Current Report Filing (8-k)

May 30 2023 - 4:11PM

Edgar (US Regulatory)

false

0000088948

0000088948

2023-05-23

2023-05-23

0000088948

senea:CommonStockClassA025ParCustomMember

2023-05-23

2023-05-23

0000088948

senea:CommonStockClassB025ParCustomMember

2023-05-23

2023-05-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 23, 2023

SENECA FOODS CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

New York

(State or Other Jurisdiction of

Incorporation)

|

0-01989

(Commission File Number)

|

16-0733425

(IRS Employer Identification No.)

|

350 WillowBrook Office Park, Fairport, NY 14450

(Address of principal executive offices, including zip code)

(585) 495-4100

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on

Which Registered

|

|

Common Stock Class A, $0.25 Par

|

SENEA

|

NASDAQ Global Select Market

|

|

Common Stock Class B, $0.25 Par

|

SENEB

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On May 23, 2023 (the “Effective Date”), Seneca Foods Corporation, Seneca Foods, LLC, Seneca Snack Company, Green Valley Foods, as Borrowers, and certain subsidiaries of Borrowers as Guarantors (collectively, the "Company") entered into Amendment 1 (the “Amendment”) to the Second Amended and Restated Loan and Guaranty Agreement with Farm Credit East, ACA (as amended, the “Loan Agreement”). The Amendment amends and modifies certain aspects of the Company’s Second Amended and Restated Loan and Guaranty Agreement with Farm Credit East, ACA dated as of January 20, 2023 (the "Prior Agreement").

The Amendment amends, restates and replaces in its entirety Term Loan A-2 (as defined in the Loan Agreement) and provides a single advance term facility in the principal amount of $125.0 million to be combined with the existing $173.5 million Term Loan A-2 into one single $298.5 million term loan (“Amended Term Loan A-2”) as of the Effective Date. Principal payments on the Amended Term Loan A-2 in the amount of $3.75 million together with interest on the unpaid principal amount outstanding will be payable quarterly on March 1, June 1, September 1 and December 1 each year, commencing June 1, 2023. The Amendment does not change the maturity or any of the pricing terms of the Amended Term Loan A-2, which will continue to mature on January 20, 2028 and bear interest at a variable interest rate based upon SOFR plus an additional margin determined by the Company’s leverage ratio. Amended Term Loan A-2 continues to be secured by a portion of the Company’s property, plant and equipment, including additional mortgages as specified in the Amendment. The proceeds of the Amended Term Loan A-2 shall be used for working capital and general company purposes, including the repayment of loans outstanding under the Company’s revolving credit facility.

The Amendment does not change any of the terms of the Company’s Term Loan A-1 under the Loan Agreement.

The Company's obligations under the Loan Agreement are jointly and severally guaranteed by all existing and future domestic subsidiaries of the Company, subject to certain exceptions. Obligations under the Loan Agreement may be declared due and payable upon the occurrence of certain events of default, as defined in the Loan Agreement, including failure to pay any obligations when due and payable, failure to comply with any covenant or representation of any loan document, any change of control, cross-defaults and certain other events as set forth in the Loan Agreement, with grace periods in some cases.

The Loan Agreement contains restrictive covenants usual and customary for loans of its type, which include, with specified exceptions, limitations on the ability of the Company and its subsidiaries to engage in certain business activities, incur debt, have liens, pay dividends or make other distributions, enter into affiliate transactions, consolidate, merge or acquire or dispose of assets, and make certain investments, acquisitions and loans. The Loan Agreement also requires the Company to satisfy certain financial covenants including minimum EBITDA and minimum tangible net worth which apply to both term loans described above.

The foregoing description of the Amendment is not complete and is qualified in its entirety by the terms and provisions of the Amendment, a copy of which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation

|

On May 23, 2023, the Company entered into Amendment 1 to the Second Amended and Restated Loan and Guaranty Agreement. The description of the terms of the Amendment set forth above in Item 1.01 is hereby incorporated by reference into this Item.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

Exhibit

|

|

|

|

No.

|

|

Description

|

| |

|

|

|

10.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SENECA FOODS CORPORATION

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Michael S. Wolcott

|

|

| |

|

Michael S. Wolcott

|

|

| |

|

Chief Financial Officer

|

|

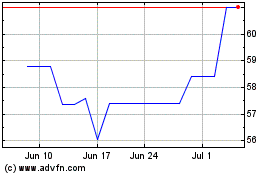

Seneca Foods (NASDAQ:SENEB)

Historical Stock Chart

From Apr 2024 to May 2024

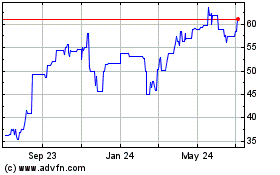

Seneca Foods (NASDAQ:SENEB)

Historical Stock Chart

From May 2023 to May 2024