PORTERVILLE, Calif., April 21 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced its financial results for the quarter ended March 31,

2008. Net income for the first quarter of 2008 increased 4% to $5.0

million, compared to $4.8 million in the same quarter a year ago.

Diluted earnings per share increased 9%, rising to $0.51 in the

first quarter of 2008 from $0.47 per diluted share in the first

quarter of 2007. Half of the increase in diluted earnings per share

is attributable to higher earnings, while the remainder is due to

lower average diluted shares outstanding for the quarter. Diluted

shares were lower because of share repurchases over the past year,

and because of a significant increase in stock options that were

"underwater" at March 31, 2008 and thus excluded from diluted

shares. Despite a relatively high loan loss provision in the first

quarter of 2008, Sierra Bancorp still generated a 19.8% return on

average equity and a 1.6% return on average assets for the quarter.

Notable balance sheet changes from December 31, 2007 to March 31,

2008 include an increase of $73 million, or 9%, in deposit

balances, a $26 million drop in Federal Home Loan Bank (FHLB)

borrowings, and an increase of $52 million, or 28%, in investment

balances. "While credit issues had a greater impact on first

quarter results than we originally expected, some favorable

developments helped soften the blow," remarked James C. Holly,

President and CEO. "We had a one-time gain on the redemption of

Visa shares, but more significantly, our deposit acquisition

strategy has been highly successful in increasing the number of

transaction accounts and associated service charges, we've

maintained a relatively strong net interest margin, and

non-interest expenses are well-controlled," he explained. "I

commend our dedicated employees and directors for their diligent

efforts and intense focus on managing credit issues, controlling

costs, enhancing revenues, and maintaining a stout return on equity

as we fight the headwinds that seem to be flattening profitability

at many other banks," Mr. Holly added. Financial Highlights The

most significant single item impacting the Company's net income for

the first quarter of 2008 versus the first quarter of 2007 was a

$1.4 million increase in our loan loss provision. Some of this

increase can be explained by the $1.2 million increase in net

charge-offs, but many of the charged-off loan balances had specific

reserves allocated to them as of the beginning of the quarter and

charging them off did not necessarily create the need for reserve

replenishment. Our first quarter net charge-offs include unsecured

personal lines of credit adding up to $791,000, auto loans and

other consumer installment loans in the amount of $266,000,

commercial loans (primarily unsecured business lines of credit) and

the non-guaranteed portion of SBA loans totaling $597,000, and real

estate loan balances (including equity lines) of $312,000. Deposit

account overdrafts totaling $115,000 were also deemed to be

uncollectible and are included in net charge-offs. In addition to

the increase in reserves related to charge-offs, we created

specific reserves for certain acquisition and development loans and

residential construction loans, due to deterioration in collateral

values and in the liquidity of some developers. We had acquisition

and development loans totaling about $31 million, and an additional

$40 million in residential construction loans on our books at March

31, 2008. Our general reserves for equity loans and unsecured

business and consumer lines were also enhanced, due to the recent

uptick in charge-offs in those loan categories. Our detailed

analysis indicates that as of March 31, 2008, our allowance for

loan and lease losses should be sufficient to cover potential

credit losses inherent in loan and lease balances outstanding as of

that date. However, no assurance can be given that the Company will

not experience substantial future losses relative to the size of

the allowance. Our allowance for loan and lease losses was 1.35% of

total loans at March 31, 2008. Net interest income was slightly

lower in the first quarter of 2008 than in the first quarter of

2007. While average interest-earning assets were $31 million

higher, the lift created by higher earning assets was offset by a

lower net interest margin. The Company's net interest margin was

5.12% in the first quarter of 2008 relative to 5.35% in the first

quarter of 2007, a drop of 23 basis points. Our net interest margin

was down due to the fact that average non-interest bearing demand

deposits were $26 million lower, and because competitive pressures

kept deposit costs relatively high despite a drop in short-term

market interest rates. Our current interest rate risk profile

indicates minimal exposure to declining interest rates, all else

being equal. For the quarter, service charges on deposits increased

by $893,000, or 57%, relative to the first quarter of 2007. Service

charges show improvement due primarily to returned item and

overdraft fees generated by new consumer checking accounts, a fee

increase that became effective mid-2007, and enhanced overdraft

management and collection capabilities for all transaction

accounts. Other non-interest income increased by $346,000, or 25%.

The primary driver behind the increase was a $289,000 one-time gain

resulting from the mandatory redemption of a portion of our Visa

shares, pursuant to Visa's initial public offering in March 2008.

Other relatively large changes in non-interest income categories,

which net out to a small overall increase, are as follows: credit

card revenue was $116,000 lower, bank-owned life insurance (BOLI)

income was down by $198,000 due to a first quarter 2008 loss on our

separate account BOLI (although associated deferred compensation

plan expense accruals were also lower), EFT interchange fees

increased by $114,000, we received a $75,000 contingent final

payment in the first quarter of 2008 related to the outsourcing of

our merchant services function in late 2006, one-time gains from

the sale of real property and leased equipment were up by $70,000,

and costs associated with our low-income housing tax credit funds,

which are shown as a reduction in other income, were $82,000 lower.

On the expense side, salaries and benefits declined by $166,000, or

4%, due to a $244,000 increase in the deferral of current-period

salaries associated with successful loan originations. A decline of

$146,000 in deferred compensation expense stemming from participant

losses on deferred compensation investments also helped offset some

of the normal annual increase in salaries and benefits. Occupancy

expense increased by only $20,000, or 1%, inclusive of a $75,000

increase in property taxes due to property tax refunds received in

the first quarter of the previous year. Lower depreciation expense

on furniture and equipment was the primary reason for the minimal

increase in occupancy expense. Other non-interest expenses dropped

by $295,000, or 10%, due mainly to a $242,000 offset against

deposit services costs to reflect non-recurring incentive payments

received in the first quarter of 2008 for last year's EFT

processing/debit card conversions. The drop in other non-interest

expenses also includes the elimination of $150,000 in costs

associated with credit cards due to the sale of our credit card

portfolio last year, and participant losses in the directors'

deferred fee plan, which are reflected as an expense accrual

reduction. Expenses that increased in the first quarter of 2008

relative to the first quarter of 2007 include demand and

foreclosure costs, appraisal and inspection costs, and internet

banking costs. Balance sheet changes during the first quarter of

2008 include sizeable increases in deposits and investment

securities. Total deposits increased by $73 million, or 9%, during

the first quarter. Most of growth was in time deposits, including

$30 million obtained from one of the counties in our market area

and $20 million from the State of California. Wholesale-sourced

brokered deposits, which are also included in time certificates of

deposit, increased by $16 million during the quarter. Combined

NOW/savings balances were up by $11 million, or 8%, and money

market deposits increased by $10 million, also representing an 8%

increase. Non-interest bearing demand deposits, however, continued

to decline, dropping by $18 million, or 8%. We were able to let $26

million in FHLB borrowings roll off and decreased overnight fed

funds purchased by $7 million due to the aggregate deposit influx.

Additionally, since the investment environment was conducive to

increasing our relative level of investment securities, much of the

cash flow generated by the increase in deposits was utilized to

increase investment balances, which were up by $52 million, or 28%,

during the quarter. Gross loan balances declined by $4 million

during the first quarter of 2008. While organic loan growth in most

branches was consistent with our expectations, aggregate balances

declined due to the prepayment of $11 million associated with a

single loan relationship and the early payoff of $3 million in loan

participations purchased. On a positive note, total non-performing

assets fell by $712,000, or 7%, during the first three months of

2008, ending the quarter at $8.9 million. The following loans that

were included in the non-accruing balance at December 31, 2007 were

resolved during the first quarter of 2008: a $1.2 million

commercial note was sold, a $1.1 million loan secured by a personal

residence and land was foreclosed on and subsequently sold, and

single-family residential loans of $415,000 and $125,000 were paid

off. Additionally, a $196,000 property held in OREO at year-end was

sold during the first quarter of 2008. Loans placed on non-accrual

status during the quarter include a $1.2 million residential

construction loan to a developer, who has completed the six units

in his project but has had difficulty selling them. Other loans and

leases downgraded to non-accrual status in the first quarter of

2008 include a $226,000 commercial real estate loan, two

residential construction loans totaling $410,000, an SBA loan in

the amount of $186,000, a $224,000 lease, and various consumer

loans. A total of $1.5 million in loans which were classified as

"non-accrual" at December 31, 2008, were written down by a combined

$241,000 and acquired into OREO in the first quarter of 2008. Three

additional foreclosures during the first quarter resulted in an

ending balance of $1.9 million for foreclosed assets. About Sierra

Bancorp Sierra Bancorp is the holding company for Bank of the

Sierra (http://www.bankofthesierra.com/), which is in its 31st year

of operations and is the largest independent bank headquartered in

the South San Joaquin Valley. The Company has over $1.2 billion in

total assets and currently maintains 21 branch offices, an

agricultural credit center, an SBA center, and an online "virtual"

branch. In January 2008, Sierra Bancorp was recognized as the 2nd

best performing mid-tier bank in the nation and the 6th bank

overall by U.S. Banker magazine, based on return on equity. The

statements contained in this release that are not historical facts

are forward-looking statements based on management's current

expectations and beliefs concerning future developments and their

potential effects on the Company. Readers are cautioned not to

unduly rely on forward looking statements. Actual results may

differ from those projected. These forward-looking statements

involve risks and uncertainties including but not limited to the

health of the national and California economies, the Company's

ability to attract and retain skilled employees, customers' service

expectations, the Company's ability to successfully deploy new

technology and gain efficiencies there from, the success of branch

expansion, changes in interest rates, loan portfolio performance,

the Company's ability to secure buyers for foreclosed properties,

and other factors detailed in the Company's SEC filings.

CONSOLIDATED INCOME STATEMENT 3-Month Period Ended: (in $000's,

unaudited) 3/31/2008 3/31/2007 % Change Interest Income $20,398

$21,745 -6.2% Interest Expense 6,536 7,769 -15.9% Net Interest

Income 13,862 13,976 -0.8% Provision for Loan & Lease Losses

2,270 900 152.2% Net Int after Provision 11,592 13,076 -11.3%

Service Charges 2,468 1,575 56.7% Loan Sale & Servicing Income

16 37 -56.8% Other Non-Interest Income 1,719 1,373 25.2% Gain

(Loss) on Investments 45 5 800.0% Total Non-Interest Income 4,248

2,990 42.1% Salaries & Benefits 4,498 4,664 -3.6% Occupancy

Expense 1,486 1,466 1.4% Other Non-Interest Expenses 2,559 2,854

-10.3% Total Non-Interest Expense 8,543 8,984 -4.9% Income Before

Taxes 7,297 7,082 3.0% Provision for Income Taxes 2,338 2,329 0.4%

Net Income $4,959 $4,753 4.3% TAX DATA Tax-Exempt Muni Income $578

$547 5.7% Tax-Exempt BOLI Income $160 $358 -55.3% Interest Income -

Fully Tax Equiv $20,709 $22,040 -6.0% NET CHARGE-OFFS $2,069 $867

138.6% PER SHARE DATA 3-Month Period Ended: (unaudited) 3/31/2008

3/31/2007 % Change Basic Earnings per Share $0.52 $0.49 6.1%

Diluted Earnings per Share $0.51 $0.47 8.5% Common Dividends $0.17

$0.15 13.3% Wtd. Avg. Shares Outstanding 9,558,161 9,729,627 Wtd.

Avg. Diluted Shares 9,801,531 10,149,369 Book Value per Basic Share

(EOP) $10.65 $9.49 12.2% Tangible Book Value per Share (EOP) $10.06

$8.92 12.8% Common Shares Outstndg. (EOP) 9,521,273 9,758,779 KEY

FINANCIAL RATIOS 3-Month Period Ended: (unaudited) 3/31/2008

3/31/2007 Return on Average Equity 19.82% 21.37% Return on Average

Assets 1.62% 1.60% Net Interest Margin (Tax-Equiv.) 5.12% 5.35%

Efficiency Ratio (Tax-Equiv.) 47.16% 51.45% Net C/O's to Avg Loans

(not annualized) 0.23% 0.10% AVERAGE BALANCES 3-Month Period Ended:

(in $000's, unaudited) 3/31/2008 3/31/2007 % Change Average Assets

$1,232,798 $1,203,998 2.4% Average Interest-Earning Assets

$1,113,727 $1,082,527 2.9% Average Gross Loans & Leases

$916,027 $891,208 2.8% Average Deposits $866,419 $868,396 -0.2%

Average Equity $100,644 $90,196 11.6% STATEMENT OF CONDITION End of

Period: (in $000's, unaudited) 3/31/2008 12/31/2007 3/31/2007

Annual Chg ASSETS Cash and Due from Banks $43,150 $44,022 $40,908

5.5% Securities and Fed Funds Sold 236,664 184,917 192,815 22.7%

Agricultural 9,864 13,103 11,690 -15.6% Commercial & Industrial

138,398 140,323 138,036 0.3% Real Estate 697,437 696,110 669,738

4.1% SBA Loans 20,817 20,366 22,678 -8.2% Consumer Loans 54,528

54,731 54,815 -0.5% Consumer Credit Card Balances - - 8,189 -100.0%

Gross Loans & Leases 921,044 924,633 905,146 1.8% Deferred Loan

& Lease Fees (2,818) (3,045) (3,662) -23.0% Loans & Leases

Net of Deferred Fees 918,226 921,588 901,484 1.9% Allowance for

Loan & Lease Losses (12,478) (12,276) (11,612) 7.5% Net Loans

& Leases 905,748 909,312 889,872 1.8% Bank Premises &

Equipment 18,240 18,255 18,187 0.3% Other Assets 77,960 77,229

74,062 5.3% Total Assets $1,281,762 $1,233,735 $1,215,844 5.4%

LIABILITIES & CAPITAL Demand Deposits $225,318 $243,764

$258,913 -13.0% NOW / Savings Deposits 149,853 138,378 134,685

11.3% Money Market Deposits 135,911 126,347 132,642 2.5% Time

Certificates of Deposit 412,466 341,658 375,882 9.7% Total Deposits

923,548 850,147 902,122 2.4% Junior Subordinated Debentures 30,928

30,928 30,928 0.0% Other Interest-Bearing Liabilities 207,894

237,082 175,404 18.5% Total Deposits & Int.-Bearing Liab.

1,162,370 1,118,157 1,108,454 4.9% Other Liabilities 18,031 16,114

14,790 21.9% Total Capital 101,361 99,464 92,600 9.5% Total

Liabilities & Capital $1,281,762 $1,233,735 $1,215,844 5.4%

CREDIT QUALITY DATA End of Period: (in $000's, unaudited) 3/31/2008

12/31/2007 3/31/2007 Annual Chg Non-Accruing Loans $7,021 $9,052

$649 981.8% Over 90 Days PD and Still Accruing - - - 0.0%

Foreclosed Assets 1,875 556 76 2367.1% Total Non-Performing Assets

$8,896 $9,608 $725 1127.0% Non-Perf Loans to Total Loans 0.76%

0.98% 0.07% Non-Perf Assets to Total Assets 0.69% 0.78% 0.06%

Allowance for Ln Losses to Loans 1.35% 1.33% 1.28% OTHER PERIOD-END

STATISTICS End of Period: (unaudited) 3/31/2008 12/31/2007

3/31/2007 Shareholders Equity / Total Assets 7.9% 8.1% 7.6% Loans /

Deposits 99.7% 108.8% 100.3% Non-Int. Bearing Dep. / Total Dep.

24.4% 28.7% 28.7% DATASOURCE: Sierra Bancorp CONTACT: Ken Taylor,

EVP|CFO, or Kevin McPhaill, EVP|Chief Banking Officer, both of

Sierra Bancorp, +1-559-782-4900, 1-888-454-BANK Web site:

http://www.sierrabancorp.com/ http://www.bankofthesierra.com/

Copyright

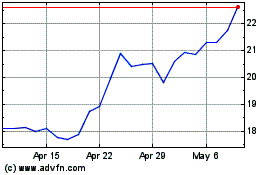

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From May 2024 to Jun 2024

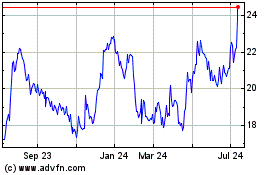

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2023 to Jun 2024