Russell Exchange Traded Funds Trust

Russell Equity ETF

Schedule of Investments — June 30, 2013 (Unaudited)

Amounts in thousands

(except share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Fair

Value

$

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments in Other ETFs - 99.8%

|

|

|

|

|

|

|

Consumer Staples Select Sector SPDR Fund

|

|

|

3,859

|

|

|

|

153

|

|

|

iShares MSCI Canada Index Fund

|

|

|

9,757

|

|

|

|

256

|

|

|

iShares MSCI EAFE Small Cap Index Fund

|

|

|

5,122

|

|

|

|

215

|

|

|

iShares Russell 1000 Growth Index Fund

|

|

|

3,528

|

|

|

|

257

|

|

|

iShares Russell 1000 Index Fund

|

|

|

38,482

|

|

|

|

3,436

|

|

|

Utilities Select Sector SPDR Fund

|

|

|

2,930

|

|

|

|

110

|

|

|

Vanguard FTSE Developed Markets ETF

|

|

|

42,293

|

|

|

|

1,506

|

|

|

Vanguard FTSE Emerging Markets ETF

|

|

|

11,059

|

|

|

|

429

|

|

|

Vanguard FTSE Europe ETF

|

|

|

5,506

|

|

|

|

265

|

|

|

Vanguard FTSE Pacific ETF

|

|

|

8,278

|

|

|

|

462

|

|

|

Vanguard Mega Cap ETF

|

|

|

3,613

|

|

|

|

197

|

|

|

Vanguard Russell 2000

|

|

|

5,284

|

|

|

|

411

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments in Other ETFs

(cost

$7,378)

|

|

|

|

7,697

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-Term Investments - 0.1%

|

|

|

|

|

|

|

Russell U.S. Cash Management Fund

|

|

|

4,065

|

(

¥

)

|

|

|

4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Short-Term Investments

(cost $4)

|

|

|

|

4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments - 99.9%

(identified cost

$7,382)

|

|

|

|

7,701

|

|

|

|

|

Other Assets and Liabilities,

Net - 0.1%

|

|

|

|

4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets - 100.0%

|

|

|

|

7,705

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying

notes which are an integral part of this quarterly report.

Russell Exchange Traded Funds Trust

Russell Equity ETF

Presentation of Portfolio Holdings — June 30, 2013 (Unaudited)

Amounts in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value

|

|

|

% of Net

Assets

|

|

|

Portfolio Summary

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments in Other ETFs

|

|

$

|

7,697

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

7,697

|

|

|

|

99.8

|

|

|

Short-Term Investments

|

|

|

—

|

|

|

|

4

|

|

|

|

—

|

|

|

|

4

|

|

|

|

0.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments

|

|

|

7,697

|

|

|

|

4

|

|

|

|

—

|

|

|

|

7,701

|

|

|

|

99.9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets and Liabilities, Net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For a description of the levels and disclosure on transfers between Levels 1, 2 and 3 during the period ended

June 30, 2013, see note 2 in the Notes to Quarterly Report.

See accompanying notes which are an integral part of this quarterly report.

Russell Exchange Traded Funds Trust

Russell Equity ETF

Notes to Quarterly Report — June 30, 2013

(Unaudited)

Russell Exchange

Traded Funds Trust (the “Investment Company” or “RET” or the “Trust”) is a series investment company with a single investment portfolio, the Russell Equity ETF (the “Fund”). The Investment Company is

registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. It is organized and operates as a Delaware statutory trust. Prior to April 15, 2011, the name of the Trust was U.S. One Trust and the

Fund name was One Fund ETF.

The Fund is an exchange-traded fund (“ETF”). ETFs are funds that trade like other

publicly-traded securities and may be designed to track an index or to be actively managed. The Fund is a “fund of funds,” which means that the Fund seeks to achieve its investment objective by investing primarily in shares of other

exchange-traded funds (“Underlying ETFs”). Russell Investment Management Company (the “Adviser” or “RIMCo”) employs an asset allocation strategy that seeks to provide exposure to multiple asset classes in a variety of

domestic and foreign markets. The Adviser’s asset allocation strategy establishes a target asset allocation for the Fund and the Adviser then implements the strategy by selecting Underlying ETFs that represent each of the desired asset classes,

sectors and strategies. The Adviser employs an active management strategy, meaning that it buys and holds Underlying ETFs based on its asset allocation views, not based on time period dependent rebalancing policies.

Unlike shares of a mutual fund, which can be bought from and redeemed by the issuing fund by all shareholders at a price based on net

asset value (“NAV”), shares of the Fund may be directly purchased from and redeemed by the Fund at NAV solely by certain large institutional investors. Also unlike shares of a mutual fund, shares of the Fund are listed on a national

securities exchange and trade in the secondary market at market prices that change throughout the day. The date the shares began trading on the secondary market is the “commencement of operations” date.

The Fund issues and redeems shares at their respective NAV only in blocks of a specified number of shares or multiples thereof

(“Creation Units”). Only certain large institutional investors may purchase or redeem Creation Units directly with the Fund at NAV (“Authorized Participants”). These transactions are in exchange for certain securities similar to

the Fund’s portfolio and/or cash. Except when aggregated in Creation Units, shares of the Fund are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares directly from the Fund.

|

2.

|

|

Significant Accounting Policies

|

The following is a summary of the significant accounting policies consistently followed by the Fund in the preparation of this Quarterly

Report. These policies are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) for investment companies. The presentation of these schedules of investments in conformity with U.S. GAAP requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the Quarterly Report. Actual results could differ from those estimates.

Security Valuation

The Fund values its portfolio securities at “fair market

value.” This generally means that equity securities listed and principally traded on any national securities exchange are valued on the basis of the last sale price or, if there were no sales, at the closing bid price, on the primary exchange

on which the security is traded. Equity securities traded over-the-counter are valued on the basis of official closing price. The fund values the shares of the underlying ETFs at the reported sale or settlement price. The Board of Trustees (the

“Board”) has delegated the responsibility for administration of the securities valuation procedures to Russell Funds Services Company (“RFSC”).

Fair value of securities is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the

investment. To increase consistency and comparability in fair value measurement, the fair value hierarchy was established to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of

fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (e.g., the risk inherent in a particular valuation

technique, such as a pricing model or the risks inherent in the inputs to a particular valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing

the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would

use in pricing the asset or liability developed based on the best information available in the circumstances.

The fair value

hierarchy of inputs is summarized in the three broad levels listed below.

|

|

•

|

|

Level 1 — Quoted prices (unadjusted) in active markets or exchanges for identical assets and liabilities.

|

|

|

|

|

|

Notes to Quarterly Report

|

|

5

|

Russell Exchange Traded Funds Trust

Russell Equity ETF

Notes to Quarterly Report, continued — June 30, 2013 (Unaudited)

|

|

•

|

|

Level 2 — Inputs other than quoted prices included within Level 1 that are observable, which may include, but are not limited to quoted prices for

similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, (such as interest rates, yield curves, implied volatilities, credit spreads) or other market

corroborated inputs.

|

|

|

•

|

|

Level 3 — Significant unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not

available, which may include assumptions made by the Board or persons acting at their direction that are used in determining the fair value of investments.

|

Investment Transactions

Investment transactions are reflected as of the trade date for

financial reporting purposes. This may cause the NAV stated in the financial statements to be different from the NAV at which transactions may occur. Realized gains and losses from securities transactions, if applicable, are recorded on the basis of

specific identified cost.

Investment Income

Distributions of income and capital gains from Underlying ETFs are recorded on the ex-dividend date.

Guarantees

In the normal course of business, the Fund enters into contracts that contain a

variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the

Fund expects the risk of loss to be remote.

Market, Credit and Counterparty Risk

In the normal course of business, the Underlying ETFs trade financial instruments and enter into financial transactions where risk of

potential loss exists due to changes in the market (market risk) or failure of the other party to a transaction to perform (credit risk). The potential loss could exceed the value of the relevant assets recorded in the Underlying ETFs’

financial statements (the “Assets”). The Assets, which potentially expose the Underlying ETFs to credit risk, consist principally of cash due from counterparties and investments. The extent of the Underlying ETFs’ exposure to credit

risks with respect to the Assets approximates their carrying value as recorded in the Underlying ETFs’ Statement of Assets and Liabilities.

|

3.

|

|

Related Party Transactions, Fees and Expenses

|

The Fund may invest its cash reserves in the Russell U.S. Cash Management Fund, an unregistered fund advised by RIMCo and administered by RFSC. As of June 30, 2013, the Fund had invested $4,065 in

the Russell U.S. Cash Management Fund.

At

June 30, 2013, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

|

|

|

|

|

|

|

|

|

Russell Equity ETF

|

|

|

Cost of Investments

|

|

$

|

7,381,753

|

|

|

|

|

|

|

|

|

Unrealized Appreciation

|

|

$

|

468,012

|

|

|

Unrealized Depreciation

|

|

|

(149,035

|

)

|

|

|

|

|

|

|

|

Net Unrealized Appreciation (Depreciation)

|

|

$

|

318,977

|

|

|

|

|

|

|

|

Management has

evaluated events and/or transactions that have occurred through the date this Quarterly Report was available to be issued and noted no items requiring adjustments of the Quarterly Report or additional disclosures.

|

|

|

|

|

|

|

|

6

|

|

|

Notes to Quarterly Report

|

Russell Exchange Traded Funds Trust

Russell Equity ETF

Frequency Distribution of Discounts and Premiums — June

30, 2013 (Unaudited)

The chart below presents information about differences between the per share

NAV of the Fund and the market trading price of shares of the Fund. For these purposes, the “market price” is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares

are listed. The term “premium” is sometimes used to describe a market price in excess of NAV and the term “discount” is sometimes used to describe a market price below NAV. The chart presents information about the size and

frequency of premiums or discounts. As with other exchange traded funds, the market price of Fund shares is typically slightly higher or lower than the Fund’s per share NAV. Factors that contribute to the differences between market price and

NAV include the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

|

|

|

|

|

|

|

|

|

|

|

|

|

Russell Equity ETF

|

|

|

Premium/Discount Range

|

|

Number of

Days*

|

|

|

Percentage of

Total Days

|

|

|

Greater than 0.20% and less than or equal to 1.00%

|

|

|

19

|

|

|

|

1.66%

|

|

|

Greater than 0.05% and less than or equal to 0.20%

|

|

|

189

|

|

|

|

16.46%

|

|

|

Greater than -0.05% and less than or equal to 0.05%

|

|

|

509

|

|

|

|

44.33%

|

|

|

Greater than -0.20% and less than or equal to -0.05%

|

|

|

305

|

|

|

|

26.57%

|

|

|

Greater than -1.00% and less than or equal to -0.20%

|

|

|

126

|

|

|

|

10.98%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,148

|

|

|

|

100.00%

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Number of days are based on inception date which is one day prior to commencement of operations.

|

|

|

|

|

|

Frequency Distribution of Discounts and Premiums

|

|

7

|

Russell Exchange Traded Funds Trust

Russell Equity ETF

Shareholder Requests for Additional Information — June

30, 2013 (Unaudited)

A complete unaudited schedule of investments is made available generally no

later than 60 days after the end of the first and third quarters of each fiscal year. These reports are available (i) free of charge, upon request, by calling the Fund at (888) 775-3837, (ii) on the Securities and Exchange

Commission’s website at www.sec.gov, and (iii) at the Securities and Exchange Commission’s public reference room.

The Board has

delegated to RIMCo, as RET’s investment adviser, the primary responsibility for monitoring, evaluating and voting proxies solicited by or with respect to issuers of securities in which assets of the Fund may be invested. RIMCo has established a

proxy voting committee (“Committee”) and has adopted written proxy voting policies and procedures (“P&P”) and proxy voting guidelines (“Guidelines”). The Fund maintains a Portfolio Holdings Disclosure Policy that

governs the timing and circumstances of disclosure to shareholders and third parties of information regarding the portfolio investments held by the Fund. A description of the P&P, Guidelines, Portfolio Holdings Disclosure Policy and additional

information about Fund Trustees are contained in the Fund’s Statement of Additional Information (“SAI”). The SAI and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month

period ended June 30, 2013 is available (i) free of charge, upon request, by calling the Fund at (888) 775-3837, (ii) at www.russelletfs.com, or (iii) on the Securities and Exchange Commission’s website at www.sec.gov.

To reduce expenses, we may mail only one copy of the Fund’s prospectus and each annual and semi-annual report to those addresses shared

by two or more accounts. If you wish to receive individual copies of these documents, please contact your Financial Intermediary.

Some

Financial Intermediaries may offer electronic delivery of the Fund’s prospectus and annual and semi-annual reports. Please contact your Financial Intermediary.

|

|

|

|

|

|

|

|

8

|

|

|

Shareholder Requests for Additional Information

|

|

|

|

|

|

|

|

Russell Exchange Traded Funds Trust

|

|

1301 Second Avenue

|

|

888-775-3837

|

|

|

|

Seattle, Washington 98101

|

|

www.russelletfs.com

|

Item 2. Controls and Procedures

(a) Registrant’s principal executive officer and principal financial officer have concluded that Registrant’s disclosure

controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) are effective, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the Act and Rule 13a-15(b)

or 15d-15(b) under the Exchange Act as of a date within 90 days of the date this report is filed with the Securities and Exchange Commission.

(b) There were no material changes in Registrant’s internal controls over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the Registrant’s last fiscal

quarter that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

Item 3. Exhibits

(a) Certification for principal executive officer of

Registrant as required by Rule 30a-2(a) under the Act and certification for principal financial officer of Registrant as required by Rule 30a-2(a) under the Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

Russell Exchange Traded Funds Trust

|

|

|

|

|

By:

|

|

/s/ Sandra Cavanaugh

|

|

|

|

Sandra Cavanaugh

|

|

|

|

Principal Executive Officer and Chief Executive Officer

|

|

|

|

|

Date:

|

|

August 22, 2013

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report

has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

|

|

|

|

|

By:

|

|

/s/ Sandra Cavanaugh

|

|

|

|

Sandra Cavanaugh

|

|

|

|

Principal Executive Officer and Chief Executive Officer

|

|

|

|

|

Date:

|

|

August 22, 2013

|

|

|

|

|

By:

|

|

/s/ Mark E. Swanson

|

|

|

|

Mark E. Swanson

|

|

|

|

Principal Financial Officer, Principal Accounting Officer and Treasurer

|

|

|

|

|

Date:

|

|

August 22, 2013

|

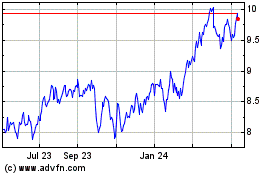

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From May 2024 to Jun 2024

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Jun 2023 to Jun 2024