Current Report Filing (8-k)

December 23 2014 - 9:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event Reported): December 23, 2014

Rand Capital Corporation

(Exact Name of Registrant as Specified in Charter)

| New York |

|

811-1825 |

|

16-0961359 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

| 2200 Rand Building, Buffalo, NY |

14203 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant's telephone number, including area code: 716-853-0802

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On December 23, 2014, Rand Capital Corporation (RAND) announced that it received $10.1 million in total proceeds from the recent sale of a portfolio company.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release of Rand Capital Corporation dated December 23, 2014

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: December 23, 2014 |

Rand Capital Corporation

|

|

|

By: |

/s/ DANIEL P. PENBERTHY

Daniel P. Penberthy

EVP/CFO |

EXHIBIT 99.1

Rand Capital to Record Proceeds of $10.1 Million

-

Provides a greater than 5.5 times return on invested capital

-

Contributes to Rand's SBIC achieving a 12-year return of over 20%

BUFFALO, N.Y., Dec. 23, 2014 (GLOBE NEWSWIRE) -- Rand Capital Corporation (Nasdaq:RAND) ("Rand"), a business development company that makes venture capital investments in companies with emerging product, service or technology concepts, announced that it received $10.1 million in total proceeds from the recent sale of a portfolio company. The portfolio company represented approximately 9% of Rand's portfolio at the end of the third quarter. Rand had a 4% equity ownership in the company, in which it initially invested in 2011. Rand's internal rate of return (IRR) for this asset was over 75%, representing a 5.5 times return on invested capital.

Allen ("Pete") F. Grum, President and Chief Executive Officer of Rand Capital, stated, "This recent sale demonstrates the success we have had with our investments, particularly over the last 12 years. Our success has been the result of Rand SBIC, which we established in 2002. It has enabled us to participate in the Small Business Administration's (SBA) Small Business Investment Company (SBIC) program as a funding source. Over that time, the SBIC portfolio has achieved an approximate return of over 20%. Our focus remains on finding companies with strong management teams that need capital for early market entry or expansion in order to commercialize a new or unique product or service."

Rand's $30 million portfolio includes 27 active companies. In addition, Rand has approximately $13 million in cash, or approximately $2 per share, for future investments.

ABOUT RAND CAPITAL

Rand Capital is a publicly held Business Development Company (BDC), and its wholly-owned subsidiary is licensed by the U.S. Small Business Administration (SBA) as a Small Business Investment Company (SBIC). Rand focuses its investments in early or expansion stage companies with strong leadership that are bringing to market new or unique products, technologies or services that have a high potential for growth. Additional information can be found at the Company's website where it regularly posts information: www.randcapital.com.

Safe Harbor Statement

This news release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning future revenue and earnings, involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Corporation to differ materially from the results expressed or implied by such statements, including general economic and business conditions, conditions affecting the valuation of the Corporation's portfolio, the timing and opportunity for investments or divestitures as well as conditions affecting the portfolio companies' markets, competitor responses, and market acceptance of their products and services and other factors disclosed in the Corporation's periodic reports filed with the Securities and Exchange Commission. Consequently, such forward looking statements should be regarded as the Corporation's current plans, estimates and beliefs. The Corporation assumes no obligation to update the forward-looking information contained in this release.

CONTACT: Allen ("Pete") F. Grum

President & CEO

716.853.0802

pgrum@randcapital.com

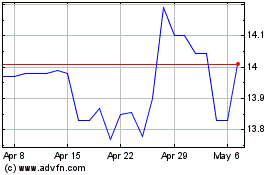

Rand Capital (NASDAQ:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

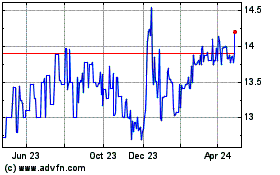

Rand Capital (NASDAQ:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024