false

0001392994

0001392994

2024-09-10

2024-09-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): September 10, 2024

______________________________

First Trust Specialty Finance and Financial Opportunities

Fund

(Exact name of registrant as specified in its charter)

| Massachusetts |

811-22039 |

06-1810845 |

| (State or other jurisdiction |

(Commission File Number) |

(IRS Employer |

| of incorporation) |

|

Identification No.) |

|

120 East Liberty Drive, Suite 400

Wheaton, Illinois

(Address of principal executive offices) |

60187

(zip code) |

Registrant’s telephone number, including area

code: (603) 765-8000

_______________________________________________________

(Former Name or Former Address, if Changed Since Last

Report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of class |

Trading Symbol |

Name of Exchange on which registered |

| Common stock, $0.01 par value per share |

FGB |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

First Trust Specialty Finance and Financial

Opportunities Fund (“FGB”) is filing herewith a press release issued on September 10, 2024, as Exhibit 99.1. The press release

was issued by First Trust Advisors L.P. (“FTA”) approving the reorganization (the “Reorganization”) of FGB into

FT Confluence BDC & Specialty Finance Income ETF, a newly created exchange-traded fund (“ETF”) that will be traded on

the NYSE and will be an actively managed ETF managed by FTA and sub-advised by Confluence Investment Management LLC (“Confluence”

or the “Sub-Advisor”), FGB’s current sub-advisor.

| Item 9.01 | Financial

Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: September 10, 2024 |

|

FIRST TRUST SPECIALTY FINANCE AND FINANCIAL OPPORTUNITIES

FUND |

| |

|

|

| |

By: |

/s/ W. Scott Jardine |

| |

Name |

W. Scott Jardine |

| |

Title: |

Secretary |

EXHIBIT INDEX

| PRESS RELEASE | | SOURCE: First Trust Advisors L.P. |

Board

of First Trust Specialty Finance and Financial Opportunities Fund Approves Conversion into an ETF and sets date of Annual Shareholder

Meeting

WHEATON,

IL – (BUSINESS WIRE) – September 10, 2024 – First Trust Advisors L.P. (“FTA”) announced today

that the Board of Trustees of First Trust Specialty Finance and Financial Opportunities Fund (NYSE: FGB), a closed-end fund managed by

FTA, approved the reorganization (the “Reorganization”) of FGB into FT Confluence BDC & Specialty Finance Income ETF,

a newly created exchange-traded fund (“ETF”) that will be traded on the NYSE and will be an actively managed ETF managed by

FTA and sub-advised by Confluence Investment Management LLC (“Confluence” or the “Sub-Advisor”), FGB’s current

sub-advisor.

Under the terms of the

Reorganization, which is expected to be tax-free, the assets of FGB would be transferred to, and the liabilities of FGB would be assumed

by, the new ETF, and shareholders of FGB would receive shares of the new ETF with a value equal to the aggregate net asset value of the

FGB shares held by them. It is currently expected that the Reorganization will be consummated during 2025, subject to requisite approval

by the shareholders of FGB and satisfaction of applicable regulatory requirements and approvals and customary closing conditions. There

is no assurance when or whether such approvals, or any other approvals required for the Reorganization, will be obtained. More information

on the Reorganization will be contained in registration statement and/or proxy materials that will be filed with the SEC in the coming

weeks.

The Board of Trustees of

FGB also set the date for the 2024 annual meeting of shareholders of FGB. The annual meeting of shareholders of FGB (the “Meeting”)

will be held at the offices of First Trust Advisors L.P., 120 East Liberty Drive, Suite 400, Wheaton, Illinois 60187, on November 12,

2024. More information on the Meeting will be contained in proxy materials that will be sent to shareholders of FGB in the coming weeks.

A separate special meeting of shareholders will be scheduled for a future date to consider the Reorganization.

FGB is a diversified, closed-end

management investment company that seeks to provide a high level of current income with a secondary focus on total return. Under normal

market conditions, FGB pursues its investment objectives by investing at least 80% of its Managed Assets in a portfolio of securities

of specialty finance and other financial companies that Confluence believes offer attractive opportunities for income and capital appreciation.

“Managed Assets” means the total asset value of FGB minus the sum of FGB’s liabilities other than the principal amount

of borrowings, if any.

FTA is a federally registered

investment advisor and serves as the investment advisor of FGB. FTA and its affiliate First Trust Portfolios L.P. (“FTP”),

a FINRA registered broker-dealer, are privately-held companies that provide a variety of investment services. FTA has collective assets

under management or supervision of approximately $241 billion as of August 31, 2024 through unit investment trusts, exchange-traded funds,

closed-end funds, mutual funds and separately managed accounts. FTA is the supervisor of the First Trust unit investment trusts, while

FTP is the sponsor. FTP is also a distributor of mutual fund shares and exchange-traded fund creation units. FTA and FTP are based in

Wheaton, Illinois.

Confluence serves as FGB’s

investment sub-advisor. The Confluence team has more than 500 years of combined financial experience and 300 years of portfolio management/research

experience, maintaining a proven track record that dates back to 1994. As of July 31, 2024, Confluence had more than $12.6 billion in

assets under management and advisement.

Additional

Information about the Proposed Reorganization and Where to Find It

This press release is not

intended to, and shall not, constitute an offer to purchase or sell shares of FGB or the new ETF; nor is this press release intended to

solicit a proxy from any shareholder of FGB. The solicitation of the purchase or sale of securities or of proxies to effect the Reorganization

may only be made by a final, effective Registration Statement that includes a definitive Proxy Statement/Prospectus.

This press release references

a Registration Statement, which includes a Proxy Statement/Prospectus, to be filed by FGB and the new ETF. This Registration Statement

has yet to be filed with the SEC. After the Registration Statement is filed with the SEC, it may be amended or withdrawn and the Proxy

Statement/Prospectus will not be distributed to shareholders of FGB unless and until the Registration Statement is declared effective

by the SEC.

FGB, the new ETF, FTA,

FTP and their respective trustees, officers and employees, and other persons may be deemed to be participants in the solicitation of proxies

with respect to the proposed Reorganization. Investors and shareholders may obtain more detailed information regarding the direct and

indirect interests of FGB’s, the new ETF’s, FTA’s and FTP’s respective directors, trustees, officers and employees

by reading the Proxy Statement/Prospectus regarding the proposed Reorganization when it is filed with the SEC.

Investors and security

holders of FGB are urged to read the Proxy Statement/Prospectus and other documents filed with the SEC carefully in their entirety when

they become available because they will contain important information about the proposed Reorganization. Investors should consider the

investment objectives, risks, charges and expenses of FGB and the new ETF carefully. The Proxy Statement/Prospectus will contain information

with respect to the investment objectives, risks, charges and expenses, and other important information about FGB and the new ETF. The

Proxy Statement/Prospectus will constitute neither an offer to sell securities, nor will it constitute a solicitation of an offer to buy

securities, in any state where such offer or sale is not permitted.

Investors may obtain free

copies of the Registration Statement and Proxy Statement/Prospectus and other documents (when they become available) filed with the SEC

at the SEC’s web site at www.sec.gov. In addition, free copies of the Proxy Statement/Prospectus and other documents filed with

the SEC may also be obtained after the Registration Statement becomes effective by calling FTA toll-free at (800) 621-1675.

The information presented

is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First

Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA and the Internal Revenue Code. First Trust

has no knowledge of and has not been provided any information regarding any investor. Financial advisors must determine whether particular

investments are appropriate for their clients. First Trust believes the financial advisor is a fiduciary, is capable of evaluating investment

risks independently and is responsible for exercising independent judgment with respect to its retirement plan clients.

Forward

Looking Statements

Certain statements made

in this press release that are not historical facts are referred to as “forward-looking statements” under the U.S. federal

securities laws. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements

due to numerous factors. Generally, the words “believe,” “expect,” “intend,” “estimate,”

“anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which

generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual

results to differ from those anticipated in any forward-looking statements. You should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. FTA, FGB and the new ETF undertake no responsibility to update publicly or revise any forward-looking

statements.

___________________________________

CONTACT: Jeff Margolin – (630) 517-7643

___________________________________

CONTACT: Daniel Lindquist – (630) 765-8692

___________________________________

CONTACT: Chris Fallow – (630) 517-7628

___________________________________

SOURCE: First Trust Advisors L.P.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

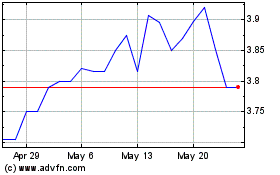

First Trust Specialty Fi... (NYSE:FGB)

Historical Stock Chart

From Aug 2024 to Sep 2024

First Trust Specialty Fi... (NYSE:FGB)

Historical Stock Chart

From Sep 2023 to Sep 2024