PORTERVILLE, Calif., Oct. 22 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced net income for the quarter and nine months ended

September 30, 2007. Net income for the third quarter of 2007 was

$5.3 million, which represents an increase of $368,000, or 8%,

relative to net income of $4.9 million in the same quarter a year

ago. Diluted earnings per share were $0.53 in the third quarter of

2007, compared to $0.48 per diluted share in the third quarter of

2006. Net income for the first nine months of 2007 was a record

$16.1 million, an increase of $1.6 million, or 11%, compared to the

prior year. Some of the year-to-date increase is due to a gain

recognized on the sale of the Company's credit card portfolio in

June 2007, which totaled $1.6 million pre-tax and approximately

$930,000 after taxes. The provision for loan losses was also

$848,000 lower in the first nine months of 2007 than for the same

period in 2006. Diluted earnings per share for the first nine

months of 2007 were $1.60, which is a 13% increase relative to the

first nine months of 2006. Sierra Bancorp generated a third quarter

return on average equity of 22.16% in 2007 versus 22.73% in 2006,

while return on average assets was 1.73% for the third quarter of

2007 as compared to 1.68% in the third quarter of 2006. The

Company's return on average equity was 23.17% for the nine months

ended September 30, 2007 compared to 23.31% in the same period last

year, and its return on average assets was 1.78% for the first nine

months of 2007 and 1.74% for the same period in 2006. During the

third quarter of 2007, gross loans and leases outstanding declined

by $3 million due to runoff that slightly exceeded new volume in

most loan categories. Total deposits declined by $37 million during

the quarter, with $25 million of the drop caused by the runoff of

wholesale-sourced brokered deposits and about $8 million being the

result of the temporary transfer of a single customer deposit at

quarter-end. Impacting capital was the Company's repurchase of

61,600 shares of its own stock during the third quarter, at a

weighted average price of $28.12 per share. For the first nine

months of 2007, gross loans and leases increased by $19 million, or

2%. Year-to-date growth was impeded by the sale of $11 million in

consumer and business credit card balances in the second quarter,

as well as the aforementioned net run-off in the third quarter.

Non-performing assets increased to $1.2 million at September 30,

2007 from only $689,000 at year-end 2006, but almost all of the

current balance is secured by real estate and our allowance for

loan and lease losses is still nearly 10 times the balance of

non-performing loans. Total deposits increased by $18 million, or

2%, during the nine months ended September 30, 2007. As with the

quarter, the change in wholesale-sourced brokered deposits had a

significant impact on year-to-date deposit growth, declining by $20

million during the first nine months of 2007. "Over the past

several months we've experienced some of the trends that seem to be

prevalent industry-wide, including net interest margin compression

and a lack of growth in earning assets and non-interest bearing

deposits. That being said, our focus on managing potential problem

areas, and on enhancing non-interest income and controlling

non-interest expense, has helped offset the negative impact and

allowed us to maintain strong financial performance," remarked

James C. Holly, President and CEO. "A highlight of our recent

performance is exceptional growth in the number of consumer deposit

accounts, which has provided a significant contribution to fee

income," Holly added. Financial Highlights Net interest income

increased slightly for both the quarter and nine months ended

September 30, 2007 relative to the same periods in 2006, due to

growth in average earning assets. Average interest-earning assets

were $52 million higher in the third quarter of 2007 than in the

third quarter of 2006, and $89 million higher during the first nine

months of 2007 than in the same period in 2006. The contribution of

additional earning assets to net interest income was diluted by

compression in the Company's net interest margin, which fell to

5.23% in the third quarter of 2007 from 5.44% in the third quarter

of 2006, and to 5.31% in the first nine months of 2007 from 5.66%

in the first nine months of 2006. Our net interest margin is lower

mainly because of a shift from non-interest bearing demand and

relatively low-cost savings deposits into more expensive money

market and time deposits. Furthermore, the Company's balance sheet

has been asset-sensitive for most of the last two years, which has

contributed to compression in our net interest margin since

short-term interest rates stopped increasing more than a year ago.

Strong growth in aggregate average customer deposits in 2007 has

allowed us to retire some of the more costly wholesale funding

obtained in 2006, however, which has helped offset some of the

negative impact created by the deposit shift and stagnant/declining

short-term interest rates. Our loan loss provision was $351,000

lower for the third quarter and $848,000 lower for the year-to-date

period in 2007 relative to 2006, primarily because of a lower rate

of growth in loan balances. Net charge-offs in 2007 remain at

levels similar to those experienced in 2006 due a relatively high

level of recoveries in 2007, but are expected to increase in future

periods based on unfavorable delinquency trends in unsecured lines

and equity lines. Our current allowance for loan and lease losses

factors in these unfavorable credit trends, and it is management's

opinion that our reserve is adequate for specifically identified

problems as well as any other losses inherent in our loan and lease

portfolio. For the quarter, service charges on deposits increased

by $607,000, or 41%, relative to the third quarter of 2006. Service

charges are up $941,000, or 21%, for the year-to-date period.

Service charges show improvement due primarily to an increase in

returned item and overdraft fees generated by checking accounts.

The number of accounts has increased, and our fee structure, while

still lower than competitor banks in many categories, has been

adjusted to be closer to average. At September 30, 2007, the

Company had over 68,000 deposit accounts, a 14% increase relative

to the number of accounts at September 30, 2006. As noted above,

the Company's year-to-date non-interest income was also impacted by

the gain on sale of credit card loans. Other non-interest income

declined slightly for the quarter, but increased by $322,000, or

9%, for the first nine months of 2007. For the quarter, higher

income from bank-owned life insurance (BOLI) was more than offset

by higher costs on an increased investment in tax credit funds,

lower bill-pay income, and lower fees related to credit cards. The

year-to-date increase is due primarily to a higher level of income

from BOLI, debit card interchange fees, and dividends on FHLB

stock, although these increases were partially offset by declining

bill-pay income and higher tax credit investment costs. On the

expense side, salaries and benefits were slightly lower for the

quarter but increased by $949,000, or 8%, for the year-to-date

period. For the quarter, a slight increase in actual wages and

benefits was offset by an increase in salaries expense deferred for

future recognition pursuant to FAS 91. The deferred amount was

actually lower on a year-to-date basis, and thus had the opposite

impact of contributing to higher year-to-date salaries expense. The

deferral, which reduces current-period expense, increased by

$149,000 for the third quarter but declined by $411,000 for the

first nine months of 2007 relative to 2006. Adding to the increase

in year-to-date salaries were regular annual salary increases and

the addition of employees for our newest branch in Delano.

Occupancy expense was virtually the same in the third quarter of

2007 as in the third quarter of 2006, and fell by $104,000, or 2%,

for the first nine months of 2007. Despite normal inflationary

increases and increased occupancy costs associated with the Delano

Branch which opened in March of 2007, occupancy expense didn't

change for the third quarter because of a $110,000 drop in

depreciation expense on certain fixtures and equipment which became

fully depreciated during the quarter. Year-to-date, occupancy

expense declined because increased rent and premises depreciation

were more than offset by a drop in furniture and equipment

depreciation as well as first quarter 2007 property tax refunds

resulting from re-assessments. Other non-interest expenses

increased by $591,000, or 24%, for the third quarter, and by $1.1

million, or 14%, for the first nine months of 2007 relative to the

same periods in 2006. This was caused in part by an increase in

marketing expenses, which were up by $125,000 for the quarter and

$528,000 year-to-date. Marketing expenses increased because of

costs associated with our current deposit-oriented marketing

initiatives, as projected. Also contributing to both the quarterly

and year-to-date increase in other expenses was a

conversion-related increase in credit card expenses, although these

expenses should be completely eliminated going forward. Other

significant expense increases for 2007 relative to 2006 include

postage, which is higher due to mailing costs associated with our

direct-mail marketing initiatives, consulting costs related to our

review of EFT contracts, legal costs, and directors' expenses.

Total assets declined by $7 million, or 1%, from December 31, 2006

to September 30, 2007. Significant balance sheet changes during the

first nine months of 2007 include a drop of $15 million, or 28%, in

cash and due from banks, a decline of over $6 million in fed funds

sold, which fell to zero, an increase of $19 million, or 2%, in

gross loans and leases, an increase of $18 million, or 2%, in total

deposits, and a drop of $36 million, or 15%, in other borrowings.

The lower balance of cash and due from banks is the result of a

reduction in cash items in process of collection. Most of the loan

growth for the nine months ended September 30, 2007 was centered in

commercial real estate loans, which grew by $23 million, or 6%. SBA

loans, on the other hand, fell by $5 million, or 20%, and as noted

previously, credit card balances were sold in June 2007. Prior to

the sale, we had close to $3 million in business credit card

balances that were included in commercial loans and over $8 million

in consumer credit card balances. As noted previously, the lack of

significant growth in total deposits during the first nine months

of 2007 was primarily due to the runoff of $20 million in

wholesale-sourced brokered deposits and the temporary loss of a

single $8 million deposit over quarter-end. Adding back that $8

million deposit and factoring out the decline in brokered deposits,

customer deposits generated by our branch system have effectively

increased by $46 million year-to-date. However, there has been a

shift from savings and non-interest bearing demand deposits into

interest bearing demand (NOW) accounts, money market accounts, and

time deposits. Non-interest bearing demand deposits declined by $49

million, or 18%, including the single $8 million account referenced

earlier. Savings deposits fell by $9 million, or 15%. NOW account

balances increased by $25 million, or 38%, money market accounts

increased by $29 million, or 25%, and time deposits increased by

$23 million, or 7%. Because deposits grew yet assets declined, we

were able to reduce our reliance on other borrowings by $36

million. 2006 Reclassifications To provide consistency with 2007

financial reporting there were minor reclassifications of income

statement amounts originally reported for the third quarter and

first nine months of 2006, including but not necessarily limited to

the following: Property insurance premiums totaling $31,000 for the

third quarter of 2006 and $90,000 for the first nine months of 2006

were moved from other non-interest expenses to occupancy expense.

About Sierra Bancorp Sierra Bancorp is the holding company for Bank

of the Sierra (http://www.bankofthesierra.com/), which is in its

30th year of operations and is the largest independent bank

headquartered in the South San Joaquin Valley. The Company has $1.2

billion in total assets and maintains 21 branch offices, an

agricultural credit center, an SBA center, and an online "virtual"

branch. In its April 2007 edition, US Banker magazine ranked Sierra

Bancorp as the 10th best performing publicly-traded mid-tier bank

in the nation based on three-year average return on equity, placing

us in the top 5% for banks in that category. The statements

contained in this release that are not historical facts are

forward-looking statements based on management's current

expectations and beliefs concerning future developments and their

potential effects on the Company. Readers are cautioned not to

unduly rely on forward-looking statements. Actual results may

differ from those projected. These forward-looking statements

involve risks and uncertainties including but not limited to the

health of the national and California economies, the Company's

ability to attract and retain skilled employees, customers' service

expectations, the Company's ability to successfully de ploy new

technology and gain efficiencies there from, the success of branch

expansion, changes in interest rates, loan portfolio performance,

the Company's ability to secure buyers for foreclosed properties,

and other factors detailed in the Company's SEC filings. SIERRA

BANCORP CONSOLIDATED INCOME STATEMENT 3-Month Period Ended: 9-Month

Period Ended: (in $000's, unaudited) 9/30/2007 9/30/2006 % Change

9/30/2007 9/30/2006 % Change Interest Income $22,190 $21,131 5.0%

$66,197 $59,015 12.2% Interest Expense 8,128 7,183 13.2% 23,873

17,467 36.7% Net Interest Income 14,062 13,948 0.8% 42,324 41,548

1.9% Provision for Loan & Lease Losses 700 1,051 -33.4% 2,302

3,150 -26.9% Net Int after Provision 13,362 12,897 3.6% 40,022

38,398 4.2% Service Charges 2,105 1,498 40.5% 5,434 4,493 20.9%

Loan Sale & Servicing Income 14 25 -44.0% 1,656 45 3580.0%

Other Non-Interest Income 1,245 1,276 -2.4% 3,998 3,676 8.8% Gain

(Loss) on Investments 2 9 -77.8% 14 9 55.6% Total Non- Interest

Income 3,366 2,808 19.9% 11,102 8,223 35.0% Salaries & Benefits

4,045 4,083 -0.9% 13,143 12,194 7.8% Occupancy Expense 1,701 1,703

-0.1% 4,808 4,912 -2.1% Other Non-Interest Expenses 3,096 2,505

23.6% 8,841 7,745 14.2% Total Non- Interest Expense 8,842 8,291

6.6% 26,792 24,851 7.8% Income Before Taxes 7,886 7,414 6.4% 24,332

21,770 11.8% Provision for Income Taxes 2,616 2,512 4.1% 8,254

7,319 12.8% Net Income $5,270 $4,902 7.5% $16,078 $14,451 11.3% Tax

Data Tax-Exempt Muni Income $559 $519 7.7% $1,664 $1,509 10.3%

Tax-Exempt BOLI Income $327 $142 130.3% $940 $578 62.6% Interest

Income - Fully Tax Equiv $22,491 $21,410 5.0% $67,093 $59,828 12.1%

Net Charge-Offs (Recoveries) $608 $729 -16.6% $1,686 $1,632 3.3%

PER SHARE DATA 3-Month Period Ended: 9-Month Period Ended:

(unaudited) 9/30/2007 9/30/2006 % Change 9/30/2007 9/30/2006 %

Change Basic Earnings per Share $0.54 $0.50 8.0% $1.66 $1.48 12.2%

Diluted Earnings per Share $0.53 $0.48 10.4% $1.60 $1.41 13.5%

Common Dividends $0.16 $0.14 14.3% $0.46 $0.40 15.0% Wtd. Avg.

Shares Outstanding 9,672,247 9,773,097 9,713,097 9,763,707 Wtd.

Avg. Diluted Shares 10,008,463 10,288,817 10,076,118 10,276,581

Book Value per Basic Share (EOP) $10.15 $9.08 11.8% $10.15 $9.08

11.8% Tangible Book Value per Share (EOP) $9.58 $8.51 12.6% $9.58

$8.51 12.6% Common Shares Outstanding (EOP) 9,719,919 9,786,755

9,719,919 9,786,755 KEY FINANCIAL 3-Month Period Ended: 9-Month

Period Ended: RATIOS (unaudited) 9/30/2007 9/30/2006 9/30/2007

9/30/2006 Return on Average Equity 22.16% 22.73% 23.17% 23.31%

Return on Average Assets 1.73% 1.68% 1.78% 1.74% Net Interest

Margin (Tax-Equiv.) 5.23% 5.44% 5.31% 5.66% Efficiency Ratio

(Tax-Equiv.) 49.38% 48.53% 48.87% 48.84% Net C/O's to Avg Loans

(not annualized) 0.07% 0.09% 0.19% 0.20% AVERAGE BALANCES 3-Month

Period Ended: 9-Month Period Ended: (in $000's, unaudited)

9/30/2007 9/30/2006 % Change 9/30/2007 9/30/2006 % Change Average

Assets $1,206,325 $1,155,046 4.4% $1,207,958 $1,112,817 8.5%

Average Interest- Earning Assets $1,089,233 $1,037,541 5.0%

$1,088,602 $1,000,102 8.8% Average Gross Loans & Leases

$902,928 $846,987 6.6% $899,624 $805,430 11.7% Average Deposits

$914,180 $827,117 10.5% $899,545 $821,628 9.5% Average Equity

$94,362 $85,564 10.3% $92,796 $82,879 12.0% STATEMENT OF CONDITION

End of Period: (in $000's, unaudited) 9/30/2007 12/31/2006

9/30/2006 Annual Chg ASSETS Cash and Due from Banks $38,166 $52,725

$41,870 -8.8% Securities and Fed Funds Sold 184,557 196,562 190,194

-3.0% Agricultural 12,296 13,193 12,373 -0.6% Commercial &

Industrial 135,934 133,794 138,093 -1.6% Real Estate 683,352

652,089 628,528 8.7% SBA Loans 20,820 25,946 25,637 -18.8% Consumer

Loans 54,163 54,568 55,693 -2.7% Consumer Credit Card Balances -

8,418 8,169 -100.0% Gross Loans & Leases 906,565 888,008

868,493 4.4% Deferred Loan Fees (3,242) (3,618) (3,250) -0.2% Loans

& Leases Net of Deferred Fees 903,323 884,390 865,243 4.4%

Allowance for Loan & Lease Losses (12,195) (11,579) (10,848)

12.4% Net Loans & Leases 891,128 872,811 854,395 4.3% Bank

Premises & Equipment 18,612 17,978 18,343 1.5% Other Assets

75,614 74,998 68,427 10.5% Total Assets $1,208,077 $1,215,074

$1,173,229 3.0% LIABILITIES & CAPITAL Demand Deposits $231,831

$281,024 $253,926 -8.7% NOW / Savings Deposits 142,956 127,521

124,322 15.0% Money Market Deposits 144,303 115,266 127,948 12.8%

Time Certificates of Deposit 367,489 344,634 324,798 13.1% Total

Deposits 886,579 868,445 830,994 6.7% Subordinated Debentures

30,928 30,928 46,392 -33.3% Other Interest-Bearing Liabilities

173,623 209,403 190,571 -8.9% Total Deposits & Int.- Bearing

Liab. 1,091,130 1,108,776 1,067,957 2.2% Other Liabilities 18,322

15,927 16,396 11.7% Total Capital 98,625 90,371 88,876 11.0% Total

Liabilities & Capital $1,208,077 $1,215,074 $1,173,229 3.0%

CREDIT QUALITY DATA End of Period: (in $000's, unaudited) 9/30/2007

12/31/2006 9/30/2006 Annual Chg Non-Accruing Loans $1,246 $689 $565

120.5% Over 90 Days PD and Still Accruing - - - 0.0% Foreclosed

Assets - - - 0.0% Total Non-Performing Assets $1,246 $689 $565

120.5% Non-Perf Loans to Total Loans 0.14% 0.08% 0.07% Non-Perf

Assets to Total Assets 0.10% 0.06% 0.05% Allowance for Ln Losses to

Loans 1.35% 1.30% 1.25% OTHER PERIOD-END STATISTICS End of Period:

(unaudited) 9/30/2007 12/31/2006 9/30/2006 Shareholders Equity /

Total Assets 8.2% 7.4% 7.6% Loans / Deposits 102.3% 102.3% 104.5%

Non-Int. Bearing Dep. / Total Dep. 26.1% 32.4% 30.6% DATASOURCE:

Sierra Bancorp CONTACT: Ken Taylor, EVP-CFO, or Kevin McPhaill,

EVP-Chief Banking Officer, both of Sierra Bancorp, +1-559-782-4900

or 1-888-454-BANK Web site: http://www.bankofthesierra.com/

http://www.sierrabancorp.com/

Copyright

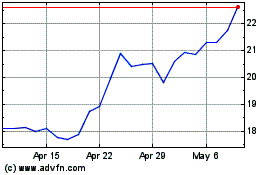

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From May 2024 to Jun 2024

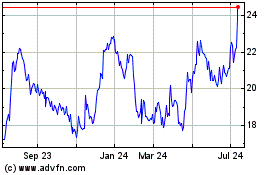

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2023 to Jun 2024