Eni Sells 10% Shorouk Concession Stake for $934 Million; Buys Abu Dhabi Concessions

March 12 2018 - 3:45AM

Dow Jones News

By Marc Bisbal Arias

Eni SpA (ENI.MI) said Sunday that it would sell a 10% stake in

the Shorouk concession, offshore Egypt, to Mubadala Petroleum for

$934 million, and announced separate purchases in two Abu Dhabi

concessions for $875 million.

Eni is the operator of the Shorouk concession and currently

holds a 60% stake in it through its subsidiary Italian Egyptian Oil

Company. Rosneft Oil Co. (ROSN.MZ) and BP PLC (BP.LN) hold a 30%

and 10% stake respectively.

Mubadala Petroleum is a subsidiary of Mubadala Investment Co.

The stake sale in the Shorouk concession is subject to regulatory

approval.

In a separate release on Sunday, Eni said it agreed to acquire a

5% stake in the Lower Zakum offshore oil field, and a 10% stake in

the oil-and-gas offshore fields of Umm Shaif and Nasr, all offshore

Abu Dhabi, for about $875 million and a duration of 40 years.

The Italy-based company said that the agreements are in line

with its expansion strategy to gain access to a country rich in

hydrocarbon reserves.

Write to Marc Bisbal Arias at marc.bisbalarias@dowjones.com

(END) Dow Jones Newswires

March 12, 2018 03:30 ET (07:30 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

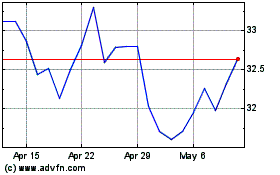

ENI (NYSE:E)

Historical Stock Chart

From Jun 2024 to Jul 2024

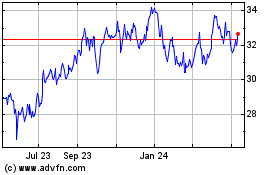

ENI (NYSE:E)

Historical Stock Chart

From Jul 2023 to Jul 2024