and because this effect will be smaller in 2011 the

market growth in the current year will probably slow to around

13-14%.

(2010 mobile device sales, units in thousands)

2010 2010 Mkt Shr 2009

Nokia 461,318 28.9% 440,882

Samsung 281,066 17.6% 235,772

LG 114,155 7.1% 121,972

RIM 47,452 3.0% 34,347

Apple 46,598 2.9% 24,890

Sony Ericsson 41,819 2.6% 54,957

Motorola 38,554 2.4% 58,475

ZTE 28,769 1.8% 16,026

HTC 24,688 1.5% 10,812

Huawei 23,815 1.5% 13,491

Others 488,569 30.6% 199,617

Total 1,596,802 100% 1,211,240

(2010 smartphone sales by Operating System, units in

thousands)

2010 2010 Mkt Shr 2009

Symbian 111,577 37.6% 80,878

Android 67,225 22.7% 6,798

RIM 47,452 16.0% 34,347

iOS 46,598 15.7% 24,890

Microsoft 12,378 4.2% 15,031

Others 11,417 3.8% 10,432

Total 296,647 100% 172,376

By Gustav Sandstrom, Dow Jones Newswires; +46-8-5451-3099;

gustav.sandstrom@dowjones.com

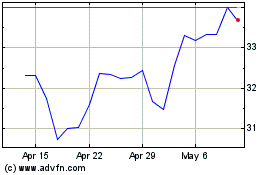

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jun 2024 to Jul 2024

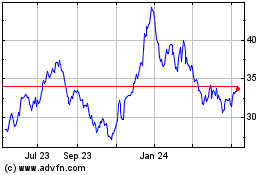

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jul 2023 to Jul 2024