Sierra Bancorp Declares $0.14 Quarterly Cash Dividend

January 19 2007 - 12:06PM

PR Newswire (US)

PORTERVILLE, Calif., Jan. 19 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced that its Board of Directors has declared a regular

quarterly cash dividend of $0.15 per share, which is an increase of

7%, or $0.01 per share, relative to the dividend paid last quarter,

and is 15% higher than the $0.13 quarterly dividend paid a year

ago. The dividend will be paid on February 15, 2007 to shareholders

of record as of February 1, 2007. "We feel that the increase is

warranted by our record financial performance for 2006," noted

James C. Holly, President and CEO. "Furthermore, the approved

dividend keeps our dividend payout ratio at a relatively attractive

level to reward loyal shareholders, while still preserving enough

equity to allow us to capitalize on current expansion

opportunities," he added. Sierra Bancorp is the holding company for

Bank of the Sierra ( http://www.bankofthesierra.com/ ), which is in

its 30th year of operations and is the largest independent bank

headquartered in the South San Joaquin Valley. The Company has over

$1.2 billion in total assets and currently maintains twenty branch

offices, an agricultural credit center, and an SBA center. In

September 2006, Sierra Bancorp was ranked as the 13th best

performing mid-tier bank in the nation by U.S. Banker magazine,

based on three-year average return on equity. The statements

contained in this release that are not historical facts are

forward-looking statements based on management's current

expectations and beliefs concerning future developments and their

potential effects on the Company. Readers are cautioned not to

unduly rely on forward looking statements. Actual results may

differ from those projected. These forward- looking statements

involve risks and uncertainties including but not limited to the

bank's ability to maintain current dividend payments or increase

dividend payouts to shareholder, its ability to continue to

generate record financial results, changes in economic conditions,

interest rates and loan portfolio performance, and other factors

detailed in the Company's SEC filings. Sierra Bancorp undertakes no

responsibility to update or revise any forward-looking statements.

DATASOURCE: Sierra Bancorp CONTACT: Ken Taylor, EVP/CFO, or Hope

Attenhofer, SVP/Marketing Director, +1-559-782-4900, or

888-454-BANK, both of Sierra Bancorp Web site:

http://www.sierrabancorp.com/

Copyright

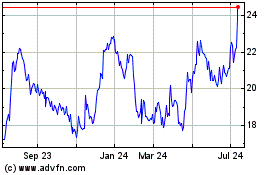

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2024 to Jul 2024

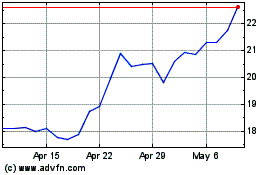

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jul 2023 to Jul 2024