Canadian Natural Resources Limited (TSX:CNQ) (NYSE:CNQ)

In commenting on the Company's 2013 budget, John Langille,

Vice-Chairman, stated, "Canadian Natural's 2013 capital budget will

deliver near term production growth, enable continued development

of our long life, low decline asset base and provide unallocated

free cash flow. We target to generate approximately $7.6 billion of

cash flow and $0.7 billion of free cash flow, further strengthening

our financial position."

Steve Laut, President, continued, "Our 2013 budget reflects the

strength and breadth of our assets. Our capital program is balanced

in allocation to near term growth and longer term growth that will

support and drive sustainable free cash flow in 2013 and beyond. We

have developed the largest reserve base in our peer group and this

provides us options to allocate capital to the highest return

projects. This is evident in our ability to grow crude oil and NGL

volumes in 2013 by 9% while spending only half our capital budget

on projects that add production in 2013. Heavy oil is a significant

contributor to the growth in 2013. As new conversion capacity and

infrastructure come online in 2013 we expect to benefit from

stronger Canadian heavy oil pricing. We continue to execute on our

defined plan that will provide value to shareholders over the near,

mid and long term."

HIGHLIGHTS OF THE 2013 BUDGET

- Canadian Natural's 2013 capital budget is targeted at $6.9

billion. The 2013 capital budget delivers both near term crude oil

and NGLs production growth of approximately 9% and the effective

development of the Company's long life, low decline asset base,

which will provide greater and more sustainable free cash flow in

2014 and beyond.

- The Company's 2013 cash flow is targeted to be $7.6 billion at

the midpoint, providing approximately $0.7 billion of free cash

flow to allocate to dividends, share repurchases, opportunistic

acquisitions or debt repayment.

- The Company's balanced asset base, and high working interest

and operatorship allows for significant flexibility and efficiency

during the capital allocation decision making process.

Approximately 53% of 2013 total capital spending will be required

to grow production in 2013 and the remaining capital will be

allocated toward longer-life, more sustainable assets that will

generate significant incremental free cash flow in the future. In

addition, approximately $2.9 billion of the 2013 capital budget

represents capital flexibility which allows the Company to

reallocate capital over the course of 2013.

- Canadian Natural has a vast and balanced asset base that

contains both near and long term growth potential. The Company's

portfolio contains in excess of 7.5 billion BOE of proved and

probable reserves, the largest in its peer group.

- Canadian Natural's ability to allocate its free cash flow in a

balanced manner is evident in its return to shareholders.

-- Over the last decade, the Company has delivered a 21%

compound average growth rate (CAGR) in dividends per share.

-- Since the completion of construction at Horizon in 2008,

total dollars returned to shareholders in the form of dividends and

share repurchases have grown by a CAGR of 38% through 2012.

-- To date, share repurchases in 2012 have accumulated to

9,712,700 common shares at a weighted average price of $29.01 per

common share.

Crude Oil and NGLs

- Total crude oil and NGLs production target of 482,000 bbl/d to

513,000 bbl/d represents a midpoint increase of approximately 9%

from the midpoint of 2012 guidance.

North America - Exploration and Production

-- Primary heavy crude oil production is targeted to increase

from the 2012 midpoint guidance by 11% in 2013 to between 139,000

bbl/d and 143,000 bbl/d as the Company high-grades its large

(approx. 8,500 wells) inventory to effectively and efficiently

execute an 890 net well drilling program in 2013. The Company will

drill over 120 net horizontal wells that will target new play

types. Primary heavy crude oil currently generates the highest

return on capital in Canadian Natural's balanced portfolio.

-- Pelican Lake crude oil production is targeted to increase

from the 2012 midpoint guidance by 19% to between 46,000 bbl/d and

50,000 bbl/d as polymer response is now being realized from the

Company's 2011 and 2012 polymer flood expansions. The development

of Pelican Lake will continue to focus on injection optimization,

monitoring polymer response and expanding the polymer flood across

this long life field. Canadian Natural targets to have 56% of the

field converted to polymer flood by year end 2013. Pelican Lake

capital spending in 2013 includes completion of a new battery with

an initial start-up facility capacity of 25,000 bbl/d at Pelican

Lake. Completion of the battery is targeted in mid-2013 and will

handle the additional targeted polymer driven production from

Pelican Lake.

-- North America light crude oil and NGLs production is a

significant part of Canadian Natural's balanced portfolio.

Production volumes are targeted to increase from the 2012 midpoint

guidance by 6% to between 65,000 bbl/d and 69,000 bbl/d. North

America light oil capital is allocated to secondary and tertiary

recovery projects, and 114 net light oil wells, 41 of which are

targeting new play developments that were initiated in 2012. The

Company continues to advance horizontal well multi-frac technology

in pools across its land base. In addition, 70% of targeted total

drilling will be focused on horizontal wells.

North America - Thermal In Situ Oil Sands and Horizon Oil Sands

Mining

-- Canadian Natural continues to execute its defined, cost

effective plan of developing its oil sands projects providing

longer life, low decline assets which will generate significant

shareholder value for decades to come. Total oil sands production

from Thermal In Situ Oil Sands (Thermal In Situ) and Horizon Oil

Sands (Horizon) is targeted to range from 200,000 bbl/d to 215,000

bbl/d in 2013.

--- The Company targets to grow Thermal in situ production to

approximately 510,000 bbl/d of capacity by delivering projects that

will add 40,000 bbl/d to 60,000 bbl/d of production every two to

three years over the next two decades.

---- Thermal in situ production is targeted to increase from the

2012 midpoint guidance by 5% to between 100,000 bbl/d and 107,000

bbl/d as a result of continued low cost Primrose pad developments

(targeted at $13,000 per flowing bbl/d).

---- Kirby South Phase 1 continues to progress ahead of plan. To

date, the Company has reached 74% completion and 89% commitment of

total Kirby South Phase 1 capital expenditures. 2013 budgeted

capital is approximately $315 million to support the completion of

construction and 3 additional pads. Kirby South Phase 1 is targeted

for first steam injection in late 2013 with facility capacity of

40,000 bbl/d, further driving thermal production growth in

2014.

---- Budgeted capital for Kirby North Phase 1 is approximately

$205 million to progress detailed engineering, order modules and

construct camp facilities. Project sanction is targeted for the

first half of 2013.

---- Thermal in situ project timing has been modified to

accommodate the potential inclusion of recently acquired lands

adjacent to Canadian Natural's greater Kirby area and provide a

more balanced capital expenditures profile going forward. As a

result, Kirby North Phase 1 and Grouse are now scheduled for first

steam injection in 2016, and between 2017 and 2019

respectively.

--- In 2013,Horizon production is targeted between 100,000 bbl/d

to 108,000 bbl/d of synthetic crude oil (SCO). This range includes

production curtailment during an 18 day planned maintenance

turnaround that is scheduled for May 2013.

---- Canadian Natural continues to execute its disciplined

strategy of staged expansion to 250,000 bbl/d of SCO facility

capacity and work remains on track. Projects currently under

construction are trending at or below cost estimates. For 2013,

budgeted project capital expenditures at Horizon reflect the Board

of Directors approval of approximately $2.1 billion in targeted

strategic expansion.

---- Canadian Natural maintains a flexible schedule for Horizon

expansion construction to ensure capital efficiencies. To date, the

Company has reached 16% completion and 38% commitment of total

Horizon project capital expenditures and targets a 10,000 bbl/d

facility capacity increase in 2015, a 45,000 bbl/d facility

capacity increase in 2016 and an 80,000 bbl/d facility capacity

increase in 2017. For the next 5 years, the Company targets to

spend approximately $2.0 billion to $2.5 billion per year on

Horizon project expansions to achieve a step-wise increase in

production to 250,000 bbl/d of SCO.

International - Exploration and Production

-- International crude oil production is targeted to range

between 32,000 bbl/d and 36,000 bbl/d. Q4/12 to Q4/13 production is

targeted to increase approximately 6%. International light oil

activities in 2013 will include ramp up of drilling programs in the

North Sea and Espoir, Offshore Africa.

--- In the North Sea, the Company is targeting a second drilling

operation to commence in the last half of 2013 at Ninian.

--- Canadian Natural's eight well infill drilling program at the

Espoir

Field continues to progress. The drilling rig is in Cote

d'Ivoire and preparations are currently being undertaken to

commence drilling operations in 2013. The Company targets first oil

in the first half of 2013 ramping up to production of 6,500 BOE/d

at the completion of the Espoir drilling program, offsetting

natural declines. The cost of this program is targeted at $24,000

per flowing BOE/d.

--- Canadian Natural continues to make significant progress on

its exploration project in South Africa. Long leads equipment has

been ordered for the earliest potential drilling window beginning

in late 2013 or early 2014. This exploration project has

significant billion barrel type structures located on this 100%

owned Canadian Natural block. The Company is currently progressing

the plan to bring in a partner to drill this well. Interest has

been very strong from a select group of operators.

Natural Gas

- Total natural gas targeted production of 1,085 MMcf/d to 1,145

MMcf/d represents a midpoint decrease of 9% from the midpoint of

2012 forecasted annual guidance while Q4/12 to Q4/13 production is

targeted to decrease 2%. The annual decrease reflects low drilling

levels associated with the Company's strategic decision to allocate

capital to higher return crude oil projects.

- Canadian Natural is the second largest producer of natural gas

in Canada and a significant owner and operator of natural gas

infrastructure in Western Canada. The Company's large North America

natural gas and NGLs reserve base of 6.6 Tcfe, gross proved and

probable reserves, generates operating free cash flow and presents

significant upside potential for natural gas production and growth

in operating free cash flow when natural gas prices recover.

- The Company will recommence in 2013 the expansion of its

liquids rich Montney play, Septimus, due to forecasted higher

natural gas pricing. In 2013, the Company will complete 10 wells

that were initially drilled in early 2012, and will drill and

complete 14 additional wells. The plant expansion is targeted for

completion in late 2013 and will increase sales capacity to 125

MMcf/d, yielding 12,200 bbl/d of liquids following

processing through the plant and deep cut facilities. Canadian

Natural has the largest Montney land position in Western Canada of

approximately 1,043,800 net acres. In addition, other North America

natural gas activity includes drilling 16 net liquids rich natural

gas wells for strategic drilling and lease preservation.

Overall

- Total BOE production is targeted to range from 663,000 BOE/d

to 704,000 BOE/d, representing a midpoint increase of 3% from the

midpoint of 2012 average production guidance. Q4/12 to Q4/13

average production is targeted to increase approximately 6%.

- Canadian Natural's 2013 production and capital guidance is

based on average annual WTI strip pricing of US$89.36/bbl, AECO

strip pricing of C$3.41/GJ, and Western Canadian Select heavy oil

differential of US$17.87/bbl. Partly based on this forecast, the

Company's focus remains on growing higher return crude oil and NGLs

projects. Heavy oil differential volatility is expected to lessen

over the next year and a half as heavy oil conversion capacity is

added in the first half of 2013. PADD II heavy oil refining

capacity is anticipated to increase by 310,000 bbl/d, a 20%

increase from existing capacity. In late 2013 and into 2014,

pipeline constraints should reduce as pipelines from the US Midwest

to the US Gulf Coast are expanded.

- Work continues as scheduled on the North West Redwater 50,000

bbl/d bitumen refinery (78,000 bbl/d of bitumen blend). Completion

of the project is targeted for mid-2016 and is targeted to provide

Canadian Natural (50% owner) a minimum 10% after tax return on its

equity investment in the project. The Company will also provide

12,500 bbl/d of bitumen feedstock to the refinery as a toll

payer.

PRODUCTION AND CAPITAL GUIDANCE

Canadian Natural continues its strategy of maintaining a large

portfolio of varied projects. This enables the Company to provide

consistent growth in production and high shareholder returns over

an extended period of time. Annual budgets are developed,

scrutinized throughout the year and changed if necessary in the

context of project returns, product pricing expectations, and

balance project risks and time horizons. Canadian Natural maintains

a high ownership level and operatorship in its properties and can

therefore control the nature, timing and extent of expenditures in

each of its project areas.

The production guidance for 2012F and 2013B are as follows:

----------------------------------

Daily production volumes, before royalties 2012 Forecast 2013 Budget

----------------------------------------------------------------------------

Natural gas (MMcf/d) 1,222 - 1,229 1,085 - 1,145

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Crude oil and NGLs (Mbbl/d)

North America - Exploration and

Production 229 - 232 250 - 262

North America - Thermal In Situ 98 - 100 100 - 107

North America - Oil Sands Mining 87- 89 100 - 108

International 38 - 39 32 - 36

----------------------------------------------------------------------------

452 - 460 482 - 513

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The capital expenditure guidance for 2012F and 2013B are as

follows:

------------------------------

($ millions) 2012 Forecast 2013 Budget

----------------------------------------------------------------------------

North America natural gas $ 470 $ 445

North America crude oil 2,190 1,965

International crude oil 420 605

----------------------------------------------------------------------------

Total Exploration and Production $ 3,080 $ 3,015

----------------------------------------------------------------------------

Thermal In Situ Oil Sands

Primrose and Future 970 770

Kirby South Phase 1 540 315

Kirby North Phase 1 - 205

----------------------------------------------------------------------------

Total Thermal In Situ Oil Sands $ 1,510 $ 1,290

----------------------------------------------------------------------------

Property acquisitions, dispositions and

other $ 185 $ 85

----------------------------------------------------------------------------

Horizon Oil Sands Mining

Project Capital

Reliability - Tranche 2 $ 75 $ 100

Directive 74 and Technology 135 60

Phase 2A 240 180

Phase 2B 505 940

Phase 3 240 535

Phase 4 15 20

Owner's costs and other 170 245

----------------------------------------------------------------------------

Total Capital Projects 1,380 2,080

Sustaining capital 200 180

Turnarounds and reclamation 25 105

Capitalized interest and other 70 190

----------------------------------------------------------------------------

Total Horizon Oil Sands Mining $ 1,675 $ 2,555

----------------------------------------------------------------------------

Total Capital Expenditures $ 6,450 $ 6,945

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The above capital expenditure guidance for 2012F and 2013B

incorporate the following levels of drilling activity:

----------------------------

Drilling activity (number of net wells) 2012 Forecast 2013 Budget

----------------------------------------------------------------------------

Targeting natural gas 35 30

Targeting crude oil 1,103 1,028

Targeting thermal in situ 165 132

Stratigraphic test / service wells - Exploration

and Production 23 31

Stratigraphic test / service wells - Thermal In

Situ 395 187

Stratigraphic test / service wells - Oil Sands Mining 311 353

----------------------------------------------------------------------------

Total 2,032 1,761

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Forward-Looking Statements

Certain statements relating to Canadian Natural Resources

Limited (the "Company") in this document or documents incorporated

herein by reference constitute forward-looking statements or

information (collectively referred to herein as "forward-looking

statements") within the meaning of applicable securities

legislation. Forward-looking statements can be identified by the

words "believe", "anticipate", "expect", "plan", "estimate",

"target", "continue", "could", "intend", "may", "potential",

"predict", "should", "will", "objective", "project", "forecast",

"goal", "guidance", "outlook", "effort", "seeks", "schedule" or

expressions of a similar nature suggesting future outcome or

statements regarding an outlook. Disclosure related to expected

future commodity pricing, production volumes, royalties, operating

costs, capital expenditures and other guidance provided throughout

this Management's Discussion and Analysis ("MD&A"), constitute

forward-looking statements. Disclosure of plans relating to and

expected results of existing and future developments, including but

not limited to Horizon Oil Sands, Primrose East, Pelican Lake,

Olowi Field (Offshore Gabon), and the Kirby Thermal Oil Sands

Project also constitute forward-looking statements. This

forward-looking information is based on annual budgets and

multi-year forecasts, and is reviewed and revised throughout the

year if necessary in the context of targeted financial ratios,

project returns, product pricing expectations and balance in

project risk and time horizons. These statements are not guarantees

of future performance and are subject to certain risks. The reader

should not place undue reliance on these forward-looking statements

as there can be no assurances that the plans, initiatives or

expectations upon which they are based will occur.

In addition, statements relating to "reserves" are deemed to be

forward-looking statements as they involve the implied assessment

based on certain estimates and assumptions that the reserves

described can be profitably produced in the future. There are

numerous uncertainties inherent in estimating quantities of proved

crude oil and natural gas reserves and in projecting future rates

of production and the timing of development expenditures. The total

amount or timing of actual future production may vary significantly

from reserve and production estimates.

The forward-looking statements are based on current

expectations, estimates and projections about the Company and the

industry in which the Company operates, which speak only as of the

date such statements were made or as of the date of the report or

document in which they are contained, and are subject to known and

unknown risks and uncertainties that could cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such risks and uncertainties include, among others:

general economic and business conditions which will, among other

things, impact demand for and market prices of the Company's

products; volatility of and assumptions regarding crude oil and

natural gas prices; fluctuations in currency and interest rates;

assumptions on which the Company's current guidance is based;

economic conditions in the countries and regions in which the

Company conducts business; political uncertainty, including actions

of or against terrorists, insurgent groups or other conflict

including conflict between states; industry capacity; ability of

the Company to implement its business strategy, including

exploration and development activities; impact of competition; the

Company's defense of lawsuits; availability and cost of seismic,

drilling and other equipment; ability of the Company and its

subsidiaries to complete capital programs; the Company's and its

subsidiaries' ability to secure adequate transportation for its

products; unexpected difficulties in mining, extracting or

upgrading the Company's bitumen products; potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures; ability of the Company to attract

the necessary labour required to build its thermal and oil sands

mining projects; operating hazards and other difficulties inherent

in the exploration for and production and sale of crude oil and

natural gas; availability and cost of financing; the Company's and

its subsidiaries' success of exploration and development activities

and their ability to replace and expand crude oil and natural gas

reserves; timing and success of integrating the business and

operations of acquired companies; production levels; imprecision of

reserve estimates and estimates of recoverable quantities of crude

oil, bitumen, natural gas and natural gas liquids ("NGLs") not

currently classified as proved; actions by governmental

authorities; government regulations and the expenditures required

to comply with them (especially safety and environmental laws and

regulations and the impact of climate change initiatives on capital

and operating costs); asset retirement obligations; the adequacy of

the Company's provision for taxes; and other circumstances

affecting revenues and expenses.

The Company's operations have been, and in the future may be,

affected by political developments and by federal, provincial and

local laws and regulations such as restrictions on production,

changes in taxes, royalties and other amounts payable to

governments or governmental agencies, price or gathering rate

controls and environmental protection regulations. Should one or

more of these risks or uncertainties materialize, or should any of

the Company's assumptions prove incorrect, actual results may vary

in material respects from those projected in the forward-looking

statements. The impact of any one factor on a particular

forward-looking statement is not determinable with certainty as

such factors are dependent upon other factors, and the Company's

course of action would depend upon its assessment of the future

considering all information then available.

Readers are cautioned that the foregoing list of factors is not

exhaustive. Unpredictable or unknown factors not discussed in this

report could also have material adverse effects on forward-looking

statements. Although the Company believes that the expectations

conveyed by the forward-looking statements are reasonable based on

information available to it on the date such forward-looking

statements are made, no assurances can be given as to future

results, levels of activity and achievements. All subsequent

forward-looking statements, whether written or oral, attributable

to the Company or persons acting on its behalf are expressly

qualified in their entirety by these cautionary statements. Except

as required by law, the Company assumes no obligation to update

forward-looking statements should circumstances or Management's

estimates or opinions change.

CONFERENCE CALL

A conference call will be held at 9:00 a.m. Mountain Time, 11:00

a.m. Eastern Time on Tuesday, December 4, 2012. The North American

conference call number is 1-877-240-9772 and the outside North

American conference call number is 001-416-340-8527. Please call in

about 10 minutes before the starting time in order to be patched

into the call. The conference call will also be broadcast live on

the internet and may be accessed through the Canadian Natural

website at www.cnrl.com.

WEBCAST

This call is being webcast and can be accessed on Canadian

Natural's website at www.cnrl.com. Presentation slides will be

available on Canadian Natural's website in PDF format shortly

before the live conference call webcast.

Contacts: John G. Langille Vice-Chairman Steve W. Laut President

Corey B. Bieber Vice-President, Finance & Investor Relations

Canadian Natural Resources Limited 2500, 855 2nd Street S.W.

Calgary, Alberta, T2P 4J8 Canada (403) 514-7777 (403) 514-7888

(FAX)ir@cnrl.com www.cnrl.com

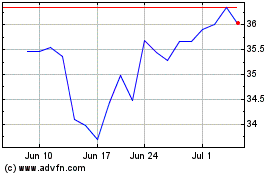

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

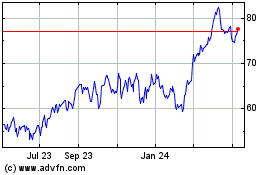

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jul 2023 to Jul 2024