PORTERVILLE, Calif., Oct. 30 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced its financial results for the quarter and the nine months

ended September 30, 2009. A highlight for the quarter is an

increase in the Company's total risk-based capital ratio, to 16.0%

at September 30, 2009 from 14.0% at June 30, 2009 and 13.6% at the

end of 2008, largely as the result of the capital added pursuant to

our private placement of common stock in August. Also of note is

the recent completion of a standard annual regulatory examination

of Bank of the Sierra. Net income for the third quarter of 2009 was

$106,000, and diluted earnings per share were $0.01. The main

reason for the decline in net income relative to the third quarter

of 2008 was an increase of $9.6 million in our provision for loan

and lease losses, necessitated primarily by higher specific loss

reserves for impaired loans. A slight drop in average

interest-earning assets and a lower net interest margin had a

negative impact on net interest income, while higher FDIC costs,

and OREO write-downs and other credit-related expenses, contributed

to a 4% increase in total non-interest expense for the quarter. The

Company took $1.0 million in gains on the sale of investments to

help offset some of the impact of these unfavorable developments.

Sierra Bancorp generated a return on average equity of 0.35% and a

return on average assets of 0.03% for the third quarter of 2009.

For the first nine months of 2009 net income was $5.4 million,

diluted earnings per share were $0.54, return on average equity was

6.39%, and return on average assets was 0.55%. In addition to a $25

million increase in capital, notable balance sheet changes for the

nine months ended September 30, 2009 include the following: Core

deposit balances, defined as all deposits except brokered deposits

and time deposits of $100,000 or greater, increased $44 million, or

7%; wholesale-sourced brokered deposits declined by $88 million, or

76%, while CDARS deposits increased by $41 million, or 36%, and

other customer time deposits of $100,000 or greater increased by $4

million, or 2%; the balance of securities sold under agreement to

repurchase declined by $24 million; and Federal Home Loan Bank

(FHLB) borrowings were reduced by $21 million, or 23%. Furthermore,

our investment portfolio increased $23 million, or 9%, while fed

funds sold fell by $5 million and gross loan and lease balances

dropped $37 million, or 4%. Nonperforming assets were up by $43

million, or 115%. Because of the relatively large loan loss

provision and the drop in gross loan balances, our allowance for

loan and lease losses increased to 2.57% of total loans at

September 30, 2009 from 1.59% at the end of 2008. "This was another

challenging quarter for us in terms of credit, but we're pleased

that other elements of the Company are still performing well and

have kept us profitable this year," commented James C. Holly,

President and CEO. "Customer deposit growth has been robust,

contributing to strong levels of non-interest income and allowing

us to further reduce brokered deposit balances and wholesale

borrowings and improve our liquidity position. Moreover, even after

the repositioning accomplished in the third quarter, our investment

portfolio remains exceptionally solid," he noted. "In addition, in

response to current conditions we have implemented several

strategic changes that have strengthened the Company. Our

processes, policies, and personnel have been enhanced, and our

recent private placement with well-regarded institutional players

demonstrates our ability to fortify capital in a difficult

environment," Holly explained. "With these changes in place we are

well-positioned to take advantage of opportunities that might

arise, although we currently expect to continue to grow the Bank at

a measured pace. Our newest branch, representing our second branch

in the City of Tulare, opened earlier this month, and we have plans

to add branches in Farmersville and Selma in 2010. In addition to

brick and mortar branches we recently implemented mobile banking

capabilities, and our internet branch is proving to be a resounding

success," he concluded. Financial Highlights Net interest income

was lower in 2009 than in 2008, reflecting declines of $752,000, or

5%, for the third quarter, and $510,000, or 1%, for the comparative

year-to-date periods. For the quarter, this decline can be

explained by a $4 million reduction in average interest-earning

assets and a 24 basis point drop of our net interest margin. For

the year-to-date comparison, average interest-earning assets were

$34 million higher, although most of the growth during the past

year has been in investments, which tend to be lower-yielding than

loans. Our net interest margin was 19 basis points lower in the

first nine months of 2009 than in the first nine months of 2008.

Our net interest margin for both the quarter and the year-to-date

period was negatively impacted by a higher level of interest

reversals and an increase in average nonperforming assets. Net

interest reversals on loans placed on non-accrual for the third

quarter and first nine months of 2009 were $206,000 and $563,000,

respectively, relative to net interest recoveries of $93,000 for

the third quarter of 2008 and net interest reversals of $387,000

for the first nine months of 2008. Average non-performing assets

were $50 million higher for the quarterly comparison, and $44

million higher for the year-to-date comparison. These unfavorable

variances were partially offset by an increase in average customer

deposit balances and the easing of market pressures on deposit

rates. Our current interest rate risk profile indicates if rates

increase over the next 12 months, interest-earning assets will

likely re-price more slowly than interest-bearing liabilities and

our net interest margin could be negatively impacted. Furthermore,

if rates were to decline relative to already historically low

levels, rates on many of our deposits would hit natural floors of

close to zero while asset yields would continue to drop,

compressing our net interest margin and also creating a negative

impact on net interest income. The Company's loan loss provision

was significantly higher in 2009, increasing by $9.6 million for

the third quarter and by $12.2 million for the first nine months

relative to like periods in 2008. This increase can be explained in

part by net charge-offs, which increased by $1.2 million, or 54%,

for the quarter and by $2.9 million, or 42%, on a year-to-date

basis. The increases in charge-offs for the quarter and the

year-to-date comparisons reflect higher levels of unsecured

consumer and commercial loan charge-offs, and the year-to-date

increase also includes a significant increase in charge-offs on

real estate loans. In addition to reserve replenishment related to

charge-offs, much of the 2009 loan loss provision was used to

enhance specific reserves on impaired loans. Our detailed analysis

indicates that as of September 30, 2009, the Company's $23.4

million allowance for loan and lease losses should be sufficient to

cover credit losses inherent in loan and lease balances outstanding

as of that date. However, no assurance can be given that we will

not experience substantial future losses relative to the size of

the allowance. Our allowance for loan and lease losses was 2.57% of

total loans at September 30, 2009, up from 1.59% at year-end 2008

and 1.18% at September 30, 2008. Service charge income on deposits

declined slightly in the third quarter of 2009 relative to the

third quarter of 2008, but increased by $288,000 for the

year-to-date comparison. While the Company's transaction accounts

and associated balances are increasing, service charges have been

declining as a percentage of those balances despite fee increases

in mid-2008. Since the decline is centered in returned item and

overdraft fees, the largest component of deposit service charges,

it is our assumption that consumers and businesses are managing

cash more carefully in this difficult economy. The $1 million gain

on investments in the third quarter of 2009 represents gains taken

on the sale of $30 million in mortgage-backed securities in

September. We reinvested the proceeds in high-quality agency-issued

mortgage-backed securities, with the overall transaction having a

positive net present value due to interest rate anomalies and the

timing of sales versus purchases. The year-to-date gain on

investments in 2009 also includes gains on bonds called prior to

maturity, and a $66,000 recovery on a previously charged-off

investment in a title insurance holding company. Investment gains

in 2008 consist entirely of gains on called securities. While there

were no material changes in loan sale and servicing income, other

non-interest income increased by $227,000, or 18%, for the quarter,

but declined by $501,000, or 13%, for the first nine months. Much

of the drop in income for the year-to-date period in 2009 is due to

non-recurring income in the first quarter of 2008. Major factors

contributing to the changes in other non-interest income for the

third quarter and first nine months include the following: Income

from bank-owned life insurance (BOLI) increased $309,000 for the

quarter and $650,000 for the year-to-date period, primarily because

of 2009 gains on BOLI associated with deferred compensation plans

(although associated deferred compensation plan expense accruals

were also higher, as noted below); dividends on our $9 million

investment in FHLB stock were suspended for most of 2009, only

recently being reinstated at a nominal level, leading to a drop in

income on restricted stock totaling $155,000 for the quarter and

$450,000 for the first nine months; pass-through operating costs

associated with our investment in low-income housing tax credit

funds, which are accounted for as a reduction in income, declined

$53,000 for the quarter but increased by $267,000 for the

year-to-date period; we recognized a one-time gain of $289,000 in

the first quarter of 2008 resulting from the mandatory redemption

of a portion of our Visa shares, pursuant to Visa's initial public

offering in March 2008; we realized a non-recurring $82,000 gain on

the sale of property adjacent to one of our branches in the first

quarter of 2008; and we received a non-recurring $75,000 contingent

final payment in the first quarter of 2008 related to the

outsourcing of our merchant services function in late 2006. With

regard to non-interest expense, salaries and benefits declined $1.1

million, or 24%, for the third quarter of 2009 and increased by

$481,000, or 4%, for the first nine months of 2009, relative to

like periods in 2008. The decline in the third quarter is the

result of the reversal of approximately $1.6 million that had been

accrued for incentive compensation payments, as it currently

appears unlikely that the Company's net income for 2009 will reach

the level necessary to trigger such payments. Despite the drop in

salaries and benefits expense in the third quarter, year-to-date

expenses experienced an increase due in part to a drop in salaries

deferred pursuant to FAS 91, which were $100,000 lower for the

quarter and $808,000 lower for the first nine months because of a

drop in loan origination activity. Furthermore, as noted above,

because of participant gains on deferred compensation plans in

2009, deferred compensation expense accruals increased by $287,000

for the third quarter and $468,000 for the first nine months of

2009 relative to 2008, although deferred compensation expense

accruals are offset by non-taxable gains on BOLI. Also impacting

compensation costs were normal annual salary adjustments, the

addition of staff for our branches opened in July and November of

2008, and strategic staff additions to help address credit issues

and position the Company for future growth opportunities. Occupancy

expense also increased, rising by $54,000, or 3%, for the third

quarter and by $383,000, or 8%, for the year-to-date period, due

primarily to costs associated with our newer branches and annual

rent increases. Other non-interest expenses rose by $1.5 million,

or 38%, for the third quarter and by $4.4 million, or 47%, in the

first nine months of 2009 relative to 2008. The largest increase in

this category was in FDIC costs, which were up $933,000 for the

quarter and $2.3 million for the first nine months. The

year-to-date increase includes a $595,000 accrual in the second

quarter of 2009 for an industry-wide special assessment, and the

increases for both comparative periods reflect significantly higher

regular assessment rates. Other large changes in non-interest

expenses for the comparative 2009 and 2008 periods include the

following: Marketing expense declined by $202,000 for the first

nine months; lending costs increased by $629,000 for the quarter

and $1.3 million on a year-to-date basis, due to foreclosed asset

write-downs, an increase in foreclosed asset operating expenses,

and higher demand and foreclosure costs; deposit-related costs were

up $436,000 for the year-to-date period, due in large part to a

non-recurring $104,000 EFT processing rebate received in the second

quarter of 2008 and one-time incentives totaling $242,000 received

in the first quarter of 2008; and, gains on directors deferred

compensation plans in 2009 resulted in increases in expense

accruals for deferred directors' fees totaling $290,000 for the

quarter and $508,000 for the first nine months. The negative income

tax provision exceeds our pre-tax loss for the third quarter of

2009, creating positive net income. This is the result of a high

level of tax credits, which added to the negative tax provision

stemming from the pre-tax loss for the quarter. Our income tax

accrual is also negative for the first nine months of 2009, in

spite of positive pre-tax income. This is due to the fact that tax

credits exceed our tax liability for the year-to-date period. Our

tax credits stem from investments in low-income housing tax credit

funds, as well as hiring tax credits. Furthermore, these credits

have a greater relative impact than might otherwise be expected,

since taxable income is lower than book income due to the effect of

tax-exempt interest income and income on bank-owned life insurance.

Significant balance sheet changes during the first nine months of

2009 include a drop in total assets of $19 million, or 1%. The

largest impact on total assets came from lower gross loans and

lease balances, which were down by $37 million, or 4%. Real estate

loan balances dropped $28 million, or 4%, due to runoff, the

charge-off or write-down of uncollectible balances, and transfers

to OREO. Consumer loans declined $5 million, or 8%, and commercial

loans were down $3 million, or 2%. Relatively weak loan demand and

heightened selectivity on the part of the Company in a difficult

credit environment contributed to overall loan runoff. Cash and due

from banks declined, as well, dropping by $12 million due to

fluctuations in cash items in process of collection. Investment

balances increased by $23 million, or 9%, due to growth in

agency-issued mortgage-backed and municipal securities, although

this was partially offset by a $5 million decline in fed funds

sold. As noted earlier, we repositioned our investment portfolio in

September, thereby realizing $1 million in gains but slightly

increasing duration and reducing our overall portfolio yield by

seven basis points. The $80 million balance of non-performing

assets at September 30, 2009 reflects an increase of $43 million,

or 115%, since year-end 2008. Approximately $22 million of that

increase came in the third quarter of 2009. The year-to-date

increase includes net increases of approximately $4 million in

non-performing acquisition/development and land loans, $3 million

in residential construction loans, $3 million in mortgage loans,

$13 million in commercial real estate loans, $4 million in

commercial and SBA loans, and $16 million in foreclosed assets. All

impaired assets at September 30, 2009 are carried at the lower of

cost or fair market value, and are well-reserved based on current

loss expectations. Total deposits increased by slightly over $1

million during the first nine months of 2009, but excluding an $88

million drop in wholesale-sourced brokered deposits, customer

deposits were up by $89 million, or 9%. Much of the growth in

customer deposits was in time deposits, including a $41 million

increase in CDARS deposits and a $10 million increase in other

customer time deposits. Non-maturity deposits also experienced a

healthy increase, with combined NOW/savings balances up $27

million, or 17%, and money market deposits up $16 million, or 11%.

Non-interest bearing demand deposits, however, reflect a

year-to-date decline of $5 million, or 2%, due mainly to migration

into interest-bearing NOW accounts. Customer repos were down $24

million because of the transfer of money into money market

deposits, and we were able to let $21 million in FHLB borrowings

roll off as the result of the overall decline in funding needs. As

noted previously, the Company's private placement in August raised

a net $20.4 million in capital. With the addition of earnings, less

dividends paid, and a $2.3 million increase in accumulated other

comprehensive income resulting from an increase in the market value

of our investment securities, total capital increased by $25.5

million, or 24%, during the first nine months of 2009. At September

30, 2009, our total risk-based capital ratio was 16.0%, our tier

one risk-based capital ratio was 14.8%, and our tier one leverage

ratio was 11.9%. About Sierra Bancorp Sierra Bancorp is the holding

company for Bank of the Sierra (http://www.bankofthesierra.com/),

which is in its 32nd year of operations and is the largest

independent bank headquartered in the South San Joaquin Valley. The

Company has 24 branch offices, an agricultural credit center, an

SBA center, and an online "virtual" branch, with over 400

employees. The statements contained in this release that are not

historical facts are forward-looking statements based on

management's current expectations and beliefs concerning future

developments and their potential effects on the Company. Readers

are cautioned not to unduly rely on forward-looking statements.

Actual results may differ from those projected. These

forward-looking statements involve risks and uncertainties

including but not limited to the health of the national and

California economies, the Company's ability to attract and retain

skilled employees, customers' service expectations, the Company's

ability to successfully deploy new technology, the success of

branch expansion, changes in interest rates, loan portfolio

performance, the Company's ability to secure buyers for foreclosed

properties, and other factors detailed in the Company's SEC

filings. CONSOLIDATED INCOME STATEMENT 3-Month Period Ended:

9-Month Period Ended: (in $000's, unaudited) 9/30/ 9/30/ % 9/30/

9/30/ % 2009 2008 Change 2009 2008 Change Interest Income $17,024

$20,082 -15.2% $52,593 $60,014 -12.4% Interest Expense 2,703 5,009

-46.0% 9,871 16,782 -41.2% ----- ----- ----- ------ Net Interest

Income 14,321 15,073 -5.0% 42,722 43,232 -1.2% Provision for Loan

& Lease Losses 10,474 900 1063.8% 17,977 5,820 208.9% ------

----- ------ ----- Net Int after Provision 3,847 14,173 -72.9%

24,745 37,412 -33.9% Service Charges 3,030 3,089 -1.9% 8,582 8,294

3.5% Loan Sale & Servicing Income 53 12 341.7% 83 31 167.7%

Other Non-Interest Income 1,471 1,244 18.2% 3,473 3,974 -12.6% Gain

(Loss) on Investments 1,005 - 100.0% 1,099 58 1794.8% ----- -----

----- ----- Total Non-Interest Income 5,559 4,345 27.9% 13,237

12,357 7.1% Salaries & Benefits 3,543 4,646 -23.7% 14,033

13,552 3.5% Occupancy Expense 1,792 1,738 3.1% 5,148 4,765 8.0%

Other Non-Interest Expenses 5,406 3,929 37.6% 13,760 9,391 46.5%

----- ----- ------ ----- Total Non-Interest Expense 10,741 10,313

4.2% 32,941 27,708 18.9% Income Before Taxes (1,335) 8,205 -116.3%

5,041 22,061 -77.1% Provision for Income Taxes (1,441) 2,433

-159.2% (354) 6,765 -105.2% ------- ----- ----- ----- Net Income

$106 $5,772 -98.2% $5,395 $15,296 -64.7% ====== ====== ======

======= Tax Data Tax-Exempt Muni Income $637 $599 6.3% $1,846

$1,777 3.9% Tax-Exempt BOLI Income $631 $322 96.0% $1,211 $561

115.9% Interest Income - Fully Tax Equiv $17,367 $20,405 -14.9%

$53,587 $60,971 -12.1% Net Charge-Offs (Recoveries) $3,468 $2,247

54.4% $9,707 $6,822 42.3% 3-Month Period Ended: 9-Month Period

Ended: PER SHARE DATA 9/30/ 9/30/ % 9/30/ 9/30/ % (unaudited) 2009

2008 Change 2009 2008 Change Basic Earnings per Share $0.01 $0.60

-98.3% $0.54 $1.60 -66.3% Diluted Earnings per Share $0.01 $0.59

-98.3% $0.54 $1.56 -65.4% Common Dividends $0.10 $0.17 -41.2% $0.30

$0.51 -41.2% Wtd. Avg. Shares Outstanding 10,376,980 9,623,683

9,913,159 9,586,589 Wtd. Avg. Diluted Shares 10,457,054 9,765,122

9,992,984 9,777,633 Book Value per Basic Share (EOP) $11.38 $11.26

1.1% $11.38 $11.26 1.1% Tangible Book Value per Share (EOP) $10.90

$10.69 2.0% $10.90 $10.69 2.0% Common Shares Outstanding (EOP)

11,620,491 9,666,391 11,620,491 9,666,391 3-Month Period 9-Month

Period Ended: Ended: KEY FINANCIAL RATIOS 9/30/ 9/30/ 9/30/ 9/30/

(unaudited) 2009 2008 2009 2008 Return on Average Equity 0.35%

21.96% 6.39% 19.87% Return on Average Assets 0.03% 1.77% 0.55%

1.60% Net Interest Margin (Tax-Equiv.) 4.95% 5.19% 4.92% 5.11%

Efficiency Ratio (Tax-Equiv.) 54.81% 51.83% 58.21% 49.08% Net C/O's

to Avg Loans (not annualized) 0.38% 0.24% 1.04% 0.74% AVERAGE

BALANCES 3-Month Period Ended: 9-Month Period Ended: (in $000's,

9/30/ 9/30/ % 9/30/ 9/30/ % unaudited) 2009 2008 Change 2009 2008

Change Average Assets $1,294,068 $1,298,989 -0.4% $1,307,120

$1,273,119 2.7% Average Interest-Earning Assets $1,175,630

$1,179,876 -0.4% $1,188,646 $1,154,160 3.0% Average Gross Loans

& Leases $923,513 $934,978 -1.2% $934,689 $926,031 0.9% Average

Deposits $1,071,476 $965,538 11.0% $1,084,922 $922,381 17.6%

Average Equity $118,658 $104,546 13.5% $112,900 $102,818 9.8% End

of Period: STATEMENT OF CONDITION 9/30/ 12/31/ 9/30/ Annual (in

$000's, unaudited) 2009 2008 2008 Chg ASSETS Cash and Due from

Banks $33,716 $46,010 $33,237 1.4% Securities and Fed Funds Sold

267,079 248,913 245,916 8.6% Agricultural 13,466 13,542 11,918

13.0% Commercial & Industrial 139,666 142,674 145,222 -3.8%

Real Estate 678,216 706,342 707,425 -4.1% SBA Loans 18,979 19,463

20,447 -7.2% Consumer Loans 59,158 64,619 68,461 -13.6% ------

------ ------ Gross Loans & Leases 909,485 946,640 953,473

-4.6% Deferred Loan Fees (383) (1,365) (1,674) -77.1% ----- -------

------- Loans & Leases Net of Deferred Fees 909,102 945,275

951,799 -4.5% Allowance for Loan & Lease Losses (23,363)

(15,094) (11,275) 107.2% -------- -------- -------- Net Loans &

Leases 885,739 930,181 940,524 -5.8% Bank Premises & Equipment

19,779 19,280 19,024 4.0% Other Assets 100,736 81,908 78,206 28.8%

------- ------ ------ Total Assets $1,307,049 $1,326,292 $1,316,907

-0.7% ========== ========== ========== LIABILITIES & CAPITAL

Demand Deposits $227,413 $232,168 $221,560 2.6% NOW / Savings

Deposits 182,823 156,322 153,532 19.1% Money Market Deposits

162,975 146,896 138,181 17.9% Time Certificates of Deposit 489,640

526,112 447,761 9.4% ------- ------- ------- Total Deposits

1,062,851 1,061,498 961,034 10.6% Junior Subordinated Debentures

30,928 30,928 30,928 0.0% Other Interest-Bearing Liabilities 68,844

113,919 199,545 -65.5% ------ ------- ------- Total Deposits &

Int.-Bearing Liab. 1,162,623 1,206,345 1,191,507 -2.4% Other

Liabilities 12,161 13,147 16,525 -26.4% Total Capital 132,265

106,800 108,875 21.5% ------- ------- ------- Total Liabilities

& Capital $1,307,049 $1,326,292 $1,316,907 -0.7% ==========

========== ========== End of Period: CREDIT QUALITY DATA 9/30/

12/31/ 9/30/ Annual (in $000's, unaudited) 2009 2008 2008 Chg

Non-Accruing Loans $56,297 $29,786 $14,307 293.5% Over 90 Days PD

and Still Accruing - 71 6,365 -100.0% Foreclosed Assets 23,327

7,127 3,909 496.8% ------ ----- ----- Total Non-Performing Assets

$79,624 $36,984 $24,581 223.9% ======= ======= ======= Non-Perf

Loans to Total Loans 6.19% 3.15% 2.17% Non-Perf Assets to Total

Assets 6.09% 2.79% 1.87% Allowance for Ln Losses to Loans 2.57%

1.59% 1.18% OTHER PERIOD-END STATISTICS End of Period: (unaudited)

9/30/2009 12/31/2008 9/30/2008 Shareholders Equity / Total Assets

10.1% 8.1% 8.3% Loans / Deposits 85.6% 89.2% 99.2% Non-Int. Bearing

Dep. / Total Dep. 21.4% 21.9% 23.1% DATASOURCE: Sierra Bancorp

CONTACT: Ken Taylor, EVP/CFO, or Kevin McPhaill, EVP/Chief Banking

Officer, both of Sierra Bancorp, +1-559-782-4900, 1-888-454-BANK

Web Site: http://www.bankofthesierra.com/

Copyright

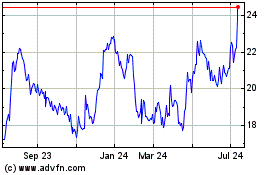

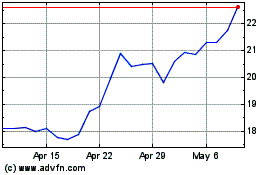

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From May 2024 to Jun 2024

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2023 to Jun 2024