UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant

| | | | | |

Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ☑ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Hannon Armstrong Sustainable

Infrastructure Capital, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

Payment of Filing Fee (Check all boxes that apply): |

| ☑ | No fee required |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

SUPPLEMENTAL MATERIAL TO THE PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS OF HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE CAPITAL, INC. TO BE HELD ON THURSDAY, JUNE 6, 2024

This supplemental information is being provided to stockholders in addition to the proxy statement of Hannon Armstrong Sustainable Infrastructure Capital, Inc. (the “Company”) filed with the Securities and Exchange Commission on April 15, 2024 (the “2024 Proxy Statement”) for the 2024 Annual Meeting of Stockholders of the Company (the “2024 Annual Meeting”), with respect to Proposal 4 regarding the conversion of the Company from a Maryland corporation to a Delaware corporation (the “Reincorporation Proposal”) included in the 2024 Proxy Statement. Please read the 2024 Proxy Statement and accompanying materials, in addition to the information provided herein, carefully before you make a voting decision. The information contained in this supplemental material modifies or supersedes any inconsistent material contained in the 2024 Proxy Statement. Even if voting instructions for your proxy have already been given, you can change your vote at any time before the 2024 Annual Meeting by giving new voting instructions as described in more detail in the 2024 Proxy Statement.

PROPOSAL 4 (the Reincorporation Proposal): Approval of the conversion of the Company from a Maryland corporation to a Delaware corporation under the name “HA Sustainable Infrastructure Capital, Inc.” in accordance with the Plan of Conversion attached to the 2024 Proxy Statement

We urge you to vote “FOR” Proposal 4 (the Reincorporation Proposal) in the 2024 Proxy Statement.

After a review of the input from Institutional Shareholder Services (“ISS”) with respect to the Reincorporation Proposal, we have determined to add language to the new Delaware certificate of incorporation to be adopted as part of the Reincorporation Proposal (the “Delaware Certificate”) to cause the provisions of the Delaware Certificate described under the heading “Tax Benefits Preservation Provisions of the Delaware Charter” in the 2024 Proxy Statement to expire upon the third anniversary of filing and effectiveness of the Delaware Certificate (if not earlier terminated pursuant to the terms of the Delaware Certificate).

As such, the defined term “Expiration Date“ in Section 10.1(k) of the Delaware Certificate attached to the 2024 Proxy Statement as Appendix B and to be adopted following approval of the Reincorporation Proposal shall be updated as follows:

“Expiration Date” means the earliest of (i) the repeal, amendment or modification of Section 382 of the Code (or any comparable successor provisions), if the Board of Directors determines that the restrictions in this Article X are no longer necessary or desirable for the preservation of the Tax Benefits, (ii) the date that the Board of Directors determines that (x) an ownership change (within the meaning of Section 382 of the Code and the Treasury Regulations thereunder) would not result in a substantial limitation on the ability of the Corporation (or a direct or indirect subsidiary of the Corporation) to use otherwise available Tax Benefits, (y) no significant value attributable to the Tax Benefits would be preserved by continuing the Transfer restrictions herein, or (z) it is not in the best interests of the Corporation to continue the Transfer restrictions herein, (iii) the date that is the third anniversary of the filing and effectiveness of this Certificate of Incorporation, or (iii iv) any other date as the Board of Directors shall fix in accordance with Section 10.8 of this Article X;

A copy of the complete text of the Delaware Certificate, as proposed to be adopted following approval of the Reincorporation Proposal (including the revisions set forth above) is included in Appendix A to this supplemental soliciting material.

Please note that abstentions and broker non-votes on the Reincorporation Proposal will have the same effect as a vote “against” the Reincorporation Proposal. If you have already voted “Against” or “Abstain” on the Reincorporation Proposal, we urge you to reconsider and to submit a new vote “FOR” the Reincorporation Proposal.

Appendix A - Form of Delaware Charter

CERTIFICATE OF INCORPORATION

OF

HA SUSTAINABLE INFRASTRUCTURE CAPITAL, INC.

I, the undersigned, for the purposes of incorporating and organizing a corporation under the General Corporation Law of the State of Delaware, do execute this Certificate of Incorporation (the “Certificate of Incorporation”) and do hereby certify as follows:

ARTICLE I.

NAME

The name of the corporation (the “Corporation”) is: HA Sustainable Infrastructure Capital, Inc.

ARTICLE II.

REGISTERED OFFICE/AGENT

The address of the Corporation's registered office in the State of Delaware is 251 Little Falls Drive, Wilmington, New Castle County, Delaware 19808. The name of its registered agent at such address is the Corporation Service Company.

ARTICLE III.

PURPOSE

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware (the “DGCL”). The Corporation is being incorporated in connection with the conversion of Hannon Armstrong Sustainable Infrastructure Capital, Inc., a Maryland corporation (the “Maryland Corporation”), to the Corporation and this Certificate of Incorporation is being filed simultaneously with the Certificate of Conversion of the Maryland Corporation to the Corporation (the “Certificate of Conversion”).

ARTICLE IV.

STOCK

Section 4.1. Authorized Shares. The Corporation has authority to issue a total of 500,000,000 shares of stock, consisting of 450,000,000 shares of Common Stock, $0.01 par value per share (“Common Stock”), and 50,000,000 shares of Preferred Stock, $0.01 par value per share (“Preferred Stock”). Upon the effectiveness of the Certificate of Conversion and this Certificate of Incorporation (the “Effective Time”), without any action required on the part of the Corporation or any former holder of stock of the Maryland Corporation, each share of common stock of the Maryland Corporation issued and outstanding immediately prior to the Effective Time will be converted into, and shall be deemed to be, one issued and outstanding, fully paid and nonassessable share of Common Stock. From and after the Effective Time, any stock certificate representing issued and outstanding shares of common stock of the Maryland Corporation immediately prior to the Effective Time shall represent the same number of shares of Common Stock of the Corporation until surrendered to the Corporation.

Section 4.2. Common Stock. Except as may otherwise be specified herein, each share of Common Stock shall entitle the holder thereof to one vote.

Section 4.3. Preferred Stock. The Board of Directors of the Corporation (the “Board of Directors”) is hereby expressly authorized, by resolution or resolutions thereof, to provide out of the unissued shares of Preferred Stock, for series of Preferred Stock and, with respect to each such series, to fix the number of shares constituting such series and the designation of such series, the powers (including voting powers (if any)) of the shares of such series, and the preferences and relative, participating, optional or other special rights, if any, and any qualifications, limitations or restrictions thereof, of the shares of such series. The powers, preferences and relative, participating, optional and other special rights of each series of Preferred Stock, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other series at any time outstanding.

Section 4.4. Increase or Decrease in Authorized Shares. Subject to the terms of any series of Preferred Stock, the number of authorized shares of Common Stock or Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) without a separate vote of any holders of shares of Common Stock or Preferred Stock, irrespective of the provisions of Section 242(b)(2) of the DGCL.

Section 4.5. Amendments to Terms of Preferred Stock. Except as otherwise required by law or this Certificate of Incorporation (including any certificate of designation), holders of shares of Common Stock shall not be entitled to vote on any amendment to this Certificate of Incorporation (including any amendment to any certificate of designation) that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series of Preferred Stock are entitled, either separately or together with the holders of one or more other such series, to vote thereon pursuant to this Certificate of Incorporation (including any certificate of designation) or the DGCL.

ARTICLE V.

ACTION BY CONSENT

Subject to the terms of any series of Preferred Stock that expressly permit the holders of such series to act by consent, any action required or permitted to be taken by the stockholders of the Corporation must be effected at an annual or special meeting of the stockholders and may not be effected by consent in lieu of a meeting.

ARTICLE VI.

THE BOARD OF DIRECTORS

Section 6.1. Number of Directors. The business and affairs of the Corporation shall be managed by or under the direction of the Board of Directors. The number of directors, other than those who may be elected by the holders of one or more series of Preferred Stock, shall be fixed from time to time exclusively by the Board of Directors.

Section 6.2. Vacancies and Newly Created Directorships. Subject to Section 6.4 of this Article VI, newly created directorships resulting from an increase in the number of directors and any vacancies on the Board resulting from death, resignation, disqualification, removal or other cause may be filled solely by a majority of the directors then in office, even if less than a quorum, or by a sole remaining director, and any director so chosen shall hold office until the next annual meeting of stockholders and until his or her successor has been duly elected and qualified, subject, however, to such director’s earlier death, resignation, disqualification or removal.

Section 6.3. Removal of Directors. Subject to the rights of holders of one or more classes or series of Preferred Stock to elect or remove one or more directors, any director, or the entire Board of Directors, may be removed from office at any time, with or without cause, by the affirmative vote of holders of at least two-thirds of the shares then entitled to vote at an election of directors.

Section 6.4. Preferred Stock Directors. During any period when the holders of one or more series of Preferred Stock have the separate right to elect additional directors as provided for or fixed pursuant to the provisions of Section 4.3 of Article IV hereof (including any certificate of designation) (a “Preferred Stock Director”), and upon commencement and for the duration of the period during which such right continues: (i) the then otherwise total authorized number of directors of the Corporation shall automatically be increased by such number of directors that the holders of any series of Preferred Stock have a right to elect, and the holders of such Preferred Stock shall be entitled to elect the additional directors so provided for or fixed pursuant to said provisions; and (ii) each Preferred Stock Director shall serve until such Preferred Stock Director’s successor shall have been duly elected and qualified, or until such director’s right to hold such office terminates pursuant to said provisions, whichever occurs earlier, subject to his or her earlier death, resignation, disqualification or removal. Except as otherwise provided for or fixed pursuant to the provisions of Section 4.3 of Article IV hereof (including any certificate of designation), whenever the holders of one or more series of Preferred Stock having a separate right to elect additional directors cease to have or are otherwise divested of such right pursuant to said provisions, the terms of office of all Preferred Stock Directors elected by the holders of such series of Preferred Stock, or elected to fill any vacancies resulting from the death, resignation, disqualification or removal of such additional directors, shall forthwith terminate (in which case each such Preferred Stock Director shall cease to be qualified as a director and shall cease to be a director) and the total authorized number of directors of the Corporation shall be automatically reduced accordingly.

ARTICLE VII.

WRITTEN BALLOT

Unless and except to the extent that the Bylaws of the Corporation (as amended and/or restated from time to time, the “Bylaws”) shall so require, the election of directors need not be by written ballot.

ARTICLE VIII.

AMENDMENTS

Section 8.1. Amendments to the Certificate of Incorporation. The Corporation reserves the right at any time and from time to time to make any amendment, alteration, repeal or change to any provision in the Certificate of Incorporation, and to add or insert other provisions authorized at such time by the laws of the State of Delaware, in the manner now or hereafter authorized by law. All rights and powers conferred by the Certificate of Incorporation on stockholders, directors, officers or any other person are granted subject to this reservation.

Section 8.2. Amendments to the Bylaws. In furtherance and not in limitation of the powers conferred by the laws of the State of Delaware, the Board is expressly authorized to adopt, amend or repeal the Bylaws. The stockholders of the Corporation may also adopt, amend or repeal the Bylaws by the affirmative vote of the holders of a majority of the outstanding shares of stock entitled to vote thereon, provided, however, that the affirmative vote of the holders of at least two-thirds of the outstanding shares of stock entitled to vote thereon shall be required for the stockholders to adopt, amend or repeal Article IX (Indemnification and Advancement of Expenses) or Article XI (Amendment of Bylaws) of the Bylaws or any provision inconsistent therewith.

ARTICLE IX.

LIMITATION OF LIABILITY

A director or officer of the corporation shall not be liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer, except to the extent such exemption from liability or limitation thereof is not permitted under the DGCL as the same exists or may hereafter be amended. Any amendment, modification or repeal of the foregoing sentence shall not adversely affect any right or protection of a director or officer of the corporation hereunder in respect of any act or omission occurring prior to the time of such amendment, modification or repeal.

ARTICLE X.

STOCK TRANSFER AND OWNERSHIP RESTRICTIONS

Section 10.1. Definitions. For purposes of this Article X only:

(a) “Affiliate” and “Associate” shall have the respective meanings ascribed to such terms in Rule 12b-2 of the Exchange Act Regulations, and shall also include, with respect to any Person, any other Person whose Corporation Securities would be deemed to be constructively owned by such first Person, owned by a single “entity” as defined in Section 1.382-3(a)(1) of the Treasury Regulations with respect to such first Person, or otherwise aggregated with Corporation Securities owned by such first Person pursuant to the provisions of Section 382 of the Code and the Treasury Regulations thereunder;

(b) A Person shall be deemed the “Beneficial Owner” of, to have “Beneficial Ownership” of, and to “Beneficially Own” any Corporation Securities:

(i) that such Person actually owns (directly or indirectly) or would be deemed to actually or constructively own pursuant to Section 382 of the Code and the Treasury Regulations thereunder, including any “coordinated acquisition” of Corporation Securities by any Persons who have a formal or informal understanding with respect to such acquisition (to the extent that ownership of such Corporation Securities would be attributed to such Person under Section 382 of the Code and the Treasury Regulations thereunder), or are otherwise aggregated with Corporation Securities owned by such Person pursuant to the provisions of Section 382 of the Code, or any successor provisions or replacement provisions and the Treasury Regulations promulgated thereunder;

(ii) that such Person or any of such Person’s Affiliates or Associates Beneficially Owns, directly or indirectly, within the meaning of Rules 13d-3 or 13d-5 of the Exchange Act Regulations;

(iii) that such Person or any of such Person’s Affiliates or Associates has (A) the right or ability to vote, cause to be voted or control or direct the voting of pursuant to any agreement, arrangement or understanding, whether or not in writing; provided that a Person shall not be deemed the Beneficial Owner of, or to Beneficially Own, any security if the agreement, arrangement or understanding to vote such security (1) arises solely from a revocable proxy or consent given to such Person in response to a public proxy or consent solicitation made pursuant to, and in accordance with, the applicable Exchange Act Regulations and (2) is not also then reportable on a statement on Schedule 13D under the Exchange Act (or any comparable or successor report) or (B) the right or the obligation to become the Beneficial Owner (whether such right is exercisable or such obligation is required to be performed immediately or only after the passage of time, the occurrence of

conditions, the satisfaction of regulatory requirements or otherwise) pursuant to any agreement, arrangement or understanding, whether or not in writing (other than customary agreements with and between underwriters and selling group members with respect to a bona fide public offering of securities), written or otherwise, or upon the exercise of conversion rights, exchange rights, rights, warrants or options, or otherwise, through conversion of a security, pursuant to the power to revoke a trust, discretionary account or similar arrangement, pursuant to the power to terminate a repurchase or similar so-called “stock-borrowing” agreement or arrangement, or pursuant to the automatic termination of a trust, discretionary account or similar arrangement; provided that a Person shall not be deemed to be the Beneficial Owner of, or to Beneficially Own, Corporation Securities tendered pursuant to a tender or exchange offer made pursuant to, and in accordance with, the applicable Exchange Act Regulations until such tendered securities are accepted for purchase or exchange;

(iv) that are Beneficially Owned (within the meaning of the preceding subsections of this Section 10.1(b)), directly or indirectly, by any other Person with which such first Person, or any of such first Person’s Affiliates or Associates, has any agreement, arrangement or understanding, whether or not in writing, for the purpose of acquiring, holding, voting or disposing of any Corporation Securities or cooperating in obtaining, changing, or influencing control of the Corporation; or

(v) that are the subject of, or the reference securities for, or that underlie, any Derivative Position of such Person or any of such Person’s Affiliates or Associates, with the number of Corporation Securities deemed Beneficially Owned in respect of a Derivative Position being the notional or other number of Corporation Securities in respect of such Derivative Position (without regard to any short or similar position) that is specified in (A) one or more filings with the Securities and Exchange Commission by such Person or any of such Person’s Affiliates or Associates or (B) the documentation evidencing such Derivative Position as the basis upon which the value or settlement amount of such Derivative Position, or the opportunity of the holder of such Derivative Position to profit or share in any profit, is to be calculated in whole or in part (whichever of (A) or (B) is greater), or if no such number of Corporation Securities is specified in such filings or documentation (or such documentation is not available to the Board of Directors), as determined by the Board of Directors in its sole discretion;

provided, however, that no Person who is an officer, director or employee of an Exempt Person shall be deemed, solely by reason of such Person’s status or authority as such, to be the “Beneficial Owner” of, to have “Beneficial Ownership” of or to “Beneficially Own” any Corporation Securities that are “Beneficially Owned” (as defined in this Section 10.1(b)), including, without limitation, in a fiduciary capacity, by such Exempt Person or by any other officer, director or employee of such Exempt Person; provided, further, that nothing in this Section 10.1(b) shall cause (y) a Person engaged in business as an underwriter of securities or (z) an initial purchaser in a bona fide offering pursuant to Section 144A of the Securities Act to be the Beneficial Owner of, to Beneficially Own or have Beneficial Ownership of, any Corporation Securities acquired through such Person’s participation in good faith in a firm commitment underwriting or a bona fide offering pursuant to Section 144A of the Securities Act, as applicable, until the expiration of forty days after the date of such acquisition, and then only if such Corporation Securities continue to be owned by such Person at such expiration of forty days;

(c) “Code” shall mean the Internal Revenue Code of 1986, as amended;

(d) “Corporation Securities” means (i) shares of Common Stock of the Corporation, (ii) shares of Preferred Stock (other than preferred stock described in Section 1504(a)(4) of the Code) of the Corporation, (iii) warrants, rights, convertible debt or options (including options within the meaning of Section 1.382-4(d)(9) of the Treasury Regulations) to purchase stock (other than preferred stock described in Section 1504(a)(4) of the Code) of the Corporation, and (iv) any other interest that would be treated as “stock” of the Corporation pursuant to Section 1.382-2T(f)(18) of the Treasury Regulations;

(e) “Derivative” shall mean any option, warrant, convertible security, stock appreciation right, or other security, contract right or derivative position or similar right (including any “swap” transaction with respect to any security, other than a broad-based market basket or index);

(f) “Derivative Position” shall mean any Derivative, whether or not presently exercisable, that (i) has an exercise or conversion privilege or a settlement payment or mechanism at a price related to the value of Corporation Securities or a value determined in whole or in part with reference to, or derived in whole or in part from, the value of Corporation Securities and that increases in value as the market price or value of Corporation Securities increases or that provides an opportunity, directly or indirectly, to profit or share in any profit derived from any increase in the value of Corporation Securities and (ii) is capable of being settled, in whole or in part, through delivery of cash or Corporation Securities (whether on a required or optional basis, and whether such settlement may occur immediately or only after the passage of time, the occurrence of conditions, the satisfaction of regulatory requirements or otherwise), in each case regardless of whether (A) it conveys any voting rights in such Corporation Securities to any Person or (B) any Person (including the holder of such Derivative Position) may have entered into other transactions that hedge its economic effect;

(g) “Excess Shares” means any Corporation Securities the Transfer or ownership of which would (x) result in a Prohibited Ownership Percentage or (y) increase the Percentage Stock Ownership of any Person with a Prohibited Ownership Percentage under Section 10.2;

(h) “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended;

(i) “Exchange Act Regulations” shall mean the General Rules and Regulations under the Exchange Act;

(j) “Exempt Person” shall mean (i) the Corporation or any Subsidiary of the Corporation, in each case, including, without limitation, in its fiduciary capacity, (ii) any employee benefit plan of the Corporation or of any Subsidiary of the Corporation, or (iii) any entity or trustee holding (or acting in a fiduciary capacity in respect of) Common Stock for or pursuant to the terms of any such plan referenced in clause (ii) or for the purpose of funding any such plan or funding other employee benefits for employees of the Corporation or any Subsidiary of the Corporation;

(k) “Expiration Date” means the earliest of (i) the repeal, amendment or modification of Section 382 of the Code (or any comparable successor provisions), if the Board of Directors determines that the restrictions in this Article X are no longer necessary or desirable for the preservation of the Tax Benefits, (ii) the date that the Board of Directors determines that (x) an ownership change (within the meaning of Section 382 of the Code and the Treasury Regulations thereunder) would not result in a substantial limitation on the ability of the Corporation (or a direct or indirect subsidiary of the Corporation) to use otherwise available Tax Benefits, (y) no significant value attributable to the Tax Benefits would be preserved by continuing the Transfer restrictions herein, or (z) it is not in the best interests of the Corporation to continue the Transfer restrictions herein, (iii) the date that is the third anniversary of the filing and effectiveness of this Certificate of Incorporation,

the date that is the third anniversary of the filing and effectiveness of this Certificate of Incorporation, or (iv) any other date as the Board of Directors shall fix in accordance with Section 10.8 of this Article X;

(l) “Initial Substantial Shareholder” shall mean any Person who, alone or together with its Affiliates and Associates, holds a Prohibited Ownership Percentage as of the Effective Time, other than the initial direct Public Group of the Corporation; provided, however, that, if an Initial Substantial Shareholder ceases to hold a Prohibited Ownership Percentage at any time after the Effective Time, such Person shall cease to be treated as an Initial Substantial Shareholder for all purposes of this Article X;

(m) “Percentage Stock Ownership” shall mean, as of any date or time, with respect to any Person who is the Beneficial Owner of Corporation Securities, the greater of (i) the percentage of Corporation Securities Beneficially Owned by such Person as of such date or time, as determined under clause (i) of the definition of Beneficial Ownership in accordance with Sections 1.382-2(a)(3), 1.382-2T(g), (h), (j) and (k), 1.382-3(a), and 1.382-4(d) of the Treasury Regulations (or in accordance with any future Treasury Regulations promulgated under Section 382 (or any successor provisions or replacement provisions)), including, without limitation, the deemed exercise of options warrants and other rights to acquire stock under certain circumstances; provided, however, that (x) for purposes of applying Treasury Regulation Section 1.382-2T(k)(2) to this definition, the Corporation shall be treated as having “actual knowledge” of the beneficial ownership of all outstanding Corporation Securities that would be attributed to any Person, and (y) for the sole purpose of determining the percentage ownership of any entity (and not for the purpose of determining the percentage ownership of any other Person) under this definition, Treasury Regulation Section 1.382-2T(h)(2)(i) (A) (treating stock attributed to an entity pursuant to Section 318(a)(2) of the Code as no longer being owned by the entity from which it is being attributed) shall not apply, and (ii) the percentage of Corporation Securities Beneficially Owned by such Person as of such date or time, as determined under clauses (ii), (iii), (iv) and (v) of the definition of Beneficial Ownership and, solely with respect to such Person, by taking into account all issued and outstanding Corporation Securities as of such date or time, together with the number of Corporation Securities not actually issued and outstanding as of such date or time, but which such Person would be deemed to be the Beneficial Owner of, to Beneficially Own or have Beneficial Ownership of, as of such date or time, pursuant to clauses (ii)-(v) of the definition of Beneficial Ownership; provided, further, that for the avoidance of doubt, and notwithstanding anything to the contrary set forth herein, the Percentage Stock Ownership of any Person holding outstanding options, warrants, rights or similar interests (including any contingent rights) to acquire Corporation Securities shall be determined as of any date or time, solely with respect to such Person, by including the number of Corporation Securities that, as of such date or time, are issued and outstanding, together with the number of Corporation Securities that are not actually issued and outstanding, but which such Person has the right to acquire upon the exercise of such options, warrants, rights or similar interests and which such Person is deemed, as of such date or time, to Beneficially Own or have Beneficial Ownership of pursuant to the terms of clauses (ii)-(v) of the definition of Beneficial Ownership;

(n) a “Person” shall mean any individual, entity, firm, corporation, estate, trust (including a trust qualified under Sections 401(a) or 501(c)(17) of the Code), a portion of a trust permanently set aside for or to be used exclusively for the purposes described in Section 642(c) of the Code, private foundation within the meaning of Section 509(a) of the Code,

company, limited liability company, partnership, joint venture, or similar organization (including the Corporation if appropriate in the context) and also includes a “group” as that term is used for purposes of Section 13(d)(3) of the Exchange Act, or a group of persons making a “coordinated acquisition” of Corporation Securities or otherwise treated as an “entity” within the meaning of Treasury Regulation Section 1.382-3(a)(1) or otherwise, and includes, without limitation, an unincorporated group of persons who, by formal or informal agreement or arrangement (whether or not in writing), have embarked on a common purpose or act, and also includes any successor (by merger or otherwise) of any such individual or entity;

(o) “Prohibited Distributions” means any and all dividends or other distributions paid by the Corporation with respect to any Excess Shares received by a Purported Acquiror with respect to any Excess Shares;

(p) “Prohibited Ownership Percentage” shall mean a Percentage Stock Ownership by any Person (other than an Exempt Person or any Initial Substantial Shareholder), together with all Affiliates and Associates of such Person, of 4.8% or more;

(q) “Prohibited Transfer” shall mean any purported Transfer of Corporation Securities to the extent that such purported Transfer is prohibited and void under this Article X;

(r) a “Public Group” shall have the meaning contained in Section 382 and the Treasury Regulations thereunder;

(s) “Purported Acquiror” shall mean any Person or Public Group that purports to acquire Beneficial Ownership or record, legal or any other ownership of any Excess Shares. If there is more than one Purported Acquiror with respect to certain Excess Shares (for example, if the Purported Acquiror of record ownership of such Excess Shares is not the Purported Acquiror of Beneficial Ownership of such Excess Shares), then all references herein to “Purported Acquiror” shall include any and all of such Purported Acquirors, as necessary to carry out the purposes of this Article X;

(t) “Securities Act” shall mean the Securities Act of 1933, as amended;

(u) “Subsidiary” shall mean, with respect to any Person, any other Person that is an entity of which such first Person (i) Beneficially Owns or otherwise directs or controls the voting of, directly or indirectly, an amount of voting securities or other equity interests having voting power sufficient to elect at least a majority of the directors or members of an equivalent governing body having similar functions or (ii) otherwise has the power to control or direct the management of such corporation or other entity;

(v) “Tax Benefits” shall mean the net operating loss carryovers, capital loss carryovers, general business credit carryovers, disallowed net business interest expense carryforwards under Section 163(j), foreign tax credit carryovers and any other item that may reduce or result in any credit against any income taxes owed by the Corporation or any of its direct or indirect Subsidiaries or refundable credits, including, but not limited to, any item subject to limitation under Section 382 or Section 383 of the Code and Treasury Regulations thereunder, as well as any “net unrealized built-in loss” (within the meaning of Section 382 of the Code) of the Corporation or any direct or indirect Subsidiary thereof;

(w) “Transfer” shall mean, subject to the last sentence of this definition, any direct or indirect sale, transfer, assignment, conveyance, pledge, other disposition or other action taken by a Person, other than the Corporation, that alters the Percentage Stock Ownership of any Person. A Transfer also shall include the creation or grant of an option (within the meaning of Treasury Regulation Section 1.382-4(d)(9)) other than the grant of an option by the Corporation or the modification, amendment or adjustment of an existing option granted by the Corporation. A Transfer shall not include (i) any unilateral issuance or grant by the Corporation of Corporation Securities (including shares of restricted stock) to any directors, officers, or employees of the Corporation or any of its Subsidiaries, (ii) pre-arranged purchases of any Corporation Securities by directors, officers or employees of the Corporation or its Subsidiaries pursuant to a dividend reinvestment plan sponsored by the Corporation or (iii) the exercise by any director, officer or employee of the Corporation or any of its Subsidiaries of any options, warrants, rights or similar interests to purchase Corporation Securities granted by the Corporation to such director, officer or employee pursuant to contract or any equity compensation plan of the Corporation;

(x) “Transferee” means any Person to whom Corporation Securities are Transferred; and

(y) “Treasury Regulations” shall mean the income tax regulations (whether temporary, proposed or final) promulgated under the Code and any successor regulations. References to any subsection of such regulations include references to any successor subsection thereof.

Section 10.2. Transfer and Ownership Restrictions. Except to the extent provided in Section 10.3, to preserve the Tax Benefits of the Corporation until the Expiration Date, any purported Transfer of Corporation Securities prior to the

Expiration Date, and any purported Transfer of Corporation Securities pursuant to an agreement, arrangement or understanding entered into prior to the Expiration Date, shall be prohibited and shall be null and void ab initio if and to the extent such purported Transfer (or any series of Transfers of which such Transfer is part): (a) would cause the Purported Acquiror to have, or result in any other Person or Public Group having, a Prohibited Ownership Percentage (other than any increase in the Percentage Stock Ownership of a Public Group by reason of a Transfer from an Initial Substantial Shareholder); or (b) would increase the Percentage Stock Ownership of any Person or Public Group that has a Prohibited Ownership Percentage (other than any increase in the Percentage Stock Ownership of a Public Group by reason of a Transfer from an Initial Substantial Shareholder). The Corporation may require, as a condition to the registration of the Transfer of any Corporation Securities or the payment of any distribution on any Corporation Securities, that the proposed Transferee or payee furnish to the Corporation all information reasonably requested by the Corporation with respect to the Beneficial Ownership of such Corporation Securities.

Section 10.3. Waiver of Restrictions. Notwithstanding anything herein to the contrary, the Board of Directors, in its sole discretion, may cause the Corporation to waive the application of any of the restrictions contained in Section 10.2, including, without limitation, to any Transfer of Corporation Securities that otherwise would be prohibited by the restrictions in Section 10.2, notwithstanding the effect such waiver could have on any Tax Benefits. The Board of Directors may impose any conditions that it deems reasonable and appropriate in connection with granting any such a waiver, including without limitation, restrictions on the ability of any Transferee to Transfer any or all of the Corporation Securities it acquires through a Transfer that is the subject of such waiver. As a condition to granting its approval, the Board of Directors may, in its discretion, require (at the expense of the transferor and/or transferee) an opinion of counsel selected by the Board of Directors that the Transfer will not result in the application of any limitation on the use of the Tax Benefits under Sections 382 or 383 of the Code. Any waiver of the Board of Directors pursuant to this Section 10.3 shall be in writing and executed on behalf of the Corporation by any duly authorized officer, and may be given prospectively or retroactively and in whole or in part with respect to any Transfer. The Board of Directors, to the fullest extent permitted by law, may exercise the authority granted by this Section 10.3 through duly authorized officers or agents of the Corporation.

Section 10.4. Purported Transfer in Violation of Transfer and Ownership Restrictions. Unless a waiver has been obtained in accordance with Section 10.3 with respect to a purported Transfer that, if completed, would result in a Transfer of Excess Shares (other than a Transfer of Excess Shares pursuant to Section 10.5(b) or (c) or pursuant to an automatic transfer as provided in this Section 10.4), (a) such purported Transfer shall constitute a Prohibited Transfer for all purposes of this Article X, shall be null and void ab initio and shall not be effective to Transfer Beneficial Ownership or any record, legal, or other ownership of such Excess Shares to the Purported Acquiror, (b) no officer, employee or agent of the Corporation shall record such Prohibited Transfer in the Corporation’s stock transfer books and (c) such Purported Acquiror shall not be entitled to any rights whatsoever with respect to such Excess Shares and shall not be recorded as the owner thereof in the Corporation’s stock ledger, and (c) such Excess Shares shall be automatically Transferred pursuant to DGCL Section 202(c)(4) to an agent designated by the Corporation (the “Agent”). Any dividends or distributions payable on any Excess Shares following such automatic Transfer to the Agent shall be paid to the Agent until the Excess Shares are sold by the Agent in accordance with Section 10.5(b). A Prohibited Transfer of Excess Shares that is null and void under this Section 10.4 shall not adversely affect the validity of any other Transfer of any Corporation Securities, including any such Transfer in the same or any other related transaction, whether to the same Purported Acquiror of Excess Shares or to any other Person. Once Excess Shares have been acquired in a Transfer, pursuant to this Section 10.4 or Section 10.5, that is not a Prohibited Transfer, the relevant Corporation Securities shall cease to be Excess Shares. For the avoidance of doubt, any Transfer of Excess Shares not in accordance with the provisions of this Section 10.4 or Section 10.5 shall also be a Prohibited Transfer.

Section 10.5.

(a) Demand by Corporation. Unless a waiver has been obtained in accordance with Section 10.3, if the Board of Directors determines that there has been or is threatened a purported Transfer of Excess Shares to a Purported Acquiror, or that a Person proposes to take any other action in violation of this Article X (whether or not such action is intentional), the Corporation shall make a demand on the Purported Acquiror to transfer or cause the transfer of any certificate or other evidence of purported ownership of the Excess Shares within the Purported Acquiror’s possession or control, along with any and all Prohibited Distributions, to the Agent.

(b) Treatment of Excess Shares. No officer, director, employee or agent of the Corporation shall record any Prohibited Transfer, and a Purported Acquiror shall not be recognized as a stockholder of the Corporation for any purpose whatsoever in respect of Excess Shares. The Purported Transferee shall not be entitled with respect to such Excess Shares to any rights of stockholders of the Corporation, including, without limitation, the right to vote such Excess Shares and to receive dividends or distributions, whether liquidating or otherwise, in respect thereof, if any, and the Excess Shares shall be

deemed to remain with the transferor unless and until the Excess Shares are transferred to the Agent pursuant to Section 10.4 or until a waiver is obtained under Section 10.3. Once the Excess Shares have been acquired in a Transfer that is not a Prohibited Transfer, the Corporation Securities shall cease to be Excess Shares. For this purpose, any Transfer of Excess Shares not in accordance with the provisions of Section 10.4 or Section 10.5 shall also be a Prohibited Transfer. The Corporation may make such arrangements or issue such instructions to its stock transfer agent as the Board of Directors may determine to be necessary or advisable to implement this Section 10.5(b), including, without limitation, authorizing such transfer agent to require an affidavit from a Purported Transferee regarding such Person’s actual and constructive ownership of Corporation Securities and other evidence that a Transfer will not be prohibited by Section 10.2.

(c) Transfer of Excess Shares and Prohibited Distributions to Agent. Upon demand by the Corporation, the Purported Acquiror shall transfer or cause the transfer of any certificate or other evidence of purported ownership of the Excess Shares within the Purported Acquiror's possession or control, along with any and all Prohibited Distributions paid in respect of such Excess Shares, to the Agent. Any failure by the Purported Acquiror to transfer or cause the transfer of any certificate or other evidence of purported ownership of the Excess Shares to the Agent shall not negate the automatic transfer of such Excess Shares to the Agent pursuant to Section 10.5(b). The Agent shall sell to a buyer or buyers, which may include the Corporation, in an arms-length transaction (through The Nasdaq Stock Market, if possible, but in any event consistent with applicable law) any Excess Shares; provided, however, that any such sale must not constitute a Prohibited Transfer, provided, further, that the Agent shall, in its reasonable discretion, effect such sale or sales in an orderly fashion and shall not be required to effect any such sale within any specific time frame if, in the Agent’s reasonable discretion, such sale or sales would disrupt the market for the Common Stock or other Corporation Securities or would otherwise substantially adversely affect the value of the Corporation Securities. The proceeds of such sale shall be referred to as “Sales Proceeds.” If, after purportedly acquiring the Excess Shares, the Purported Acquiror has purported to sell some or all of the Excess Shares to an unrelated party in an arms-length transaction, the Purported Acquiror shall be deemed to have sold such Excess Shares on behalf of the Agent, and in lieu of transferring any certificate or other evidence of purported ownership of the Excess Shares and any Prohibited Distributions to the Agent, the Purported Acquiror shall transfer to the Agent the Prohibited Distributions and the proceeds of such sale (the “Resale Proceeds”), except to the extent that the Agent grants written permission to the Purported Acquiror to retain a portion of the Resale Proceeds not exceeding the amount that would have been payable by the Agent to the Purported Acquiror pursuant to Section 10.5(d) if the Excess Shares had been sold by the Agent rather than by the Purported Acquiror.

(d) Allocation of Sale Proceeds, Resale Proceeds and Prohibited Distributions. The Sales Proceeds, the Resale Proceeds, if applicable, and Prohibited Distributions, if applicable, shall be allocated as follows: (1) first to the Agent in an amount equal to the expenses incurred in selling such Excess Shares and exercising its duties hereunder; then (2) second, to the Purported Acquiror up to the following amount: (a) the purported purchase price paid or value of consideration surrendered by the Purported Acquiror to acquire the Excess Shares, or (b) where the purported Transfer of the Excess Shares to the Purported Acquiror was by gift, inheritance, or any similar purported Transfer, the fair market value of the Excess Shares at the time of such purported Transfer, in each case, which amount shall be determined by the Board of Directors; and then (3) third any remaining amounts to an entity designated by the Corporation that is described in Section 501(c)(3) of the Code, contributions to which must be eligible for deduction under each of Sections 170(b)(1)(A), 2055 and 2522 of the Code; provided, however, that if the Excess Shares (including any Excess Shares arising from a previous Prohibited Transfer not sold by the Agent in a prior sale or sales), represent a 4.8% or greater Percentage Stock Ownership, then any such remaining amounts shall be paid to two or more such organizations. The Purported Acquiror’s sole right with respect to such Excess Shares shall be limited to the amount payable to the Purported Acquiror pursuant to this Section 10.5(d). In no event shall any Excess Shares, Sales Proceeds, Resale Proceeds or Prohibited Distributions inure to the benefit of the Corporation or the Agent, except to the extent used to cover expenses incurred by the Agent in performing its duties hereunder.

(e) Other Securities. In the event of any Transfer which does not involve a transfer of securities of the Corporation within the meaning of Delaware law (“Securities,” and individually, a “Security”) but which would cause a Purported Acquiror to violate a restriction on Transfers provided for in this Article X, the application of Section 10.5(b), (c) and (d) shall be modified as described in this Section 10.5(e). In such case, no such Purported Acquiror shall be required to dispose of any interest that is not a Security, but such Purported Acquiror and/or any Person whose ownership of Securities is attributed to such Purported Acquiror shall be required to dispose of sufficient Securities (which Securities shall be disposed of in the inverse order in which they were acquired) to cause such Purported Acquiror, following such disposition, not to be in violation of this Article X. Such disposition shall be deemed to occur simultaneously with the Transfer giving rise to the application of this provision, and such number of Securities that are disposed of shall be considered Excess Shares and shall be disposed of through the Agent as provided in Section 10.5(c) and (d), except that the maximum aggregate amount payable either to such Purported Acquiror, or to such other Person that was the direct holder of such Excess Shares, in

connection with such sale shall be the fair market value of such Excess Shares at the time of the purported Transfer. All expenses incurred by the Agent in disposing of such Excess Shares shall be paid out of any amounts due such Purported Acquiror or such other Person. The purpose of this Section 10.5(e) is to apply the provisions in Section 10.5(b), (c) and (d) to situations in which there is a Prohibited Transfer without a direct Transfer of Securities, and this Section 10.5(e), along with the other provisions of this Article X, shall be interpreted to produce the same results, with differences as the context requires, as a direct Transfer of Corporation Securities.

(f) Remedies. Without limiting any other remedies available to the Corporation, if a Purported Acquiror shall fail to comply with any provision of Section 10.5(b) within thirty (30) days of the Corporation’s demand, and unless a waiver is obtained in accordance with Section 10.3, the Corporation shall promptly take all cost effective actions that it believes appropriate to compel the Purported Acquiror to surrender to the Agent any certificates or other evidence of purported ownership of Excess Shares, the Resale Proceeds, and/or the Prohibited Distributions or to enjoin or rescind any such purported Transfer. The Board of Directors may authorize such additional actions as it deems advisable to give effect to the provisions of this Article X, including, without limitation, refusing to give effect on the books of the Corporation to any Prohibited Transfer. The Corporation is authorized specifically to seek equitable relief, including injunctive relief, to enforce or prevent a violation of the provisions of this Article X. Nothing in this Section 10.5(f) shall (i) be deemed inconsistent with any Prohibited Transfer of Excess Shares provided in this Article X being void ab initio or (ii) preclude the Corporation in its discretion from immediately bringing legal proceedings without a prior demand.

(g) Securities Exchange Transactions. Nothing in this Article X (including, without limitation, any determinations made, or actions taken, by the Board of Directors or the Corporation pursuant to this Article X) shall preclude the settlement of any transaction entered into through the facilities of a national securities exchange or any national securities quotation system. The fact that such settlement of any transaction occurs shall not negate the effect of any other provision of this Article X and any Purported Acquiror in such transaction shall be subject to all of the provisions and limitations set forth in this Article X.

(h) Liability. If any Person shall knowingly violate, or knowingly cause any other Person under the control of such Person (“Controlled Person”) to violate, the provisions of this Article X, then that Person and any such Controlled Person shall be jointly and severally liable for, and shall pay to the Corporation, such amount as will, after taking account of all taxes imposed with respect to the receipt or accrual of such amount and all costs incurred by the Corporation as a result of such violation, put the Corporation in the same financial position as it would have been in had such violation not occurred, including but not limited to damages resulting from a reduction in, or elimination of, the Corporation’s ability to utilize its Tax Benefits, and attorneys’ and auditors’ fees incurred in connection with such violation.

Section 10.6. Obligation to Provide Information. At the request of the Corporation or as a condition to the registration of the Transfer of any Corporation Securities, any Person who is a Beneficial Owner or legal or record holder of Corporation Securities, and any proposed Transferee and any Person controlling, controlled by or under common control with the proposed Transferee, shall provide such information as the Corporation may request from time to time to determine compliance with this Article X or the status of the Corporation’s Tax Benefits. Any Purported Acquiror who attempts to acquire Corporation Securities in excess of the limitations set forth in this Article X shall immediately give written notice to the Corporation of such event and shall provide to the Corporation such other information as the Corporation may request to determine the effect, if any, of such Prohibited Transfer on the preservation and usage of the Tax Benefits.

Section 10.7. Legends. The Board of Directors may require that any certificates issued by the Corporation evidencing ownership of shares of Corporation Securities that are subject to the restrictions on Transfer and ownership contained in this Article X and, if applicable, to conditions, including restrictions on the Transfer of such shares, imposed by the Board of Directors under Section 10.3 bear a conspicuous legend referencing the applicable restrictions.

Section 10.8. Authority of Board of Directors. The Board of Directors shall have the exclusive power to (i) determine all matters necessary for administering and determining compliance with this Article X and (ii) exercise all rights and powers as may be advisable in the administration of this Article X, including without limitation, the right and power to (w) interpret the provisions of this Article X, (x) make all calculations and determinations deemed necessary or advisable for the administration of this Article X, and (y) determine value in good faith, which determination shall be conclusive, in each case, to prevent an ownership change for purposes of Section 382 of the Code as a result of any changes in applicable Treasury Regulations or other provisions of law. Nothing contained in this Article X shall limit the authority of the Board of Directors to take such other action to the extent permitted by law as it deems necessary, desirable or advisable to preserve the Tax Benefits. In addition, the Board of Directors may from time to time establish, modify, amend or rescind Bylaws, regulations and procedures of the Corporation not inconsistent with the express provisions of this Article X for purposes of determining whether any Transfer of Corporation Securities would jeopardize the Corporation’s ability to

preserve or utilize any Tax Benefits, or for the orderly application, administration and implementation of the provisions of this Article X. Without limiting the generality of the foregoing, in the event of a change in law (including applicable regulations) making one or more of the following actions necessary or desirable or in the event that the Board of Directors believes one or more of such actions is in the best interest of the Corporation, the Board of Directors may accelerate or extend the Expiration Date; provided that the Board of Directors shall determine in writing that such acceleration or extension is reasonably necessary or desirable to preserve the Tax Benefits or that the continuation of these restrictions is no longer reasonably necessary or desirable to preserve the Tax Benefits, as the case may be. In the case of an ambiguity in the application of any of the provisions of this Article X, including any definition used herein, the Board of Directors shall have the power to determine the application of such provisions with respect to any situation based on its reasonable belief, understanding or knowledge of the circumstances. In the event this Article X requires an action by the Board of Directors but fails to provide specific guidance with respect to such action, the Board of Directors shall have the power to determine the action to be taken so long as such action is not contrary to the provisions of this Article X. All actions, calculations, interpretations and determinations which are done or made by the Board of Directors in good faith in accordance with this Section 10.8 shall be final, conclusive and binding on the Corporation, the Agent, and all other parties for all purposes of this Article X absent manifest error. The Board of Directors may delegate all or any portion of its duties and powers under this Article X to a committee of the Board of Directors as it deems necessary or advisable and, to the fullest extent permitted by law, may exercise the authority granted by this Article X through duly authorized officers or agents of the Corporation. Notwithstanding anything herein to the contrary, nothing in this Article X shall be construed to limit or restrict the Board of Directors in the exercise of its fiduciary duties under applicable law.

Section 10.9. Reliance. To the fullest extent permitted by law, the members of the Board of Directors shall be fully protected in relying in good faith upon the information, opinions, reports or statements provided by the Corporation’s Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and Treasurer, Secretary and Chief Legal Officer or Assistant Secretary, or by the Corporation’s outside legal counsel, independent auditors, transfer agent, investment bankers or other employees and agents (including the Agent) as to matters reasonably believed to be within their professional or expert competence in making any determinations and findings contemplated by this Article X, and the members of the Board of Directors shall not be responsible for any good faith errors made in connection therewith. For purposes of determining the existence and identity of, and the amount of any Corporation Securities owned by any stockholder, the Corporation is entitled to rely on the existence and absence of filings on Schedule 13D or 13G under the Exchange Act (or similar filings), if any, as of any date, subject to its actual knowledge of the ownership of Corporation Securities.

Section 10.10. Benefits of this Article X. Nothing in this Article X shall be construed to give to any Person other than the Corporation or the Agent any legal or equitable right, remedy or claim under this Article X. This Article X shall be for the sole and exclusive benefit of the Corporation and the Agent.

Section 10.11. Severability. If any provision of this Article X or the application of any such provision to any Person or under any circumstance shall be held invalid, illegal, or unenforceable in any respect by a court of competent jurisdiction, such invalidity, illegality or unenforceability shall not affect any other provision of this Article X.

Section 10.12. Waiver. With regard to any power, remedy or right provided herein or otherwise available to the Corporation or the Agent under this Article X, (i) no waiver will be effective unless expressly contained in a writing signed by the waiving party; and (ii) no alteration, modification or impairment will be implied by reason of any previous waiver, extension of time, delay or omission in exercise, or other indulgence.

ARTICLE XI.

INCORPORATOR

The incorporator of the Corporation is Steven Chuslo, whose mailing address is One Park Place, Suite 200, Annapolis, Mayland 21401.

ARTICLE XII.

INITIAL BOARD OF DIRECTORS

The powers of the incorporator are to terminate upon the filing of this Certificate of Incorporation with the Secretary of State of the State of Delaware. The names and mailing addresses of the persons who are to serve as the initial directors of the Corporation until the first annual meeting of stockholders of the corporation and until their successors are duly elected and qualified, are:

| | | | | |

| Name | Address |

| Jeffery W. Eckel | One Park Place, Suite 200 Annapolis, Maryland 21401 |

| Jeffrey A. Lipson | One Park Place, Suite 200 Annapolis, Maryland 21401 |

| Teresa M. Brenner | One Park Place, Suite 200 Annapolis, Maryland 21401 |

| Lizabeth A. Ardisana | One Park Place, Suite 200 Annapolis, Maryland 21401 |

| Clarence D. Armbrister | One Park Place, Suite 200 Annapolis, Maryland 21401 |

| Nancy C. Floyd | One Park Place, Suite 200 Annapolis, Maryland 21401 |

| Charles M. O’Neil | One Park Place, Suite 200 Annapolis, Maryland 21401 |

| Richard J. Osborne | One Park Place, Suite 200 Annapolis, Maryland 21401 |

| Steven G. Osgood | One Park Place, Suite 200 Annapolis, Maryland 21401 |

| Kimberly A. Reed | One Park Place, Suite 200 Annapolis, Maryland 21401 |

[SIGNATURE PAGE FOLLOWS]

The undersigned incorporator hereby acknowledges that the foregoing certificate of incorporation is his act and deed on this the ___ day of ______, 2024.

| | | | | | | | |

| | |

| Steven Chuslo

Incorporator | |

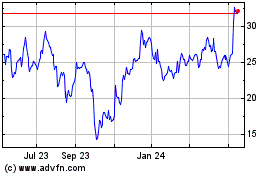

Hannon Armstrong Sustain... (NYSE:HASI)

Historical Stock Chart

From May 2024 to Jun 2024

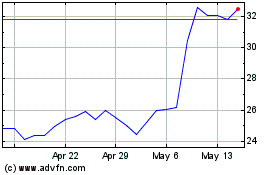

Hannon Armstrong Sustain... (NYSE:HASI)

Historical Stock Chart

From Jun 2023 to Jun 2024