ITT Corporation (NYSE: ITT) today reported first quarter 2009

income of $187 million, or $1.02 per share, from continuing

operations, including a net $54 million tax benefit resulting

primarily from the reorganization of certain international legal

entities. Excluding special items, income from continuing

operations for the quarter was $132 million, or 72 cents per share,

and better than expected primarily due to performance in the

Defense Electronics & Services and Fluid Technology segments.

Compared to the prior year quarter, earnings decreased due to lower

sales volumes and higher employee benefit plan and restructuring

expenses, partially offset by cost saving initiatives and lower

interest expense.

First quarter revenue was $2.6 billion, down nine percent

compared to the first quarter of 2008, and down five percent

excluding the impact of foreign exchange, acquisitions and

divestitures on a comparable basis. Year-to-date free cash flow

generation exceeded $165 million, representing a 128 percent

conversion of income from continuing operations, excluding the

non-cash tax adjustments.

�Given our solid preparation, strong balance sheet, and focused

execution by our teams, we believe we are managing the current

conditions effectively and performing well relative to our peers,�

said Steve Loranger, ITT�s chairman, president and chief executive

officer.

�We anticipated a slower economy and have been very proactive in

managing the changing conditions. Our current view suggests that

while the outlook for the defense segment remains solid, we

anticipate an extended slowdown in certain end markets affecting

our commercial businesses. We no longer anticipate any sequential

improvement this year in the industrial, commercial, and automotive

markets, and have recalibrated our forecast accordingly,� Loranger

added.

ITT now forecasts full-year earnings from continuing operations,

excluding special items, to be in the range of $3.20 to $3.60 per

share. This range includes an anticipated additional $26 million,

or $0.10 per share, for incremental restructuring and acquisition

expenses. Full-year 2009 revenue is now expected to be in the range

of $10.6 billion to $11.0 billion.

2009 First Quarter Business Segment Results

Fluid Technology

- First quarter revenue for the

segment was $744 million, down 16 percent compared to the first

quarter of the prior year or down 6 percent excluding the impact of

foreign currency exchange. This performance reflects better than

anticipated sales in municipal markets and softer residential and

commercial market performance.

- First quarter operating income

for the segment was down to $69 million, primarily due to volume

declines, change in order mix, and higher employee benefit plan and

restructuring costs.

- During the first quarter, ITT

won a $22 million contract to supply a number of high-end water

pumps for two irrigation systems to the Andhra Pradesh irrigation

project, the largest irrigation project in India.

- ITT recently announced that it

has signed an agreement to acquire Laing GmbH, which will broaden

the company�s portfolio of energy-efficient plumbing and HVAC pumps

and demonstrates ITT�s commitment to its vision of achieving global

water leadership.

Defense Electronics & Services

- Segment revenue for the first

quarter was $1.5 billion, essentially flat as compared to the first

quarter of 2008. Revenue performance was led by double-digit growth

on a comparable basis in the Electronic Systems and Space

businesses that offset a double-digit decline at Communication

Systems due to large one-time shipments during the first quarter of

2008.

- Compared to the prior year

quarter, segment operating income for the first quarter grew to

$164 million. Operating margins improved 80 basis points compared

to the first quarter of the prior year, as productivity

improvements and mix offset increased employee benefit plan

costs.

- Backlog for the segment remained

flat year-over-year at $5.2 billion, on strong orders for Night

Vision goggles, GPS and classified satellite payloads, and a $317

million order for counter-IED jammers for the U.S. Marines.

Motion & Flow Control

- Revenue for the first quarter

was $306 million, down 27 percent compared to the prior year or

down 18 percent excluding the impacts of foreign currency exchange,

acquisitions and divestitures. This performance reflects

challenging conditions in end markets served by the Flow Control,

Interconnect Solutions and Motion Technologies businesses.

- First quarter 2009 segment

operating income was $28 million, down significantly as compared to

the prior year as volume declines, employee benefit plan costs and

foreign currency exchange impacted earnings.

�We have continued confidence in our portfolio, which we�ve

aligned around enduring growth drivers, including threats to global

security, fresh water scarcity, and population growth. It�s a

portfolio we anticipate will continue to perform relatively well

compared to our peers during these times, and positions us for

success well into the future,� said Loranger.

Investor Call Today

ITT's senior management will host a conference call for

investors today at 10:30 a.m. Eastern Daylight Time to review first

quarter performance and answer questions. The briefing can be

monitored live via webcast at the following address on the

company's Web site: www.itt.com/ir.

About ITT Corporation

ITT Corporation is a high-technology engineering and

manufacturing company operating on all seven continents in three

vital markets: water and fluids management, global defense and

security, and motion and flow control. With a heritage of

innovation, ITT partners with its customers to deliver

extraordinary solutions that create more livable environments,

provide protection and safety and connect our world. Headquartered

in White Plains, N.Y., the company generated 2008 sales of $11.7

billion. www.itt.com

Safe Harbor Statement

Certain material presented herein includes forward-looking

statements intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995

("the Act"). These forward-looking statements include statements

that describe the Company's business strategy, outlook, objectives,

plans, intentions or goals, and any discussion of future operating

or financial performance. Whenever used, words such as

"anticipate," "estimate," "expect," "project," "intend," "plan,"

"believe," "target" and other terms of similar meaning are intended

to identify such forward-looking statements. Forward-looking

statements are uncertain and to some extent unpredictable, and

involve known and unknown risks, uncertainties and other important

factors that could cause actual results to differ materially from

those expressed in, or implied from, such forward-looking

statements. Factors that could cause results to differ materially

from those anticipated include: Economic, political and social

conditions in the countries in which we conduct our businesses;

Changes in government defense budgets; Decline in consumer

spending; Sales and revenues mix and pricing levels; Availability

of adequate labor, commodities, supplies and raw materials;

Interest and foreign currency exchange rate fluctuations;

Competition and industry capacity and production rates; Ability of

third parties, including our commercial partners, financial

institutions and insurers, to comply with their commitments to us;

Our ability to borrow or refinance our existing indebtedness and

availability of liquidity sufficient to meet our needs;

Acquisitions or divestitures; Personal injury claims; Our ability

to effect restructuring and cost reduction programs and realize

savings from such actions; Government regulations and compliance

therewith; Changes in technology; Intellectual property matters;

Governmental investigations; Potential future employee benefit plan

contributions and other employment and pension matters;

Contingencies related to actual or alleged environmental

contamination, claims and concerns; Changes in generally accepted

accounting principles; Other factors set forth in our Annual Report

on Form 10?K for the fiscal year ended December 31, 2008 and our

other filings with the Securities and Exchange Commission.

The Company undertakes no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

�

ITT CORPORATION AND

SUBSIDIARIES

CONSOLIDATED CONDENSED INCOME

STATEMENTS

(In millions, except per

share)

(Unaudited)

�

Three Months Ended March 31, �

2009 � �

2008 � Sales and

revenues $

2,557.1 � $

2,806.4 � Costs of

sales and revenues 1,888.0 2,045.5 Selling, general and

administrative expenses 384.0 420.6 Research and development

expenses 52.9 52.6 Restructuring and asset impairment charges, net

�

10.7 � �

3.6 Total costs and expenses

2,335.6 2,522.3 � Operating income 221.5 284.1 Interest expense

26.4 40.6 Interest income 4.3 8.4 Miscellaneous expense, net �

2.9 � �

3.0 Income from continuing

operations before income tax expense 196.5 248.9 Income taxes �

10.0 � �

78.0 Income from continuing

operations 186.5 170.9 Discontinued operations, net of tax �

(2.4 ) �

1.0 Net income

$ 184.1 �

$

171.9 �

Earnings Per Share: Income from

continuing operations: Basic $ 1.02 $ 0.94 Diluted $ 1.02 $ 0.93

Discontinued operations: Basic $ (0.01 ) $ 0.01 Diluted $ (0.01 ) $

0.00 Net income: Basic $ 1.01 $ 0.95 Diluted $ 1.01 $ 0.93 � �

Average Common Shares � Basic 182.0 181.8 Average Common Shares �

Diluted 183.2 184.0 � �

ITT CORPORATION AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(In millions)

(Unaudited)

�

March 31, December 31, 2009 2008 �

Assets Current Assets: Cash and cash equivalents $ 911.0 $

964.9 Receivables, net 1,853.6 1,961.1 Inventories, net 826.2 803.8

Deferred income taxes 203.0 203.4 Other current assets �

159.3 �

131.0 Total current assets

3,953.1 4,064.2 � Plant, property and equipment, net 960.5 993.9

Deferred income taxes 602.8 608.5 Goodwill, net 3,798.8 3,831.3

Other intangible assets, net 584.5 616.5 Other assets �

398.1 �

365.8 Total assets

$

10,297.8 $ 10,480.2 �

Liabilities and Shareholders' Equity Current Liabilities:

Accounts payable $ 1,231.3 $ 1,234.6 Accrued expenses 926.2 991.2

Accrued taxes 69.1 30.2 Notes payable and current maturities of

long-term debt 1,510.9 1,679.0 Pension and postretirement benefits

68.8 68.8 Deferred income taxes �

28.2 �

26.7 Total current liabilities 3,834.5 4,030.5 �

Pension and postretirement benefits 2,134.7 2,141.6 Long-term debt

466.5 467.9 Other liabilities �

707.8 �

780.3 Total liabilities 7,143.5 7,420.3 �

Shareholders' equity �

3,154.3 �

3,059.9

Total liabilities and shareholders' equity

$

10,297.8 $ 10,480.2 �

ITT CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In millions)

(Unaudited)

�

Three Months Ended March 31, �

2009 � � �

2008 �

Operating Activities

Net income

$

184.1

$

171.9

Loss (Income) from discontinued operations �

2.4 � �

(1.0 ) Income from continuing operations

186.5 170.9 � Adjustments to income from continuing operations:

Depreciation and amortization 66.2 71.2 Stock-based compensation

8.1 8.1 Restructuring and asset impairment charges, net 10.7 3.6

Payments for restructuring (25.9 ) (14.6 ) Change in receivables

75.6 (2.7 ) Change in inventories (44.2 ) (49.7 ) Change in

accounts payable and accrued expenses (16.8 ) 0.9 Change in accrued

and deferred taxes (3.8 ) 63.9 Change in other current and

non-current assets (46.5 ) (27.4 ) Change in other current and

non-current liabilities (6.5 ) (3.8 ) Other, net �

9.7

� �

(1.1 ) Net cash � operating

activities �

213.1 � �

219.3 � �

Investing Activities

Additions to plant, property and

equipment

(47.7

)

(33.9

)

Acquisitions, net of cash acquired (1.6 ) (195.9 ) Proceeds from

sale of assets and businesses 10.3 3.2 Other, net �

2.0 � �

0.8 � Net cash � investing

activities �

(37.0 ) �

(225.8 ) �

Financing Activities

Short-term debt, net

(166.2

)

(972.5

)

Long-term debt repaid (2.6 ) (14.1 ) Long-term debt issued � 0.5

Proceeds from issuance of common stock 2.4 4.3 Dividends paid (31.8

) (25.4 ) Tax benefit from stock option exercises and restricted

stock award lapses (1.4 ) 0.6 Other, net �

� � �

(1.8 ) Net cash � financing activities �

(199.6 ) �

(1,008.4

) �

Exchange Rate Effects on Cash and Cash

Equivalents (29.8 ) 74.0

Net Cash � Discontinued

Operations: Operating Activities �

(0.6

) �

0.5 � � Net change in cash and cash

equivalents (53.9 ) (940.4 ) Cash and cash equivalents � beginning

of year �

964.9 � �

1,840.0 �

Cash and

Cash Equivalents � end of period $

911.0 �

$ 899.6 � �

ITT

Corporation Non-GAAP Reconciliation Reported vs. Organic

Revenue / Orders Growth First Quarter 2009 & 2008 �

� � � � � � � � � � �

($ Millions) � � � � � � � � � � � � �

� � � � � � �

(As Reported - GAAP) (As Adjusted -

Organic) �

Sales & Revenues

3M 2009

Sales & Revenues

3M 2008

Change

2009 vs. 2008

% Change

2009 vs. 2008

Sales & Revenues

3M 2009

Acquisition/

Divestitures

3M 2009

FX Contribution

3M 2009

Adj. Sales &

Revenues

3M 2009

Sales &

Revenues

3M 2008

Change

Adj. 09 vs. 08

% Change

Adj. 09 vs. 08

� � ITT Corporation - Consolidated 2,557.1 2,806.4 (249.3) -8.9%

2,557.1 4.3 119.7 2,681.1 2,806.4 (125.3) -4.5% � Defense

Electronics & Services 1,508.5 1,507.6 0.9 0.1% 1,508.5 0.0 2.4

1,510.9 1,507.6 3.3 0.2% Communications Systems 257.3 316.5 (59.2)

-18.7% 257.3 0.0 0.0 257.3 316.5 (59.2) -18.7% Space Systems 150.1

133.0 17.1 12.9% 150.1 0.0 0.3 150.4 133.0 17.4 13.1% Advanced

Engineering & Sciences 231.8 220.0 11.8 5.4% 231.8 0.0 0.0

231.8 220.0 11.8 5.4% Electronic Systems 398.7 357.9 40.8 11.4%

398.7 0.0 2.1 400.8 357.9 42.9 12.0% Night Vision 115.5 113.9 1.6

1.4% 115.5 0.0 0.0 115.5 113.9 1.6 1.4% Systems 333.2 326.8 6.4

2.0% 333.2 0.0 0.0 333.2 326.8 6.4 2.0% Intell & Info Warfare

31.4 47.2 (15.8) -33.5% 31.4 0.0 0.0 31.4 47.2 (15.8) -33.5% � �

Fluid Technology 744.3 881.4 (137.1) -15.6% 744.3 0.0 84.1 828.4

881.4 (53.0) -6.0% Industrial Process 183.6 189.3 (5.7) -3.0% 183.6

0.0 8.4 192.0 189.3 2.7 1.4% Residential and Commercial Water Group

241.4 296.2 (54.8) -18.5% 241.4 0.0 16.1 257.5 296.2 (38.7) -13.1%

Water & WasteWater 336.8 409.8 (73.0) -17.8% 336.8 0.0 60.6

397.4 409.8 (12.4) -3.0% � � Motion & Flow Control 305.9 420.5

(114.6) -27.3% 305.9 4.3 33.3 343.5 420.5 (77.0) -18.3% Flow

Control 43.4 68.3 (24.9) -36.5% 43.4 1.2 7.4 52.0 68.3 (16.3)

-23.9% Motion Technologies 113.3 160.1 (46.8) -29.2% 113.3 0.0 19.7

133.0 160.1 (27.1) -16.9% Control Technologies 63.8 76.5 (12.7) NA

63.8 3.1 1.4 68.3 76.5 (8.2) -10.7% Interconnect Solutions 86.9

115.9 (29.0) -25.0% 86.9 0.0 4.8 91.7 115.9 (24.2) -20.9% � �

Orders

3M 2009

Orders

3M 2008

Change

2009 vs. 2008

% Change

2009 vs. 2008

Orders

3M 2009

Acquisition

Contribution

3M 2009

FX Contribution

3M 2009

Adj. Orders

3M 2009

Orders

3M 2008

Change

Adj. 09 vs. 08

% Change

Adj. 09 vs. 08

� Defense Electronics & Services 1,489.5 1,297.3 192.2 15%

1,489.5 0.0 1.8 1,491.3 1,297.3 194.0 15.0% � Fluid Technology

802.0 956.7 (154.7) -16% 802.0 0.0 88.3 890.3 956.7 (66.4) -6.9% �

Motion & Flow Control 281.1 428.6 (147.5) -34% 281.1 5.1 33.2

319.4 428.6 (109.2) -25.5% � Total Segment Orders 2,572.6 2,682.6

(110.0) -4% 2,572.6 5.1 123.2 2,700.9 2,682.6 18.3 0.7% � Note:

Excludes intercompany eliminations. � � � �

ITT Corporation

Segment Operating Income & OI Margin First Quarter of

2009 & 2008 �

($ Millions) �

Q1 2009

As Reported

Q1 2008

As Reported

%

Change 09

vs. 08

�

Sales and Revenues: Defense Electronics & Services

1,508.5 1,507.6 Fluid Technology 744.3 881.4 Motion & Flow

Control 305.9 420.5 Intersegment eliminations (1.6 ) (3.1 ) Total

Sales and Revenues 2,557.1 � 2,806.4 � �

Operating Margin:

Defense Electronics & Services 10.9 % 10.1 % 80 BP Fluid

Technology 9.2 % 11.6 % (240 ) BP Motion & Flow Control 9.1 %

16.2 % (710 ) BP Total Ongoing Segments 10.2 % 11.5 % (130 ) BP � �

Income: Defense Electronics & Services 164.3 152.8 7.5 %

Fluid Technology 68.8 102.0 -32.5 % Motion & Flow Control 27.9

� 68.0 � -59.0 % Total Segment Operating Income 261.0 � 322.8 �

-19.1 % �

ITT Corporation Non-GAAP Reconciliation

Reported vs. Adjusted Net Income & EPS First Quarter

of 2009 & 2008 � � � � � � � � � � � �

($ Millions,

except EPS and shares) �

Q1 2009

As Reported

Q1 2009

Adjustments

Q1 2009

As Adjusted

Q1 2008

As Reported

Q1 2008

Adjustments

Q1 2008

As Adjusted

Change

2009 vs. 2008

As Adjusted

Percent Change

2009 vs. 2008

As Adjusted

� � � � � � � Segment Operating Income 261.0 � 261.0 322.8 � 322.8

� � Interest Income (Expense) (22.1) (22.1) (32.2) (32.2) Other

Income (Expense) (2.9) (2.9) (3.0) (3.0) Corporate (Expense) (39.5)

� (39.5) (38.7) � (38.7) � � � � � � Income from Continuing

Operations before Tax 196.5 � 196.5 248.9 � 248.9 � � � � � � �

Income Tax Expense (10.0) (54.1) #A (64.1) (78.0) (3.1) #B (81.1) �

� � � � � Income from Continuing Operations 186.5 (54.1) 132.4

170.9 (3.1) 167.8 � � � � � � � � Diluted EPS from Continuing

Operations 1.02 (0.30) 0.72 0.93 (0.02) 0.91 ($0.19) -20.9% � #A -

Primarily removal of the reversal of a deferred tax liability no

longer required as a result of the restructuring of certain

international legal entities. � #B - Remove Tax Benefit of ($3.1M)

related to prior year adjustments. � � � � � � �

ITT Corporation

Non-GAAP Reconciliation EPS - as Adjusted re: FSP No. EITF

03-6-1 For the Quarters of 2008 �

($ Millions, except

EPS and shares) � 1st Qtr 08 2nd Qtr 08 Jun YTD 08 3rd Qtr 08

Sep YTD 08 4th Qtr 08 Dec YTD 08 � Income from Operations 170.9

224.3 395.2 204.5 599.7 175.5 775.2 � Adjustments - Special Items

(3.1 ) (5.3 ) (8.4 ) 0.6 � (7.8 ) (26.3 ) (34.1 ) � Income from

Operations - As Adjusted 167.8 219.0 386.8 205.1 591.9 149.2 741.1

� Diluted Shares Previously Reported 183.4 184.3 184.0 183.8 183.8

182.4 183.4 New Diluted Shares 184.0 184.9 184.6 184.4 184.4 182.9

184.0 � �

As Adjusted EPS � � � � � � � � � � � � � �

Income from Continuing Op's - As Adjusted Diluted (Old

Share Count) 0.91 1.19 2.10 1.12 3.22 0.82 4.04 � � � � � � � �

� � � � � � � �

EPS Change - (0.01 ) - (0.01 ) (0.01 ) -

(0.01 ) � � � � � � � � � � � � � � �

Income from Continuing

Op's - As Adjusted Diluted (New Share Count) 0.91 1.18

2.10 1.11 3.21 0.82 4.03 � � � � � � � � � � � � � � � � � � � � �

� � �

ITT Corporation Non-GAAP Reconciliation Cash From

Operating Activities vs. Free Cash Flow First Quarter of

2009 & 2008 �

($ Millions)

� 3M 2009 3M 2008 �

Net Cash - Operating Activities

213.1 219.3 � Capital Expenditures (47.7 ) (33.9 ) �

Pension Pre-funding, net of tax - � - � �

Free Cash Flow

165.4 �

185.4 � �

Income from Continuing

Operations 186.5 �

170.9 � �

Free Cash Flow

Conversion 89 % 108 % � � Non-Cash

Special Tax Item (57.7 ) - � � �

Adjusted Income from Continuing

Operations 128.8 �

170.9 � � �

Adjusted Free

Cash Flow Conversion 128 % 108 % �

ITT Corporation Non-GAAP Reconciliation Debt Coverage

Ratios 2009 & 2008 � �

March-09 December-08 �

Net Debt/Net Capitalization 25.3 % 27.9 % Total Debt/Total

Capitalization 38.5 % 41.2 % � � Short Term Debt 1,510.9 1,679.0

Long Term Debt 466.5 � 467.9 � Total Debt 1,977.4 2,146.9 Cash

& Cash equivalents 911.0 � 964.9 � Net Debt 1,066.4 1,182.0 � �

Total Shareholders' Equity 3,154.3 3,059.9 Net Debt 1,066.4 �

1,182.0 � Net Capitalization 4,220.7 4,241.9

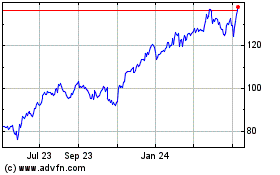

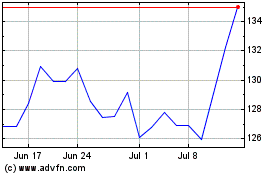

ITT (NYSE:ITT)

Historical Stock Chart

From Jul 2024 to Aug 2024

ITT (NYSE:ITT)

Historical Stock Chart

From Aug 2023 to Aug 2024