Current Report Filing (8-k)

March 28 2022 - 10:49AM

Edgar (US Regulatory)

false

0000944695

0000944695

2022-03-28

2022-03-28

0000944695

us-gaap:CommonStockMember

2022-03-28

2022-03-28

0000944695

thg:SevenPointSixTwoFivePercentageSeniorDebenturesDueTwoThousandTwentyFiveMember

2022-03-28

2022-03-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 28, 2022

THE HANOVER INSURANCE GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

1-13754 |

04-3263626 |

|

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

|

440 Lincoln Street, Worcester, Massachusetts

(Address of principal executive offices) |

01653

(Zip Code) |

|

|

(508) 855-1000

Registrant’s telephone number, including area code: |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Stock, $.01 par value |

|

THG |

|

New York Stock Exchange |

|

7 5/8% Senior Debentures due 2025 |

|

THG |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

The following information is being furnished under Item 7.01 – Regulation FD Disclosure. Such information, including the exhibits attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section.

On March 28, 2022, The Hanover Insurance Group, Inc. (the “Company”) published select historical quarterly and annual financial information reflecting the planned changes to the Company’s segment reporting. As publicly announced during the Company’s fourth quarter earnings call on February 3, 2022, the Company plans to change its segment reporting, beginning with the quarterly financial information to be released for the first quarter ending March 31, 2022, to disaggregate the former Commercial Lines segment into Core Commercial and Specialty segments, including expenses, allocated net investment income, and other income and expenses for each. Additionally, the Company will expand its reporting of top-line measures to include line of business and sub-segment net premiums written, renewal price change, retention, and other such measures. Concurrently, the Company will no longer report supplemental loss ratio information by product line for its Core Commercial segment. Finally, although the Company’s Personal Lines segment definition did not change, in order to streamline reporting and better align with industry practice, its homeowners sub-segment will be combined with other personal lines, which is primarily comprised of the Company’s personal umbrella product. A copy of the select historical financial information for 2019 through 2021 to reflect the changes discussed above is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is hereby incorporated by reference in this Item 7.01.

The changes in reportable segment structure discussed above, as reflected in the information included in this Current Report on Form 8-K, do not affect the Company’s previously reported consolidated results of operations, underwriting ratios, financial condition or cash flows and affects only the presentation of the segment information previously reported.

A copy of the March 28, 2022, press release discussing both the planned changes to the Company’s segment reporting and the publication of the select historical quarterly and annual financial information to reflect the changes in segment reporting is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are furnished herewith.

2

Exhibit Index

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

The Hanover Insurance Group, Inc.

(Registrant) |

|

|

|

|

|

|

Date: March 28, 2022 |

|

By: |

/s/ Jeffrey M. Farber |

|

|

|

|

Jeffrey M. Farber |

|

|

|

|

Executive Vice President and

Chief Financial Officer |

4

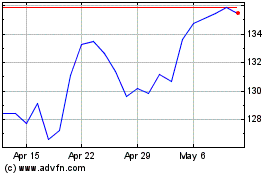

Hanover Insurance (NYSE:THG)

Historical Stock Chart

From Jun 2024 to Jul 2024

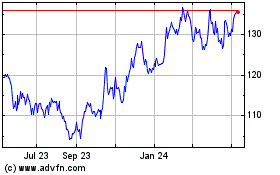

Hanover Insurance (NYSE:THG)

Historical Stock Chart

From Jul 2023 to Jul 2024