Nova Measuring Instruments Announces 2003 Third Quarter Results

REHOVOTH, Israel, Nov. 13 /PRNewswire-FirstCall/ -- Nova Measuring

Instruments, Ltd. , the worldwide market leader in Integrated

Metrology systems for the semiconductor industry today reported

results for the third quarter of 2003. 2003 Third Quarter Results

Total revenues for the third quarter of 2003 were $7.4 million, a

36% increase over revenues of $5.4 million reported for the third

quarter of 2002, and a 15% sequential increase over revenues of

$6.4 million for the previous quarter. The Company reported gross

profit of $3.1 million (42% of revenues) compared with gross profit

of $2.0 million (37% of revenues) for the third quarter of 2002 and

gross profit of $2.4 million (38% of revenues) in the previous

quarter. Net loss for the quarter was $(0.8) million, or $(0.06)

per share, compared with a net loss in the third quarter of 2002 of

$(2.7) million, or $(0.18) per share and a net loss of $(1.4)

million, or $(0.09) per share in the previous quarter. Third

quarter 2003 results include stock-based compensation expenses of

$0.1 million. Excluding these expenses, net loss was $(0.05) per

share. Research and development expenses were $1.8 million (25% of

revenues) compared with $2.4 million (44% of revenues) in the third

quarter of 2002 and $1.6 million (25% of revenues) in the previous

quarter. Sales and marketing expenses were $1.7 million (23% of

revenues) compared with $1.8 million (33% of revenues) in the third

quarter of 2002 and $1.8 million (28% of revenues) in the previous

quarter. At the end of the third quarter, cash and cash

equivalents, short and long term bank deposits were $32 million,

the same level as at the end of previous quarter. Working capital

was recorded at $29 million. The third quarter results reflects a

continuing sequential revenue growth of 36% over the same quarter

last year and 15% sequentially. The results also show a continuing

reduction in the net loss, from $1.4M to $0.8M and approaching the

breakeven point. Sales of the quarter included the delivery of the

new NovaScan CD systems, both in stand-alone and integrated

configurations. We believe there is now a higher probability of

increasing sales of the NovaScan CD in the next 12 months. In

addition, over the quarter, the company has seen some important

gains of multiple systems sales in several major accounts in Japan

and Asia Pacific, and maintained its leading integrated metrology

market share of over 70%. Dr. Giora Dishon, President & CEO of

Nova commented: "The company is succeeding to improve its

performance significantly and consistently: increased revenues,

improved margins and reduction of losses for several quarters.

Improvements are across all regions, but most significantly in Asia

Pacific and Japan, and we expect that these territories will

continue to lead in the coming quarters. We are proud that 18 of

the top 20 semiconductor manufacturers are now using our integrated

metrology systems and Advanced Process Control (APC) solutions.

Orders and deliveries in both stand-alone and integrated systems of

the new NovaScan 3030CD system for optical CD control -- a process

control equipment segment, which Dataquest expects to grow from $8M

last year to about $100M in 2006, are very encouraging. Most of the

sales to the different CMP equipment manufacturers were of our new

300mm systems, and yet we have also seen a trend of increase in

upgrade activity. These combined, may be initial signs of a

recovery in the sector, and they do represent an additional

opportunity for the company." Dr. Dishon concluded, "We are

encouraged by the results and the trends in the industry. However,

as long as the visibility is still limited, we continue to manage

our business looking forward with a high sense of caution --

ramping up and continuing introduction of our new integrated

systems, while controlling the cost of the operations to reduce

losses and to return the business to profitability." About Nova

Nova Measuring Instruments Ltd. develops, designs and produces

integrated process control systems in the semiconductor

manufacturing industry. Nova provides a broad range of integrated

process control solutions that link between different semiconductor

processes and process equipment. The Company's website is

http://www.nova.co.il/. This press release may contain

forward-looking statements, including statements related to

anticipated growth rates, manufacturing capacity and tax rate.

Actual results may differ materially from those projected due to a

number of risks, including changes in customer demands for our

products, new product offerings from our competitors, changes in or

an inability to execute our business strategy, unanticipated

manufacturing or supply problems, or changes in tax requirements.

Nova cannot guarantee future results, levels of activity,

performance or achievements. The matters discussed in this press

release also involve risks and uncertainties summarized under the

heading "Risk Factors' in Nova's Form F-1 filed with the Securities

and Exchange Commission on April 9, 2000. These factors are updated

from time to time through the filing of reports and registration

statements with the Securities and Exchange Commission. Nova

Measuring Instruments Ltd. does not assume any obligation to update

the forward-looking information contained in this press release.

NOVA MEASURING INSTRUMENTS LTD. INTERIM CONSOLIDATED STATEMENT OF

OPERATIONS (U.S. dollars in thousands, except share and per share

data) Three months ended September 30, June 30, 2003 2003

(unaudited) REVENUES Products sale 5,827 5,213 Services 1,565 1,220

7,392 6,433 COST OF REVENUES Products sale 2,794 2,549 Services

1,526 1,455 4,320 4,004 GROSS PROFIT 3,072 2,429 OPERATING COSTS

AND EXPENSES Research & Development expenses, net 1,813 1,605

Sales & Marketing expenses 1,727 1,782 General &

Administration expenses 466 489 4,006 3,876 OPERATING LOSS (934)

(1,447) FINANCING INCOME 87 93 LOSS (847) (1,354) LOSS PER SHARE

(0.06) (0.09) Comments: 1. Employee Stock Based Compensation

expenses 134 106 2. Shares used in calculation of basic loss per

share 14,988 14,939 3. The adjusted results excluding Employee

Stock Based Compensation: Gross Profit 3,088 2,442 Operating

Expenses 3,888 3,783 Loss (800) (1,248) Loss per share (0.05)

(0.08) NOVA MEASURING INSTRUMENTS LTD. INTERIM CONSOLIDATED

STATEMENT OF OPERATIONS (U.S. dollars in thousands, except share

and per share data) Three months ended September 30, September 30,

2003 2002 (unaudited) REVENUES Products sale 5,827 3,662 Services

1,565 1,761 7,392 5,423 COST OF REVENUES Products sale 2,794 1,787

Services 1,526 1,651 4,320 3,438 GROSS PROFIT 3,072 1,985 OPERATING

COSTS AND EXPENSES Research & Development expenses, net 1,813

2,390 Sales & Marketing expenses 1,727 1,792 General &

Administration expenses 466 434 4,006 4,616 OPERATING LOSS (934)

(2,631) FINANCING INCOME (EXPENSES) 87 (45) LOSS (847) (2,676) LOSS

PER SHARE (0.06) (0.18) Comments: 1. Employee Stock Based

Compensation expenses 134 277 2. Shares used in calculation of

basic loss per share 14,988 14,904 3. The adjusted results

excluding Employee Stock Based Compensation: Gross Profit 3,088

2,017 Operating Expenses 3,888 4,372 Loss (800) (2,399) Loss per

share (0.05) (0.16) NOVA MEASURING INSTRUMENTS LTD. INTERIM

CONSOLIDATED BALANCE SHEET (U.S. dollars in thousands) As of As of

September 30, December 31, 2003 2002 CURRENT ASSETS Cash and cash

equivalents & 28,383 37,586 Short-term interest-bearing bank

deposits Held to maturity securities 1,990 994 Trade accounts

receivable 7,015 2,663 Inventories 2,911 3,150 Other current assets

1,103 1,137 41,402 45,530 LONG-TERM ASSETS Long-term

interest-bearing bank deposits 1,483 - Severance pay funds 1,960

1,701 3,443 1,701 FIXED ASSETS, NET 1,442 1,777 46,287 49,008

CURRENT LIABILITIES Trade accounts payable 3,787 3,340 Other

current liabilities 8,317 7,616 12,104 10,956 LONG-TERM LIABILITIES

Liability for employee termination benefits 2,592 2,162 Other

long-term liability 163 213 2,755 2,375 SHAREHOLDERS' EQUITY Share

capital 46 46 Additional paid- in capital 72,580 72,614 Deferred

stock-based compensation (243) (809) Accumulated other

comprehensive income 8 - Accumulated deficit (40,963) (36,174)

31,428 35,677 46,287 49,008 Company Contact: Investor relations

Contacts: Chai Toren, CFO and Vice President Finance Ehud Helft or

Kenny Green Nova Measuring Instruments Ltd. Gal IR International

Tel: 972-8-938-7505 Tel: +1-866-704-6710 E-mail: E-mail:

http://www.nova.co.il/ DATASOURCE: Nova Measuring Instruments, Ltd.

CONTACT: Chai Toren, CFO and Vice President Finance of Nova

Measuring Instruments, Ltd., +972-8-938-7505, ; or Investors - Ehud

Helft, or Kenny Green, , both of Gal IR International,

+1-866-704-6710, for Nova Measuring Instruments, Ltd. Web site:

http://www.nova.co.il/

Copyright

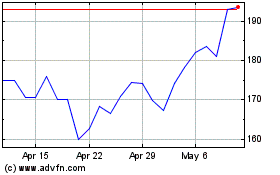

Nova (NASDAQ:NVMI)

Historical Stock Chart

From May 2024 to Jun 2024

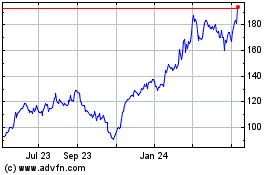

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Jun 2023 to Jun 2024