PORTERVILLE, Calif., April 24 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced its financial results for the quarter ended March 31,

2006. During the first quarter of 2006, gross loan and lease

balances grew by $54 million, or 7%, surpassing the $45 million

growth in loans and leases for the entire year in 2005. Net income

for the first quarter of 2006 increased 36% to $4.5 million, or

$0.43 per diluted share, compared to $3.3 million, or $0.31 per

diluted share, in the same quarter a year ago. Sierra Bancorp

generated a return on average equity of 22.5% in the first quarter

of 2006 compared to 18.3% in the same quarter last year. "We're off

to a spirited start in 2006," remarked James C. Holly, President

and CEO. "Our Bank is really a reflection of the people who work

here," Holly stated, "and we are fortunate to have retained highly

dedicated, talented, and hard-working individuals on staff who have

created the momentum to provide such a strong launch in our 29th

year of operations." Financial Highlights The Company's improved

quarterly operating results were primarily the result of growth in

average earning assets and a higher net interest margin. Average

interest-earning assets were $57 million higher in the first

quarter of 2006 than in the first quarter of 2005, and the

Company's net interest margin was 5.85% for the first quarter of

2006 versus 5.43% in the first quarter of 2005. The following

factors contributed to the net interest margin increase: the

Company's balance sheet is asset-sensitive, and net interest income

tends to increase as short-term interest rates rise; the ratio of

average interest-free demand deposit balances to average earning

assets grew to 29% in the first quarter of 2006 from 27% in the

first quarter of 2005; and non-performing loan balances declined to

$914,000 at March 31, 2006 from $3.9 million at March 31, 2005. For

the quarter, service charges on deposits increased by $218,000, or

17%, relative to the first quarter of 2005. Service charges show

considerable improvement due primarily to the implementation of new

charges for higher-risk accounts. Loan sale and servicing income

was down 98% because of the prior-year sale of $21 million in

mortgage loans at a $527,000 gain. Other non-interest income

increased by $473,000, or 56%, due largely to the $330,000

write-down of our investment in Diversified Holdings, Inc. in the

first quarter of 2005, but year-over-year increases in core

operating income such as debit card interchange fees and leasing

income also contributed. On the expense side, salaries and benefits

were only 3% higher despite the addition of staff for our two

newest branches. The main reason for the lower-than-expected

increase is a $177,000, or 24%, increase in the deferral of salary

costs that are associated with successful loan originations. The

cost of benefits also fell by $127,000, due in large part to a

reduction in workers compensation costs. As with salaries and

benefits, occupancy expense increased by only 3%. Other

non-interest expenses declined by $329,000, or 10%. One of the

principal reasons for the drop is that marketing expenses were

$273,000 lower in 2006 than in 2005, due to a $95,000 reduction in

expenditures for a deposit program that is not being repeated in

2006 and timing differences in the payment of other promotional

expenses. Another factor in the reduction in non-interest expenses

is that OREO properties were written down by $200,000 in the first

quarter of 2005, but only by $133,000 in the first quarter of 2006.

The Company's single remaining OREO property at year-end 2005 was

sold in March, and the balance at the end of the first quarter was

zero. While it is possible that other properties may be foreclosed

upon during the remainder of the year, further OREO write-downs

during 2006 are not anticipated. Major balance sheet changes during

the first quarter of 2006 include a $54 million, or 7%, increase in

gross loans and leases, an $8 million, or 1%, drop in total

deposits, and an increase of $53 million, or 47%, in other borrowed

money. Most of the loan growth for the quarter was centered in

commercial loans, SBA loans, and real estate loans, which grew by

12%, 9%, and 7% respectively. Within real estate loans, the

strongest growth for the quarter was in loans secured by

residential properties (most of which are actually commercial loans

with residential real estate taken as collateral), which increased

by $26 million, or 20%. Commenting further on balance sheet growth,

Holly stated, "while most of the loan growth in the first quarter

was generated by more-established branches, our Reedley branch has

over $5 million in gross loans after its first full quarter of

operation, and our newly-opened office in the Bakersfield

Riverlakes area also appears poised to do well." The new branch in

Bakersfield brings the total number of branches operated by the

Company to twenty, and Holly explained that the Company's branch

expansion strategy, which allows for two to three new branches a

year, should provide a strong foundation for continued steady

growth in the future. Time certificates of deposit fell by $18

million during the quarter, and non-interest demand deposits were

down by about $2 million. On the other hand, NOW, savings, and

money market account deposits increased by a combined $12 million.

It is anticipated that recently-added deposit products targeted at

commercial customers will help reverse the decline in deposits and

provide for more balanced growth between loans and deposits in the

future. "The decline in deposits in the first quarter of 2006 is

similar to cycles the Company has experienced in the past, and

borrowings from the Federal Home Loan Bank were used to make up for

the deposit decrease and to fund loan growth," observed Ken Taylor,

Chief Financial Officer. Taylor noted further, "the Company has

ample liquidity resources in the form of brokered CD's, Federal

Home Loan Bank borrowing lines, and correspondent bank lines of

credit to fund any anticipated loan growth, although if core

deposit growth doesn't materialize as anticipated our net interest

margin could be negatively impacted by increased reliance on these

more costly wholesale sources of funding." About Sierra Bancorp

Sierra Bancorp is the holding company for Bank of the Sierra

(http://www.bankofthesierra.com/), which is in its 29th year of

operations and is the largest independent bank headquartered in the

South San Joaquin Valley. The Company has $1.1 billion in total

assets and currently maintains twenty branch offices, an

agricultural credit center, and an SBA center. In June 2005, Sierra

Bancorp was added to the Russell 2000 index based on relative

growth in market capitalization. In its July 2005 edition, US

Banker magazine ranked Sierra Bancorp as the nation's 8th best

performing publicly-traded community bank based on three-year

average return on equity. The statements contained in this release

that are not historical facts are forward-looking statements based

on management's current expectations and beliefs concerning future

developments and their potential effects on the Company. Readers

are cautioned not to unduly rely on forward-looking statements.

Actual results may differ from those projected. These

forward-looking statements involve risks and uncertainties

including but not limited to the health of the national and

California economies, the Company's ability to attract and retain

skilled employees, customers' service expectations, the Company's

ability to successfully de ploy new technology and gain

efficiencies there from, the success of branch expansion, changes

in interest rates, loan portfolio performance, the Company's

ability to secure buyers for foreclosed properties, and other

factors detailed in the Company's SEC filings. CONSOLIDATED INCOME

STATEMENT 3-Month Period Ended: (in $000's, unaudited) 3/31/2006

3/31/2005 % Change Interest Income $18,019 $14,659 22.9% Interest

Expense 4,540 2,831 60.4% Net Interest Income 13,479 11,828 14.0%

Provision for Loan & Lease Losses 1,050 1,000 5.0% Net Int

after Provision 12,429 10,828 14.8% Service Charges 1,476 1,258

17.3% Loan Sale & Servicing Income 13 560 -97.7% Other

Non-Interest Income 1,314 841 56.2% Gain (Loss) on Investments - -

0.0% Total Non-Interest Income 2,803 2,659 5.4% Salaries &

Benefits 4,191 4,066 3.1% Occupancy Expense 1,548 1,497 3.4% Other

Non-Interest Expenses 2,844 3,173 -10.4% Total Non-Interest Expense

8,583 8,736 -1.8% Income Before Taxes 6,649 4,751 39.9% Provision

for Income Taxes 2,199 1,490 47.6% Net Income $4,450 $3,261 36.5%

TAX DATA Tax-Exempt Muni Income $475 $334 42.2% Tax-Exempt BOLI

Income $185 $253 -26.9% Interest Income - Fully Tax Equiv $18,275

$14,831 23.2% NET CHARGE-OFFS $83 $191 -56.5% PER SHARE DATA

3-Month Period Ended: (unaudited) 3/31/2006 3/31/2005 % Change

Basic Earnings per Share $0.46 $0.34 35.3% Diluted Earnings per

Share $0.43 $0.31 38.7% Common Dividends $0.13 $0.11 18.2% Wtd.

Avg. Shares Outstanding 9,752,996 9,723,454 Wtd. Avg. Diluted

Shares 10,271,246 10,386,027 Book Value per Basic Share (EOP) $8.43

$7.49 12.6% Tangible Book Value per Share (EOP) $7.86 $6.92 13.6%

Common Shares Outstndg. (EOP) 9,769,880 9,775,923 KEY FINANCIAL

RATIOS 3-Month Period Ended: (unaudited) 3/31/2006 3/31/2005 Return

on Average Equity 22.46% 18.32% Return on Average Assets 1.70%

1.32% Net Interest Margin (Tax-Equiv.) 5.85% 5.43% Efficiency Ratio

(Tax-Equiv.) 51.53% 57.78% Net C/O's to Avg Loans (not annualized)

0.01% 0.03% AVERAGE BALANCES 3-Month Period Ended: (in $000's,

unaudited) 3/31/2006 3/31/2005 % Change Average Assets $1,061,229

$998,893 6.2% Average Interest-Earning Assets $953,215 $896,070

6.4% Average Gross Loans & Leases $756,109 $692,782 9.1%

Average Deposits $813,560 $755,044 7.8% Average Equity $80,347

$72,176 11.3% STATEMENT OF CONDITION End of Period: (in $000's,

unaudited) 3/31/2006 12/31/2005 3/31/2005 Annual Chg ASSETS Cash

and Due from Banks $41,627 $50,147 $35,022 18.9% Securities and Fed

Funds Sold 197,495 193,676 218,403 -9.6% Agricultural 8,642 9,898

12,519 -31.0% Commercial & Industrial 124,404 110,683 103,085

20.7% Real Estate 577,102 537,182 488,745 18.1% SBA Loans 26,463

24,190 21,659 22.2% Consumer Loans 50,268 51,006 48,868 2.9%

Consumer Credit Card Balances 8,162 8,401 8,335 -2.1% Gross Loans

& Leases 795,041 741,360 683,211 16.4% Deferred Loan &

Lease Fees (2,933) (2,250) (1,223) 139.8% Loans & Leases Net of

Deferred Fees 792,108 739,110 681,988 16.1% Allowance for Loan

& Lease Losses (10,297) (9,330) (9,651) 6.7% Net Loans &

Leases 781,811 729,780 672,337 16.3% Bank Premises & Equipment

18,128 18,055 17,353 4.5% Other Assets 63,169 61,028 59,576 6.0%

Total Assets $1,102,230 $1,052,686 $1,002,691 9.9% LIABILITIES

& CAPITAL Demand Deposits $280,866 $282,451 $241,603 16.3% NOW

/ Savings Deposits 148,124 140,989 140,400 5.5% Money Market

Deposits 112,008 107,045 115,578 -3.1% Time Certificates of Deposit

267,167 285,186 271,512 -1.6% Total Deposits 808,165 815,671

769,093 5.1% Junior Subordinated Debentures 30,928 30,928 30,928

0.0% Other Interest-Bearing Liabilities 167,228 113,861 118,720

40.9% Total Deposits & Int.- Bearing Liab. 1,006,321 960,460

918,741 9.5% Other Liabilities 13,555 13,463 10,758 26.0% Total

Capital 82,354 78,763 73,192 12.5% Total Liabilities & Capital

$1,102,230 $1,052,686 $1,002,691 9.9% CREDIT QUALITY DATA End of

Period: (in $000's, unaudited) 3/31/2006 12/31/2005 3/31/2005

Annual Chg Non-Accruing Loans $914 $309 $1,631 -44.0% Over 90 Days

PD and Still Accruing - - - 0.0% Other Real Estate Owned - 533

2,234 -100.0% Total Non-Performing Assets $914 $842 $3,865 -76.4%

Non-Perf Loans to Total Loans 0.11% 0.04% 0.24% Non-Perf Assets to

Total Assets 0.08% 0.08% 0.39% Allowance for Ln Losses to Loans

1.30% 1.26% 1.41% OTHER PERIOD-END STATISTICS End of Period:

(unaudited) 3/31/2006 12/31/2005 3/31/2005 Shareholders Equity /

Total Assets 7.5% 7.5% 7.3% Loans / Deposits 98.4% 90.9% 88.8%

Non-Int. Bearing Dep. / Total Dep. 34.8% 34.6% 31.4% DATASOURCE:

Sierra Bancorp CONTACT: Ken Taylor, EVP/CFO, or Hope Attenhofer,

SVP/Marketing Director, both of Sierra Bancorp, +1-559-782-4900 or

888-454-BANK Web site: http://www.bankofthesierra.com/

Copyright

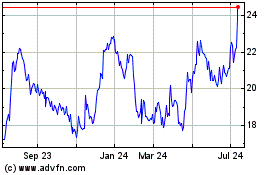

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Aug 2024 to Sep 2024

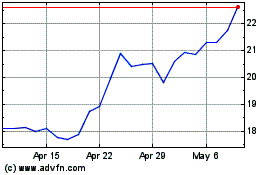

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Sep 2023 to Sep 2024