Avista Corp. - Growth & Income

May 25 2011 - 8:00PM

Zacks

When the cold and wet weather swept across much of the U.S. last

winter, Americans cranked up their thermostats, and utilities like

Avista Corp. (AVA) cashed in.

The company recently reported better than expected

first quarter results due in large part to cold weather. Analysts

revised their estimates higher off the solid quarter, sending the

stock to a Zacks #2 Rank (Buy).

The company is expected to grow EPS in the mid- to

upper-single digits over the next two years. On top of this growth,

Avista pays a dividend that yields an attractive 4.5%. That should

leave shareholders feeling warm too.

First Quarter Results

On May 6, Avista Corp. reported first quarter

earnings per share of 73 cents, well ahead of the Zacks Consensus

Estimate of 64 cents. It was an increase of 40% from the same

quarter in 2010.

Avista benefited from much colder and wetter

weather compared to Q1 2010, which led to an 11% increase in

residential electric use per customer. This helped drive a 4%

increase in operating revenues. The company also benefited from

general rate increases that went into effect last fall.

Avista was able to leverage its fixed expenses

because of higher revenues. Operating expenses fell from 85.1% of

revenues to 82.2% in the quarter. This led to a 25.1% jump in

operating income.

Confirmed Guidance

Management expects to earn between $1.60 and $1.80

per share in 2011. In its Q1 press release, management confirmed

its guidance but stated that it expects to come in on the high end

of the range.

Analysts mostly raised their estimates for both

2011 and 2012 following Q1 results. The 2011 Zacks Consensus

Estimate is currently $1.79, which represents an 8% increase over

2010 EPS. The 2012 Zacks Consensus Estimate is 5% higher at

$1.87.

It is a Zacks #2 Rank (Buy) stock.

Attractive Yield

Avista has been consistently raising its dividend

over the last decade, at an average annual rate of 8.6%:

It currently yields a hefty 4.5%.

Valuation

From a relative valuation standpoint, Avista looks

attractive. Shares trade at 13.6x forward earnings, a discount to

the industry average of 15.2x. Its also trades at 1.2x book value,

a discount to the industry average of 1.5x.

Company Description

Avista Corp.'s primary operating division is Avista

Utilities, which provides electric service to 358,000 customers and

natural gas to 319,000 customers throughout eastern Washington,

northern Idaho and parts of southern and eastern Oregon.

It is headquartered in Spokane, Washington and has

a market cap of $1.4 billion.

Conclusion

For investors in search of solid, stable growth and

a fat dividend yield, Avista Corp. looks like an attractive buy.

With consensus estimates rising and relative valuation below the

industry average, now might be a good time to get in.

Todd Bunton is the Growth & Income Stock

Strategist for Zacks.com.

AVISTA CORP (AVA): Free Stock Analysis Report

Zacks Investment Research

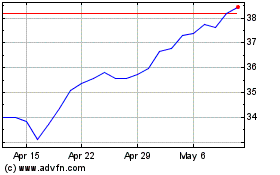

Avista (NYSE:AVA)

Historical Stock Chart

From May 2024 to Jun 2024

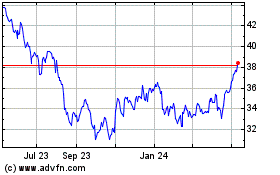

Avista (NYSE:AVA)

Historical Stock Chart

From Jun 2023 to Jun 2024