false

0000714256

0000714256

2024-05-10

2024-05-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 10, 2024

| SANARA

MEDTECH INC.

|

| (Exact

name of registrant as specified in its charter) |

| Texas |

|

001-39678 |

|

59-2219994 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File Number) |

|

Identification

No.) |

1200

Summit Avenue, Suite 414

Fort

Worth, Texas |

|

76102 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (817) 529-2300

(Former

name or former address, if changed since last report)

Not

Applicable

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

SMTI |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

May 13, 2024, Sanara MedTech Inc. (the “Company”) issued a press release announcing its financial results for the quarter

ended March 31, 2024. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and

is incorporated by reference herein.

In

addition, the Company is furnishing a copy of an earnings presentation (the “Presentation”) that the Company intends to use,

in whole or in part, in one or more meetings with investors or analysts, including in a webcast on May 14, 2024 at 9:00 a.m. (Eastern

Time). A copy of the Presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated by reference herein.

The

information in Item 2.02 of this

Current Report on Form 8-K, including Exhibits 99.1 and 99.2 furnished hereto, shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the

Exchange Act, except as expressly set forth in such filing.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Resignation

of Chief Executive Officer

On

May 10, 2024 (the “Effective Date”), Zachary B. Fleming delivered notice to the Board of Directors of the Company (the

“Board”) that he is resigning from his position as Chief Executive Officer of the Company, effective immediately. Mr.

Fleming’s resignation was not in connection with any disagreement with the Company on any matter relating to the

Company’s operations, policies or practices. Effective as of the Effective Date, Mr. Fleming’s amended and restated

employment agreement (the “Fleming Employment Agreement”) terminated, except that certain surviving customary

confidentiality provisions and non-disparagement covenants will remain in full force and effect. The Company intends to negotiate a

separation agreement (the “Separation Agreement”) with Mr. Fleming to set forth certain separation benefits for Mr.

Fleming and provide for certain restrictive covenants in favor of the Company.

In

connection with Mr. Fleming’s resignation, the Board modified the vesting provisions of Mr. Fleming’s restricted stock award

agreements such that fifty percent (50%) of the unvested shares of restricted stock that have previously been granted to Mr. Fleming

under such award agreements shall continue to vest on the same time schedule in the applicable restricted stock agreements; provided

that Mr. Fleming enters into the Separation Agreement (which must be acceptable to the Company) and, in lieu of the continued service

requirement, Mr. Fleming continues to comply with the continuing provisions of the Fleming Employment Agreement, the restricted stock

agreements and the restrictive covenants set forth in the Separation Agreement.

Appointment

of New Chief Executive Officer

On

May 12, 2024, the Board appointed Ronald T. Nixon, the Company’s Executive Chairman, as the Chief Executive Officer of the Company,

effective immediately, to serve in such position until his successor is elected and qualified.

Mr.

Nixon, age 68, has been a director of the Company since March 2019 and has served as Executive Chairman of the Board since May 2019.

As Executive Chairman, Mr. Nixon has been involved in strategic planning, execution and identifying prospective partnerships and acquisition

opportunities for the Company. Mr. Nixon is the Founder and Managing Partner of The Catalyst Group, Inc. (“Catalyst”), a

private investment firm that provides growth capital and strategic advisory services to private companies. Mr. Nixon serves on the board

of directors of LHC Group, Inc. as well as a number of private companies, including Superior Plant Rentals LLC, Rochal Industries, LLC

(“Rochal”), Next Level Medical LLC and Aviditi Advisors LLC. Mr. Nixon also serves on the Engineering Advisory Board for

the Cockrell School of Engineering at the University of Texas at Austin. Mr. Nixon holds a Bachelor’s degree in Mechanical Engineering

from the University of Texas at Austin and is a registered professional engineer (inactive) in Texas.

There

are no arrangements or understandings between Mr. Nixon and any other persons pursuant to which he was selected to serve as the Company’s

Chief Executive Officer. There is no family relationship between Mr. Nixon and any director or executive officer of the Company. Other

information regarding Mr. Nixon required by Item 404(a) of Regulation S-K was previously disclosed in the Company’s definitive

proxy statement on Schedule 14A filed with the Securities and Exchange Commission on April 15, 2024, and such information is incorporated

by reference herein.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date: |

May

13, 2024 |

|

|

| |

|

|

|

| |

|

Sanara

MedTech Inc. |

| |

|

|

|

| |

|

By: |

/s/

Michael D. McNeil |

| |

|

Name: |

Michael D. McNeil |

| |

|

Title: |

Chief Financial Officer |

Exhibit

99.1

Sanara

MedTech Inc. Announces First Quarter 2024 Results

FORT

WORTH, TX / GlobeNewswire / May 13, 2024 / Sanara MedTech Inc. Based in Fort Worth, Texas, Sanara MedTech Inc. (“Sanara,”

the “Company,” “we,” “our” or “us”) (NASDAQ: SMTI), a medical technology company focused

on developing and commercializing transformative technologies to improve clinical outcomes and reduce healthcare expenditures in the

surgical, chronic wound and skincare markets, announced today its strategic, operational and financial results for the quarter ended

March 31, 2024.

Ron

Nixon, Sanara’s CEO, stated, “Over the course of 2023, we made significant advancements in data analytics, sales force optimization,

and our sales processes. These improvements and the momentum we achieved in the fourth quarter of 2023 helped us exceed our internal

forecast for the first quarter, and, we believe, position us to continue to build upon the success the team has achieved in previous

periods. In the first quarter of 2024, Sanara continued to execute on its strategic and operational plans and realized its tenth consecutive

record revenue quarter. Subsequent to the end of the quarter, the Company’s former CEO resigned and the Company took steps to strengthen

its cash resources as well as add to the executive team.”

Strategic

and Operational Highlights in the First Quarter 2024

| ● | In

the first quarter of 2024, the Company generated a record $18.5 million in sales, representing

a tenth consecutive record revenue quarter for the Company. |

| ● | For

the three months ended March 31, 2024, the Company had a net loss of $1.8 million, compared

to a net loss of $1.2 million for the three months ended March 31, 2023. The Company generated

Adjusted EBITDA* of $0.3 million for the three months ended March 31, 2024, compared to negative

Adjusted EBITDA of $0.3 million for the three months ended March 31, 2023. |

| ● | During

the trailing twelve-month period, the Company’s products were sold in over 1,080 facilities

across 34 states plus the District of Columbia. The Company’s products were contracted

or approved to be sold in more than 3,000 hospitals/ambulatory surgery centers as of March

31, 2024. |

| ● | The

Company made significant progress in the areas of intellectual property and the manufacturing

process for its CellerateRX® product. |

| ● | Subsequent

to the end of the quarter, the Company announced the appointments of Jake Waldrop as Chief

Operating Officer and Tyler Palmer as Chief Corporate Development and Strategy Officer. |

| ● | Subsequent

to the end of the quarter, the Company announced that it has entered into a $55.0 million

non-dilutive term loan agreement with CRG Servicing LLC, an affiliate of CRG LP, a healthcare

focused investment fund, to support the Company’s growth initiatives in 2024 and 2025.

The Company received $15.0 million in gross proceeds at closing and, subject to certain conditions,

has the option to draw up to $40.0 million in additional funds in two tranches before June

30, 2025. |

| ● | Subsequent

to the end of the quarter, former CEO Zach Fleming delivered notice of his resignation, effective

May 10, 2024. Ron Nixon, Sanara’s Chairman, who has been deeply involved in developing

and executing the Company’s strategic vision, has been appointed CEO by Sanara’s

Board of Directors. |

First

Quarter 2024 Sales Analysis

In

the first quarter of 2024, Sanara focused on increasing the use of its products in new and existing territories, expanding usage in new

specialty areas, and increasing per facility sales. For the quarter ended March 31, 2024, Sanara generated net revenue of $18.5 million

compared to net revenue of $15.5 million for the quarter ended March 31, 2023, a 19% increase from the prior year period. The higher

net revenue in the first quarter of 2024 was due to increased sales of soft tissue repair products (CellerateRX® Surgical Activated

Collagen®, FORTIFY TRG® Tissue Repair Graft, FORTIFY FLOWABLE® Extracellular Matrix, and TEXAGEN® Amniotic Membrane Allograft)

as a result of increased market penetration, geographic expansion and the Company’s continuing strategy to expand independent distribution

network in both new and existing U.S. markets.

Earnings

Analysis

Sanara

reported a net loss of $1.8 million for the quarter ended March 31, 2024, compared to a net loss of $1.2 million for the quarter ended

March 31, 2023. The higher loss in 2024 was primarily due to increased SG&A costs related to direct sales and marketing expenses

and amortization expenses due to amortization of our acquired intangible assets related to our Applied Nutritionals asset acquisition.

These increased costs were partially offset by higher gross profit and lower R&D expenses. The Company generated Adjusted EBITDA

of $0.3 million for the quarter ended March 31, 2024, compared to negative Adjusted EBITDA of $0.3 million for the quarter ended March

31, 2023.

*

Adjusted EBITDA is a non-GAAP financial measure. See the discussion below under the heading “Use of Non-GAAP Financial Measures”

and the reconciliations at the end of this release for additional information.

Use

of Non-GAAP Financial Measures

To

supplement the Company’s financial information presented in accordance with generally accepted accounting principles in the United

States (“GAAP”), we present certain non-GAAP financial measures in this press release and on the related teleconference call,

including Adjusted EBITDA. The Company’s management uses these non-GAAP financial measures, both internally and externally, to

assess and communicate the financial performance of the Company. The Company defines Adjusted EBITDA as net loss excluding interest expense/income,

provision/benefit for income taxes, depreciation and amortization, non-cash stock compensation expense, change in fair value of earnout

liabilities, effects of noncontrolling interests, and gains/losses on the disposal of property and equipment. The Company’s believes

Adjusted EBITDA is useful to investors because it facilitates comparisons of its core business operations across periods on a consistent

basis. Accordingly, the Company adjusts for certain items, such as change in fair value of earnout liabilities, when calculating Adjusted

EBITDA because the Company believes that such items are not related to the Company’s core business operations.

The

Company’s non-GAAP financial measures are not in accordance with, nor an alternative for, measures conforming to GAAP and may be

different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures are not based on any

comprehensive set of accounting rules or principles. The Company continues to provide all information required by GAAP, but it believes

that evaluating its ongoing operating results may not be as useful if an investor or other user is limited to reviewing only GAAP financial

measures. The Company does not, nor does it suggest that investors should, consider these non-GAAP financial measures in isolation from,

or as a substitute for, financial information prepared in accordance with GAAP. Material limitations associated with the use of such

measures include that they do not reflect all costs included in operating expenses and may not be comparable with similarly named financial

measures of other companies. Furthermore, these non-GAAP financial measures are based on subjective determinations of management regarding

the nature and classification of events and circumstances. The Company presents these non-GAAP financial measures to provide investors

with information to evaluate the Company’s operating results in a manner similar to how management evaluates business performance.

To compensate for any limitations in such non-GAAP financial measures, management believes that it is useful in understanding and analyzing

the results of the business to review both GAAP information and the related non-GAAP financial measures. Whenever the Company uses a

non-GAAP financial measure, it provides a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial

measure. Investors are encouraged to review and consider these reconciliations.

Conference

Call

Sanara

will host a conference call on Tuesday, May 14, 2024, at 9:00 a.m. Eastern Time. The toll-free number to call for this teleconference

is 888-506-0062 (international callers: 973-528-0011) and the access code is 253700. A telephonic replay of the conference call will

be available through Tuesday, May 28, 2024, by dialing 877-481-4010 (international callers: 919-882-2331) and entering the replay passcode:

50526.

A

live webcast of Sanara’s conference call will be available under the Investor Relations section of the Company’s website,

www.SanaraMedTech.com. A one-year online replay will be available after the conclusion of the live broadcast.

About

Sanara MedTech Inc.

With

a focus on improving patient outcomes through evidence-based healing solutions, Sanara MedTech Inc. markets, distributes and develops

surgical, wound and skincare products for use by physicians and clinicians in hospitals, clinics and all post-acute care settings and

offers wound care and dermatology virtual consultation services via telemedicine. Sanara’s products are primarily sold in the North

American advanced wound care and surgical tissue repair markets. Sanara markets and distributes CellerateRX® Surgical Activated Collagen®,

FORTIFY TRG® Tissue Repair Graft and FORTIFY FLOWABLE® Extracellular Matrix as well as a portfolio of advanced biologic products

focusing on ACTIGEN™ Verified Inductive Bone Matrix, ALLOCYTE™ Plus Advanced Viable Bone Matrix, BiFORM® Bioactive Moldable

Matrix, TEXAGEN® Amniotic Membrane Allograft, and BIASURGE® Advanced Surgical Solution to the surgical market. In addition, the

following products are sold in the wound care market: BIAKŌS® Antimicrobial Skin and Wound Cleanser, BIAKŌS® Antimicrobial

Wound Gel, BIAKŌS® Antimicrobial Skin and Wound Irrigation Solution and HYCOL® Hydrolyzed Collagen. Sanara’s pipeline

also contains potentially transformative product candidates for mitigation of opportunistic pathogens and biofilm, wound re-epithelialization

and closure, necrotic tissue debridement and cell compatible substrates. The Company believes it has the ability to drive its pipeline

from concept to preclinical and clinical development while meeting quality and regulatory requirements. Sanara is constantly seeking

long-term strategic partnerships with a focus on products that improve outcomes at a lower overall cost.

Information

about Forward-Looking Statements

The

statements in this press release that do not constitute historical facts are “forward-looking statements,” within the meaning

of and subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. These statements may be identified

by terms such as “aims,” “anticipates,” “believes,” contemplates,” “continue,”

“could,” “estimates,” “expect,” “forecast,” “guidance,” “intend,”

“may,” “plan,” “possible,” “potential,” “predicts,” “preliminary,”

“projects,” “seeks,” “should,” “targets,” “will” or “would,”

or the negatives of these terms, variations of these terms or other similar expressions. These forward-looking statements include, among

others, statements regarding the development of new products, the timing of commercialization of our products, the regulatory approval

process and expansion of the Company’s business in telehealth and wound care. These items involve risks, contingencies and uncertainties

such as our ability to build out our executive team, our ability to identify and effectively utilize the net proceeds of the term loan

to support the Company’s growth initiatives, the extent of product demand, market and customer acceptance, the effect of economic

conditions, competition, pricing, uncertainties associated with the development and process for obtaining regulatory approval for new

products, the ability to consummate and integrate acquisitions, and other risks, contingencies and uncertainties detailed in the Company’s

SEC filings, which could cause the Company’s actual operating results, performance or business plans or prospects to differ materially

from those expressed in, or implied by these statements.

All

forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to revise any of

these statements to reflect the future circumstances or the occurrence of unanticipated events, except as required by applicable securities

laws.

Investor

Contact:

Callon

Nichols, Director of Investor Relations

713-826-0524

CNichols@sanaramedtech.com

SOURCE:

Sanara MedTech Inc.

SANARA

MEDTECH INC. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

| | |

(Unaudited) | | |

| |

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 2,828,234 | | |

$ | 5,147,216 | |

| Accounts receivable, net | |

| 9,194,799 | | |

| 8,474,965 | |

| Accounts receivable – related parties | |

| 23,002 | | |

| 8,400 | |

| Royalty receivable | |

| - | | |

| 49,344 | |

| Inventory, net | |

| 4,229,150 | | |

| 4,717,533 | |

| Prepaid and other assets | |

| 911,594 | | |

| 608,411 | |

| Total current assets | |

| 17,186,779 | | |

| 19,005,869 | |

| | |

| | | |

| | |

| Long-term assets | |

| | | |

| | |

| Intangible assets, net | |

| 43,953,610 | | |

| 44,926,061 | |

| Goodwill | |

| 3,601,781 | | |

| 3,601,781 | |

| Investment in equity securities | |

| 3,084,278 | | |

| 3,084,278 | |

| Right of use assets – operating leases | |

| 1,894,687 | | |

| 1,995,204 | |

| Property and equipment, net | |

| 1,190,805 | | |

| 1,257,956 | |

| Total long-term assets | |

| 53,725,161 | | |

| 54,865,280 | |

| | |

| | | |

| | |

| Total assets | |

$ | 70,911,940 | | |

$ | 73,871,149 | |

| | |

| | | |

| | |

| Liabilities and shareholders’ equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,191,816 | | |

$ | 1,924,082 | |

| Accounts payable – related parties | |

| 87,116 | | |

| 77,805 | |

| Accrued bonuses and commissions | |

| 6,893,381 | | |

| 7,676,770 | |

| Accrued royalties and expenses | |

| 2,288,428 | | |

| 2,047,678 | |

| Earnout liabilities – current | |

| 979,488 | | |

| 1,100,000 | |

| Current portion of debt | |

| 928,571 | | |

| 580,357 | |

| Operating lease liabilities – current | |

| 377,273 | | |

| 361,185 | |

| Total current liabilities | |

| 12,746,073 | | |

| 13,767,877 | |

| | |

| | | |

| | |

| Long-term liabilities | |

| | | |

| | |

| Long-term debt, net of current portion | |

| 8,767,991 | | |

| 9,113,123 | |

| Earnout liabilities – long-term | |

| 2,777,835 | | |

| 2,723,001 | |

| Operating lease liabilities – long-term | |

| 1,626,130 | | |

| 1,737,445 | |

| Other long-term liabilities | |

| 1,982,345 | | |

| 1,941,686 | |

| Total long-term liabilities | |

| 15,154,301 | | |

| 15,515,255 | |

| | |

| | | |

| | |

| Total liabilities | |

| 27,900,374 | | |

| 29,283,132 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Common Stock: $0.001 par value, 20,000,000 shares authorized; 8,622,739 issued and outstanding as of March 31, 2024 and 8,535,239 issued and outstanding as of December 31, 2023 | |

| 8,623 | | |

| 8,535 | |

| Additional paid-in capital | |

| 73,180,208 | | |

| 72,860,556 | |

| Accumulated deficit | |

| (29,898,146 | ) | |

| (28,036,814 | ) |

| Total Sanara MedTech shareholders’ equity | |

| 43,290,685 | | |

| 44,832,277 | |

| Equity attributable to noncontrolling interest | |

| (279,119 | ) | |

| (244,260 | ) |

| Total shareholders’ equity | |

| 43,011,566 | | |

| 44,588,017 | |

| Total liabilities and shareholders’ equity | |

$ | 70,911,940 | | |

$ | 73,871,149 | |

SANARA

MEDTECH INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Net Revenue | |

$ | 18,536,638 | | |

$ | 15,521,917 | |

| | |

| | | |

| | |

| Cost of goods sold | |

| 1,890,046 | | |

| 2,125,659 | |

| | |

| | | |

| | |

| Gross profit | |

| 16,646,592 | | |

| 13,396,258 | |

| | |

| | | |

| | |

| Operating expenses | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 16,192,259 | | |

| 12,969,069 | |

| Research and development | |

| 946,298 | | |

| 1,317,324 | |

| Depreciation and amortization | |

| 1,105,420 | | |

| 778,875 | |

| Change in fair value of earnout liabilities | |

| (65,678 | ) | |

| (452,687 | ) |

| Total operating expenses | |

| 18,178,299 | | |

| 14,612,581 | |

| | |

| | | |

| | |

| Operating loss | |

| (1,531,707 | ) | |

| (1,216,323 | ) |

| | |

| | | |

| | |

| Other expense | |

| | | |

| | |

| Interest expense and other | |

| (267,336 | ) | |

| (6 | ) |

| Total other expense | |

| (267,336 | ) | |

| (6 | ) |

| | |

| | | |

| | |

| Net loss | |

| (1,799,043 | ) | |

| (1,216,329 | ) |

| | |

| | | |

| | |

| Less: Net loss attributable to noncontrolling interest | |

| (34,859 | ) | |

| (38,429 | ) |

| | |

| | | |

| | |

| Net loss attributable to Sanara MedTech shareholders | |

$ | (1,764,184 | ) | |

$ | (1,177,900 | ) |

| | |

| | | |

| | |

| Net loss per share of common stock, basic and diluted | |

$ | (0.21 | ) | |

$ | (0.14 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding, basic and diluted | |

| 8,419,528 | | |

| 8,173,784 | |

SANARA

MEDTECH INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED)

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (1,799,043 | ) | |

$ | (1,216,329 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,105,420 | | |

| 778,875 | |

| Bad debt expense | |

| 65,000 | | |

| 36,000 | |

| Inventory obsolescence | |

| 95,235 | | |

| 30,511 | |

| Share-based compensation | |

| 803,386 | | |

| 597,305 | |

| Noncash lease expense | |

| 100,517 | | |

| 76,545 | |

| Accretion of finance liabilities | |

| 58,834 | | |

| - | |

| Amortization of debt issuance costs | |

| 3,083 | | |

| - | |

| Change in fair value of earnout liabilities | |

| (65,678 | ) | |

| (452,687 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable, net | |

| (735,490 | ) | |

| 352,102 | |

| Accounts receivable – related parties | |

| (14,602 | ) | |

| 74,602 | |

| Inventory, net | |

| 393,148 | | |

| 86,785 | |

| Prepaid and other assets | |

| (303,182 | ) | |

| (361,719 | ) |

| Accounts payable | |

| (732,266 | ) | |

| 405,360 | |

| Accounts payable – related parties | |

| 9,311 | | |

| (10,747 | ) |

| Accrued royalties and expenses | |

| 300,574 | | |

| (112,774 | ) |

| Accrued bonuses and commissions | |

| (783,390 | ) | |

| (1,949,325 | ) |

| Operating lease liabilities | |

| (95,227 | ) | |

| (75,817 | ) |

| Net cash used in operating activities | |

| (1,594,370 | ) | |

| (1,741,313 | ) |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (65,818 | ) | |

| (27,705 | ) |

| Proceeds from disposal of property and equipment | |

| - | | |

| 650 | |

| Net cash used in investing activities | |

| (65,818 | ) | |

| (27,055 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Equity offering net proceeds | |

| - | | |

| 751,752 | |

| Net settlement of equity-based awards | |

| (580,794 | ) | |

| (655,942 | ) |

| Cash payment of finance and earnout liabilities | |

| (78,000 | ) | |

| - | |

| Net cash provided by (used in) financing activities | |

| (658,794 | ) | |

| 95,810 | |

| Net decrease in cash | |

| (2,318,982 | ) | |

| (1,672,558 | ) |

| Cash, beginning of period | |

| 5,147,216 | | |

| 8,958,995 | |

| Cash, end of period | |

$ | 2,828,234 | | |

$ | 7,286,437 | |

| | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | 205,591 | | |

$ | 6 | |

| Supplemental noncash investing and financing activities: | |

| | | |

| | |

| Equity offering accrued proceeds | |

| - | | |

| 282,010 | |

| Right of use assets obtained in exchange for lease obligations | |

| - | | |

| 1,369,164 | |

Reconciliation

of GAAP to Non-GAAP Financial Measures

Reconciliation

of Net Loss to Adjusted EBITDA (Unaudited):

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Net Loss | |

$ | (1,764,184 | ) | |

$ | (1,177,900 | ) |

| Adjustments | |

| | | |

| | |

| Interest expense and other | |

| 267,336 | | |

| 6 | |

| Depreciation and amortization | |

| 1,105,420 | | |

| 778,875 | |

| Noncash share-based compensation | |

| 803,386 | | |

| 597,305 | |

| Change in fair value of earnout liabilities | |

| (65,678 | ) | |

| (452,687 | ) |

| Noncontrolling interest | |

| (34,859 | ) | |

| (38,429 | ) |

| Adjusted EBITDA | |

$ | 311,421 | | |

$ | (292,830 | ) |

Exhibit

99.2

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

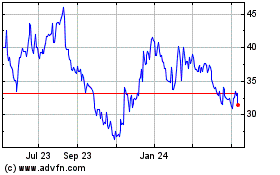

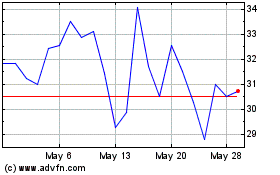

Sanara MedTech (NASDAQ:SMTI)

Historical Stock Chart

From Apr 2024 to May 2024

Sanara MedTech (NASDAQ:SMTI)

Historical Stock Chart

From May 2023 to May 2024