64% Sequential Revenue Increase to $11.4 Million and Record

Quarterly Net Income of $1.7 Million; Company Expects Trend to

Continue REHOVOT, Israel, November 3 /PRNewswire-FirstCall/ -- Nova

Measuring Instruments Ltd. (NASDAQ:NVMI), provider of leading edge

stand alone metrology and the market leader of integrated metrology

solutions to the semiconductor process control market, today

reported its 2009 third quarter financial results. Highlights for

the Third Quarter of 2009 - Total revenues of $11.4 million, up 64%

sequentially and 29% from the third quarter of 2008 - Gross margins

of 48%, up from 41% in the second quarter of 2009 and 24% in the

third quarter of 2008 - Record high quarterly GAAP net income of

$1.7 million, or $0.08 per diluted share - Continued market share

gains 2009 Third Quarter Results Total revenues for the third

quarter of 2009 were $11.4 million, an increase of 29% relative to

the third quarter of 2008, and an increase of 64% relative to the

second quarter of 2009. Gross margin for the third quarter of 2009

was 48%, compared with 24% in the third quarter of 2008 and 41% in

the second quarter of 2009. Operating expenses in the third quarter

of 2009 were $4.0 million, compared with $4.7 million in the third

quarter of 2008, and $3.0 million in the second quarter of 2009. On

a GAAP basis, the company reported record net income of $1.7

million in the third quarter of 2009, or $0.08 per diluted share.

This compares to a GAAP net loss of $2.6 million, or $0.14 per

share, for the third quarter of 2008, and a net loss of $0.1

million for the second quarter of 2009. On a non-GAAP basis, which

excludes stock-based compensation and inventory write-off charges,

the company reported record net income of $1.8 million in the third

quarter of 2009, or $0.09 per diluted share. This compares with a

non-GAAP net loss of $1.7 million, or $0.09 per share, in the third

quarter of 2008, and breakeven results in the second quarter of

2009. The company generated $1.9 million in cash from operating

activities during the third quarter of 2009. Total cash reserves

increased to $16.1 million at the end of the third quarter of 2009.

Management Comments "As anticipated, third quarter results showed

excellent sequential improvement and a real turnaround compared to

the third quarter of last year", commented Gabi Seligsohn,

President and CEO of Nova. "We doubled our gross margins and

reported a swing of over $4 million from a net loss of $2.6 million

in the third quarter of 2008 to a net profit of $1.7 million in the

third quarter of 2009, on improved revenues which grew 29%. In

addition, our order patterns remain strong and we expect this trend

to continue". "Looking forward, sales of both our Integrated and

Stand Alone solutions are well-positioned for further growth,

because they enable cost-effective migration to lower technology

nodes, while still using existing process equipment. Another

positive sign is that we have begun to receive orders related to

capacity expansions, driven by consumer demand for mobile computing

devices such as netbooks and high end cellular devices. Given the

significant increase we are continuing to see in our bookings, we

expect to continue and show strong financial performance in the

coming quarters". The Company will host a conference call today,

November 3, 2009, at 8:30am ET. To participate, please dial in the

US: 1-888-668-9141; or internationally: +972-3-918-0609. A

recording of the call will be available on Nova's website, within

24 hours following the end of the call. In addition, the conference

call will also be webcast live from a link on Nova's website at

http://www.nova.co.il/. This press release provides financial

measures that exclude non-cash charges for stock-based

compensation, inventory write-off and impairment charges and are

therefore not calculated in accordance with generally accepted

accounting principles (GAAP). Management believes that these

non-GAAP financial measures provide meaningful supplemental

information regarding Nova's performance because they reflect our

operational results and enhances management's and investors'

ability to evaluate Nova's performance before charges considered by

management to be outside Nova's ongoing operating results. The

presentation of this non-GAAP financial information is not intended

to be considered in isolation or as a substitute for the financial

information prepared and presented in accordance with GAAP.

Management believes that it is in the best interest of its

investors to provide financial information that will facilitate

comparison of both historical and future results and allows greater

transparency to supplemental information used by management in its

financial and operational decision making. A reconciliation of each

GAAP to non-GAAP financial measure discussed in this press release

is contained in the accompanying financial tables. About Nova Nova

Measuring Instruments Ltd. develops, produces and markets advanced

integrated and stand alone metrology solutions for the

semiconductor manufacturing industry. Nova is traded on the NASDAQ

& TASE under the symbol NVMI. The Company's website is

http://www.nova.co.il/. This press release contains forward-looking

statements within the meaning of safe harbor provisions of the

Private Securities Litigation Reform Act of 1995 relating to future

events or our future performance, such as statements regarding

trends, demand for our products, expected deliveries, transaction,

expected revenues, operating results, earnings and profitability.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance

or achievements expressed or implied in those forward looking

statements. These risks and other factors include but are not

limited to: unanticipated consequences of the global economic

crisis, our dependency on a single integrated process control

product line; the highly cyclical nature of the markets we target;

our inability to reduce spending during a slowdown in the

semiconductor industry; our ability to respond effectively on a

timely basis to rapid technological changes; risks associated with

our dependence on a single manufacturing facility; our ability to

expand our manufacturing capacity or marketing efforts to support

our future growth; our dependency on a small number of large

customers and small number of suppliers; risks related to our

intellectual property; changes in customer demands for our

products; new product offerings from our competitors; changes in or

an inability to execute our business strategy; unanticipated

manufacturing or supply problems; changes in tax requirements;

changes in customer demand for our products; risks related to

currency fluctuations; and risks related to our operations in

Israel. We cannot guarantee future results, levels of activity,

performance or achievements. The matters discussed in this press

release also involve risks and uncertainties summarized under the

heading "Risk Factors" in Nova's Annual Report on Form 20-F for the

year ended December 31,2008 filed with the Securities and Exchange

Commission on March 30, 2009. These factors are updated from time

to time through the filing of reports and registration statements

with the Securities and Exchange Commission. Nova Measuring

Instruments Ltd. does not assume any obligation to update the

forward-looking information contained in this press release. NOVA

MEASURING INSTRUMENTS LTD. CONSOLIDATED BALANCE SHEET (U.S. dollars

in thousands) As of As of September 30, December 31, 2009 2008

CURRENT ASSETS Cash and cash equivalents 15,546 19,325 Short-term

interest-bearing bank deposits 47 97 Trade accounts receivable

5,602 2,783 Inventories 4,709 6,862 Other current assets 1,212

1,086 27,116 30,153 LONG-TERM ASSETS Long-term interest-bearing

bank deposits 525 544 Other Long-term assets 170 157 Severance pay

funds 2,266 2,141 2,961 2,842 FIXED ASSETS, NET 2,196 2,796 Total

assets 32,273 35,791 CURRENT LIABILITIES Trade accounts payable

1,516 3,480 Deferred income 699 2,385 Other current liabilities

3,357 4,042 5,572 9,907 LONG-TERM LIABILITIES Liability for

employee severance pay 3,238 3,152 Deferred income 242 351 Other

long-term liability 38 40 3,518 3,543 SHAREHOLDERS' EQUITY 23,183

22,341 Total liabilities and shareholders' equity 32,273 35,791

NOVA MEASURING INSTRUMENTS LTD. QUARTERLY CONSOLIDATED STATEMENTS

OF OPERATIONS (U.S. dollars in thousands, except per share data)

Three months ended September 30, June 30, September 30, 2009 2009

2008 REVENUES Product sales 8,717 4,631 5,535 Services 2,677 2,333

3,305 11,394 6,964 8,840 COST OF REVENUES Product sales 3,699 2,050

2,872 Inventory write-off -- -- 850 Services 2,191 2,091 2,956

5,890 4,141 6,678 GROSS PROFIT 5,504 2,823 2,162 OPERATING EXPENSES

Research & Development expenses, net 1,850 1,183 2,301 Sales

& Marketing expenses 1,523 1,293 1,631 General &

Administration Expenses 594 484 760 3,967 2,960 4,692 OPERATING

PROFIT (LOSS) 1,537 (137) (2,530) INTEREST INCOME (EXPENSES), NET

153 43 (94) NET INCOME (LOSS) FOR THE PERIOD 1,690 (94) (2,624) Net

income (loss) per share: Basic 0.09 (0.00) (0.14) Diluted 0.08

(0.00) (0.14) Shares used for calculation of net income(loss) per

share: Basic 19,417 19,378 19,378 Diluted 19,942 19,378 19,378 NOVA

MEASURING INSTRUMENTS LTD. YEAR TO DATE CONSOLIDATED STATEMENTS OF

OPERATIONS (U.S. dollars in thousands, except per share data)

Nine-months ended September 30, September 30, 2009 2008 REVENUES

Product sales 16,993 22,645 Services 7,085 10,096 24,078 32,741

COST OF REVENUES Product sales 7,333 10,884 Inventory write-off --

850 Services 6,554 9,363 13,887 21,097 GROSS PROFIT 10,191 11,644

OPERATING EXPENSES Research & Development expenses, net 4,816

6,383 Sales & Marketing expenses 3,989 6,113 General &

Administration expenses 1,581 2,461 Impairment loss on equipment

related to Hypernex assets and liabilities acquisition -- 633

10,386 15,590 OPERATING LOSS (195) (3,946) INTEREST INCOME, NET 132

96 NET LOSS FOR THE PERIOD (63) (3,850) Basic net loss per share

(0.00) (0.20) Shares used for calculation of basic net loss per

share 19,391 19,366 NOVA MEASURING INSTRUMENTS LTD. QUARTERLY

CONSOLIDATED STATEMENTS OF CASH FLOWS (U.S. dollars in thousands)

Three months ended September 30, June 30, September 30, 2009 2009

2008 CASH FLOW - OPERATING ACTIVITIES Net income (loss) for the

period 1,690 (94) (2,624) Adjustments to reconcile net loss to net

cash used in operating activities: Depreciation and amortization

311 276 323 Amortization of deferred stock-based compensation 130

100 123 Increase (decrease) in liability for employee (2) 144 (33)

termination benefits, net Net recognized losses (gains) on

Investments 4 (4) 4 Increase in trade accounts Receivables (622)

(2,441) (208) Decrease in inventories 790 636 1,703 Decrease

(increase) in other current and long term assets 45 (608) 314

Decrease in trade accounts payables (662) (102) (494) Increase

(decrease) in current liabilities 1,039 (2) (1,918) Increase

(decrease) in short and long term deferred income (857) (44) 526

Net cash from (used in) operating activities 1,866 (2,139) (2,284)

CASH FLOW - INVESTMENT ACTIVITIES Increase in short-term -- -- (46)

interest-bearing bank deposits Decrease (increase) in short-term

investments 4,595 -- (4,243) Proceeds from held to maturity

securities -- -- 1,506 Proceeds (investments) in long-term deposits

(2) 141 9 Additions to fixed assets (72) (24) (165) Net cash from

(used in) investment Activities 4,521 117 (2,939) CASH FLOW -

FINANCING ACTIVITIES Shares issued under employee share-based plans

142 -- -- Net cash from investment activities 142 -- -- Increase

(decrease) in cash and cash equivalents 6,529 (2,022) (5,223) Cash

and cash equivalents - beginning of period 9,017 11,039 13,744 Cash

and cash equivalents - end of period 15,546 9,017 8,521 NOVA

MEASURING INSTRUMENTS LTD. YEAR TO DATE CONSOLIDATED STATEMENTS OF

CASH FLOWS (U.S. dollars in thousands) Nine months ended September

30, September 30, 2009 2008 CASH FLOW - OPERATING ACTIVITIES Net

loss for the period (63) (3,850) Adjustments to reconcile net loss

to net cash used in operating activities: Depreciation and

amortization 907 1,005 Amortization of deferred stock-based

Compensation 336 442 Increase in liability for employee termination

benefits, net 28 94 Impairment loss on equipment -- 633 Net

recognized losses on investments -- 17 Decrease (increase) in trade

accounts Receivables (2,819) 3,898 Decrease in inventories 1,946

571 Decrease in other current and long term assets 134 207 Decrease

in trade accounts payables and other long term liabilities (1,964)

(3,561) Decrease in current liabilities (600) (3,117) Increase

(decrease) in short and long term deferred income (1,795) 1,079 Net

cash used in operating activities (3,890) (2,582) CASH FLOW -

INVESTMENT ACTIVITIES Decrease (increase) in short-term

interest-bearing bank deposits 50 (118) Increase in short-term and

long-term investments -- (8,554) Proceeds from held to maturity

securities -- 3,700 Proceeds from long-term deposits 19 1,643

Additions to fixed assets (100) (904) Net cash used in investment

activities (31) (4,233) CASH FLOW - FINANCING ACTIVITIES Shares

issued under employee share-based plans 142 12 Net cash from

financing activities 142 12 Decrease in cash and cash equivalents

(3,779) (6,803) Cash and cash equivalents - beginning of period

19,325 15,324 Cash and cash equivalents - end of period 15,546

8,521 NOVA MEASURING INSTRUMENTS LTD. DISCLOSURE OF NON-GAAP NET

INCOME (LOSS) (U.S. dollars in thousands, except per share data)

Three months ended September 30, June 30, September 30, 2009 2009

2008 GAAP Net income (loss) for the period 1,690 (94) (2,624)

Non-GAAP Adjustments: Stock based compensation expenses 130 100 123

Inventory write-off -- -- 850 Non-GAAP Net income (loss) for the

period 1,820 6 (1,651) Non-GAAP net income (loss) per share: Basic

0.09 0.00 (0.09) Diluted 0.09 0.00 (0.09) Shares used for

calculation of non-GAAP net income (loss) per share: Basic 19,417

19,378 19,378 Diluted 19,942 19,378 19,378 Nine months ended

September 30, September 30, 2009 2008 GAAP Net loss for the period

(63) (3,850) Non-GAAP Adjustments: Stock based compensation

expenses 336 442 Inventory write-off -- 850 Impairment loss on

equipment related to Hypernex assets and liabilities acquisition --

633 Non-GAAP Net income (loss) for the period 273 (1,925) Non-GAAP

net income (loss) per share: Basic 0.01 (0.10) Diluted 0.01 (0.10)

Shares used for calculation of non-GAAP net income (loss) per share

Basic 19,391 19,366 Diluted 19,749 19,433 Company Contact: Dror

David, Chief Financial Officer Nova Measuring Instruments Ltd. Tel:

+972-8-938-7505 E-mail: Investor relations Contacts: Ehud Helft /

Kenny Green GK Investor Relations Tel: +1-646-201-9246 E-mail:

http://www.nova.co.il/ DATASOURCE: Nova Measuring Instruments Ltd

CONTACT: Company Contact: Dror David, Chief Financial Officer, Nova

Measuring Instruments Ltd., Tel: +972-8-938-7505, E-mail: ;

Investor relations Contacts: Ehud Helft / Kenny Green, GK Investor

Relations, Tel: +1-646-201-9246, E-mail:

Copyright

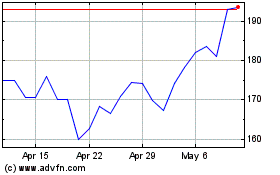

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Jun 2024 to Jul 2024

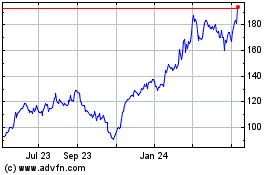

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Jul 2023 to Jul 2024