Sierra Bancorp to Raise $21.3 Million in Private Placement of Common Stock to Institutional Investors

August 27 2009 - 9:00PM

PR Newswire (US)

PORTERVILLE, Calif., Aug. 27 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), the bank holding company for Bank of the

Sierra, today announced that it has entered into a purchase

agreement with select institutional investors pursuant to which it

will raise $21.3 million in a private placement of its common

stock. Sierra Bancorp will sell 1,935,000 shares of its common

stock at a price of $11.00 per share. The net proceeds from the

offering, after placement fees and estimated transaction expenses,

are approximately $20.4 million. Proceeds of the offering will be

available for general corporate purposes and to support ongoing

organic growth of Bank of the Sierra. The closing is expected to

take place on or about August 28, 2009, subject to satisfaction of

customary closing conditions. "This capital raise confirms that,

even in troubled economic times, disciplined banks, like Bank of

the Sierra, with sound business models and an outstanding

management team can successfully access the capital markets," said

Jim Holly, Sierra Bancorp's Chief Executive Officer. "The proceeds

of this offering further strengthens our already strong capital

position and provides us the additional resources to continue to

grow and support the businesses and communities we serve," added

Holly. The securities to be issued in the private transaction have

not been registered under the Securities Act of 1933, as amended,

and may not be sold by the holders except pursuant to an effective

registration statement or an applicable exemption from the

registration requirements. As part of the financing, Sierra Bancorp

has agreed to file a registration statement with the Securities and

Exchange Commission within 60 days of the closing covering the

issuance of the shares sold in the private placement. Wunderlich

Securities, Inc., headquartered in Memphis, Tennessee, is serving

as the placement agent in the private placement. About Sierra

Bancorp Sierra Bancorp is the holding company for Bank of the

Sierra (http://www.bankofthesierra.com/), which is in its 32nd year

of operations and is the largest independent bank headquartered in

the South San Joaquin Valley. The Company has $1.3 billion in total

assets with 23 branch offices, an agricultural credit center, an

SBA center, an online "virtual" branch, and over 400 employees. The

statements contained in this release that are not historical facts

are forward-looking statements based on management's current

expectations and beliefs concerning future developments and their

potential effects on the Company. Readers are cautioned not to

unduly rely on forward-looking statements. Actual results may

differ from those projected. These forward-looking statements

involve risks and uncertainties, including but not limited to the

health of the national and California economies, the Company's

ability to attract and retain skilled employees, customers' service

expectations, the Company's ability to successfully deploy new

technology, the success of branch expansion, changes in interest

rates, loan portfolio performance, the Company's ability to secure

buyers for foreclosed properties, and other factors detailed in the

Company's SEC filings. Website Address:

http://www.sierrabancorp.com/ DATASOURCE: Sierra Bancorp CONTACT:

Ken Taylor, EVP/CFO, or Jim Holly, President/CEO, both of Sierra

Bancorp, +1-559-782-4900, 1-888-454-BANK Web Site:

http://www.sierrabancorp.com/ http://www.bankofthesierra.com/

Copyright

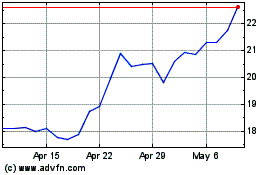

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From May 2024 to Jun 2024

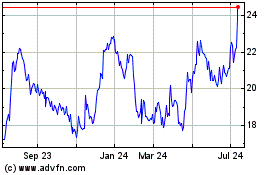

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2023 to Jun 2024