Assurant Beats on Higher Premium - Analyst Blog

February 02 2012 - 9:15AM

Zacks

Assurant Inc. (AIZ) reported

fourth quarter 2011 operating earnings of $1.65 per share, beating

the Zacks Consensus Estimate by a good 28 cents and also

significantly ahead of the prior-year quarter’s earnings of $1.08

per share. The outperformance was the result of significant

contributions from Assurant Specialty Property, Assurant Health and

Assurant Solutions, party offset by lower operating income from

Assurant Employee Benefits. Earnings also benefited from a lower

share count.

Total revenue for the reported quarter stood at $2.1 billion,

unchanged relative to the prior-year quarter.

Net earned premiums also remained unchanged at $1.8 billion

compared with the prior-year quarter. Net investment income dipped

3.5% to $171.6 million owing to a drop in yields.

For the full year, Assurant's operating income decreased to

$4.55 per share from $5.02 per share in the year-ago quarter.

Earnings, however, compared favorably with the Zacks Consensus

Estimate of $4.28 per share. Total revenue fell to $8.27 billion

from $8.53

billion.

Segment Performance

Net operating income at Assurant Solutions

increased more than two-fold to $28.5 million from

$11.7 million in the prior-year quarter. This can be primarily

attributed to stronger business from international operations and

growth in domestic business. Net earned premiums increased 4% year

over year to $691.3 million, primarily owing to growth in domestic

and international income and partly offset by continued run-off of

the domestic credit business and service contract from old

customers.

Assurant Specialty Property’s

net operating income increased 22% year over year to $116.1

million, primarily the result of no reportable catastrophe losses

compared with $9.8 million after-tax of reportable catastrophe

losses in fourth quarter 2010. Net earned premiums increased 3%

year over year to $517.6 million.

Net premiums earned at Assurant Health fell

5.0% year over year to $445 million. This was due to the decline in

traditional individual medical and small group business. Net

operating income increased 51% year over year to $22.7 million,

owing to reduced operating expenses and lower after-tax accrual of

premium rebates associated with the minimum medical ratio

requirement provisions, as stated by the Health Care Reform

Act.

Year over year, Assurant Employee Benefits' net

premiums earned declined 2% to $268.0 million. The decrease in

premium was due to pricing actions on a block of assumed disability

business and lower sales, partly mitigated by premium growth in

voluntary and supplemental products. Net operating income dropped

significantly by 18% to $14.5 million on the back of lower

favorable loss experience and low disability incidence.

The financial position of Assurant remains strong with $4.5

billion of equity capital, unchanged from the level at the end of

2010. The company maintains a low leverage ratio of 17.9% and has

no debt maturing until 2014.

Book value per share, excluding accumulated and other

comprehensive income, increased 14.0% to $49.05 from $43.08 on

December 31, 2010. The company repurchased 4.5 million shares

during the quarter at a total cost of $173 million.

Assurant’s fourth quarter results reflected continued execution

of the company’s growth strategy. Also, full year results reflect

favorable performance, despite the high cat losses incurred. The

company managed to beat the estimate on the back of better

performance from its international business. Though the company is

facing operating headwinds related to economy and regulations in

its businesses, we expect it to perform well over the longer term

given a solid capital position, low leverage and good capital

management. We thus reiterate our Neutral recommendation on the

shares of Assurant, which closely competes with Torchmark

Corp. (TMK) and Unum

Group (UNM).

ASSURANT INC (AIZ): Free Stock Analysis Report

TORCHMARK CORP (TMK): Free Stock Analysis Report

UNUM GROUP (UNM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

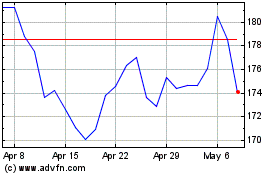

Assurant (NYSE:AIZ)

Historical Stock Chart

From May 2024 to Jun 2024

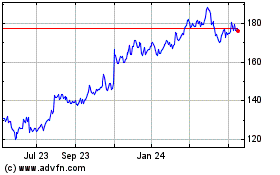

Assurant (NYSE:AIZ)

Historical Stock Chart

From Jun 2023 to Jun 2024