SPOKANE, Wash., Oct. 31 /PRNewswire-FirstCall/ -- Avista Corp.

(NYSE:AVA) today reported a net loss of $3.9 million, or $0.07 per

diluted share, for the third quarter of 2007, as compared to net

income of $10.1 million, or $0.20 per diluted share, for the third

quarter of 2006. For the nine months ended Sept. 30, 2007, Avista

Corp.'s net income was $24.4 million, or $0.45 per diluted share, a

decrease compared to net income of $55.1 million, or $1.11 per

diluted share, for the nine months ended Sept. 30, 2006. (Logo:

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO) On Oct.

30, 2007, Avista Corp. reached an all-party settlement that

resolves all issues in its general rate case that was filed with

the Washington Utilities and Transportation Commission (WUTC) in

April 2007. The settlement is subject to final approval by the

WUTC. "Overall, we are very pleased with the settlement. This

should allow for significant improvement in our results for 2008 as

compared to 2007," said Avista Chairman and Chief Executive Officer

Gary G. Ely. "The third quarter is generally the lowest earnings

quarter for our utility due to seasonally low hydroelectric

generation and absorption of higher power supply costs, as well as

low natural gas loads. Results for the third quarter of 2007 for

our utility were lower than expected primarily due to the

disallowance of debt repurchase costs in our Washington general

rate case settlement and the write-down of a turbine," said Ely.

Results for the third quarter of 2007 and the nine months ended

Sept. 30, 2007 (YTD), as compared to the respective periods of

2006: ($ in thousands, except Q3 2007 Q3 2006 YTD 2007 YTD 2006

per-share data) Operating Revenues $267,662 $293,001 $1,030,854

$1,079,597 Income from Operations $15,736 $34,091 $94,891 $147,607

Net Income (Loss) $(3,875) $10,073 $24,402 $55,104 Net Income

(Loss) by Business Segment: Avista Utilities $(5,574) $480 $31,610

$43,531 Energy Marketing & Resource Management $(243) $8,773

$(11,804) $9,209 Advantage IQ $2,077 $1,918 $4,971 $4,903 Other

$(135) $(1,098) $(375) $(2,539) Contribution to earnings (loss) per

diluted share by Business Segment: Avista Utilities $(0.11) $0.01

$0.59 $0.88 Energy Marketing & Resource Management $ -- $0.17

$(0.22) $0.18 Advantage IQ $0.04 $0.04 $0.09 $0.10 Other $ --

$(0.02) $(0.01) $(0.05) Total earnings (loss) per diluted share

$(0.07) $0.20 $0.45 $1.11 Third Quarter and Year-to-date 2007

Highlights Avista Utilities: As agreed to in the Washington general

rate case settlement, electric rates for our Washington customers

will increase by an average of 9.4 percent, which is intended to

increase annual revenues by $30.2 million. As part of this general

rate increase, the base level of power supply costs used in the

Energy Recovery Mechanism (ERM) calculations will be updated.

Natural gas rates will increase by an average of 1.7 percent, which

is intended to increase annual revenues by $3.3 million. The new

electric and natural gas rates will become effective on Jan. 1,

2008. The settlement is based on a rate of return of 8.2 percent,

with a common equity ratio of 46 percent and a 10.2 percent return

on equity. We will not establish a Power Cost Only Rate Case

(PCORC) mechanism at this time as we had originally requested;

however, the parties have agreed to meet and further discuss a

PCORC prior to our next general rate case filing. In addition, we

have agreed to write-off $3.8 million of unamortized debt

repurchase costs effective Sept. 30, 2007. These costs were for

premiums paid to repurchase higher coupon debt prior to its

scheduled maturity as part of an effort to reduce interest expense.

In October 2007, we filed a natural gas general rate case in Oregon

requesting rate increases averaging 2.3 percent, which is designed

to increase annual revenues by $3.0 million. The decrease in third

quarter 2007 results over the third quarter of 2006 was primarily

due to an increase in other operating expenses and the disallowance

of unamortized debt repurchase costs. The increase in other

operating expenses included a pre-tax charge of $2.3 million to

reduce the carrying value of a turbine, which we are no longer

planning to use in our utility operations, to its estimated fair

value. Also contributing to the decline in results was an increase

in depreciation and amortization due to additions to utility plant

not yet covered in rates. On a year-to-date basis, utility earnings

decreased as compared to the same period in 2006. This was

primarily due to a decrease in gross margin (operating revenues

less resource costs), an increase in other operating expenses and

the disallowance of unamortized debt repurchase costs. The decline

in gross margin was primarily due to the difference in electric

resource costs as compared to the amount included in base retail

rates. On a year-to-date basis, we recognized an expense of $7.6

million under the ERM compared to a benefit of $3.4 million under

the ERM for the same period in 2006. The increase in electric

resource costs for 2007 (as compared to the amount included in base

rates) was primarily due to lower hydroelectric generation (second

and third quarters), higher fuel costs and greater use of our

thermal generating resources. We are expecting to absorb

approximately $8 million of costs under the ERM for the full year

of 2007. Advantage IQ: Net income from Advantage IQ for the third

quarter and year-to-date 2007 was slightly higher than the prior

year. Earnings growth for Advantage IQ has been limited in 2007 due

to expenses incurred for consulting services during the second and

third quarters. We are implementing certain strategic investments

at Advantage IQ aimed at creating long-term value that will

increase operating and capitalized costs in the short-term. These

investments are designed to enhance the long-term profit potential

of this business. Energy Marketing and Resource Management: On June

30, 2007, Avista Energy completed the sale of substantially all of

its contracts and ongoing operations to Coral Energy Holding, L.P.

(Coral Energy), a subsidiary of Shell, and certain of Coral

Energy's subsidiaries. Completion of this transaction ends

substantially all of the operations of this business segment. As

previously reported, results from the segment prior to the sale

were below our expectations. Other: Results from our other

businesses improved as compared to 2006. This was primarily due to

net gains on certain long-term venture fund investments in 2007

compared to net losses in 2006, as well as certain tax adjustments

recorded in 2006. Liquidity and Capital Resources: In September

2007, Avista Energy paid a cash dividend of $169 million to Avista

Capital representing the cash consideration for the net assets sold

to Coral Energy and liquidation of the net current assets of Avista

Energy not sold to Coral Energy. Avista Capital then paid a cash

dividend of $155 million to Avista Corp. The remaining funds were

utilized by Avista Capital to repay outstanding borrowings due to

Avista Corp. and the extension of an intercompany loan to Avista

Corp. For the remainder of 2007, we expect net cash flows from

operating activities, proceeds from the Avista Energy transaction

and our committed line of credit to provide adequate resources to

fund capital expenditures, maturing long-term debt, dividends and

other contractual commitments. We have long-term debt maturities of

$14 million in the fourth quarter of 2007 and $318 million in 2008.

While proceeds from the Avista Energy transaction should reduce our

funding needs, our forecasts indicate that we will need to issue

new debt securities to fund a portion of these requirements in

2008. Utility capital expenditures were $149 million for the nine

months ended Sept. 30, 2007. We expect utility capital expenditures

to be between $190 and $200 million in 2007 and 2008, and over $200

million in each of 2009 and 2010. In August 2007, our credit

ratings were upgraded by Fitch, Inc. In September 2007, our "Senior

Secured Debt" credit rating was upgraded to "BBB+" from "BBB-" by

Standard & Poor's. Earnings Guidance and Outlook At this time,

we are revising our guidance for 2007 consolidated earnings to a

range of $0.73 to $0.83 per diluted share. Our guidance for Avista

Utilities has been revised downward to a range of $0.85 to $0.95

per diluted share for 2007. The outlook for Avista Utilities

assumes that during the fourth quarter of the year we will have

normal precipitation, temperatures and hydroelectric generation.

The 2007 outlook for our Energy Marketing and Resource Management

segment is a loss of $0.22 per diluted share. The loss from this

segment reflects the operating loss for the nine months ended Sept.

30, 2007 and the loss on the sale of substantially all of Avista

Energy contracts and ongoing operations. Our guidance for Advantage

IQ is a contribution range of $0.11 to $0.13 per diluted share. We

expect our other businesses to lose $0.02 per diluted share. We are

confirming our 2008 guidance for consolidated earnings to be in the

range of $1.35 to $1.55 per diluted share. We expect Avista

Utilities to contribute in the range of $1.20 to $1.40 per diluted

share for 2008. Our outlook for Avista Utilities assumes, among

other variables, the implementation of a revenue increase from the

Washington general rate case as designed in the settlement

agreement effective Jan. 1, 2008, as well as normal precipitation,

temperatures and hydroelectric generation. We expect Advantage IQ

to contribute in a range of $0.13 to $0.15 per diluted share and

the other businesses to be between break-even and a loss of $0.03

per diluted share. NOTE: We will host a conference call with

financial analysts and investors on Oct. 31, 2007, at 10:30 a.m.

EDT to discuss this news release. The call is available at (866)

271-6130, passcode: 49624266. A replay of the conference call will

be available through Wednesday, Nov. 7, 2007. Call (888) 286-8010,

passcode 80080717 to listen to the replay. A simultaneous Webcast

of the call is available on our website,

http://www.avistacorp.com/. Avista Corp. is an energy company

involved in the production, transmission and distribution of energy

as well as other energy-related businesses. Avista Utilities is our

operating division that provides service to 348,000 electric and

305,000 natural gas customers in three Western states. Avista's

primary, non-regulated subsidiary is Advantage IQ. Our stock is

traded under the ticker symbol "AVA." For more information about

Avista, please visit http://www.avistacorp.com/. Avista Corp. and

the Avista Corp. logo are trademarks of Avista Corporation. The

attached condensed consolidated statements of income, condensed

consolidated balance sheets, and financial and operating highlights

are integral parts of this earnings release. This news release

contains forward-looking statements, including statements regarding

our current expectations for future financial performance and cash

flows, capital expenditures, our current plans or objectives for

future operations, future hydroelectric generation projections and

other factors, which may affect the company in the future. Such

statements are subject to a variety of risks, uncertainties and

other factors, most of which are beyond our control and many of

which could have significant impact on our operations, results of

operations, financial condition or cash flows and could cause

actual results to differ materially from those anticipated in such

statements. The following are among the important factors that

could cause actual results to differ materially from the

forward-looking statements: weather conditions, including the

effect of precipitation and temperatures on the availability of

hydroelectric resources and the effect of temperatures on customer

demand; changes in wholesale energy prices that can affect, among

other things, cash needed to purchase electricity, natural gas for

our retail customers and natural gas fuel for electric generation,

and the value of surplus energy sold, as well as the market value

of derivative assets and liabilities; volatility and illiquidity in

wholesale energy markets, including the availability and prices of

purchased energy and demand for energy sales; the effect of state

and federal regulatory decisions affecting our ability to recover

costs and/or earn a reasonable return including, but not limited

to, the disallowance of costs that we have deferred; the potential

effects of any legislation or administrative rulemaking passed into

law, including the possible adoption of national, regional, or

state laws requiring resources to meet certain standards and

placing restrictions on greenhouse gas emissions to mitigate

concerns over global warming; the outcome of pending regulatory and

legal proceedings arising out of the "western energy crisis" of

2000 and 2001, and including possible retroactive price caps and

resulting refunds; the outcome of legal proceedings and other

contingencies concerning us or affecting directly or indirectly our

operations; changes in, and compliance with, environmental and

endangered species laws, regulations, decisions and policies,

including present and potential environmental remediation costs;

the potential impact of changes to electric transmission ownership,

operation and governance, such as the formation of one or more

regional transmission organizations or similar entities; wholesale

and retail competition including, but not limited to, electric

retail wheeling and transmission costs; the ability to relicense

and maintain licenses for our hydroelectric generating facilities

at cost-effective levels with reasonable terms and conditions;

unplanned outages at any of our generating facilities or the

inability of facilities to operate as intended; unanticipated

delays or changes in construction costs, as well as our ability to

obtain required operating permits for present or prospective

facilities; natural disasters that can disrupt energy production or

delivery, as well as the availability and costs of materials and

supplies and support services; blackouts or disruptions of

interconnected transmission systems; the potential for future

terrorist attacks or other malicious acts, particularly with

respect to our utility assets; changes in the long-term climate of

the Pacific Northwest, which can affect, among other things,

customer demand patterns and the volume and timing of streamflows

to our hydroelectric resources; changes in future economic

conditions in our service territory and the United States in

general, including inflation or deflation and monetary policy;

changes in industrial, commercial and residential growth and

demographic patterns in our service territory; the loss of

significant customers and/or suppliers; failure to deliver on the

part of any parties from which we purchase and/or sell capacity or

energy; changes in the creditworthiness of our customers and energy

trading counterparties; our ability to obtain financing through the

issuance of debt and/or equity securities, which can be affected by

various factors including our credit ratings, interest rates and

other capital market conditions; the effect of any change in our

credit ratings; changes in actuarial assumptions, the interest rate

environment and the actual return on plan assets for our pension

plan, which can affect future funding obligations, costs and

pension plan liabilities; increasing health care costs and the

resulting effect on health insurance premiums paid for our

employees and retirees; increasing costs of insurance, changes in

coverage terms and our ability to obtain insurance; employee

issues, including changes in collective bargaining unit agreements,

strikes, work stoppages or the loss of key executives, as well as

our ability to recruit and retain employees; the potential effects

of negative publicity regarding business practices, whether true or

not, which could result in, among other things, costly litigation

and a decline in our common stock price; changes in technologies,

possibly making some of the current technology quickly obsolete;

changes in tax rates and/or policies; and changes in our strategic

business plans and/or our subsidiaries, which may be affected by

any or all of the foregoing, including the entry into new

businesses and/or the exit from existing businesses. For a further

discussion of these factors and other important factors, please

refer to the company's Annual Report on Form 10-K for the year

ended Dec. 31, 2006 and Quarterly Report on Form 10-Q for the

quarter ended June 30, 2007. The forward-looking statements

contained in this news release speak only as of the date hereof.

The company undertakes no obligation to update any forward-looking

statement or statements to reflect events or circumstances that

occur after the date on which such statement is made or to reflect

the occurrence of unanticipated events. New factors emerge from

time to time, and it is not possible for management to predict all

of such factors, nor can it assess the impact of each such factor

on the company's business or the extent to which any such factor,

or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statement.

AVISTA CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED) (Dollars in Thousands except Per Share Amounts) Nine

Months Ended Third Quarter September 30, 2007 2006 2007 2006

Operating revenues $267,662 $293,001 $1,030,854 $1,079,597

Operating expenses: Resource costs 150,318 159,044 611,937 621,058

Other operating expenses 63,991 63,082 202,531 189,907 Depreciation

and amortization 22,605 21,614 67,438 65,466 Utility taxes other

than income taxes 15,012 15,170 54,057 55,559 Total operating

expenses 251,926 258,910 935,963 931,990 Income from operations

15,736 34,091 94,891 147,607 Other income (expense): Interest

expense, net of capitalized interest (20,057) (23,444) (61,917)

(70,097) Regulatory disallowance of unamortized debt repurchase

costs (3,850) - (3,850) - Other income - net 2,156 2,736 9,414

7,289 Total other income (expense) - net (21,751) (20,708) (56,353)

(62,808) Income (loss) before income taxes (6,015) 13,383 38,538

84,799 Income taxes (2,140) 3,310 14,136 29,695 Net income (loss)

$(3,875) $10,073 $24,402 $55,104 Weighted-average common shares

outstanding (thousands), basic 52,834 49,098 52,769 48,951

Weighted-average common shares outstanding (thousands), diluted

52,834 49,902 53,267 49,633 Total earnings (loss) per common share,

basic $(0.07) $0.21 $0.46 $1.13 Total earnings (loss) per common

share, diluted $(0.07) $0.20 $0.45 $1.11 Dividends paid per common

share $0.150 $0.145 $0.445 $0.425 Issued October 31, 2007 AVISTA

CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Dollars in Thousands) September 30, December 31, 2007 2006 Assets

Cash and cash equivalents $5,190 $28,242 Restricted cash 1,318

29,903 Accounts and notes receivable 112,718 286,150 Current energy

commodity derivative assets - 343,726 Other current assets 242,990

344,253 Total net utility property 2,305,795 2,215,037 Non-utility

properties and investments-net 57,881 60,301 Non-current energy

commodity derivative assets - 313,300 Other property and

investments-net 59,892 60,030 Regulatory assets for deferred income

taxes 112,336 105,935 Regulatory assets for pensions and other

postretirement benefits 52,124 54,192 Other regulatory assets

36,927 31,752 Non-current utility energy commodity derivative

assets 42,531 25,575 Power and natural gas deferrals 87,486 97,792

Unamortized debt expense 37,972 46,554 Other deferred charges 4,962

13,766 Total Assets $3,160,122 $4,056,508 Liabilities and

Stockholders' Equity Accounts payable $75,083 $286,099 Current

energy commodity derivative liabilities - 313,499 Current portion

of long-term debt 307,608 26,605 Current portion of preferred stock

(subject to mandatory redemption) - 26,250 Short-term borrowings -

4,000 Other current liabilities 248,360 288,756 Long-term debt

655,207 949,854 Long-term debt to affiliated trusts 113,403 113,403

Non-current energy commodity derivative liabilities - 309,990

Regulatory liability for utility plant retirement costs 205,974

197,712 Pensions and other postretirement benefits 93,705 103,604

Deferred income taxes 440,008 459,756 Other non-current liabilities

and deferred credits 107,878 62,455 Total Liabilities 2,247,226

3,141,983 Common stock - net (52,858,878 and 52,514,326 outstanding

shares) 723,054 715,620 Retained earnings and accumulated other

comprehensive loss 189,842 198,905 Total Stockholders' Equity

912,896 914,525 Total Liabilities and Stockholders' Equity

$3,160,122 $4,056,508 Issued October 31, 2007 AVISTA CORPORATION

FINANCIAL AND OPERATING HIGHLIGHTS (Dollars in Thousands) Nine

Months Ended Third Quarter September 30, 2007 2006 2007 2006 Avista

Utilities Retail electric revenues $140,491 $135,151 $418,963

$406,939 Retail kWh sales (in millions) 2,162 2,143 6,538 6,446

Retail electric customers at end of period 347,717 341,337 347,717

341,337 Wholesale electric revenues $23,664 $26,542 $82,762 $98,971

Wholesale kWh sales (in millions) 303 411 1,322 1,815 Sales of fuel

$3,459 $5,776 $11,608 $45,023 Other electric revenues $4,429 $4,272

$12,687 $15,310 Retail natural gas revenues $39,487 $37,039

$280,624 $267,019 Wholesale natural gas revenues $29,941 $18,129

$111,232 $69,026 Transportation and other natural gas revenues

$2,327 $2,426 $8,185 $8,413 Total therms delivered (in thousands)

114,456 91,944 498,247 434,717 Retail natural gas customers at end

of period 305,155 298,582 305,155 298,582 Income from operations

(pre-tax) $13,050 $18,661 $109,142 $130,911 Net income (loss)

$(5,574) $480 $31,610 $43,531 Energy Marketing and Resource

Management Gross margin (operating revenues less resource costs)

$55 $17,913 $(7,251) $25,447 Realized gross margin $55 $6,534

$17,343 $24,007 Unrealized gross margin - $11,379 $(24,594) $1,440

Income (loss) from operations (pre-tax) $(924) $12,220 $(21,996)

$9,634 Net income (loss) $(243) $8,773 $(11,804) $9,209 Advantage

IQ Revenues $12,193 $10,389 $34,607 $29,011 Income from

operations(pre-tax) $3,439 $3,256 $8,201 $8,218 Net income $2,077

$1,918 $4,971 $4,903 Other Revenues $5,357 $5,566 $15,065 $16,317

Income (loss) from operations (pre-tax) $171 $(46) $(456) $(1,156)

Net loss $(135) $(1,098) $(375) $(2,539) Issued October 31, 2007

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO

http://photoarchive.ap.org/ DATASOURCE: Avista Corp. CONTACT:

Media, Jessie Wuerst, +1-509-495-8578, , or Investors, Jason Lang,

+1-509-495-2930, , both of Avista Corp.; or Avista 24-7 Media

Access, +1-509-495-4174 Web site: http://www.avistacorp.com/

Copyright

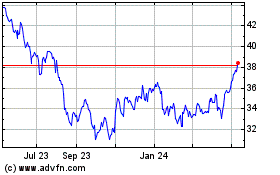

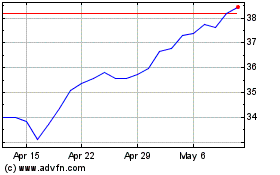

Avista (NYSE:AVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Avista (NYSE:AVA)

Historical Stock Chart

From Jul 2023 to Jul 2024