PORTERVILLE, Calif., July 21 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced its financial results for the quarter and half ended June

30, 2008. Sierra Bancorp generated a 17.8% return on average equity

and a 1.4% return on average assets for the quarter, due in large

part to solid growth in core non-interest income and

well-controlled operating expenses. A relatively strong increase in

core deposits during the quarter also contributed to profitability.

These favorable results were achieved despite a relatively large

loan loss provision and interest reversals necessitated by an

increase in non-performing assets. Net income for the second

quarter of 2008 was $4.6 million, compared to $6.1 million in the

same quarter a year ago. Diluted earnings per share fell 22%, to

$0.47 in the second quarter of 2008 from $0.60 per diluted share in

the second quarter of 2007. In addition to the aforementioned

factors impacting performance in the second quarter of 2008, a $1.6

million pre-tax gain on the sale of credit card loans in the second

quarter of 2007 contributed to the difference in income between the

two quarters. For the first half of 2008 net income was $9.5

million, diluted earnings per share were $0.97, return on average

equity was 18.8%, and return on average assets was 1.5%. Notable

balance sheet changes from December 31, 2007 to June 30, 2008

include the following: Core deposit balances, defined as all

deposits except brokered deposits and time deposits of $100,000 or

greater, increased $21 million, or 3%, with most of the increase

occurring in the second quarter; time deposits of $100,000 or

greater increased by $33 million, or 17%; Federal Home Loan Bank

(FHLB) borrowings were reduced by $50 million, or 25%; and

investment balances increased by $56 million, or 30%. During the

first half of 2008 aggregate loan balances grew by only $7 million,

or 1%, due primarily to large prepayments and heightened

selectivity on the part of the Company in a difficult credit

environment. "While not unscathed by credit issues, the Bank has

posted encouraging financial results so far this year," commented

James C. Holly, President and CEO. "We're operating in a regional

economy that has been buoyed up by the agricultural and oil

industries, our core financial performance is quite good and our

capital position remains strong. These factors have facilitated the

continuation of a moderate branch expansion strategy -- we recently

opened a branch office in East Bakersfield, and should be able to

open additional offices in Fresno, Tulare, and Selma in the coming

12 to 18 months," Mr. Holly noted further. "Our 'slow but steady'

philosophy recognizes that consistent efforts in the right

direction lead to sustained success, and even as we work to stay on

top of potential problem credits we're focused on profitability and

judicious growth in order to position the Bank for a continued high

level of financial performance going forward," he added. Financial

Highlights The most significant impact on the Company's net income

for the second quarter and first half of 2008 versus the same

periods in 2007 came from an increase in the loan loss provision,

which was $1.9 million higher for the quarter and $3.3 million

higher for the year-to-date period. The relatively large loan loss

provision in 2008 can be explained in part by net charge-offs,

which increased by $2.3 million for the quarter and $3.5 million

for the half due mainly to increased losses on unsecured loans,

both business and consumer, and on equity lines. However, many of

the charged-off loan balances had specific reserves allocated to

them as of the beginning of the respective periods and charging

them off did not necessarily create the need for reserve

replenishment. Much of the 2008 loan loss provision was

necessitated by the enhancement of specific reserves on acquisition

and development loans and residential construction loans, pursuant

to deterioration in the liquidity of some developers and based on

recent appraisals that reflect "fire sale" prices. Our detailed

analysis indicates that as of June 30, 2008, our $12.6 million

allowance for loan and lease losses should be sufficient to cover

potential credit losses inherent in loan and lease balances

outstanding as of that date. However, no assurance can be given

that the Company will not experience substantial future losses

relative to the size of the allowance. Our allowance for loan and

lease losses was 1.35% of total loans at June 30, 2008, the same as

at March 31, 2008 but a little higher than at year-end 2007.

Relative to the same periods in 2007, net interest income was

slightly lower for both the second quarter and first half of 2008.

While average interest-earning assets were $75 million higher for

the quarter and $53 million higher for the half, the lift created

by higher earning assets was offset by a lower net interest margin.

The Company's net interest margin was 4.98% in the second quarter

of 2008 relative to 5.35% in the second quarter of 2007, and 5.05%

in the first half of 2008 relative to 5.35% in the first half of

2007. Our net interest margin would have been 5.14% and 5.13% for

the second quarter and first half of 2008, respectively, if not for

$480,000 in interest reversals on loans placed on non-accrual in

the second quarter of 2008. Also having a negative impact on our

net interest margin were increases of $10 million and $9 million in

average non-performing assets for the quarter and the half,

respectively, and declines of $24 million and $25 million in

average non-interest bearing demand deposits for the quarter and

the half, respectively. The negative factors impacting our net

interest margin were partially offset by higher average balances

for NOW accounts, money market accounts, and core time deposits.

Our current interest rate risk profile indicates that net interest

income should increase slightly if interest rates were to fall by

up to 200 basis points, but an immediate and sustained drop of more

than 200 basis points in rates could have an adverse impact. Net

interest income will likely decline in rising interest rate

scenarios, as well, all else being equal. Service charge income on

deposits increased by $983,000, or 56%, in the second quarter of

2008 relative to the second quarter of 2007, and the increase for

the half was $1.9 million, also representing a 56% increase.

Service charges show improvement due primarily to returned item and

overdraft fees generated by new consumer checking accounts, a fee

increase that became effective mid-2007, and enhanced overdraft

management and collection capabilities for all transaction

accounts. All other non-interest revenue declined by $1.8 million,

or 60%, for the quarter, and by $1.4 million, or 33%, for the half,

due primarily to the $1.6 million pre-tax gain on the sale of

credit card loans in the second quarter of 2007. Other relatively

large items contributing to changes in non-interest income for the

second quarter and first half include the following: A one-time

gain of $289,000 in the first quarter of 2008 resulting from the

mandatory redemption of a portion of our Visa shares, pursuant to

Visa's initial public offering in March 2008; declines of $156,000

and $271,000 in credit card revenue for the second quarter and the

first half, respectively, pursuant to the sale of our credit card

portfolio in June 2007; increases of $105,000 and $220,000 in EFT

interchange fees for the quarter and half, respectively, resulting

from new EFT contracts that became effective in the fourth quarter

of 2007; lower bank-owned life insurance (BOLI) income, which was

down by $176,000 and $374,000 for the second quarter and first half

of 2008, respectively, due mainly to losses on our separate account

BOLI (although associated deferred compensation plan expense

accruals were also lower); a non-recurring $82,000 gain on the sale

of property adjacent to one of our branches in the first quarter of

2008; and a non-recurring $75,000 contingent final payment in the

first quarter of 2008 related to the outsourcing of our merchant

services function in late 2006. On the expense side, salaries and

benefits declined by $26,000, or 1%, for the second quarter of 2008

and by $192,000, or 2%, for the first half of 2008, relative to

like periods in 2007. The decrease occurred because normal annual

salary increases were offset by lower deferred compensation expense

and higher deferred salaries associated with successful loan

originations. The aforementioned participant losses on deferred

compensation plans contributed to a decline in deferred

compensation expense totaling $134,000 for the second quarter and

$280,000 for the first half. Total salaries associated with

successful loan originations and thus deferred pursuant to FAS 91

increased by $177,000 for the quarter and $421,000 for the half,

due in large part to a third quarter 2007 re-evaluation of, and

subsequent increase in, standardized per loan origination costs.

Occupancy expense also declined, dropping by $100,000, or 6%, for

the second quarter and by $80,000, or 3%, for the half due

primarily to lower depreciation on furniture and equipment, with

the drop for the first half of 2008 partially offset by an $88,000

increase in property taxes resulting from property tax refunds

received in the first quarter of the previous year. Other

non-interest expenses were essentially flat for the quarter, but

dropped by $283,000, or 5%, in the first half of 2008 relative to

the first half of 2007. Significant changes in other non-interest

expenses for the comparative 2008 and 2007 periods include the

following: Costs associated with credit cards were eliminated due

to the sale of our credit card portfolio last year, and thus

declined by $190,000 for the quarter and $340,000 for the half; ATM

network and EFT processing costs were down by $128,000 for the

quarter and $310,000 for the half, due in large part to a

non-recurring $104,000 EFT processing rebate received in the second

quarter of 2008 and one-time incentives totaling $242,000 received

in the first quarter of 2008; and participant losses on balances

associated with deferred directors' fees resulted in a reduction in

directors' expense accruals totaling $141,000 for the quarter and

$220,000 for the half. Additional non-recurring expense items for

the second quarter of 2008 include a $54,000 insurance recovery on

check fraud losses which reduced expenses, and $83,000 in

initiation costs associated with our new mortgage program that is

slated for launch in the third quarter of 2008. Balance sheet

changes during the first half of 2008 include sizeable increases in

deposits and investment securities. Total deposits increased by

$113 million, or 13%, during the first half. Much of the growth was

in time deposits, including $50 million obtained from one of the

counties in our market area and a $50 million increase in State of

California balances. Wholesale-sourced brokered deposits, which are

also included in time certificates of deposit, declined by $10

million during the half. Combined NOW/savings balances were up by

$16 million, or 11%, and money market deposits increased by $24

million, or 19%. Non-interest bearing demand deposits, however,

while up slightly in the second quarter, show a year-to-date

decline of $14 million, or 6%. We let $50 million in FHLB

borrowings roll off due to the aggregate deposit influx.

Additionally, much of the cash flow generated by the increase in

deposits was utilized to increase investment balances, which were

up by $56 million, or 30%, during the half because the investment

environment was conducive to increasing our relative level of

investment securities. Gross loan balances increased by $7 million

during the first half of 2008, despite a decline of $4 million in

the first quarter. Organic loan growth in most branches has been

consistent with expectations. Total non-performing assets increased

by $5 million, or 48%, during the first six months of 2008, ending

the half at $14 million. This includes net increases of

approximately $3.6 million in non-performing acquisition and

development and residential construction loans, $400,000 in SBA

loans, and $1.3 million in other real estate owned. Specific loss

reserves are allocated to non-performing loans based on loss

expectations, which for real estate loans are based on current

appraisals and the expected timing of resolution. About Sierra

Bancorp Sierra Bancorp is the holding company for Bank of the

Sierra (http://www.bankofthesierra.com/), which is in its 31st year

of operations and is the largest independent bank headquartered in

the South San Joaquin Valley. The Company has over $1.3 billion in

total assets and currently maintains 22 branch offices, an

agricultural credit center, an SBA center, and an online "virtual"

branch. In January 2008, Sierra Bancorp was recognized as the 2nd

best performing mid-tier bank in the nation and the 6th bank

overall by U.S. Banker magazine, based on return on equity. The

statements contained in this release that are not historical facts

are forward-looking statements based on management's current

expectations and beliefs concerning future developments and their

potential effects on the Company. Readers are cautioned not to

unduly rely on forward looking statements. Actual results may

differ from those projected. These forward-looking statements

involve risks and uncertainties including but not limited to the

health of the national and California economies, the Company's

ability to attract and retain skilled employees, customers' service

expectations, the Company's ability to successfully deploy new

technology and gain efficiencies there from, the success of branch

expansion, changes in interest rates, loan portfolio performance,

the Company's ability to secure buyers for foreclosed properties,

and other factors detailed in the Company's SEC filings.

CONSOLIDATED INCOME 3-Month Period Ended: 6-Month Period Ended:

STATEMENT 6/30/ 6/30/ % 6/30/ 6/30/ % (in $000's, unaudited) 2008

2007 Change 2008 2007 Change Interest Income $19,374 $22,263 -13.0%

$39,772 $44,008 -9.6% Interest Expense 5,237 7,978 -34.4% 11,773

15,746 -25.2% Net Interest Income 14,137 14,285 -1.0% 27,999 28,262

-0.9% Provision for Loan & Lease Losses 2,650 701 278.0% 4,920

1,601 207.3% Net Int after Provision 11,487 13,584 -15.4% 23,079

26,661 -13.4% Service Charges 2,737 1,754 56.0% 5,205 3,329 56.4%

Loan Sale & Servicing Income 3 1,605 -99.8% 19 1,642 -98.8%

Other Non-Interest Income 1,171 1,381 -15.2% 2,890 2,753 5.0% Gain

(Loss) on Investments 13 6 116.7% 58 11 427.3% Total Non-Interest

Income 3,924 4,746 -17.3% 8,172 7,735 5.6% Salaries & Benefits

4,409 4,435 -0.6% 8,906 9,098 -2.1% Occupancy Expense 1,542 1,642

-6.1% 3,027 3,107 -2.6% Other Non-Interest Expenses 2,902 2,889

0.4% 5,462 5,745 -4.9% Total Non-Interest Expense 8,853 8,966 -1.3%

17,395 17,950 -3.1% Income Before Taxes 6,558 9,364 -30.0% 13,856

16,446 -15.7% Provision for Income Taxes 1,994 3,309 -39.7% 4,333

5,638 -23.1% Net Income $4,564 $6,055 -24.6% $9,523 $10,808 -11.9%

Tax Data Tax-Exempt Muni Income $600 $558 7.5% $1,178 $1,106 6.5%

Tax-Exempt BOLI Income $79 $255 -69.0% $239 $613 -61.0% Interest

Income - Fully Tax Equiv $19,697 $22,563 -12.7% $40,406 $44,604

-9.4% Net Charge-Offs (Recoveries) $2,506 $210 $4,575 $1,077 PER

SHARE DATA 3-Month Period Ended: 6-Month Period Ended: (unaudited)

6/30/ 6/30/ % 6/30/ 6/30/ % 2008 2007 Change 2008 2007 Change Basic

Earnings per Share $0.48 $0.62 -22.6% $1.00 $1.11 -9.9% Diluted

Earnings per Share $0.47 $0.60 -21.7% $0.97 $1.07 -9.3% Common

Dividends $0.17 $0.15 13.3% $0.34 $0.30 13.3% Wtd. Avg. Shares

Outstanding 9,577,515 9,738,048 9,567,838 9,733,862 Wtd. Avg.

Diluted Shares 9,766,734 10,090,450 9,783,702 10,110,627 Book Value

per Basic Share (EOP) $10.62 $9.64 10.2% $10.62 $9.64 10.2%

Tangible Book Value per Share (EOP) $10.04 $9.07 10.7% $10.04 $9.07

10.7% Common Shares Outstanding (EOP) 9,597,391 9,687,379 9,597,391

9,687,379 KEY FINANCIAL RATIOS 3-Month Period Ended: 6-Month Period

Ended: (unaudited) 6/30/2008 6/30/2007 6/30/2008 6/30/2007 Return

on Average Equity 17.78% 25.90% 18.79% 23.69% Return on Average

Assets 1.43% 2.00% 1.52% 1.80% Net Interest Margin (Tax-Equiv.)

4.98% 5.35% 5.05% 5.35% Efficiency Ratio (Tax-Equiv.) 48.00% 46.07%

47.58% 48.62% Net C/O's to Avg Loans (not annualized) 0.27% 0.02%

0.50% 0.12% AVERAGE BALANCES 3-Month Period Ended: 6-Month Period

Ended: (in $000's, 6/30/ 6/30/ % 6/30/ 6/30/ % unaudited) 2008 2007

Change 2008 2007 Change Average Assets $1,287,286 $1,213,526 6.1%

$1,260,042 $1,208,789 4.2% Average Interest- Earning Assets

$1,168,640 $1,093,972 6.8% $1,141,162 $1,088,282 4.9% Average Gross

Loans & Leases $927,034 $904,606 2.5% $921,509 $897,945 2.6%

Average Deposits $934,714 $915,555 2.1% $900,566 $892,106 0.9%

Average Equity $103,246 $93,785 10.1% $101,945 $92,000 10.8%

STATEMENT OF CONDITION End of Period: (in $000's, unaudited) 6/30/

12/31/ 6/30/ Annual 2008 2007 2007 Chg ASSETS Cash and Due from

Banks $52,737 $44,022 $44,366 18.9% Securities and Fed Funds Sold

241,155 184,917 186,358 29.4% Agricultural 10,953 13,103 9,828

11.4% Commercial & Industrial 144,745 140,323 136,882 5.7% Real

Estate 700,850 696,110 685,278 2.3% SBA Loans 21,276 20,366 21,946

-3.1% Consumer Loans 54,223 54,731 55,513 -2.3% Consumer Credit

Card Balances - - - Gross Loans & Leases 932,047 924,633

909,447 2.5% Deferred Loan Fees (2,269) (3,045) (3,411) -33.5%

Loans & Leases Net of Deferred Fees 929,778 921,588 906,036

2.6% Allowance for Loan & Lease Losses (12,622) (12,276)

(12,103) 4.3% Net Loans & Leases 917,156 909,312 893,933 2.6%

Bank Premises & Equipment 18,809 18,255 18,721 0.5% Other

Assets 78,446 77,229 72,575 8.1% Total Assets $1,308,303 $1,233,735

$1,215,953 7.6% LIABILITIES & CAPITAL Demand Deposits $230,157

$243,764 $244,288 -5.8% NOW/Savings Deposits 154,148 138,378

139,062 10.8% Money Market Deposits 150,699 126,347 152,263 -1.0%

Time Certificates of Deposit 428,311 341,658 388,070 10.4% Total

Deposits 963,315 850,147 923,683 4.3% Subordinated Debentures

30,928 30,928 30,928 0.0% Other Interest-Bearing Liabilities

196,214 237,082 153,052 28.2% Total Deposits & Int.-Bearing

Liab. 1,190,457 1,118,157 1,107,663 7.5% Other Liabilities 15,955

16,114 14,871 7.3% Total Capital 101,891 99,464 93,419 9.1% Total

Liabilities & Capital $1,308,303 $1,233,735 $1,215,953 7.6%

CREDIT QUALITY DATA End of Period: (in $000's, unaudited) 6/30/

12/31/ 6/30/ Annual 2008 2007 2007 Chg Non-Accruing Loans $12,407

$9,052 $403 2978.7% Over 90 Days PD and Still Accruing - - - 0.0%

Foreclosed Assets 1,820 556 - 100.0% Total Non-Performing Assets

$14,227 $9,608 $403 3430.3% Non-Perf Loans to Total Loans 1.33%

0.98% 0.04% Non-Perf Assets to Total Assets 1.09% 0.78% 0.03%

Allowance for Ln Losses to Loans 1.35% 1.33% 1.33% OTHER PERIOD-END

STATISTICS End of Period: (unaudited) 6/30/2008 12/31/2007

6/30/2007 Shareholders Equity/Total Assets 7.8% 8.1% 7.7%

Loans/Deposits 96.8% 108.8% 98.5% Non-Int. Bearing Dep./Total Dep.

23.9% 28.7% 26.4% DATASOURCE: Sierra Bancorp CONTACT: Ken Taylor,

EVP|CFO, or Kevin McPhaill, EVP|Chief Banking Officer, both of

Sierra Bancorp, +1-559-782-4900, 1-888-454-BANK Web site:

http://www.sierrabancorp.com/ http://www.bankofthesierra.com/

Copyright

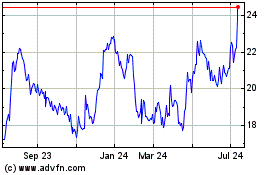

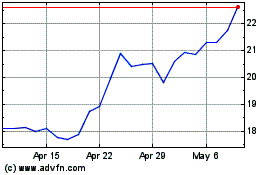

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From May 2024 to Jun 2024

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2023 to Jun 2024