Gradually Improving Market Conditions; Bookings Increase REHOVOTH,

Israel, May 10 /PRNewswire-FirstCall/ -- Nova Measuring

Instruments, Ltd. (NASDAQ:NVMI), the market leader in integrated

measurement and process control for the semiconductor industry,

today reported breakeven results for the first quarter of 2006.

Total revenues for the first quarter of 2006 were $10.3 million, a

106% increase over revenues of $5.0 million reported for the first

quarter of 2005 and a 16% sequential increase over revenues of $8.8

million reported for the fourth quarter of 2005. The Company

reported a gross profit of $4.8 million compared with gross profit

of $1.4 million for the first quarter of 2005 and gross profit of

$3.8 million for the previous quarter. Gross margin for the first

quarter of 2006 was 46% compared with 27% for the first quarter of

2005 and 42% for the previous quarter. Total operating expenses

were $5.0 million for the first quarter of 2006 compared with $5.3

million in the first quarter of 2005, and $5.4 million in the

fourth quarter of 2005. Net results were close to breakeven,

compared with a net loss of $3.8 million for the first quarter of

2005, or $0.25 per share, and net loss of $1.5 million, or $0.10

per share, for the fourth quarter of 2005. Cash reserves at the end

of the first quarter of 2006 were $21.1 million, a decrease of $1.7

million compared to the end of previous quarter. "During 2006, we

began to see positive changes in market conditions," said Dr. Giora

Dishon, President and CEO. "The overall trends are favorable,

although visibility on the precise timing of revenue remain low.

Bookings have increased relative to the previous quarters of 2005,

including orders for delivery in the following quarters for

integrated metrology as well as stand-alone systems; our backlog at

the end of the quarter is better than the previous quarters, and we

continue to see positive demand for the new NovaScan 3090 product

series, both direct from major end-users and through the process

equipment manufacturers. We expect to continue to increase

deliveries of the NovaScan 3090 systems for all applications:

Oxide, Copper and Optical CD, in the following quarters, as the

industry continues moving to technology nodes of 65nm and below,"

Dr. Dishon added, "We are very excited about the acquisition of

HyperNex, Inc., which manufactures stand-alone wide-angle X-ray

diffraction metrology systems, and we are confident of the long

term prospects of this technology for the most advanced

semiconductors high-volume manufacturing. Acquiring the assets of

HypeNex will strengthen our offering in the high-end stand-alone

metrology market and will expand our array of process control

solutions." The Company will host a conference call today, May 10,

2006, at 9:00am EST. To participate please dial in the U.S:

1-866-652 8972 UK: 0-800-917-9141 or internationally:

+972-3-918-0609 at least 5 minutes before the start of the call. A

recording of the call will be avialble on Nova's website, within 24

hours following the end of the call. About Nova Nova Measuring

Instruments Ltd. develops, designs and produces integrated process

control systems in the semiconductor manufacturing industry. Nova

provides a broad range of integrated process control solutions that

link between different semiconductor processes and process

equipment. The Company's website is http://www.nova.co.il/. This

press release contains forward-looking statements within the

meaning of safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 relating to future events or our

future performance, such as statements regarding trends, demand for

our products, expected deliveries, the effect of the pending

Hypernex, Inc. transaction, expected revenues, operating results,

and earnings. Forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause our actual

results, levels of activity, performance or achievements to be

materially different from any future results, levels of activity,

performance or achievements expressed or implied in those

forward-looking statements. These risks and other factors include

but are not limited to: our ability to successfully complete our

acquisition and integration of HyperNex, Inc., changes in customer

demands for our products, new product offerings from our

competitors, changes in or an inability to execute our business

strategy, unanticipated manufacturing or supply problems, changes

in tax requirements and changes in customer demand for our

products. We cannot guarantee future results, levels of activity,

performance or achievements. The matters discussed in this press

release also involve risks and uncertainties summarized under the

heading ``Risk Factors' in Nova's Annual Report on Form 20-F for

the year ended December 31, 2004 filed with the Securities and

Exchange Commission on June 28, 2005. These factors are updated

from time to time through the filing of reports and registration

statements with the Securities and Exchange Commission. Nova

Measuring Instruments Ltd. does not assume any obligation to update

the forward-looking information contained in this press release.

NOVA MEASURING INSTRUMENTS LTD. QUARTERLY CONSOLIDATED STATEMENTS

OF OPERATIONS (U.S. dollars in thousands, except per share data)

Q1-2006 Q1-2005 Q4-2005 (corrected) REVENUES Product sales 7,797

3,378 6,601 Services 2,485 1,618 2,236 10,282 4,996 8,837 COST OF

REVENUES Product sales 3,656 2,063 2,939 Services 1,857 1,571 2,152

5,513 3,634 5,091 GROSS PROFIT 4,769 1,362 3,746 OPERATING EXPENSES

Research & Development expenses, net 2,297 2,917 2,280 Sales

& Marketing expenses 1,672 1,710 2,007 General &

Administration expenses 1,048 711 1,089 5,017 5,338 5,376 OPERATING

LOSS 248 3,976 1,630 INTEREST INCOME, NET 207 193 105 NET LOSS 41

3,783 1,525 Loss per share 0.00 0.25 0.10 Shares used for

calculation of loss per share 15,478 15,339 15,457 NOVA MEASURING

INSTRUMENTS LTD. CONSOLIDATED BALANCE SHEET (U.S. dollars in

thousands) March 31, 2006 December 31, 2005 CURRENT ASSETS Cash and

cash equivalents 4,893 5,776 Short-term interest-bearing bank

deposits 1,471 1,206 Short-term investments 3,100 3,500 Held to

maturity securities 4,830 4,388 Trade accounts receivable, net

6,031 6,841 Inventories 6,658 6,606 Other current assets 1,104

1,141 28,087 29,458 LONG-TERM ASSETS Long-term interest-bearing

bank deposits 2,655 2,974 Held to maturity securities 4,115 4,952

Other Long-term assets 279 262 Severance pay funds 2,265 2,186

9,314 10,374 FIXED ASSETS, NET 2,582 2,507 Total assets 39,983

42,339 CURRENT LIABILITIES Trade accounts payable 5,295 5,744 Other

current liabilities 6,926 8,880 12,221 14,624 LONG-TERM LIABILITIES

Liability for employee termination 2,997 2,907 benefits Deferred

income 1,204 1,264 Other long-term liability 100 100 4,301 4,271

SHAREHOLDERS' EQUITY Ordinary shares 46 46 Additional paid-in

capital 73,672 73,636 Accumulated other comprehensive 4 (18) income

Accumulated deficit (50,261) (50,220) Total shareholders' equity

23,461 23,444 Total liabilities and shareholders' equity 39,983

42,339 DATASOURCE: Nova Measuring Instruments, Ltd CONTACT: Company

Contact: Dror David, Chief Financial Officer, Nova Measuring

Instruments Ltd., Tel: +972-8-938-7505, E-mail: ,

http://www.nova.co.il/, Investor relations Contacts: Ehud Helft /

Kenny Green, GK International Investor Relations, Tel:

+1-866-704-6710, E-mail : ,

Copyright

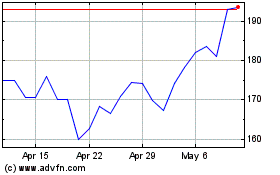

Nova (NASDAQ:NVMI)

Historical Stock Chart

From May 2024 to Jun 2024

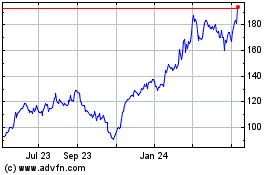

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Jun 2023 to Jun 2024