GALION, Ohio, Aug. 13 /PRNewswire-FirstCall/ -- PECO II, Inc.

(NASDAQ:PIII), a communications industry power systems and services

provider, today reported results for the second quarter ended June

30, 2008. PECO II reported net sales of $11.1 million in the second

quarter of 2008. This compares with $9.0 million in the first

quarter of 2008, a 22.7 percent quarter-to-quarter increase, and

$10.6 million in the second quarter of 2007, a 4.8 percent

year-to-year increase. The Company reported a net loss of $1.2

million, or $0.45 per diluted share (on a post-split basis), for

the second quarter of 2008, compared with a net loss of $1.4

million, or $0.51 per diluted share (on a post-split basis), for

the first quarter of 2008 and a net loss of $0.7 million, or $0.27

per diluted share (on a post-split basis), for the second quarter

of 2007. The $0.2 million reduction in net loss for the second

quarter of 2008, compared with the first quarter of 2008, was

primarily attributed to sequential revenue growth, offset by

increased inventory obsolescence charges of $0.3 million. The $0.5

million increase in net loss for the second quarter of 2008,

compared to the second quarter of 2007, was primarily driven by

reductions in services gross margins of $0.3 million resulting from

reduced business levels, combined with a $0.3 million inventory

obsolescence charge. EBITDA was a loss of $0.7 million in the

second quarter of 2008, compared with an EBITDA loss of $0.9

million for the first quarter of 2008 and an EBITDA loss of $0.2

million for the second quarter of 2007. An explanation and

reconciliation of GAAP net income to EBITDA is included as

Attachment A. Cash used for operating activities for the six months

ended June 30, 2008, was $0.1 million. This was primarily from the

net loss, offset by reductions in working capital and other

non-cash charges. Bookings increased during the second quarter of

2008, resulting in a sales backlog of $6.2 million as of June 30,

2008. The second-quarter backlog was a 30 percent increase from the

$4.8 million backlog at the end of the first quarter of 2008. The

bookings-to-billings ratio reflects customer orders received as

compared with the same period's billings and is an indication of

future periods. For the second quarter of 2008, the ratio was 1 to

1. PECO II CEO John Heindel stated, "The second-quarter financial

performance reflects solid in-year revenue growth for both products

and services. Revenues for the quarter were the highest quarterly

revenues recorded since the fourth quarter of 2006. Product

revenues grew 17 percent both sequentially and year-to-year.

Product market share gains were realized among both our large

tier-one customers as well as our general markets customers.

Services revenues, while down year-to-year by 23 percent, were up

sequentially by 48 percent." The year-to-year services revenue

reduction was primarily attributed to reduced spending from two

customers. In both cases, the Company believes that these reduced

spending levels did not result in market share losses. The

sequential growth of the services business was driven by

across-the-board growth with a number of customers. One customer

comprised 61 percent of this sequential growth, as its initial 2008

spending was delayed due to budget issues. The shortfall incurred

in the first quarter of 2008 with this customer is expected to be

recovered in the second half of 2008. Heindel added, "Gross margins

of 13.9 percent, or $1.5 million, in the second quarter were

negatively impacted by the write-off of inventory totaling $0.3

million and the slow ramp up of the services business that

continued into the second quarter." Second-quarter 2008 operating

expenses of $2.8 million were $0.1 million greater than the first

quarter of 2008 and $0.2 million more than the second quarter of

2007. On a year-to-date basis, operating expenses included $0.6

million of costs related to the development and rollout of the

Company's new small power product platform. The Quantum product is

in lab trials, currently undergoing customer evaluations. The

Company expects that these products will begin to be sold into the

market in the third quarter and start generating revenues by the

fourth quarter of 2008. The Company also expects its engineering

expenses to decline somewhat in the second half of the year as it

rolls out its small power to market. The Company anticipates that

its selling expenses will increase in the second half of the year

as it invests in its go-to-market strategy for small power. Heindel

further noted, "In June, the Company introduced its new small power

platform at the NXTcomm08 trade show in Las Vegas. The Quantum(TM)

Power System positions PECO as a player in the shelf power market

segment and the fast-growing outside plant broadband market." He

noted that according to industry analyst Skyline Marketing, the

size of this power market segment in the United States is estimated

to be $269 million in 2008, reaching $450 million by 2011. The

Quantum platform is a 48-volt DC power system that combines

high-density rectifiers, distribution and control in a sleek,

low-profile shelf for optimized value to telecom carriers deploying

fiber-to-the-node and traditional wireline architectures. Designed

for the harsh outside plant environment, the Quantum system's small

footprint makes it ideal for cabinets where rack space is at a

premium. The Quantum Power System has several distinctive features

that optimize the user experience. PECO II's innovative

QuickLoad(TM) feature enables the technician to rapidly configure

the system. The system controller features a technician-friendly

input control device and a display that can easily be read in

difficult outdoor conditions. The rectifiers include PECO II's

unique I-View(TM) faceplate indicators that report rectifier

current and load-sharing status. In addition to introducing the

Quantum system, the Company also completed the design of a new

cabinet for powering wireless base stations. The SC1172 battery

cabinet occupies the same footprint as the previous vintage, but

with nearly twice the battery capacity. The improved system density

lowers operating expenses for the wireless carriers by reducing the

requirements for site leases at cell towers. Heindel noted that the

Company announced to customers at the end of June its plans to

increase prices on non-contracted items to compensate for the

significant rise in the cost of key commodities such as copper,

aluminum and sheet metal. The increase went into effect on August

4, 2008. "The impact on the financial performance of the Company is

contingent on product mix and order volumes," he said. Heindel

added, "With the introduction of PECO II's small power products,

the Company has an exciting opportunity to grow its business in a

space that it has not competed in to date. By leveraging the

Company's industry leading responsiveness capability with this new

technology platform provides our customers with another reason to

rely on PECO II for its power requirements." Conference Call on the

Web PECO II will hold a conference call with investors and analysts

on Wednesday, August 13, 2008, at 10 a.m. Eastern time. The call

will be available over the Internet at http://www.peco2.com/. To

listen to the call, go to the Web site to register, download and

install any necessary audio software. For those unable to listen to

the live broadcast, a replay of the webcast will be archived and

available shortly after the call. About PECO II, Inc. PECO II,

headquartered in Galion, Ohio, provides engineering and on-site

installation services and designs, manufactures and markets

communications power systems and power distribution equipment. As

the largest independent full-service provider of telecommunications

power systems, the Company provides total power quality/reliability

solutions and supports the power infrastructure needs of

communications service providers in the local exchange,

long-distance, wireless, broadband and Internet markets. Additional

information about PECO II can be found at http://www.peco2.com/.

Forward-Looking Statements Statements in this release that are not

historical fact are forward-looking statements, which involve risks

and uncertainties that may cause actual results or events to differ

materially from those expressed or implied in such statements.

Factors that may cause actual results to differ materially from

those in the forward-looking statements include, but are not

limited to, a general economic recession; a downturn in our

principal customers' businesses; the growth in the communications

industry; the ability to develop and market new products and

product enhancements; the ability to attract and retain customers;

competition and technological change; and successful implementation

of the Company's business strategy. In addition, this release

contains time-sensitive information that reflects management's best

analysis only as of the date of this release. PECO II does not

undertake any obligation to publicly update or revise any

forward-looking statements to reflect future events, information or

circumstances that arise after the date of this release. Further

information concerning issues that could materially affect

financial performance related to forward-looking statements can be

found in PECO II's periodic filings with the Securities and

Exchange Commission. PECO II, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except for per share data) (unaudited)

For the Three Months For the Six Months Ended June 30, Ended June

30, 2008 2007 2008 2007 Net sales: Product $8,505 $7,256 $15,795

$13,151 Services 2,552 3,298 4,273 5,497 11,057 10,554 20,068

18,648 Cost of goods sold: Product 7,429 6,305 13,807 11,746

Services 2,087 2,490 3,517 4,269 9,516 8,795 17,324 16,015 Gross

margin: Product 1,076 951 1,988 1,405 Services 465 808 756 1,228

1,541 1,759 2,744 2,633 Operating expenses: Research, development

and engineering 678 495 1,310 1,335 Selling, general and

administrative 2,136 2,091 4,152 4,597 2,814 2,586 5,462 5,932 Loss

from operations (1,273) (827) (2,718) (3,299) Interest income, net

41 95 105 197 Loss before income taxes (1,232) (732) (2,613)

(3,102) Income tax expense (1) (13) (9) (27) Net loss $(1,233)

$(745) $(2,622) $(3,129) Net loss per common share: Basic and

diluted $(0.45) $(0.27) $(0.95) $(1.15) Weighted average common

shares outstanding: Basic and diluted 2,755 2,720 2,751 2,719 PECO

II, INC. CONSOLIDATED BALANCE SHEETS (In thousands, except for

share data) June 30, December 31, 2008 2007 ASSETS (unaudited)

Current assets: Cash and cash equivalents $7,686 $7,935 Accounts

receivable, net of allowance of $81 at June 30, 2008 and $90 at

December 31, 2007 3,902 3,685 Note receivable 250 - Inventories,

net of allowance of $1,819 at June 30, 2008 and $1,906 at December

31, 2007 10,588 11,433 Cost and earnings in excess of billings on

uncompleted contracts 789 514 Prepaid expenses and other current

assets 184 263 Assets held for sale 83 219 Total current assets

23,482 24,049 Property and equipment, at cost: Land and land

improvements 195 195 Buildings and building improvements 7,251

7,251 Machinery and equipment 2,916 2,869 Furniture and fixtures

5,513 5,527 15,875 15,842 Less-accumulated depreciation: (11,573)

(11,360) Property and equipment, net 4,302 4,482 Other assets:

Goodwill 1,485 1,515 Intangibles, net 3,285 3,822 Investment in

joint venture 2 2 Total assets $ 32,556 $ 33,870 LIABILITIES AND

SHAREHOLDERS' EQUITY Current liabilities: Accounts payable $5,984

$4,485 Billings in excess of cost and estimated earnings on

uncompleted contracts - 510 Accrued compensation expense 897 722

Accrued income taxes 23 81 Other accrued expenses 1,769 1,800 Total

current liabilities 8,673 7,598 Shareholders' equity: Common stock,

no par value: 150,000,000 shares authorized; 2,756,155 and

2,739,157 shares issued at June 30, 2008 and December 31, 2007,

respectively 3,496 3,475 Warrants 5,130 5,078 Additional paid-in

capital 116,572 116,412 Accumulated deficit (101,315) (98,693)

Total shareholders' equity 23,883 26,272 Total liabilities and

shareholders' equity $ 32,556 $ 33,870 Attachment A EBITDA is not a

financial measure calculated in accordance with U.S. generally

accepted accounting principles (GAAP) and should not be considered

as an alternative to net income, operating income or any other

financial measure so calculated and presented. We define EBITDA as

net income/(loss) before interest expense, taxes, depreciation,

amortization, and non-cash stock compensation expense. Other

companies may define EBITDA differently. We present EBITDA because

we believe it to be an important supplemental measure of our

performance that is commonly used by securities analysts, investors

and other interested parties in the evaluation of companies in our

industry. Management also uses this information internally for

forecasting and budgeting. You should not consider EBITDA in

isolation, or as a substitute for analysis of our results as

reported under GAAP. Reconciliation of GAAP Net Loss to EBITDA

(unaudited) For the Three Months Ended June 30, (In thousands) 2008

2007 2008 and 2007 EBITDA Breakdown Net Loss per GAAP $(1,233)

$(745) Interest expense $- $8 Taxes $1 $13 Depreciation/

amortization $381 $423 Non-cash stock-based compensation $117 $102

EBITDA $(734) $(199) DATASOURCE: PECO II, Inc. CONTACT: Kevin

Borders, Vice President of Marketing and Product Development and

Secretary of PECO II, Inc., +1-419-468-7600 Web site:

http://www.peco2.com/

Copyright

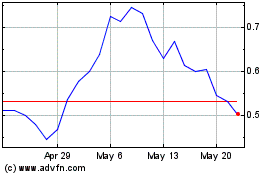

P3 Partners (NASDAQ:PIII)

Historical Stock Chart

From Jun 2024 to Jul 2024

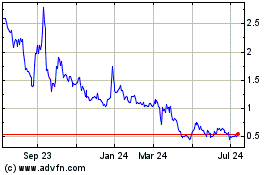

P3 Partners (NASDAQ:PIII)

Historical Stock Chart

From Jul 2023 to Jul 2024