Canadian Nat'l in Neutral Lane - Analyst Blog

September 11 2012 - 9:45AM

Zacks

We are maintaining our Neutral

recommendation on Canadian Natural Resources Ltd.

(CNQ) – a company engaged in the acquisition, development and

exploitation of crude oil and natural gas properties.

The company displays an impressive portfolio of exploration and

development projects, planned investment program and updated

outlook. We also appreciate Canadian Natural’s diverse asset base

both geographically and in terms of product, comprising

approximately 35% natural gas and 65% crude oil with the bulk of

production located in G8 countries.

During the second quarter of 2012, Canadian Natural performed

modestly with earnings per share, excluding one-time and non-cash

items, of 55 Canadian cents (54 U.S. cents) lagging our estimate of

59 U.S. cents. Quarterly revenue of C$3,826.0 million (US$3,864.2

million), however, surpassed our projection of US$3,504.0

million.

The quarterly results reflect robust crude oil and natural gas

liquids sales volumes in North America, partially negated by poor

performing North Sea region and steeper production costs.

For the third quarter, the company is guiding toward production of

451,000–480,000 barrels per day (Bbl/d) of liquids and 1,170–1,190

million cubic feet per day (MMcf/d) of natural gas. For 2012, the

company guided toward production of 454,000–474,000 Bbl/d of

liquids and 1,220–1,235 MMcf/d of natural gas. We believe that

extensive drilling activities, development works at Primrose unit

and advanced technological applications will aid the company in

accomplishing the set goal.

Calgary, Alberta-based Canadian Natural’s strong, balanced and

diverse asset portfolio, combined with its focus on low cost

operations, allowed it to generate substantial free cash flow even

in a low price environment. Additionally, with most of the

company’s production generated from North America, Canadian Natural

escapes the political risk associated with operations in unstable

countries.

However, the unstable macro environment and unpredictable

operational hazards pose as overhangs for the stock. The company’s

results for the coming quarters are directly exposed to oil and gas

prices, which are inherently volatile and subject to complex market

forces.

A significant portion of Canadian Natural’s production/reserves

growth in the last few years has come from property acquisitions,

exposing it to acquisition-related risks. The company may find it

difficult to complete accretive transactions in the future, which

could negatively impact its growth rate.

Considering these factors, we recommend investors to hold on to the

stock, until major catalysts push it higher. Canadian Natural, like

the other domestic energy company Encana Corp.

(ECA), currently retains a Zacks #3 Rank that translates into a

short-term Hold rating.

CDN NTRL RSRCS (CNQ): Free Stock Analysis Report

ENCANA CORP (ECA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

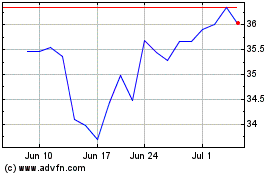

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

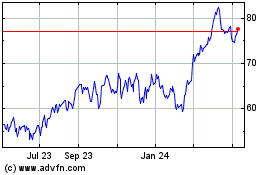

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jul 2023 to Jul 2024