Avraham Livnat holds, through Avraham Livnat Ltd., a private Israeli

corporation which is controlled by him, approximately 13.2%of the outstanding

shares of IDB Holding, including approximately 10% of the outstanding shares of

IDB Holding owned through Livnat, which is a wholly owned subsidiary of Avraham

Livnat Ltd. These shares of IDB Holding, other than approximately 10% of the

outstanding shares of IDB Holding owned by Livnat, are not subject to the IDB

Shareholders Agreement.

The name, citizenship, residence or business address and present principal

occupation of the directors and executive officers of Clal Electronics, Clal

Industries, IDB Development and IDB Holding are set forth in Exhibits 1 through

4 attached hereto, respectively, and incorporated herein by reference.

(d) None of the Reporting Persons or, to the knowledge of the Reporting Persons,

any of the persons named in Exhibits 1 through 4 to this Statement, has, during

the last five years, been convicted in a criminal proceeding (excluding traffic

violations and similar misdemeanors).

(e) None of the Reporting Persons or, to the knowledge of the Reporting Persons,

any of the persons named in Exhibits 1 through 4 to this Statement has, during

the last five years, been a party to a civil proceeding of a judicial or

administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or

state securities laws or finding any violation with respect to such laws.

ITEM 4. PURPOSE OF TRANSACTION

Item 4 of the Statement is hereby amended and supplemented as follows:

The Ordinary Shares reported herein as beneficially owned by the Reporting

Persons are held for investment purposes and the Ordinary Shares are not held

for the purpose of or with the effect of changing or influencing the control of

the Issuer. The Reporting Persons intend to review on a continuing basis their

investment in the Ordinary Shares and take such actions with respect to their

investment as they deem appropriate in light of the circumstances existing from

time to time. Such actions could include, among other things, selling the

Ordinary Shares, in whole or in part, at any time (whether through open market

transactions, privately negotiated transactions or otherwise). The Reporting

Persons could also determine to purchase Ordinary Shares, subject to applicable

laws. Any such decision would be based on an assessment by the Reporting Persons

of a number of different factors, including, without limitation, the business,

prospects and affairs of the Issuer, the market for the Ordinary Shares, the

condition of the securities markets, general economic and industry conditions

and other opportunities available to the Reporting Persons.

To the best knowledge of the Reporting Persons, the persons named in Exhibits

1-4 hereto may purchase or dispose of Ordinary Shares on their own account from

time to time, subject to applicable laws.

Except as may be provided otherwise herein, none of the Reporting Persons, nor

to the best of their knowledge, any of the persons named in Exhibits 1-4 hereto,

has any present plans or proposals which relate to or would result in any of the

actions described in subsections (a) through (j) of Item 4 of Schedule 13D.

Page 11 of 22 pages

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

Item 5 of the Statements is hereby amended and restated in its entirety as

follows:

The Issuer has advised the Reporting Persons that there were 24,477,034 Ordinary

Shares outstanding on March 1, 2010. As described in Item 5(c) below, on March

11, 2010, Clal Electronics was issued 336,134 Ordinary Shares upon the exercise

of outstanding warrants. The percentages of Ordinary Shares outstanding set

forth in this Statement are based on the total of the above two numbers, or

24,813,168 Ordinary Shares.

(a), (b) As of March 10, 2010:

Clal Industries and Clal Electronics beneficially own, and may be deemed to

share the power to vote and dispose of, 3,474,476 Ordinary Shares, constituting

approximately 14.00% of the outstanding Ordinary Shares of the Issuer.

IDB Development may be deemed the beneficial owner of, and to share the

power to vote and dispose of the 3,474,476 Ordinary Shares held by Clal

Industries, constituting, in the aggregate, approximately 14.00% of the

outstanding Ordinary Shares of the Issuer. IDB Development disclaims beneficial

ownership of all of the 3,474,476 Ordinary Shares reported in this Statement.

IDB Holding and the Reporting Persons who are natural persons may be deemed

to be the beneficial owners of, and to share the power to vote and dispose of

the 3,474,476 Ordinary Shares beneficially owned by IDB Development,

constituting approximately 14.38 of the outstanding Ordinary Shares of the

Issuer. IDB Holding and the Reporting Persons who are natural persons disclaim

beneficial ownership of such shares.

Based on information furnished to the Reporting Persons, the Reporting

Persons are not aware of any executive officer or director named in Exhibit 1

through 4 to the Statement, beneficially owning any Ordinary Shares.

(c) None of the Reporting Persons or, to the Reporting Persons' knowledge, any

of the executive officers and directors named in Exhibits 1 through 4 to this

Statement, purchased or sold any Ordinary Shares in the sixty days preceding

March 10, 2010, except as set forth below:

During the period from January 8, 2010 through March 10, 2010, Clal

Electronics made the following sales of Ordinary Shares, totaling 1,000,000

Ordinary Shares, at prices ranging from $5.10 to $5.2922 per share, all of which

were made in open market transactions on the NASDAQ:

PRICE PER SHARE (US $) AMOUNT OF ORDINARY SHARES DATE

---------------------- ------------------------- ----

5.10 858,531 March 10, 2010

5.2922 141,469 March 10, 2010

On February 28, 2007 the Issuer issued warrants to Clal Electronics for the

purchase of approximately 872,093 Ordinary Shares at an exercise price of $3.05

per share (the "Warrants"). On March 11, 2010, Clal Electronics exercised all of

the Warrants, via a cashless exercise, and was issued 336,134 Ordinary Shares.

Page 12 of 22 pages

(d) Not applicable.

(e) Not applicable.

ITEM 6. INTEREST IN SECURITIES OF THE ISSUER

Item 6 of the Statement is hereby amended and supplemented as follows:

Clal Electronics is a party to a lock-up letter agreement with the underwriters

for the Issuer's public offering of Ordinary Shares. The lock-up letter

agreement expires 60 days after the date of the Issuer's final prospectus

supplement (April 5, 2010). The restrictions of the lock-up letter agreement do

not apply to the sale by Clal Electronics of up to one million Ordinary Shares.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

EXHIBIT # DESCRIPTION

Exhibits 1-4 Name, citizenship, business address, present principal occupation

and employer of executive officers and directors of (1) Clal

Electronics Industries Ltd. (2) Clal Industries and Investments

Ltd., (3) IDB Development and (4) IDB Holding.

Exhibit 5 (*) Joint Filing Agreement between Clal Industries and

Investments Ltd. and Clal Electronics Industries Ltd. authorizing

Clal Industries and Investments Ltd. to file this Schedule 13D

and any amendments hereto.

Exhibit 6 (*) Joint Filing Agreement between Clal Industries and

Investments Ltd. and IDB Development authorizing Clal Industries

and Investments Ltd. to file this Schedule 13D and any

amendments hereto.

Exhibit 7 (*) Joint Filing Agreement between Clal Industries and

Investments Ltd. and IDB Holding authorizing Clal Industries and

Investments Ltd. to file this Schedule 13D and any amendments

hereto.

Exhibit 8 (*) Joint Filing Agreement between Clal Industries and

Investments Ltd. and Mr. Dankner authorizing Clal Industries and

Investments Ltd. to file this Schedule 13D and any amendments

hereto.

Exhibit 9 (*) Joint Filing Agreement between Clal Industries and

Investments Ltd. and Mrs. Bergman authorizing Clal Industries and

Investments Ltd. to file this Schedule 13D and any amendments

hereto.

Exhibit 10 (*) Joint Filing Agreement between Clal Industries and

Investments Ltd. and Mrs. Manor authorizing Clal Industries and

Investments Ltd. to file this Schedule 13D and any amendments

hereto.

Exhibit 11 (*) Joint Filing Agreement between Clal Industries and

Investments Ltd. and Mr. Livnat authorizing Clal Industries and

Investments Ltd. to file this Schedule 13D and any amendments

hereto.

(*) Previously filed as Exhibits 5-11 to Amendment No. 3 to the Schedule 13D

filed with the SEC on December 11, 2007, and incorporated herein by reference.

Page 13 of 22 pages

SIGNATURE

After reasonable inquiry and to the best of our knowledge and belief, we

certify that the information set forth in this statement is true, complete and

correct.

Dated: March 25, 2010

CLAL ELECTRONICS INDUSTRIES LTD.

CLAL INDUSTRIES AND INVESTMENTS LTD.

IDB DEVELOPMENT CORPORATION LTD.

IDB HOLDING CORPORATION LTD.

NOCHI DANKNER

SHELLY BERGMAN

RUTH MANOR

AVRAHAM LIVNAT

BY: CLAL INDUSTRIES AND INVESTMENTS LTD.

By: /s/ Yehuda Ben Ezra, /s/ Gonen Bieber

-------------------------------------

Yehuda Ben Ezra, and Gonen Bieber authorized signatories of

Clal Industries and Investments Ltd. for itself and on

behalf of IDB Holding Corporation Ltd, IDB Development

Corporation Ltd., Nochi Dankner, Shelly Bergman, Ruth Manor

and Avraham Livnat pursuant to the agreements annexed as

exhibits 5-11 to this Schedule 13D.

Page 14 of 22 pages

EXHIBIT 1

Executive Officers and Directors of

CLAL ELECTRONICS INDUSTRIES LTD.

(as of March 10, 2010)

Citizenship is same as country of address, unless otherwise noted.

NAME AND ADDRESS POSITION PRINCIPAL OCCUPATION

---------------- -------- --------------------

Avi Fischer Director Director and Co-Chief Executive

3 Azrieli Center, The Officer of Clal Electronics

Triangular Tower, 44th floor, Industries Ltd.

Tel-Aviv 67023, Israel

Yehuda Ben Ezra Director and Comptroller of Clal Electronics

3 Azrieli Center, The Comptroller Industries Ltd.

Triangular Tower, 44th floor,

Tel-Aviv 67023, Israel

Gonen Bieber * Director and Finance Manager of Clal

3 Azrieli Center, The Finance Manager Electronics Industries Ltd.

Triangular Tower, 44th floor,

Tel-Aviv 67023, Israel

Nitsa Einan General Counsel General Counsel of Clal

3 Azrieli Center, The Electronics Industries Ltd.

Triangular Tower, 44th floor,

Tel-Aviv 67023, Israel

* Mr. Bieber is a dual citizen of Israel and Germany.

Page 15 of 22 pages

EXHIBIT 2

Executive Officers and Directors of

CLAL INDUSTRIES AND INVESTMENTS LTD.

(as of March 10, 2010)

Citizenship is same as country of address, unless otherwise noted.

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Nochi Dankner Chairman of the Chairman of IDB Holding; IDB Development, Discount

3 Azrieli Center, The Triangular Board of Directors Investment Corporation Ltd. and Clal Industries and

Tower, 44th floor, Tel-Aviv 67023, Investments Ltd.; Businessman and director of companies.

Israel

Avi Fischer Director & Co-Chief Executive Vice President of IDB Holding; Deputy Chairman

3 Azrieli Center, The Triangular Executive Officer of IDB Development; Co-Chief Executive Officer of Clal

Tower, 45th floor, Tel-Aviv 67023, Industries and Investments Ltd..

Israel

Refael Bisker Director Chairman of Property and Building Corporation Ltd.

3 Azrieli Center, The Triangular Co-Chairman of Shufersal Ltd.

Tower, 44th floor, Tel-Aviv 67023,

Israel

Marc Schimmel Director Co-Managing Director of UKI Investments.

54-56 Euston St., London NW1,

United Kingdom

Yecheskel Dovrat Director Economic consultant & director of companies.

1 Nachshon Street, Ramat Hasharon

47301, Israel

Eliahu Cohen Director Chief Executive Officer of IDB Development.

3 Azrieli Center, The Triangular

Tower 44th floor, Tel-Aviv 67023,

Israel

Shay Livnat Director President of Zoe Holdings Ltd.

3 Azrieli Center, The Triangular

Tower, 45th floor, Tel-Aviv 67023,

Israel

David Leviatan Director Director of companies.

18 Mendele Street, Herzelia 46709,

Israel

Isaac Manor (*) Director Chairman of companies in the motor vehicle sector of the

103 Kahanman Street, David Lubinski Ltd. group.

Bnei Brak 51553, Israel

Dori Manor (*) Director Chief Executive Officer of companies in the motor vehicle

103 Kahanman Street, sector of the David Lubinski Ltd. group.

Bnei Brak 51553, Israel

Adiel Rosenfeld Director Representative in Israel of the Aktiva group.

42 Ha'Alon Street, Timrat 23840,

Israel

Page 16 of 22 pages

Liora Polachek External Director Independent Lawyer, Partner and Director at Sitan

46 He Beiyyar St., Tel Aviv , Polachek Attorney.

Israel

Zeev Ben- Asher External Director Managers Coacher and organizational consultant.

20 Carmely St., Ramt-Gan ,

Israel

Zvi Livnat Co-Chief Executive Executive Vice President of IDB Holding; Deputy Chairman

3 Azrieli Center, The Triangular Officer of IDB Development; Co-Chief Executive Officer of Clal

Tower, 45th floor, Tel-Aviv 67023, Industries and Investments Ltd..

Israel

Boaz Simons Senior Vice Senior Vice President of Clal Industries and Investments

3 Azrieli Center, The Triangular President Ltd..

Tower 45th floor, Tel-Aviv 67023,

Israel

Guy Rosen Senior Vice Senior Vice President of Clal Industries and Investments

3 Azrieli Center, The Triangular President Ltd.; Deputy Chairman of IDB Tourism Ltd..

Tower 45th floor, Tel-Aviv 67023,

Israel

Gonen Bieber (**) Vice President and Vice President and Chief Financial Officer of Clal

3 Azrieli Center, The Triangular Chief Financial Industries and Investments Ltd.; Vice President and

Tower 45th floor, Tel-Aviv 67023, Officer finance manager of IDB Development; Finance manager of

Israel IDB Holding.

Nitsa Einan Vice President and General Counsel of Clal Industries and Investments Ltd.

3 Azrieli Center, The Triangular General Counsel and Clal Biotechnology Industries Ltd.

Tower 45th floor, Tel-Aviv 67023,

Israel

Yehuda Ben Ezra Vice President & Comptroller of Clal Industries and Investments Ltd..

3 Azrieli Center, The Triangular Comptroller

Tower 45th floor, Tel-Aviv 67023,

Israel

Tal Mund Vice President Business Development of Clal Industries and Investments

3 Azrieli Center, the Triangular Ltd..

Tower

45th floor, Tel Aviv 67023, Israel

(*) Dual citizen of Israel and France.

(**) Dual citizen of Israel and Germany.

Page 17 of 22 pages

EXHIBIT 3

Directors and Executive Officers of

IDB DEVELOPMENT CORPORATION LTD.

(as of March 10, 2010)

Citizenship is the same as country of address, unless otherwise noted.

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Nochi Dankner Chairman of the Board of Chairman of IDB Holding, IDB

3 Azrieli Center, The Directors Development, Discount Investment

Triangular Tower, 44th floor, Corporation Ltd. and Clal

Tel-Aviv 67023, Israel Industries and Investments Ltd.;

Businessman and director of

companies.

Zehava Dankner Director Director of companies.

64 Pinkas Street, Tel Aviv

62157, Israel

Avi Fischer Deputy Chairman of the Board Executive Vice President of IDB

3 Azrieli Center, The of Directors Holding; Deputy Chairman of IDB

Triangular Tower, 45th floor, Development; Co-Chief Executive

Tel-Aviv 67023, Israel Officer of Clal Industries and

Investments Ltd..

Zvi Livnat Deputy Chairman of the Board Executive Vice President of IDB

3 Azrieli Center, The of Directors Holding; Deputy Chairman of IDB

Triangular Tower, 45th floor, Development; Co-Chief Executive

Tel-Aviv 67023, Israel Officer of Clal Industries and

Investments Ltd..

Refael Bisker Director Chairman of Property and

3 Azrieli Center, The Building Corporation Ltd.;

Triangular Tower, 44th floor, Co-Chairman of Shufersal Ltd.

Tel-Aviv 67023, Israel

Jacob Schimmel Director Co-Managing Director of UKI

7 High field Gardens, Investments.

London NW11 9HD, United

Kingdom

Shay Livnat Director President of Zoe Holdings Ltd.

3 Azrieli Center, The

Triangular Tower, 45th floor,

Tel-Aviv 67023, Israel

Eliahu Cohen Director and Chief Executive Chief Executive Officer of IDB

3 Azrieli Center, The Officer Development.

Triangular Tower 44th floor,

Tel-Aviv 67023, Israel

Page 18 of 22 pages

Isaac Manor (*) Director Chairman of companies in the

103 Kahanman Street, motor vehicle sector of the

Bnei Brak 51553, Israel David Lubinski Ltd. group.

Dori Manor (*) Director Chief Executive Officer of

103 Kahanman Street, companies in the motor vehicle

Bnei Brak 51553, Israel sector of the David Lubinski

Ltd. group.

Abraham Ben Joseph Director Director of companies.

87 Haim Levanon Street,

Tel-Aviv 69345, Israel

Amos Malka Director Director of companies

18 Nahal Soreq Street,

Modi'in 71700, Israel

Prof. Yoram Margalioth Director Senior lecturer (expert on tax

16 Ha'efroni Street, laws) at the Faculty of Law in

Raanana 43724, Israel the Tel Aviv University.

Irit Izakson Director Director of companies.

15 Great Matityahou Cohen

Street,

Tel-Aviv 62268, Israel

Lior Hannes Senior Executive Vice Senior Executive Vice President

3 Azrieli Center, The President of IDB Development; Chief

Triangular Tower, 44th floor, Executive Officer of IDB

Tel-Aviv 67023, Israel Investments (U.K.) Ltd.

Dr. Eyal Solganik Executive Vice President and Executive Vice President and

3 Azrieli Center, The Chief Financial Officer Chief Financial Officer of IDB

Triangular Tower, 44th floor, Development; Chief Financial

Tel-Aviv 67023, Israel Officer of IDB Holding.

Ari Raved Vice President Vice President of IDB

3 Azrieli Center, The Development.

Triangular Tower, 44th floor,

Tel-Aviv 67023, Israel

Gonen Bieber ** Vice President and finance Vice President and Chief

3 Azrieli Center, The manager Financial Officer of Clal

Triangular Tower, 45th floor, Industries and Investments Ltd.;

Tel-Aviv 67023, Israel Vice President and finance

manager of IDB Development;

Finance manager of IDB Holding.

Haim Gavrieli Executive Vice President Chief Executive Officer of IDB

3 Azrieli Center, The Holding; Executive Vice

Triangular Tower, 44th floor, President of IDB Development.

Tel-Aviv 67023, Israel

Page 19 of 22 pages

Haim Tabouch Vice President Comptrolling Vice President Comptrolling of

3 Azrieli Center, The IDB Development; Comptroller of

Triangular Tower, 44th floor, IDB Holding.

Tel-Aviv 67023, Israel

Amir Harosh Comptroller Comptroller of IDB Development.

3 Azrieli Center, The

Triangular Tower, 44th floor,

Tel-Aviv 67023, Israel

Inbal Tzion Vice President and Corporate Vice President and Corporate

3 Azrieli Center, The Secretary Secretary of IDB Development;

Triangular Tower, 44th floor, Corporate Secretary of IDB

Tel-Aviv 67023, Israel Holding.

(*) Dual citizen of Israel and France.

(**) Dual citizen of Israel and Germany.

Page 20 of 22 pages

EXHIBIT 4

Directors and Executive Officers of

IDB HOLDING CORPORATION LTD.

(as of March 10, 2010)

Citizenship is the same as country of address, unless otherwise noted.

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Nochi Dankner Chairman of the Board of Chairman of IDB Holding, IDB

3 Azrieli Center, The Directors Development, Discount Investment

Triangular Tower, 44th floor, Corporation Ltd. and Clal

Tel-Aviv 67023, Israel Industries and Investments Ltd.;

Businessman and director of

companies.

Isaac Manor (*) Deputy Chairman of the Board Chairman of companies in the

103 Kahanman Street, of Directors motor vehicle sector of the

Bnei Brak 51553, Israel David Lubinski Ltd. group.

Arie Mientkavich Vice Chairman of the Board of Chairman of Elron; Deputy

3 Azrieli Center, The Directors Chairman of Gazit-Globe Ltd. and

Triangular Tower, 42nd floor, Chairman of Gazit-Globe Israel

Tel-Aviv 67023, Israel (Development) Ltd.

Zehava Dankner Director Director of companies.

64 Pinkas Street, Tel Aviv

62157, Israel

Lior Hannes Director Senior Executive Vice President

3 Azrieli Center, The of IDB Development; Chief

Triangular Tower, 44th floor, Executive Officer of IDB

Tel-Aviv 67023, Israel Investments (U.K.) Ltd.

Refael Bisker Director Chairman of Property and

3 Azrieli Center, The Building Corporation Ltd.;

Triangular Tower, 44th floor, Co-Chairman of Shufersal Ltd.

Tel-Aviv 67023, Israel

Jacob Schimmel Director Co-Managing Director of UKI

7 High field Gardens, Investments.

London NW11 9HD, United Kingdom

Shaul Ben-Zeev Director Chief Executive Officer of

Taavura Junction, Ramle 72102, Avraham Livnat Ltd.

Israel

Eliahu Cohen Director Chief Executive Officer of IDB

3 Azrieli Center, The Development.

Triangular Tower, 44th floor,

Tel-Aviv 67023, Israel

Dori Manor (*) Director Chief Executive Officer of

103 Kahanman Street, companies in the motor vehicle

Bnei Brak 51553, Israel sector of the David Lubinski

Ltd. group.

Page 21 of 22 pages

Meir Rosenne Director Attorney.

8 Oppenheimer Street, Ramat

Aviv,

Tel Aviv 69395, Israel

Shmuel Dor External Director Head of auditing of subsidiaries

7 Tarad Street, Ramat Gan of Clalit Health Services

52503, Israel

Zvi Dvoresky External Director Chief Executive Officer of Beit

3 Biram Street, Haifa 34986, Kranot Trust Ltd.

Israel

Zvi Livnat Director and Executive Vice Executive Vice President of IDB

3 Azrieli Center, The President Holding; Deputy Chairman of IDB

Triangular Tower, 45th floor, Development; Co-Chief Executive

Tel-Aviv 67023, Israel Officer of Clal Industries and

Investments Ltd..

Haim Gavrieli Chief Executive Officer Chief Executive Officer of IDB

3 Azrieli Center, The Holding; Executive Vice

Triangular Tower, 44th floor, President of IDB Development.

Tel-Aviv 67023, Israel

Avi Fischer Executive Vice President Executive Vice President of IDB

3 Azrieli Center, The Holding; Deputy Chairman of IDB

Triangular Tower, 45th floor, Development; Co-Chief Executive

Tel-Aviv 67023, Israel Officer of Clal Industries and

Investments Ltd..

Dr. Eyal Solganik Chief Financial Officer Chief Financial Officer of IDB

3 Azrieli Center, The Holding; Executive Vice

Triangular Tower, 44th floor, President and Chief Financial

Tel-Aviv 67023, Israel Officer of IDB Development.

Haim Tabouch Comptroller Comptroller of IDB Holding; Vice

3 Azrieli Center, The President Comptrolling of IDB

Triangular Tower, 44th floor, Development.

Tel-Aviv 67023, Israel

(*) Dual citizen of Israel and France.

Page 22 of 22 pages

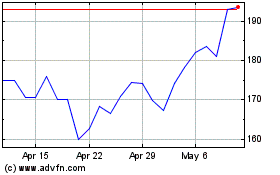

Nova (NASDAQ:NVMI)

Historical Stock Chart

From May 2024 to Jun 2024

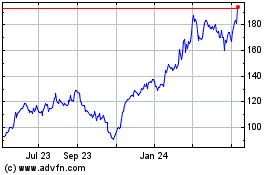

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Jun 2023 to Jun 2024