SI International Reports Record Financial Results for Second

Quarter FY05 and Raises Full Year 2005 Guidance Revenue up 50% to

$96 million; Operating Income up 61% to $8.3 million; Net Income up

50% to $4.0 million; Diluted EPS of 35 Cents RESTON, Va., July 25

/PRNewswire-FirstCall/ -- SI International, Inc. (NASDAQ:SINT), an

information technology and network solutions (IT) company, today

announced record results for its second quarter ended June 25,

2005. Revenue for the second quarter of fiscal year 2005 (FY05)

increased 50 percent and operating income increased by 61 percent

as compared to the second quarter in the previous year. The

Company's results were driven by strong organic growth in the

Federal government IT business and the acquisition of Bridge

Technology Corporation in December 2004 and of Shenandoah

Electronic Intelligence, Inc. in February 2005. Second Quarter FY05

Financial Results Revenue for the second quarter of FY05 was $96.0

million, an increase of 50 percent over second quarter FY04 revenue

of $63.8 million. Federal government contract revenue, which

represented 99 percent of second quarter FY05 total revenue, grew

by 54 percent to $94.5 million, from $61.6 million for the second

quarter FY04. The strong growth during the second quarter reflects

SI International's continued excellence in performing mission-

critical assignments in its four key focus areas: Federal IT

modernization, defense transformation, homeland defense, and

mission-critical outsourcing. Income from operations for the second

quarter of FY05 was $8.3 million, an increase of 61 percent over

operating income of $5.2 million reported in the second quarter

FY04. Operating margin for the second quarter of FY05 was 8.7

percent, as compared to 8.1 percent in the second quarter of FY04.

Net income for the second quarter FY05 was $4.0 million, an

increase of 50 percent over second quarter FY04 net income of $2.7

million. Diluted earnings per share for the second quarter FY05 was

$0.35. Backlog as of June 25, 2005 was $894 million, including $150

million in funded backlog and $744 million in unfunded backlog.

Days Sales Outstanding (DSOs) were 71 days at the end of the second

quarter FY05. "We are very pleased to report another record quarter

of financial results, marked by exceptional top-line growth,

improving profitability, and very strong cash flow performance.

Organic growth was ahead of our targeted range of 10-15 percent,

confirming that our capabilities are well aligned with the Federal

government's IT priorities. And we have successfully completed the

integration of our two most recent acquisitions, which have

substantially strengthened our capabilities in areas that offer

significant opportunities for future growth," said Ray Oleson, SI

International's Chairman and CEO. "We continue our tradition of

meeting or exceeding our financial goals for every quarter since

becoming a public company." First Half FY05 Financial Results For

the first half of FY05 ended June 25, 2005, revenue increased 50

percent to $179.7 million, compared to $119.8 million for the first

half of FY04. Income from operations for the first half of FY05 was

$14.8 million, an increase of 55 percent over operating income of

$9.6 million reported a year earlier. Operating margin for the

first half of FY05 was 8.3 percent, as compared to 8.0 percent in

the first half of FY04. Net income for the first six months of FY05

was $7.3 million, an increase of 44 percent over the same period

last year of $5.0 million. Business Outlook Based on the Company's

current backlog and management estimates as to future tasking and

contract awards, SI International issued the following guidance

ranges for the third and fourth fiscal quarters FY05 and revised

its guidance for full year 2005. The Company projects annual

organic growth of 10 to 15 percent for fiscal year 2005: Q3 2005 Q4

2005 Full Year 2005 Revenue $100 - 104 $108 million or $390 million

or million better better Net income $4.2 - 4.4 $4.4 million or

$16.0 million or million better better Diluted earnings per share

$0.36 - 0.38 $0.38 or better $1.37 or better "Our strong

performance in the first half of 2005, combined with robust

opportunities for future work, provide us confidence that SI

International is on track for an outstanding fiscal year. We

believe that the trends that are driving government spending on IT

are squarely aligned with SI International's strengths," said

Oleson. Conference Call SI International has scheduled a conference

call to discuss its results and business outlook for 9:00 AM EDT,

tomorrow. Participating in the conference call will be SI

International's Chairman and CEO, Ray Oleson, President and COO,

Brad Antle, and Executive Vice President and CFO, Ted Dunn. A

question and answer session will be included to further discuss the

results and the Company's future performance expectations.

Interested parties should contact Alan Hill at 703-234-6854 for

dial-in information. The conference call will be webcast

simultaneously to the public through a link on the Investor

Relations section of SI International's web site,

http://www.si-intl.com/. A replay of the webcast will be available

on the SI International web site beginning two hours after the

conclusion of the conference call. In addition, a replay of the

conference will be available by telephone beginning on Tuesday,

July 26, 2005 at 11:00 AM ET through Tuesday, August 2, 2005 at

5:00 PM ET by calling 1-888-286-8010 and entering the conference

passcode number 29143837. About SI International: SI International,

a member of the Russell 2000 index, is a provider of information

technology and network solutions (IT) primarily to the Federal

government. The Company combines technology and industry expertise

to provide a full spectrum of state-of-the-practice solutions and

services, from design and development to documentation and

operations, to assist clients in achieving their missions. SI

International is ranked as the 49th largest Federal Prime IT

Contractor by Washington Technology and has over 3,800 employees.

More information about SI International can be found at

http://www.si-intl.com/. The above-referenced statements may

contain forward-looking statements that are made pursuant to the

safe-harbor provisions of the Private Securities Litigation Reform

Act of 1995. Expressions of future goals and similar expressions

reflecting something other than historical fact are intended to

identify forward-looking statements, but are not the exclusive

means of identifying such statements. These forward-looking

statements involve a number of risks and uncertainties, which are

described in the Company's filings with the Securities and Exchange

Commission. These risks and uncertainties include: differences

between authorized amounts and amounts received by the Company

under government contracts; government customers' failure to

exercise options under contracts; changes in federal government (or

other applicable) procurement laws, regulations, policies and

budgets; the Company's ability to attract and retain qualified

personnel; and the important factors discussed in the Risk Factors

section of the annual report on Form 10-K filed by the Company with

the Securities and Exchange Commission and available directly from

the Commission at http://www.sec.gov/. The actual results may

differ materially from any forward-looking statements due to such

risks and uncertainties. The Company undertakes no obligations to

revise or update any forward-looking statements in order to reflect

events or circumstances that may arise after the date of this

release. SI International, Inc. Consolidated Income Statement

(unaudited) (In thousands, except per share data) Three Months

Ended Six Months Ended

---------------------------------------------------- June 25, June

26, June 25, June 26, 2005 2004 2005 2004 --------- ---------

--------- --------- Revenue $95,983 $63,814 $179,700 $119,784

Direct costs 58,598 38,801 111,201 72,330 Indirect costs 27,929

19,049 51,509 36,358 Depreciation and amortization 531 598 1,082

1,187 Amortization of intangible assets 611 192 1,068 306 ---------

--------- --------- --------- Income from Operations 8,314 5,174

14,840 9,603 Other Income (expense) 14 (85) Interest expense

(1,659) (738) (2,756) (1,272) --------- --------- ---------

--------- Income before provision for income taxes 6,669 4,436

11,999 8,331 Provision for income taxes 2,633 1,752 4,739 3,291

--------- --------- --------- --------- Net income $4,036 $2,684

$7,260 $5,040 ========= ========= ========= ========= Basic

weighted average shares outstanding 11,131 8,473 11,097 8,465

Diluted weighted average shares outstanding 11,650 9,008 11,638

8,926 Earnings per common share: Basic $0.36 $0.32 $0.65 $0.60

Diluted $0.35 $0.30 $0.62 $0.56 EBITDA (1) $9,456 $5,964 $16,990

$11,096 Notes (1) EBITDA is defined as GAAP net income (loss) plus

interest expense, income taxes, and depreciation and amortization.

EBITDA as calculated by us may be calculated differently than

EBITDA for other companies. We have provided EBITDA because we

believe it is a commonly used measure of financial performance in

comparable companies and is provided to help investors evaluate

companies on a consistent basis, as well as to enhance an

understanding of our operating results. EBITDA should not be

construed as either an alternative to net income as an indicator of

our operating performance or as an alternative to cash flows as a

measure of liquidity. Reconciliation of Net Income to EBITDA is as

follows: Three Months Ended Six Months Ended

----------------------------------------------- June 25, June 26,

June 25, June 26, 2005 2004 2005 2004 -------- --------- --------

-------- Net income $4,036 $2,684 $7,260 $5,040 Other expense

(income) (14) -- 85 -- Interest expense 1,659 738 2,756 1,272

Provision for income taxes 2,633 1,752 4,739 3,291 Depreciation 531

598 1,082 1,187 Amortization 611 192 1,068 306 -------- ---------

-------- -------- EBITDA $9,456 $5,964 $16,990 $11,096 SI

International, Inc. Revenue Segmentation Data (unaudited) (In

thousands) Three Months Ended

--------------------------------------------------- June 25, 2005

June 26, 2004 Growth -------------- -------------- ---------------

$ % $ % $ % Core government revenue 94,515 98.5% 61,587 96.5%

32,928 53.5% Commercial revenue 1,468 1.5% 2,227 3.5% (759) (34.1)%

--------------------------------------------------- Total revenue

95,983 100.0% 63,814 100.0% 32,169 50.4% Prime revenue 70,647 73.6%

51,300 80.4% 19,347 37.7% Subcontract revenue 25,336 26.4% 12,514

19.6% 12,822 102.5%

--------------------------------------------------- Total revenue

95,983 100.0% 63,814 100.0% 32,169 50.4% Cost plus 25,890 27.0%

17,085 26.8% 8,805 51.5% Time & materials 43,352 45.2% 30,654

48.0% 12,698 41.4% Fixed price 26,741 27.8% 16,075 25.2% 10,666

66.4% --------------------------------------------------- Total

revenue 95,983 100.0% 63,814 100.0% 32,169 50.4% Department of

Defense 42,376 44.2% 33,341 52.2% 9,035 27.1% Civilian agencies

52,139 54.3% 28,246 44.3% 23,893 84.6% Commercial 1,468 1.5% 2,227

3.5% (759) (34.1)%

--------------------------------------------------- Total revenue

95,983 100.0% 63,814 100.0% 32,169 50.4 % Major contracts:

C4I2TSR/C4I2SR 15,866 16.5% 8,613 13.5% 7,253 84.2% SCOT 9,937

10.4% 0 0.0% 9,937 100.0% NVC/KCC 9,474 9.9% 6,215 9.7% 3,259 52.4%

All other 60,706 63.2% 48,986 76.8% 11,720 23.9%

--------------------------------------------------- Total revenue

95,983 100.0% 63,814 100.0% 32,169 50.4% SI International, Inc.

Consolidated Balance Sheets (in thousands, except share and per

share data) June 25, December 25, 2005 2004

--------------------------- (Unaudited) Assets Current assets: Cash

and cash equivalents $ 14,932 $ 5,754 Accounts receivable, net

74,463 65,710 Deferred tax asset 2,740 2,740 Other current assets

4,962 3,503 Total current assets 97,097 77,707 Property and

equipment, net 4,536 4,971 Intangible assets, net 17,708 6,575

Other assets 5,681 2,142 Goodwill 173,876 120,712 Total assets $

298,898 $ 212,107 Liabilities and stockholders' equity Current

liabilities: Note Payable-Line of Credit $ - $ 28,954 Current

portion of long-term debt 1,000 - Accounts payable 13,433 11,225

Accrued expenses and other current liabilities 20,089 15,314

Deferred revenue - 289 Note payable - former owner of acquired

business 2,280 - Total current liabilities 36,802 55,782 Long-term

debt, net of current portion 99,000 - Note payable-former owner of

acquired business - 2,280 Deferred income tax 5,046 5,046 Other

long-term liabilities 4,268 3,929 Stockholders' equity: Common

stock-$0.01 par value per share; 50,000,000 shares authorized;

11,167,894 and 11,047,533 shares issued and outstanding as of June

25, 2005 and December 25, 2004, respectively 112 111 Additional

paid-in capital 129,568 128,192 Deferred compensation (133) (208)

Retained earnings 24,235 16,975 Total stockholders' equity 153,782

145,070 Total liabilities and stockholders' equity $ 298,898 $

212,107 SI International, Inc. Consolidated Statements of Cash

Flows (unaudited (in thousands) Six Months Ended June 25, June 26,

2005 2004 -------- -------- Cash flows from operating activities:

Net income $7,260 $5,040 Adjustments to reconcile net income to net

cash provided by (used in) operating activities: Depreciation and

amortization 1,082 1,187 Amortization of intangible assets 1,068

306 Loss on disposal of fixed assets 9 - Deferred income tax

provision - 1,371 Stock-based compensation 62 66 Amortization of

deferred financing costs 288 226 Changes in operating assets and

liabilities, net of effect of acquisitions: Accounts receivable,

net 3,724 (11,164) Other current assets (1,360) (1,047) Other

assets (658) (502) Accounts payable and accrued expenses 2,152

(671) Deferred revenue (289) (49) Other long term liabilities 934

1,223 ------------------ Net cash provided by (used in) operating

activities 14,272 (4,014) Cash flows from investing activities:

Purchase of property and equipment, net (333) (803) Cash paid for

acquisition of MATCOM (82) (66,065) Cash paid for acquisition of

Bridge Tech (133) - Cash paid for acquisition of SEI, net of cash

assumed (73,758) - ------------------ Net cash used in investing

activities (74,306) (66,868) Cash flows from financing activities:

Proceeds from exercise of stock options 1,389 285 Proceeds from

bank overdrafts - 2,872 Net (repayments) borrowings under line of

credit (28,954) 16,000 Proceeds from long-term debt 100,000 30,000

Payments of debt issuance costs (3,170) (1,201) Repayments of

capital lease obligations (53) (70) ------------------ Net cash

provided by financing activities 69,212 47,886 ------------------

Net change in cash and cash equivalents 9,178 (22,996) Cash and

cash equivalents, beginning of period 5,754 23,252

------------------ Cash and cash equivalents, end of period $14,932

$256 ================== Supplemental disclosures of cash flow

information: Cash payments for interest $1,916 $793 Cash payments

for income taxes $2,458 $2,788 CONTACT: Alan Hill of SI

International, Inc., +1-703-234-6854, or . DATASOURCE: SI

International, Inc. CONTACT: Alan Hill of SI International, Inc.,

+1-703-234-6854, or Web site: http://www.si-intl.com/

Copyright

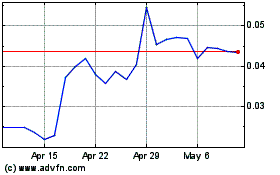

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jun 2024 to Jul 2024

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jul 2023 to Jul 2024