ITT Corp.'s 4Q Net Profit Up 7.3%; Raises 2010 Outlook

February 03 2010 - 7:32AM

Dow Jones News

ITT Corp. (ITT) reported a 7.3% increase in fourth-quarter net

profit, helped by an improved performance in the company's motion

and flow control business.

Net income for the defense and industrial conglomerate rose to

$199.2 million, or $1.08 a share, from $185.5 million, or $1.01

cents a share, a year earlier. Revenue in the quarter slipped 2.6%

to $2.87 billion.

Excluding gains from tax adjustments and discontinued

operations, the White Plains, N.Y., company earned 97 cents a

share, beating Wall Street analysts' estimate of 93 cents a

share.

The company raised its 2010 profit outlook to a range of $3.90 a

share to $4.10 a share from $3.85 to $4.05 previously. The $4

mid-point of the revised guidance is roughly in line with the $4.01

a share projected by analysts surveyed by Thomson Reuters.

Chairman and Chief Executive Steve Loranger said the higher

earnings forecast was prompted by improved productivity, lower

restructuring expenses and confidence that the company's products

and services will grow at a higher rate than the markets they

compete in.

ITT's motion and flow control unit, which supplies equipment and

components to the automotive, aerospace, rail and beverage

industries, reported a 1.7% increase in fourth-quarter revenue to

$332 million. Operating income from the quarter was $16.7 million,

compared with a $3.6 million loss a year earlier. The company

attributed the improvement to raising order volumes, particularly

from European auto makers and the beverage industry, as well as

productivity gains and lower business realignment expenses.

In ITT's defense business, which has been the company's

best-performing segment in recent quarters, revenue fell 1.2% to

$1.62 billion. Lower sales of tactical radios were offset by

revenue growth from service contracts and night vision goggles used

by U.S. soldiers in Afghanistan and Iraq. The company said

productivity improvements helped boost operating income from the

unit by nearly 11% to $207.1 million.

At the end of 2009, the defense business had a funded order

backlog of $5.2 billion, nearly the same amount as at the end of

2008.

In ITT's fluid technology unit, which makes pumps for

residential water plants and industrial processes, fourth-quarter

revenue fell 6.1% to $924.3 million because of weakness in U.S.

residential housing construction and lower capital spending by

companies. Nevertheless, operating income from the unit rose 9.2%

to $104.5 million on lower restructuring expenses and favorable

exchange rates for foreign currency.

For 2009, ITT earned $643.7 million, or $3.50 a share, on

revenue of $10.9 billion.

ITT's stock Tuesday closed up 3.4%, or $1.69, at $50.45 a

share.

-By Bob Tita, Dow Jones Newswires; 312-750-4129;

robert.tita@dowjones.com

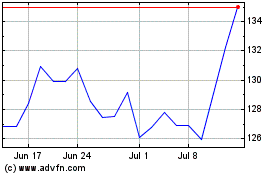

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2024 to Jul 2024

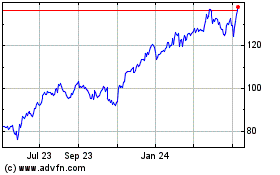

ITT (NYSE:ITT)

Historical Stock Chart

From Jul 2023 to Jul 2024