Patriot National Bancorp, Inc. (“Patriot,” “Bancorp” or the

“Company”) (NASDAQ: PNBK), the parent company of Patriot Bank, N.A.

(the “Bank”), today announced pretax loss of $1.4 million (net

loss of $1.1 million), or $0.27 basic and diluted loss per share

for the quarter ended March 31, 2020. Concurrently, the

institution’s total assets increased 2% to $999.6 million, net loan

portfolio increased 0.7%, deposits grew 4.4%, and net interest

income was up 1.9% for the quarter ended March 31, 2020 as compared

to the fourth quarter of 2019.

In the first quarter of 2020, total assets

increased to $999.6 million, up 2%, at March 31, 2020, as compared

to $979.8 million at December 31, 2019. Net Loan portfolio

increased $5.9 million or 0.7%, from $802.0 million at December 31,

2019 to $807.9 million at March 31, 2020. Deposits increased $33.7

million or 4.4%, from $769.5 million at December 31, 2019 to $803.2

million at March 31, 2020.

In its 2019 Form 10-K filed on April 29, 2020,

Patriot reported a net loss of $2.8 million or $0.72 per share in

the full year 2019, compared with net income of $3.2 million ($0.82

per share) in 2018.

In connection with the COVID-19 impact on its

customer base, staff and the financial community, Patriot has taken

the following actions:

- All branches have remained open

with customers re-directed to non-contact ATMs and Live Banker

ATMs. Lobbies have been closed and customers welcomed by

appointment only. Staff is available to handle all banking

matters, as necessary.

- Daily branch staffing rotation

schedules have been reduced. Staffing schedules have also been

revised with expanded work at home arrangements, when practical, to

better protect employees.

- Patriot’s on-line banking services

are being optimized, with expanded customer call center staff to

better serve customers’ needs and meet significantly higher

transaction volumes from Live Banker ATMs.

- We have connected with our borrower

base in the context of the Coronavirus Aid, Relief and Economic

Security (“CARES”) Act, resulting in requests for payment relief on

loan balances totaling approximately $218.2 million, predominately

commercial real estate loans and commercial industrial loans.

- The Company continues to thoroughly

evaluate incoming deferral requests and if appropriate, will grant

payment deferrals considering regulatory guidance.

The earnings decline in first quarter 2020 was

primarily due to a material increase in provision for loan losses

of $804,000 due primarily to the impact of COVID-19. Fourth

quarter 2019 results had also been negatively impacted by an

increase in loan loss provisions of $1.8 million primarily

associated with a single commercial real estate loan that was

restructured in December of 2019, the inability to successfully

execute SBA loan sales, and higher operating costs.

Michael Carrazza, Patriot’s Chairman and interim

CEO stated: “The past six months have been a challenging

time. Our Allowance for Loan Losses significantly increased

as a result of a single commercial loan and the impact of the

COVID-19 pandemic. In efforts to protect capital given the

uncertainties surrounding the COVID-19 situation, we promptly

adjusted our strategic plan by limiting loan growth, realigning

management resources and further reducing operating expenses.

Loan originations will continue, albeit on a limited basis, until

future uncertainty and the impact of the COVID-19 pandemic are

mitigated.

“In parallel, we have initiated changes at the

senior management level, including the search for a seasoned

community bank leader as our candidate to lead day-to-day

operations as President and CEO. We have identified a

candidate and are currently waiting for the required regulatory

non-objection before proceeding to finalize the appointment.

Lastly, each business unit has undergone heavy analysis of unit

profitability and realignment in addition to material

enterprise-wide cost reductions from the board level down.”

Mr. Carrazza added: “The bank’s foundation

remains strong. We are looking forward to soon naming a new

President and CEO to oversee operations and several new initiatives

we have underway. Our capital ratios continue to receive the

‘well-capitalized’ designation, while the aforementioned strategic

changes are expected to result in a strengthening of those ratios

over the balance of the year. In addition, our SBA and

prepaid card businesses retain untapped potential, which can

provide a significant boost to future growth in profitability.”

Financial Results

As of March 31, 2020, total assets were $999.6

million, as compared to $979.8 million at December 31, 2019 and

$953.1 million at March 31, 2019, for a total asset growth of 4.9%

over the past 12 months. Net loans receivable totaled $807.9

million, as compared to $802.0 million at December 31, 2019 and

$780.7 million at March 31, 2019, up 3.5% over the past 12 months.

Deposits totaled $803.2 million at March 31, 2020, as compared to

$769.5 million at December 31, 2019 and $752.8 million at March 31,

2019, a 6.7% increase over the past 12 months.

Net interest income was $6.3 million in the

first quarter of 2020, an increase of 1.9% from the fourth quarter

of 2019, and a decline of 0.6% from the first quarter of 2019.

Net interest margin was 2.72% in the first

quarter of 2020, as compared to 2.65% in the fourth quarter of 2019

and 2.88% in the first quarter of 2019. The decline in net

interest margin as compared to the first quarter of 2019 reflects

the increase in retail deposit costs associated with an

increasingly competitive local rate environment and the increase in

the rate paid on FHLB borrowings associated with the conversion of

certain borrowings from a low variable initial rate to a higher

fixed rate. This was partially offset by a higher loan volume.

The provision for loan losses in the first

quarter of 2020 was $804,000, as compared to $1.8 million in the

fourth quarter of 2019 and $165,000 in the first quarter of 2019.

The 2020 increase as compared to the first quarter of 2019 was

primarily due to an increase in the specific reserve for a cash

flow-dependent loan and additional reserve attributable to

COVID-19. In the fourth quarter of 2019, the provision for loan

losses included an additional allowance of loan loss reserve of

$1.5 million in connection with accounting for one troubled debt

restructuring.

Noninterest income was $421,000 in the first

quarter of 2020, 3.2% higher than the fourth quarter of 2019, and

43.6% lower than the first quarter of 2019. The decrease in

noninterest income as compared to the first quarter of 2019 was

due to lower realized gains on the sale of SBA loans of $368,000 in

the first quarter of 2020. Noninterest expense was $7.4

million in the first quarter of 2020, 8.4% higher than the fourth

quarter of 2019, and 14.3% higher than the first quarter of 2019.

The increase in non-interest expense in 2020 was primarily related

to higher staff salaries and benefits for the build-up of the SBA

team, new deposit initiatives, and expansion of credit, finance and

compliance support functions.

The income tax benefit was $359,000 in the first

quarter of 2020, representing an effective tax rate of 25%.

As of March 31, 2020, shareholders’ equity was

$64.6 million, a decrease of $2.4 million, as compared to December

31, 2019. Patriot’s book value per share decreased to $16.43 at

March 31, 2020, as compared to $17.04 at December 31, 2019.

The Bank’s capital ratios continue to be strong, maintaining its

“well capitalized” regulatory status. As of March 31, 2020, the

Bank’s Tier 1 leverage ratio was 9.16%, Tier 1 risk-based capital

ratio was 10.51% and total risk-based capital ratio was 11.76%.

Patriot temporarily suspended its quarterly

dividend and expects to resume when the current economic

uncertainties are settled.

Patriot Bank is headquartered in Stamford and

operates 9 branch locations: in Scarsdale, NY; and Darien,

Fairfield, Greenwich, Milford, Norwalk, Orange, Stamford, Westport,

Ct. with Express Banking locations at Bridgeport/ Housatonic

Community College, downtown New Haven and Trumbull at Westfield

Mall. The Bank also maintains SBA lending offices in Jacksonville,

Indianapolis, and Stamford, along with a Rhode Island operations

center.

About the Company

Founded in 1994, and now celebrating its 26th

year, Patriot National Bancorp, Inc. (“Patriot” or “Bancorp”) is

the parent holding company of Patriot Bank N.A. (“Bank”), a

nationally chartered bank headquartered in Stamford, CT. Patriot

operates with full service branches in Connecticut and New York and

provides lending products and services nationally. Patriot’s

mission is to serve its local community and nationwide customer

base by providing a growing array of banking solutions to meet the

needs of individuals and small businesses owners. Patriot places

great value in the integrity of its people and how it conducts

business. An emphasis on building strong client relationships and

community involvement are cornerstones of our philosophy as we seek

to maximize shareholder value.

“Safe Harbor” Statement Under Private

Securities Litigation Reform Act of 1995

Certain statements contained in Bancorp’s public

statements, including this one, may be forward looking and subject

to a variety of risks and uncertainties. These factors include, but

are not limited to: (1) changes in prevailing interest rates which

would affect the interest earned on the Company’s interest earning

assets and the interest paid on its interest bearing liabilities;

(2) the timing of re-pricing of the Company’s interest earning

assets and interest bearing liabilities; (3) the effect of changes

in governmental monetary policy; (4) the effect of changes in

regulations applicable to the Company and the Bank and the conduct

of its business; (5) changes in competition among financial service

companies, including possible further encroachment of non-banks on

services traditionally provided by banks; (6) the ability of

competitors that are larger than the Company to provide products

and services which it is impracticable for the Company to provide;

(7) the state of the economy and real estate values in the

Company’s market areas, and the consequent effect on the quality of

the Company’s loans; (8) demand for loans and deposits in our

market area; (9) recent governmental initiatives that are expected

to have a profound effect on the financial services industry and

could dramatically change the competitive environment of the

Company; (10) other legislative or regulatory changes, including

those related to residential mortgages, changes in accounting

standards, and Federal Deposit Insurance Corporation (“FDIC”)

premiums that may adversely affect the Company; (11) the

application of generally accepted accounting principles,

consistently applied; (12) the fact that one period of reported

results may not be indicative of future periods; (13) the state of

the economy in the greater New York metropolitan area and its

particular effect on the Company's customers, vendors and

communities and other such factors, including risk factors, as may

be described in the Company’s other filings with the Securities and

Exchange Commission (the “SEC”); (14) political, social, legal and

economic instability, civil unrest, war, catastrophic events, acts

of terrorism; (15) widespread outbreaks of infectious diseases,

including the ongoing novel coronavirus (COVID-19) outbreak; (16)

changes in the level and direction of loan delinquencies and

write-offs and changes in estimates of the adequacy of the

allowance for loan losses; (17) our ability to access

cost-effective funding; (18) our ability to implement and change

our business strategies; (19) changes in the quality or composition

of our loan or investment portfolios; (20) technological changes

that may be more difficult or expensive than expected; (21) our

ability to manage market risk, credit risk and operational risk in

the current economic environment; (22) our ability to enter new

markets successfully and capitalize on growth opportunities; (23)

changes in consumer spending, borrowing and savings habits; (24)

our ability to retain key employees; and (25) our compensation

expense associated with equity allocated or awarded to our

employees.

|

Contacts: |

|

|

|

|

|

Patriot Bank, N.A.900 Bedford StreetStamford, CT

06901www.BankPatriot.com |

|

Joseph PerilloChief Financial Officer203-252-5954 |

|

Michael CarrazzaChairman & interim CEO203-251-8230 |

|

|

|

|

|

|

|

PATRIOT NATIONAL BANCORP, INC. AND

SUBSIDIARIES |

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS (Unaudited) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| (In

thousands, except share data) |

March 31, 2020 |

|

December 31, 2019 |

|

March 31, 2019 |

|

December 31, 2018 |

| |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

| Cash and due

from banks: |

|

|

|

|

|

|

|

|

Noninterest bearing deposits and cash |

$ |

1,806 |

|

|

$ |

2,693 |

|

|

$ |

6,661 |

|

|

$ |

7,381 |

|

|

Interest bearing deposits |

|

50,350 |

|

|

|

36,711 |

|

|

|

49,971 |

|

|

|

59,056 |

|

|

Total cash and cash equivalents |

|

52,156 |

|

|

|

39,404 |

|

|

|

56,632 |

|

|

|

66,437 |

|

| Investment

securities: |

|

|

|

|

|

|

|

|

Available-for-sale securities, at fair value |

|

44,830 |

|

|

|

48,317 |

|

|

|

40,275 |

|

|

|

39,496 |

|

|

Other investments, at cost |

|

4,450 |

|

|

|

4,450 |

|

|

|

4,963 |

|

|

|

4,963 |

|

|

Total investment securities |

|

49,280 |

|

|

|

52,767 |

|

|

|

45,238 |

|

|

|

44,459 |

|

| |

|

|

|

|

|

|

|

| Federal

Reserve Bank stock, at cost |

|

2,897 |

|

|

|

2,897 |

|

|

|

2,892 |

|

|

|

2,866 |

|

| Federal Home

Loan Bank stock, at cost |

|

4,477 |

|

|

|

4,477 |

|

|

|

4,513 |

|

|

|

4,928 |

|

| |

|

|

|

|

|

|

|

| Gross loans

receivable |

|

818,841 |

|

|

|

812,164 |

|

|

|

788,536 |

|

|

|

780,376 |

|

| Allowance

for loan losses |

|

(10,916 |

) |

|

|

(10,115 |

) |

|

|

(7,823 |

) |

|

|

(7,609 |

) |

|

Net loans receivable |

|

807,925 |

|

|

|

802,049 |

|

|

|

780,713 |

|

|

|

772,767 |

|

| |

|

|

|

|

|

|

|

| SBA loans

held for sale |

|

17,996 |

|

|

|

15,282 |

|

|

|

- |

|

|

|

- |

|

| Accrued

interest and dividends receivable |

|

3,801 |

|

|

|

3,603 |

|

|

|

3,621 |

|

|

|

3,766 |

|

| Premises and

equipment, net |

|

34,312 |

|

|

|

34,568 |

|

|

|

35,335 |

|

|

|

35,435 |

|

| Other real

estate owned |

|

2,400 |

|

|

|

2,400 |

|

|

|

2,945 |

|

|

|

2,945 |

|

| Deferred tax

asset, net |

|

11,989 |

|

|

|

11,133 |

|

|

|

10,357 |

|

|

|

10,851 |

|

|

Goodwill |

|

1,107 |

|

|

|

1,107 |

|

|

|

1,107 |

|

|

|

1,728 |

|

| Core deposit

intangible, net |

|

605 |

|

|

|

623 |

|

|

|

680 |

|

|

|

698 |

|

| Other

assets |

|

10,634 |

|

|

|

9,526 |

|

|

|

9,075 |

|

|

|

4,816 |

|

|

Total assets |

$ |

999,579 |

|

|

$ |

979,836 |

|

|

$ |

953,108 |

|

|

$ |

951,696 |

|

| |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

Noninterest bearing deposits |

$ |

83,583 |

|

|

$ |

88,135 |

|

|

$ |

82,248 |

|

|

$ |

84,471 |

|

|

Interest bearing deposits |

|

719,631 |

|

|

|

681,400 |

|

|

|

670,573 |

|

|

|

658,810 |

|

|

Total deposits |

|

803,214 |

|

|

|

769,535 |

|

|

|

752,821 |

|

|

|

743,281 |

|

| |

|

|

|

|

|

|

|

| Federal Home

Loan Bank and correspondent bank borrowings |

|

90,000 |

|

|

|

100,000 |

|

|

|

90,000 |

|

|

|

100,000 |

|

| Senior

notes, net |

|

11,871 |

|

|

|

11,853 |

|

|

|

11,796 |

|

|

|

11,778 |

|

| Subordinated

debt, net |

|

9,760 |

|

|

|

9,752 |

|

|

|

9,731 |

|

|

|

9,723 |

|

| Junior

subordinated debt owed to unconsolidated trust, net |

|

8,104 |

|

|

|

8,102 |

|

|

|

8,096 |

|

|

|

8,094 |

|

| Note

payable |

|

1,143 |

|

|

|

1,193 |

|

|

|

1,339 |

|

|

|

1,388 |

|

| Advances

from borrowers for taxes and insurance |

|

2,637 |

|

|

|

3,681 |

|

|

|

1,922 |

|

|

|

2,926 |

|

| Accrued

expenses and other liabilities |

|

8,227 |

|

|

|

8,726 |

|

|

|

7,754 |

|

|

|

5,166 |

|

|

Total liabilities |

|

934,956 |

|

|

|

912,842 |

|

|

|

883,459 |

|

|

|

882,356 |

|

| |

|

|

|

|

|

|

|

| Commitments

and Contingencies |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

|

|

|

| Preferred

stock |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Common

stock |

|

106,213 |

|

|

|

106,170 |

|

|

|

106,004 |

|

|

|

105,956 |

|

| Accumulated

deficit |

|

(39,845 |

) |

|

|

(38,773 |

) |

|

|

(35,517 |

) |

|

|

(35,790 |

) |

| Accumulated

other comprehensive loss |

|

(1,745 |

) |

|

|

(403 |

) |

|

|

(838 |

) |

|

|

(826 |

) |

|

Total shareholders' equity |

|

64,623 |

|

|

|

66,994 |

|

|

|

69,649 |

|

|

|

69,340 |

|

| |

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

999,579 |

|

|

$ |

979,836 |

|

|

$ |

953,108 |

|

|

$ |

951,696 |

|

| |

|

|

|

|

|

|

|

|

PATRIOT NATIONAL BANCORP, INC. AND

SUBSIDIARIES |

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

| (In

thousands, except per share amounts) |

March 31, 2020 |

|

December 31, 2019 |

|

March 31, 2019 |

|

December 31, 2018 |

| |

|

|

|

|

|

|

|

|

Interest and Dividend Income |

|

|

|

|

|

|

|

|

Interest and fees on loans |

$ |

10,033 |

|

|

$ |

10,223 |

|

|

$ |

9,755 |

|

$ |

10,158 |

|

|

Interest on investment securities |

|

416 |

|

|

|

460 |

|

|

|

379 |

|

|

385 |

|

|

Dividends on investment securities |

|

138 |

|

|

|

109 |

|

|

|

118 |

|

|

116 |

|

|

Other interest income |

|

135 |

|

|

|

161 |

|

|

|

333 |

|

|

270 |

|

|

Total interest and dividend income |

|

10,722 |

|

|

|

10,953 |

|

|

|

10,585 |

|

|

10,929 |

|

| |

|

|

|

|

|

|

|

|

Interest Expense |

|

|

|

|

|

|

|

|

Interest on deposits |

|

3,200 |

|

|

|

3,533 |

|

|

|

3,264 |

|

|

2,913 |

|

|

Interest on Federal Home Loan Bank borrowings |

|

697 |

|

|

|

708 |

|

|

|

439 |

|

|

389 |

|

|

Interest on senior debt |

|

229 |

|

|

|

229 |

|

|

|

229 |

|

|

229 |

|

|

Interest on subordinated debt |

|

268 |

|

|

|

273 |

|

|

|

289 |

|

|

278 |

|

|

Interest on note payable and other |

|

5 |

|

|

|

5 |

|

|

|

6 |

|

|

15 |

|

|

Total interest expense |

|

4,399 |

|

|

|

4,748 |

|

|

|

4,227 |

|

|

3,824 |

|

| |

|

|

|

|

|

|

|

|

Net interest income |

|

6,323 |

|

|

|

6,205 |

|

|

|

6,358 |

|

|

7,105 |

|

| |

|

|

|

|

|

|

|

|

Provision for Loan Losses |

|

804 |

|

|

|

1,769 |

|

|

|

165 |

|

|

1,018 |

|

| |

|

|

|

|

|

|

|

|

Net interest income after provision for loan

losses |

|

5,519 |

|

|

|

4,436 |

|

|

|

6,193 |

|

|

6,087 |

|

| |

|

|

|

|

|

|

|

|

Non-interest Income |

|

|

|

|

|

|

|

|

Loan application, inspection and processing fees |

|

53 |

|

|

|

39 |

|

|

|

14 |

|

|

15 |

|

|

Deposit fees and service charges |

|

114 |

|

|

|

126 |

|

|

|

127 |

|

|

132 |

|

|

Gains on sale of loans |

|

12 |

|

|

|

27 |

|

|

|

380 |

|

|

93 |

|

|

Rental income |

|

131 |

|

|

|

130 |

|

|

|

130 |

|

|

131 |

|

|

Other income |

|

111 |

|

|

|

86 |

|

|

|

95 |

|

|

194 |

|

|

Total non-interest income |

|

421 |

|

|

|

408 |

|

|

|

746 |

|

|

565 |

|

| |

|

|

|

|

|

|

|

|

Non-interest Expense |

|

|

|

|

|

|

|

|

Salaries and benefits |

|

3,861 |

|

|

|

3,409 |

|

|

|

3,184 |

|

|

3,324 |

|

|

Occupancy and equipment expenses |

|

949 |

|

|

|

923 |

|

|

|

917 |

|

|

813 |

|

|

Data processing expenses |

|

390 |

|

|

|

375 |

|

|

|

370 |

|

|

341 |

|

|

Professional and other outside services |

|

784 |

|

|

|

777 |

|

|

|

709 |

|

|

583 |

|

|

Project expenses, net |

|

94 |

|

|

|

188 |

|

|

|

80 |

|

|

330 |

|

|

Advertising and promotional expenses |

|

147 |

|

|

|

125 |

|

|

|

115 |

|

|

64 |

|

|

Loan administration and processing expenses |

|

24 |

|

|

|

54 |

|

|

|

14 |

|

|

25 |

|

|

Regulatory assessments |

|

440 |

|

|

|

371 |

|

|

|

315 |

|

|

317 |

|

|

Insurance expenses (income) |

|

70 |

|

|

|

(24 |

) |

|

|

41 |

|

|

38 |

|

|

Communications, stationary and supplies |

|

120 |

|

|

|

135 |

|

|

|

134 |

|

|

134 |

|

|

Other operating expenses |

|

492 |

|

|

|

466 |

|

|

|

569 |

|

|

467 |

|

|

Total non-interest expense |

|

7,371 |

|

|

|

6,799 |

|

|

|

6,448 |

|

|

6,436 |

|

| |

|

|

|

|

|

|

|

|

(Loss) income before income taxes |

|

(1,431 |

) |

|

|

(1,955 |

) |

|

|

491 |

|

|

216 |

|

| |

|

|

|

|

|

|

|

|

(Benefit) provision for Income Taxes |

|

(359 |

) |

|

|

(443 |

) |

|

|

168 |

|

|

(110 |

) |

|

Net (loss) income |

$ |

(1,072 |

) |

|

$ |

(1,512 |

) |

|

$ |

323 |

|

$ |

326 |

|

| |

|

|

|

|

|

|

|

|

Basic (loss) earnings per share |

$ |

(0.27 |

) |

|

$ |

(0.39 |

) |

|

$ |

0.08 |

|

$ |

0.08 |

|

|

Diluted (loss) earnings per share |

$ |

(0.27 |

) |

|

$ |

(0.39 |

) |

|

$ |

0.08 |

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

FINANCIAL RATIOS AND OTHER DATA |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

(Dollars in thousands) |

March 31, 2020 |

|

December 31, 2019 |

|

March 31, 2019 |

|

December 31, 2018 |

| |

|

|

|

|

|

|

|

|

Quarterly Performance Data: |

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(1,072 |

) |

|

$ |

(1,512 |

) |

|

$ |

323 |

|

|

$ |

326 |

|

|

Return on Average Assets |

|

-0.44 |

% |

|

|

-0.61 |

% |

|

|

0.14 |

% |

|

|

0.14 |

% |

|

Return on Average Equity |

|

-6.37 |

% |

|

|

-8.74 |

% |

|

|

1.87 |

% |

|

|

1.85 |

% |

|

Net Interest Margin |

|

2.72 |

% |

|

|

2.65 |

% |

|

|

2.88 |

% |

|

|

3.20 |

% |

|

Efficiency Ratio |

|

109.28 |

% |

|

|

102.80 |

% |

|

|

90.78 |

% |

|

|

83.91 |

% |

|

Efficiency Ratio excluding project costs |

|

107.90 |

% |

|

|

101.47 |

% |

|

|

89.65 |

% |

|

|

79.61 |

% |

| %

increase loans |

|

0.82 |

% |

|

|

1.48 |

% |

|

|

1.05 |

% |

|

|

2.24 |

% |

| %

increase deposits |

|

4.38 |

% |

|

|

0.98 |

% |

|

|

1.28 |

% |

|

|

3.30 |

% |

| |

|

|

|

|

|

|

|

|

Asset Quality: |

|

|

|

|

|

|

|

|

Nonaccrual loans |

$ |

16,450 |

|

|

$ |

18,049 |

|

|

$ |

28,029 |

|

|

$ |

19,186 |

|

|

Other real estate owned |

$ |

2,400 |

|

|

$ |

2,400 |

|

|

$ |

2,945 |

|

|

$ |

2,945 |

|

|

Total nonperforming assets |

$ |

18,850 |

|

|

$ |

20,449 |

|

|

$ |

30,974 |

|

|

$ |

22,131 |

|

| |

|

|

|

|

|

|

|

|

Nonaccrual loans / loans |

|

2.01 |

% |

|

|

2.22 |

% |

|

|

3.55 |

% |

|

|

2.46 |

% |

|

Nonperforming assets / assets |

|

1.89 |

% |

|

|

2.09 |

% |

|

|

3.25 |

% |

|

|

2.33 |

% |

|

Allowance for loan losses |

$ |

10,916 |

|

|

$ |

10,115 |

|

|

$ |

7,823 |

|

|

$ |

7,609 |

|

|

Valuation reserve |

$ |

1,100 |

|

|

$ |

1,258 |

|

|

$ |

1,384 |

|

|

$ |

1,712 |

|

|

Allowance for loan losses with valuation reserve |

$ |

12,016 |

|

|

$ |

11,373 |

|

|

$ |

9,207 |

|

|

$ |

9,321 |

|

| |

|

|

|

|

|

|

|

|

Allowance for loan losses / loans |

|

1.33 |

% |

|

|

1.25 |

% |

|

|

0.99 |

% |

|

|

0.98 |

% |

|

Allowance / nonaccrual loans |

|

66.36 |

% |

|

|

56.04 |

% |

|

|

27.91 |

% |

|

|

39.66 |

% |

|

Allowance for loan losses and valuation reserve / loans |

|

1.47 |

% |

|

|

1.40 |

% |

|

|

1.17 |

% |

|

|

1.19 |

% |

|

Allowance for loan losses and valuation reserve / nonaccrual

loans |

|

73.05 |

% |

|

|

63.01 |

% |

|

|

32.85 |

% |

|

|

48.58 |

% |

| |

|

|

|

|

|

|

|

|

Gross loan charge-offs |

$ |

44 |

|

|

$ |

71 |

|

|

$ |

- |

|

|

$ |

16 |

|

|

Gross loan (recoveries) |

$ |

(41 |

) |

|

$ |

(11 |

) |

|

$ |

(49 |

) |

|

$ |

(2 |

) |

|

Net loan charge-offs (recoveries) |

$ |

3 |

|

|

$ |

60 |

|

|

$ |

(49 |

) |

|

$ |

14 |

|

| |

|

|

|

|

|

|

|

|

Capital Data and Capital Ratios |

|

|

|

|

|

|

|

|

Book value per share (1) |

$ |

16.43 |

|

|

$ |

17.04 |

|

|

$ |

17.77 |

|

|

$ |

17.73 |

|

|

Shares outstanding |

|

3,932,841 |

|

|

|

3,930,669 |

|

|

|

3,919,610 |

|

|

|

3,910,674 |

|

|

Bank Capital Ratios: |

|

|

|

|

|

|

|

|

Leverage Ratio |

|

9.16 |

% |

|

|

9.28 |

% |

|

|

9.79 |

% |

|

|

9.84 |

% |

|

Tier 1 Capital |

|

10.51 |

% |

|

|

10.64 |

% |

|

|

10.99 |

% |

|

|

10.62 |

% |

|

Total Risk Based Capital |

|

11.76 |

% |

|

|

11.83 |

% |

|

|

11.91 |

% |

|

|

11.50 |

% |

| |

|

|

|

|

|

|

|

(1) Book value per share represents shareholders' equity divided

by outstanding shares.

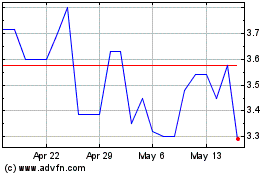

Patriot National Bancorp (NASDAQ:PNBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Patriot National Bancorp (NASDAQ:PNBK)

Historical Stock Chart

From Jul 2023 to Jul 2024