ITT Corporation (NYSE: ITT) today reported first quarter 2008

income of $171 million, or 93 cents per share, from continuing

operations. Excluding special items, income for the quarter grew to

$168 million, or 91 cents per share, up 25 percent compared to the

first quarter of 2007. First quarter revenue was $2.8 billion, up

36 percent in total on a comparable basis, comprising nine percent

organic growth, a 23 percent benefit from recent acquisitions, and

four percent from foreign exchange. The company�s organic revenue

growth is largely due to robust international sales in both

commercial segments and continued strong performance on key defense

contracts. In addition, free cash flow generation exceeded $185

million, a first quarter record for the company and nine times

greater than the prior year period. �Our strong operating

capabilities and well-balanced geographic and end-market

participation positioned us well as we built our strategic plan

heading into 2008,� said Steve Loranger, ITT�s chairman, president

and chief executive officer. �Our teams across each business

segment demonstrated extraordinary focus and delivered another

outstanding quarter, which puts us off to a great start and gives

us the confidence to raise our guidance for the year.� ITT now

forecasts full-year revenue of $11.4 billion to $11.5 billion,

approximately 27 percent higher than reported 2007 full-year

revenue. The company also expects earnings from continuing

operations, excluding special items, to be in the range of $4.00 to

$4.10 per share, an 18 cent increase to the mid-point of previous

guidance. This forecast reflects approximately 23 percent

anticipated earnings growth over 2007 on a comparable basis. First

Quarter Business Segment Results Fluid Technology Compared to the

prior year quarter, revenue for the segment grew 12 percent in

total - six percent organically and six percent from foreign

exchange - to $881 million. Strong sales growth in Europe, South

America, China and the Middle East, led by the Industrial Process

business, overcame flat North American performance. First quarter

operating income for the segment was up 17 percent on a comparable

basis to $102 million, as price, productivity improvements and

pension benefits more than offset the impact of foreign exchange

and increased material costs. Compared to first quarter 2007,

operating margins improved 50 basis points in the quarter, despite

a negative 80 basis point impact from foreign exchange. The segment

continues to benefit from robust emerging market growth, especially

in the oil, gas and mining sectors. ITT is again expanding its

footprint to better serve these regions and will soon break ground

on a product assembly and service operation in Saudi Arabia, which

is expected to open during the fourth quarter of this year. Defense

Electronics & Services Segment revenue growth for the quarter

was up 56 percent, compared to the first quarter of 2007, to $1.5

billion, attributable to the acquisition of EDO Corporation and

strong organic growth of 13 percent. Revenue growth was led, in

part, by the Communications Systems business, which grew 38 percent

organically, on a comparable basis. Its performance is due

partially to shipments related to the Iraqi radio and tactical

networking contract awarded in November of last year. The Advanced

Engineering & Sciences business continued its strong

performance achieving first quarter year-over-year organic growth

of 44 percent. This growth is credited to continued success on

several important contracts, including ITT�s work with the

Department of Defense�s Joint Spectrum Center and the Federal

Aviation Administration (FAA). For the Joint Spectrum contract, ITT

is providing engineering and research services to help make use of

the electromagnetic spectrum to meet military objectives. For the

FAA, ITT is the prime contractor leading the development of the

next-generation air traffic control system for the United States.

Compared to the prior year quarter, segment operating income for

the first quarter grew 38 percent to $153 million. Operating

margins declined 130 basis points primarily due to the 170 basis

point impact from the EDO acquisition and related integration

costs. Motion & Flow Control Revenue for the quarter grew 32

percent in total on a comparable basis to $421 million, benefiting

18 percent from the 2007 acquisition of International Motion

Control (IMC), seven percent from strong organic revenue growth -

led by the Aerospace Controls and Friction Technologies businesses

- and the balance due to foreign exchange. Segment operating income

grew 33 percent, compared to first quarter of 2007, to $68 million.

Operating margins improved 20 basis points, despite a 40 basis

point headwind related to the acquisition of IMC and associated

integration expenses. During the quarter, ITT broke ground on a

manufacturing facility in the Czech Republic to support the rapid

ramp up of its Friction Technologies business. Since January,

Friction Technologies has been chosen to supply brake pads on six

new automotive platforms, contributing to its 12 percent organic

revenue growth, year over year. Investor Call Today ITT's senior

management will host a conference call for investors today at 9:00

a.m. Eastern Daylight Time to review first quarter performance and

answer questions. The briefing can be monitored live via webcast at

the following address on the company's Web site: www.itt.com/ir.

About ITT Corporation ITT Corporation (www.itt.com) is a

diversified high-technology engineering and manufacturing company

dedicated to creating more livable environments, enabling

communications and providing protection and safety. The company

plays an important role in vital markets including water and fluids

management, global defense and security, and motion and flow

control. ITT employs approximately 40,000 people serving customers

in more than 50 countries. Headquartered in White Plains, N.Y., the

company generated $9 billion in 2007 sales. Safe Harbor Statement

Certain material presented herein includes forward-looking

statements intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995

("the Act"). These forward-looking statements include statements

that describe the Company's business strategy, outlook, objectives,

plans, intentions or goals, and any discussion of future operating

or financial performance. Whenever used, words such as

"anticipate," "estimate," "expect," "project," "intend," "plan,"

"believe," "target" and other terms of similar meaning are intended

to identify such forward-looking statements. Forward-looking

statements are uncertain and to some extent unpredictable, and

involve known and unknown risks, uncertainties and other important

factors that could cause actual results to differ materially from

those expressed in, or implied from, such forward-looking

statements. Factors that could cause results to differ materially

from those anticipated by the Company include general global

economic conditions, decline in consumer spending, interest and

foreign currency exchange rate fluctuations, availability of

commodities, supplies and raw materials, competition, acquisitions

or divestitures, changes in government defense budgets, employment

and pension matters, contingencies related to actual or alleged

environmental contamination, claims and concerns, intellectual

property matters, personal injury claims, governmental

investigations, tax obligations and income tax accounting, and

changes in generally accepted accounting principles. Other factors

are more thoroughly set forth in Item 1. Business, Item 1A. Risk

Factors, and Item 7. Management's Discussion and Analysis of

Financial Condition and Results of Operations - Forward-Looking

Statements in the ITT Corporation Annual Report on Form 10-K for

the fiscal year ended December 31, 2007, and other of its filings

with the Securities and Exchange Commission. The Company undertakes

no obligation to update any forward-looking statements, whether as

a result of new information, future events or otherwise. ITT

CORPORATION AND SUBSIDIARIES CONSOLIDATED CONDENSED INCOME

STATEMENTS (In millions, except per share) (Unaudited) � Three

Months Ended March 31, 2008 � 2007 � Sales and revenues $ 2,806.4 $

2,070.3 � Costs of sales and revenues 2,045.5 1,486.1 Selling,

general and administrative expenses 420.6 320.0 Research and

development expenses 52.6 40.3 Restructuring and asset impairment

charges, net 3.6 6.4 Total costs and expenses 2,522.3 1,852.8 �

Operating income 284.1 217.5 Interest expense 40.6 23.8 Interest

income 8.4 8.2 Miscellaneous expense, net 3.0 3.9 Income from

continuing operations before income tax expense 248.9 198.0 Income

tax expense 78.0 61.2 Income from continuing operations 170.9 136.8

Discontinued operations, net of tax 1.0 3.2 Net income $ 171.9 $

140.0 � Earnings Per Share: Income from continuing operations:

Basic $ 0.94 $ 0.75 Diluted $ 0.93 $ 0.74 Discontinued operations:

Basic $ 0.01 $ 0.02 Diluted $ 0.01 $ 0.02 Net income: Basic $ 0.95

$ 0.77 Diluted $ 0.94 $ 0.76 � � Average Common Shares � Basic

180.7 181.2 Average Common Shares � Diluted 183.4 184.3 ITT

CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In

millions) (Unaudited) � March 31, December 31, 2008 2007 � Assets

Current Assets: Cash and cash equivalents $ 899.6 $ 1,840.0

Receivables, net 1,984.3 1,935.0 Inventories, net 960.3 887.6

Deferred income taxes 105.9 105.9 Other current assets 193.2 161.3

Total current assets 4,143.3 4,929.8 � Plant, property and

equipment, net 985.3 980.3 Deferred income taxes 36.2 29.7

Goodwill, net 3,891.4 3,829.7 Other intangible assets, net 684.7

733.0 Other assets 1,054.4 1,050.2 Total assets $ 10,795.3 $

11,552.7 � Liabilities and Shareholders' Equity Current

Liabilities: Accounts payable $ 1,341.0 $ 1,296.8 Accrued expenses

921.1 958.9 Accrued taxes 101.4 40.9 Notes payable and current

maturities of long-term debt 1,990.3 3,083.0 Pension and

postretirement benefits 68.5 68.5 Deferred income taxes 7.5 8.2

Total current liabilities 4,429.8 5,456.3 � Pension and

postretirement benefits 775.4 764.6 Long-term debt 482.5 483.0

Other liabilities 906.7 904.0 Total liabilities 6,594.4 7,607.9 �

Shareholders' equity 4,200.9 3,944.8 Total liabilities and

shareholders' equity $ 10,795.3 $ 11,552.7 ITT CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions)

(Unaudited) � Three Months Ended March 31, 2008 � 2007 Operating

Activities Net income $ 171.9 $ 140.0 Less: Income from

discontinued operations (1.0) (3.2) Income from continuing

operations 170.9 136.8 � Adjustments to income from continuing

operations: Depreciation and amortization 71.2 44.2 Stock-based

compensation 8.1 7.5 Restructuring and asset impairment charges,

net 3.6 6.4 Payments for restructuring (14.6) (11.2) Change in

receivables (2.7) (54.7) Change in inventories (49.7) (34.4) Change

in accounts payable and accrued expenses 0.9 0.1 Change in accrued

and deferred taxes 63.9 1.6 Change in other current and non-current

assets (27.4) (89.1) Change in other current and non-current

liabilities (3.8) (13.7) Other, net (1.1) 5.8 Net cash � operating

activities 219.3 (0.7) � Investing Activities Additions to plant,

property and equipment (33.9) (28.1) Acquisitions, net of cash

acquired (195.9) (4.4) Proceeds from sale of assets and businesses

3.2 1.0 Other, net 0.8 (0.4) Net cash � investing activities

(225.8) (31.9) � Financing Activities Short-term debt, net (972.5)

305.6 Long-term debt repaid (14.1) (1.7) Long-term debt issued 0.5

0.3 Repurchase of common stock � (186.5) Proceeds from issuance of

common stock 4.3 31.3 Dividends paid (25.4) (20.3) Tax benefit from

stock option exercises 0.6 7.3 Other, net (1.8) (0.3) Net cash �

financing activities (1,008.4) 135.7 � Exchange Rate Effects on

Cash and Cash Equivalents 74.0 7.3 Net Cash � Discontinued

Operations: Operating Activities 0.5 5.0 Investing Activities �

(2.3) Financing Activities � � � Net change in cash and cash

equivalents (940.4) 113.1 Cash and cash equivalents � beginning of

year 1,840.0 937.1 Cash and Cash Equivalents � end of period $

899.6 $ 1,050.2 ITT Corporation Non-GAAP Reconciliation Reported

vs. Organic Revenue / Orders Growth First Quarter 2008 & 2007 �

($ Millions) � � � � � � � � � � � � � � � � � � � � � � � (As

Reported - GAAP) (As Adjusted - Organic) � � � � � � � � � � � � �

� � � � � � � Sales & Revenues 3M 2008 Sales & Revenues 3M

2007 Change 2008 vs. 2007 % Change 2008 vs. 2007 � Sales &

Revenues 3M 2008 Acquisition/ OtherContribution3M 2008 FX

Contribution 3M 2008 Adj. Sales &Revenues 3M 2008 Sales

&Revenues 3M 2007 ChangeAdj. 08 vs. 07 % ChangeAdj. 08 vs. 07 �

� ITT Corporation - Consolidated 2,806.4 2,070.3 736.1 35.6%

2,806.4 (474.2) (70.2) 2,262.0 2,070.3 191.7 9.3% � Defense

Electronics & Services 1,507.6 969.4 538.2 55.5% 1,507.6

(417.5) 0.1 1,090.2 969.4 120.8 12.5% Communications Systems 316.5

187.2 129.3 69.1% 316.5 (59.0) 0.0 257.5 187.2 70.3 37.6% Space

Systems 133.0 141.6 (8.6) -6.1% 133.0 0.0 (0.2) 132.8 141.6 (8.8)

-6.2% Advanced Engineering & Sciences 220.0 105.0 115.0 109.5%

220.0 (68.6) 0.0 151.4 105.0 46.4 44.2% Electronic Systems 318.7

106 212.7 200.7% 318.7 (206.0) 0.0 112.7 106.0 6.7 6.3% Night

Vision 113.9 121.1 (7.2) -5.9% 113.9 0.0 0.0 113.9 121.1 (7.2)

-5.9% Systems 326.8 311.3 15.5 5.0% 326.8 0.0 0.0 326.8 311.3 15.5

5.0% Integrated Structures 39.3 0.0 39.3 N/A 39.3 (39.3) 0.3 0.3

0.0 0.3 N/A Intell & Info 47.2 0.0 47.2 N/A 47.2 (47.2) 0.0 0.0

0.0 0.0 N/A � � Fluid Technology 881.4 786.0 95.4 12.1% 881.4 (0.7)

(45.4) 835.3 786.0 49.3 6.3% Industrial Process 189.3 163.7 25.6

15.6% 189.3 0.0 (0.3) 189.0 163.7 25.3 15.5% Residential and

Commercial Water Group 293.1 267.9 25.2 9.4% 293.1 0.0 (12.8) 280.3

267.9 12.4 4.6% Water & WasteWater 410.9 362.6 48.3 13.3% 410.9

(0.7) (33.1) 377.1 362.6 14.5 4.0% � � � Motion & Flow Control

420.5 318.2 102.3 32.1% 420.5 (56.0) (25.0) 339.5 318.2 21.3 6.7%

Aerospace Controls 26.9 23.5 3.4 14.5% 26.9 0.0 0.0 26.9 23.5 3.4

14.5% Flow Control 68.3 62.6 5.7 9.1% 68.3 (7.3) (1.5) 59.5 62.6

(3.1) -5.0% Friction Technologies 130.7 103.2 27.5 26.6% 130.7 0.0

(14.8) 115.9 103.2 12.7 12.3% Energy Absorption 64.9 25.0 39.9

159.6% 64.9 (36.5) (3.5) 24.9 25.0 (0.1) -0.4% IMC Controls 14.0

0.0 14.0 N/A 14.0 (13.9) (0.1) 0.0 0.0 0.0 N/A Interconnect

Solutions 115.9 104.0 11.9 11.4% 115.9 0.0 (5.1) 110.8 104.0 6.8

6.5% � � � � � � � � � � � � Orders3M 2008 Orders3M 2007 Change2008

vs. 2007 % Change2008 vs. 2007 � Orders3M 2008

AcquisitionContribution 3M 2008 FX Contribution 3M 2008 Adj. Orders

3M 2008 Orders3M 2007 ChangeAdj. 08 vs. 07 % ChangeAdj. 08 vs. 07 �

Defense Electronics & Services 1,297.3 803.3 494.0 61% 1,297.3

(298.6) - 998.7 803.3 195.4 24.3% � Fluid Technology 956.7 881.8

74.9 8% 956.7 (1.2) (50.6) 904.9 881.8 23.1 2.6% � Motion &

Flow Control 428.6 328.1 100.5 31% 428.6 (57.9) (25.2) 345.5 328.1

17.4 5.3% � Total Segment Orders 2,679.3 2,011.5 667.8 33% 2,679.3

(357.7) (75.7) 2,245.9 2,011.5 234.4 11.7% � Note: Excludes

intercompany eliminations. ITT Corporation Non-GAAP Reconciliation

Segment Operating Income & OI Margin First Quarter of 2008

& 2007 � � ($ Millions) � � Q1 2008 Q1 2007 % As Reported As

Reported Change 08 vs. 07 � Sales and Revenues: Defense Electronics

& Services 1,507.6 969.4 Fluid Technology 881.4 786.0 Motion

& Flow Control 420.5 318.2 Intersegment eliminations (3.1)

(3.3) Total Sales and Revenues 2,806.4 2,070.3 � Operating Margin:

Defense Electronics & Services 10.1% 11.4% (130) BP Fluid

Technology 11.6% 11.1% 50 BP Motion & Flow Control 16.2% 16.0%

20 BP Total Ongoing Segments 11.5% 12.0% (50) BP � � Income:

Defense Electronics & Services 152.8 110.4 38.4% Fluid

Technology 102.0 87.1 17.1% Motion & Flow Control 68.0 51.0

33.3% Total Segment Operating Income 322.8 248.5 29.9% ITT

Corporation Non-GAAP Reconciliation Reported vs. Adjusted Net

Income & EPS First Quarter of 2008 & 2007 � ($ Millions,

except EPS and shares) � � � � � Change Percent Change Q1 2008 Q1

2008 Q1 2008 Q1 2007 Q1 2007 Q1 2007 2008 vs. 2007 2008 vs. 2007 As

Reported Adjustments As Adjusted As Reported Adjustments As

Adjusted As Adjusted As Adjusted � � � � � � � Segment Operating

Income 322.8 � 322.8 248.5 � 248.5 � � Interest Income (Expense)

(32.2) (32.2) (15.6) � (15.6) Other Income (Expense) (3.0) (3.0)

(3.9) � (3.9) Corporate (Expense) (38.7) � (38.7) (31.0) � (31.0) �

� � � � � Income from Continuing Operations before Tax 248.9 �

248.9 198.0 � 198.0 � � Income Tax Expense (78.0) (3.1) #A (81.1)

(61.2) (1.4) #B (62.6) � � � � � � Total Tax Expense (78.0) (3.1)

(81.1) (61.2) (1.4) (62.6) � � � � � � Income from Continuing

Operations 170.9 (3.1) 167.8 136.8 (1.4) 135.4 � � � � � � � �

Diluted EPS from Continuing Operations 0.93 (0.02) 0.91 0.74 (0.01)

0.73 $0.18 24.7% � � #A - Remove Tax Benefit of ($3.1M). #B -

Remove Tax Benefit of ($1.4M). ITT Corporation Non-GAAP

Reconciliation Cash From Operating Activities vs. Free Cash Flow

First Quarter of 2008 & 2007 � � ($ Millions) � � Q1 2008 Q1

2007 � Net Cash - Operating Activities 219.3 (0.7) � Capital

Expenditures (33.9) (28.1) � Pension Pre-funding, net of tax - 50.0

� Free Cash Flow 185.4 21.2

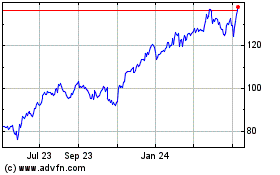

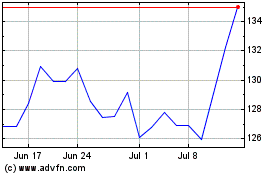

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2024 to Jul 2024

ITT (NYSE:ITT)

Historical Stock Chart

From Jul 2023 to Jul 2024