UPDATE: ITT 3Q Net Profit Surges On Sale Proceeds; Revenue Flat

October 29 2010 - 11:14AM

Dow Jones News

ITT Corp.'s (ITT) third-quarter net profit more than doubled

from a year ago as the proceeds from the sale of a business offset

flat revenue and costs for asbestos liability.

The diversified defense and industrial company's results

exceeded profit expectations for the quarter and ITT said the

transformation of its business portfolio toward higher-growth

businesses remains on course.

"Our ongoing strategy to further align our business portfolio

with macro growth trends is progressing nicely," Chairman and Chief

Executive Steve Loranger said Friday during a conference call. "The

pipeline [of potential acquisitions] is robust and we're in due

diligence with a couple of companies."

During the third quarter the company completed the purchase of

Godwin Pumps and announced the acquisition of two other businesses.

ITT said recent acquisitions like Godwin have been quickly

integrated into ITT and are contributing to the company's profit.

The White Plains, N.Y., company raised its 2010 earnings guidance

to a range of $4.28 to $4.32 a share from $4.08 to $4.18 a share

forecast in July.

During the third quarter, the continued weakness in ITT's

defense and information solutions segment--the company's largest

business unit--was offset by solid sales and income growth from the

company's fluid technology segment and motion and flow control

unit. Net profit rose to $145 million, or 78 cents a share, from

$59 million, or 32 cents a share, in the third quarter a year

ago.

Income in the quarter ended Sept. 30 was aided by an after-tax

gain of $152 million from the sale of CAS Inc., a defense systems

engineering and technical assistance firm. The gain helped to blunt

a $198 million special expense for asbestos liability claims

against ITT.

ITT's exposure to asbestos liability mostly stems from pumps the

company once sold that had gaskets and packing that allegedly

contained asbestos. The gaskets and packing were manufactured by

other companies. Asbestos, which was once widely used for fire

proofing, is a suspected carcinogen in humans. The money set aside

by ITT is based on the projected amount it will need for claims

over the next 10 years, ITT said. The company also uses insurance

to cover its costs for asbestos claims.

Excluding special items, the company said its adjusted earnings

from continuing operations in the quarter totaled $1.08 a share,

topping analysts' consensus estimate of 99 cents a share. But ITT's

$2.64 billion in revenue during the quarter was flat compared with

a year earlier and came in below analysts' estimate of $2.70

billion.

At ITT's fluid technology unit, which makes pumps for municipal

water plants and industrial processes, operating income rose 7.4%

in the third quarter while revenue grew 11.4%. ITT's motion and

flow control unit, which supplies components to the automotive,

aerospace, rail and beverage industries, reported a 12.5% increase

in operating profit as revenue climbed 17.3%.

Operating income from the defense business dropped 11% to $178

million and revenue slipped 9.5% to $1.36 billion. Defense had been

the company's best-performing segment in recent years, benefiting

from increased demand for ITT's radios, night-vision goggles and

other equipment used by U.S. troops in Afghanistan and Iraq. But

with cuts in U.S. defense spending anticipated as combat operations

in the Middle East ratchet down, ITT has been paring its defense

holdings and investing in other business lines.

"We no longer expect to see large surges in orders," Chief

Financial Office Denise Ramos said. "We are certain that our

defense business is very well-positioned to produce sold returns

and cash flows."

The company's third-quarter backlog of fully funded military

orders increased by $175 million from the second quarter to $4.3

billion. The company also recently racked up $4.8 billion in

additional defense orders that have yet to be added to funded order

backlog. Among the company's newest contracts is a $1.4 billion

deal to manage U.S. military facilities in Kuwait.

ITT's stock closed was recently trading down 0.21% at at

$48.11.

-By Bob Tita, Dow Jones Newswires; 312-750-4129;

robert.tita@dowjones.com

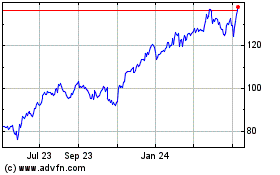

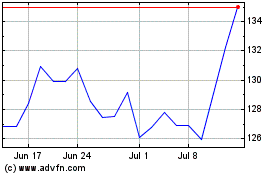

ITT (NYSE:ITT)

Historical Stock Chart

From May 2024 to Jun 2024

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2023 to Jun 2024