Eni Unveils Strategic Plan; Proposes Higher Dividend for 2018

March 16 2018 - 8:27AM

Dow Jones News

By Marc Bisbal Arias

Eni SpA (ENI.MI) released its strategic plan Friday and proposed

to raise its dividend to 0.83 euros ($1.02) a share for 2018.

For the 2018-21 period, capital expenditures will be below EUR32

billion, the company said. Share buybacks will be considered should

there be cash in excess of the leverage target of 20% to 25%.

The proposed dividend for the year is 3.75% higher than it was

in 2017.

The break-even point for new projects in upstream--entailing its

exploration business--will be below $30 a barrel in the period, the

oil-and-gas company said. Eni expects to spend about EUR3.5 billion

in the next four years in this segment and is targeting 2 billion

barrels of new resources. Hydrocarbon production is expected to

grow by 3.5% a year until 2021, Eni said.

Chief Executive Claudio Descalzi said Eni is "entering a renewed

phase of strong and enhanced industrial expansion, driven by a

deeper business integration and a relentless focus on efficiency

and capital discipline."

A decarbonization strategy will also be pursued, and investments

in green business development for the 2018-21 period will be in

excess of EUR1.8 billion, Eni said.

Write to Marc Bisbal Arias at marc.bisbalarias@dowjones.com

(END) Dow Jones Newswires

March 16, 2018 08:12 ET (12:12 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

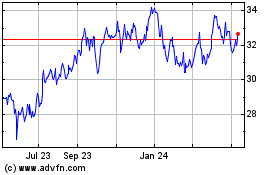

ENI (NYSE:E)

Historical Stock Chart

From Jun 2024 to Jul 2024

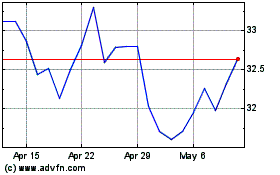

ENI (NYSE:E)

Historical Stock Chart

From Jul 2023 to Jul 2024