SI International to Acquire Bridge Technology Corporation

December 01 2004 - 9:06AM

PR Newswire (US)

SI International to Acquire Bridge Technology Corporation

Acquisition Broadens Customer Base With Intelligence Platform

RESTON, Va., Dec. 1 /PRNewswire-FirstCall/ -- SI International,

Inc. (NASDAQ:SINT), an information technology and network solutions

(IT) company, announced today that it has signed a definitive

merger agreement to acquire Bridge Technology Corporation. The

acquisition supports SI International's strategic growth goals to

broaden its customer base into the intelligence agencies, and

strengthen and broaden its portfolio of mission-critical solutions.

The acquisition of Bridge Technology will provide SI International

with a platform to offer its existing practice areas directly to

the intelligence agencies within the Federal government. Bridge

Technology, a privately-held company headquartered in Columbia, MD,

provides solutions to the Defense intelligence agencies in areas

such as program management, acquisition management, logistics

management, systems engineering, software engineering, and business

process reengineering. Established in 2000, Bridge Technology has

approximately 140 employees with approximately 90 percent holding

security clearances. Bridge Technology's primary clients are major

Defense intelligence agencies. "We believe that the acquisition of

Bridge Technology will establish a solid foundation for SI

International to take advantage of the growth in the intelligence

sector. The acquisition will greatly improve our presence within

Defense intelligence agencies and bring new core competencies that

enhance SI International's practice areas," said Ray Oleson,

Chairman and CEO of SI International. "Bridge Technology has a

highly talented team of professionals with a track record of

success in supporting high priority intelligence programs." Lou

Gould, Bridge Technology CEO added, "We are very excited about the

opportunities this union will create for our customers and

employees. Our clients will benefit from SI International's

expertise in mission-critical information technology services, and

from the resources of a larger company. Our employees will have

increased opportunities for growth and professional development.

Bridge Technology is an excellent fit with SI International's

corporate culture of building and maintaining long-term customer

relationships, while providing state-of-the-practice solutions."

The terms of the definitive merger agreement provide that SI

International will acquire the capital stock of Bridge Technology

for $30 million in cash. SI International will pay the purchase

price with its cash-on-hand and borrowings from its credit

facility. SI International and Bridge Technology plan to close the

transaction within the next 30 days. For the trailing twelve months

ended September 30, 2004, Bridge Technology had revenues of

approximately $22.2 million and operating income of approximately

$3.5 million. The consummation of the acquisition is subject to a

number of conditions, including SI International obtaining the

approval of its Board of Directors and the satisfactory completion

of its due diligence investigation. There can be no assurances that

the acquisition will be consummated. About SI International: SI

International, a member of the Russell 2000 index, is a provider of

information technology and network solutions (IT) primarily to the

Federal government. The company combines technological and industry

expertise to provide a full spectrum of state-of-the-practice

solutions and services, from design and development to

documentation and operations, to assist clients in achieving their

missions. More information about SI International can be found at

http://www.si-intl.com/. About Bridge Technology: Bridge

Technology, a small veteran-owned business, provides solutions to

the Defense intelligence agencies in areas such as program

management; acquisition, technology, and logistics management;

systems engineering; network design and management consulting

services; business process re-engineering; and, financial

management system implementation and consulting. This press release

contains various remarks about the future expectations, plans and

prospects of SI International, Inc. that constitute forward-looking

statements for purposes of the safe harbor provisions under The

Private Securities Litigation Reform Act of 1995. The actual

results of SI International, Inc. may differ materially from those

indicated by these forward-looking statements as a result of

various risks and uncertainties, including the following risks and

uncertainties that relate specifically to the acquisition: (i) the

risk that the transaction will not be consummated, including as a

result of any of the conditions precedent; (ii) the ability to

obtain government approvals required for closing the acquisition;

(iii) the risk that the Bridge Technology businesses will not be

integrated successfully into SI International; (iv) the risk that

the expected benefits of the acquisition may not be realized,

including the realization of accretive effects from the

acquisition; and (v) SI International's increased indebtedness

after the acquisition. Other non-acquisition related risks and

uncertainties include: differences between authorized amounts and

amounts received by SI International under government contracts;

government customers' or prime contractors' failure to exercise

options under contracts; changes in federal government (or other

applicable) procurement laws, regulations, policies and budgets; SI

International's ability to attract and retain qualified personnel;

and the important factors discussed in the Risk Factors section of

the annual report on Form 10-K/A filed by SI International, Inc.

with the Securities and Exchange Commission and available directly

from the Commission at http://www.sec.gov/. Contact: Alan Hill SI

International 703-234-6854 DATASOURCE: SI International, Inc.

CONTACT: Alan Hill of SI International, Inc., +1-703-234-6854, Web

site: http://www.si-intl.com/

Copyright

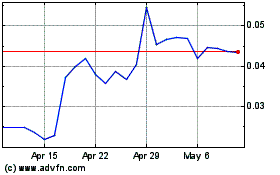

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jun 2024 to Jul 2024

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jul 2023 to Jul 2024