REHOVOTH, Israel, April 11 /PRNewswire-FirstCall/ -- Nova Measuring

Instruments, Ltd. (NASDAQ:NVMI), the market leader in integrated

measurement and process control for the semiconductor industry,

today announced results for the fourth quarter and full year 2005

(the comparable figures below are 2004 restated figures). Total

revenues for the fourth quarter of 2005 were $8.8 million, an 11%

decrease relative to revenues of $10.0 million of the fourth

quarter of 2004 and a 1% sequential decrease relative to revenues

of $8.9 million for the third quarter of 2005. Total revenues for

2005 were $30.1 million, an 18% decrease relative to revenues of

$36.8 million in 2004. Net loss for the fourth quarter of 2005 was

$1.5 million, or $0.10 per share, compared with a net loss of $0.3

million, or $0.02 per share, for the fourth quarter of 2004 and net

loss of $1.0 million, or $0.06 per share, for the third quarter of

2005. Net loss in 2005 was $8.4 million, or $0.55 per share,

compared to net loss of $1.4 million, or $0.09 per share, in 2004.

Cash reserves at the end of 2005 were $22.8 million, a decrease of

$1.2 million compared to the third quarter of 2005. "During 2005 we

focused on building our product portfolio, strengthening our

customer relations with leading process equipment and semiconductor

manufacturers, and on expanding our global infrastructure. During

the first quarter of 2006 we began to see positive changes in

market conditions. The bookings stream has increased relative to

the previous quarters, including orders for delivery in the

following quarters, and we expect moderate growth in the following

quarters." said Dr. Giora Dishon, President and CEO. "In addition,

during the first quarter of 2006, we have continued successfully

the proliferation of our new NovaScan 3090 product series, as

stand-alone and integrated metrology for CMP and Optical CD

applications. We have received positive demand through our process

equipment manufacturers and from major end-users for this new

product series and we expect increases in deliveries of the

NovaScan 3090 in the following quarters," continued Dr. Dishon.

Restated financial results for year 2004 The company also announced

that it has completed the restatement of the financial results for

the fiscal year ended December 31, 2004, which was announced during

February 2006. The restatement relates to recognition of revenues,

in transactions that included an upgrade or trade-in option, which

did not comply with generally accepted accounting principles. The

restated revenues for year 2004 are $36.8 million, compared to

previously reported revenues of $40.9 million. The restated net

loss for year 2004 is $1.4 million, or ($0.09) per share, compared

to previously reported net profit of $1.5 million, or $0.10 per

share. The majority of the $4.1 million in revenues improperly

recognized in 2004 is expected to be recognized during 2006 (some

already in Q1/06), as the upgrades and trade-in options are

fulfilled or expire. In addition to restating its financial

statements for 2004, the company also corrected its previously

published results for the first three quarters of 2005, which

resulted in a $0.2 million reduction of revenues for the nine

months ended September 30, 2005. These corrections related mainly

to year 2004 restatement issues, as well as a correction to the

method of apportioning revenues from extended warranty contracts

relating to the first quarter of 2005. Commenting on the restated

results and corrections, Mr. Dror David, CFO, noted, "In the last

two months we have been working intensively to conclude the review

of prior years, and our auditors have completed their audit on the

restatement of year 2004 and their review on the quarterly

corrections of 2005. We appreciate the dedication of our financial

team and the Audit Committee of the Board of Directors in resolving

the restatement issues as promptly as possible. We are confident we

improved our control measures, and are pleased that we are now able

to focus our full attention on realizing our business objectives

and continuing our growth." The full financial statements for 2004,

as restated, are attached as an Exhibit to the Current Report on

Form 6-K furnished by the Company to the Securities and Exchange

Commission, and are also available on Nova's website at

nova_restated_year_2004. The restated quarterly results of 2004 and

the corrected quarterly results of 2005 are available on the

company's website at nova_quarterly_adjustments. The company

intends to file an Amended Annual Report on Form 20-F for the year

ended December 31, 2004 as soon as practicable, and Annual Report

on Form 20-F for the year ended December 31, 2005 in June 2006. The

Company will host a conference call on April 11, 2006, at 12:00

EST. To participate please dial in the US: +1-866-500-4964 or

internationally: +972-3-925-5910 at least 5 minutes before the

start of the call. About Nova Nova Measuring Instruments Ltd.

Develops, designs and produces integrated process control systems

in the semiconductor manufacturing industry. Nova provides a broad

range of integrated process control solutions that link between

different semiconductor processes and process equipment. The

Company's website is http://www.nova.co.il/. This press release

contains forward-looking statements relating to future events or

our future performance and involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance

or achievements expressed or implied in those forward-looking

statements. These risks and other factors include but are not

limited to: our ability to successfully complete our review of our

financial statements and results, the discovery of additional

accounting irregularities, the outcome of our investigation into

accounting irregularities, our ability to implement improvements to

our internal controls and procedures to prevent similar accounting

irregularities in the future, changes in customer demands for our

products, new product offerings from our competitors, changes in or

an inability to execute our business strategy, unanticipated

manufacturing or supply problems, changes in tax requirements and

changes in customer demand for our products. We cannot guarantee

future results, levels of activity, performance or achievements.

The matters discussed in this press release also involve risks and

uncertainties summarized under the heading ``Risk Factors' in

Nova's Annual Report on Form 20-F for the year ended December 31,

2004 filed with the Securities and Exchange Commission on June 28,

2005. These factors are updated from time to time through the

filing of reports and registration statements with the Securities

and Exchange Commission. Nova Measuring Instruments Ltd. does not

assume any obligation to update the forward-looking information

contained in this press release. Nova Measuring Instruments Ltd.

Quarterly Consolidated Statements of Operations (US dollars in

thousands, except per share data) Q4-2005 Q4-2004 Q3-2005 (As

restated) (Corrected) REVENUES Product sales 6,601 8,503 6,658

Services 2,236 1,452 2,244 8,837 9,955 8,902 COST OF REVENUES

Product sales 2,939 3,733 3,313 Services 2,152 1,782 2,156 5,091

5,515 5,469 GROSS PROFIT 3,746 4,440 3,433 OPERATING EXPENSES

Research & Development expenses, net 2,280 2,370 1,990 Sales

& Marketing expenses 2,007 1,898 1,510 General &

Administration expenses 1,089 642 1,068 5,376 4,910 4,568 OPERATING

LOSS 1,630 470 1,135 INTEREST INCOME, NET 105 180 133 NET LOSS

1,525 290 1,002 Loss per share 0.10 0.02 0.06 Shares used for

calculation of loss per share 15,457 15,309 15,453 Nova Measuring

Instruments Ltd. Consolidated Statements of Operations (U.S.

dollars in thousands, except per share data) Year ended December

31, 2005 2004 2003 (As restated) REVENUES Product sales 21,985

29,274 21,152 Services 8,157 7,532 5,536 30,142 36,806 26,688 COST

OF REVENUES Product sales 11,413 14,396 10,270 Services 7,893 6,715

6,265 19,306 21,111 16,535 GROSS PROFIT 10,836 15,695 10,153

OPERATING EXPENSES Research and development expenses, net 9,301

8,665 8,561 Sales and marketing expenses 6,950 6,647 6,534 General

and administrative expenses 3,626 2,331 1,898 Other operating

income - - (2,203) 19,877 17,643 14,790 OPERATING LOSS 9,041 1,948

4,637 INTEREST INCOME, NET 627 528 425 NET LOSS FOR THE YEAR 8,414

1,420 4,212 Loss per share 0.55 0.09 0.28 Shares used in

calculation of loss per share 15,437 15,259 14,994 Nova Measuring

Instruments Ltd. Consolidated Balance Sheet (U.S. dollars in

thousands) As of December 31, 2005 2004 (As restated) CURRENT

ASSETS Cash and cash equivalents 5,776 12,171 Short-term

interest-bearing bank deposits 1,206 1,916 Short-term investments

3,500 - Held to maturity securities 4,388 8,583 Trade accounts

receivable, net 6,841 6,850 Inventories 6,606 6,354 Other current

assets 1,141 1,169 29,458 37,043 LONG-TERM ASSETS Long-term

interest-bearing bank deposits 2,974 2,145 Held to maturity

securities 4,952 5,989 Other Long-term assets 262 382 Severance pay

funds 2,186 2,288 10,374 10,804 FIXED ASSETS, NET 2,507 2,119 Total

assets 42,339 49,966 CURRENT LIABILITIES Trade accounts payable

5,744 4,795 Other current liabilities 8,880 6,539 14,624 11,334

LONG-TERM LIABILITIES Liability for employee termination benefits

2,907 3,075 Deferred income 1,264 3,831 Other long-term liability

100 145 4,271 7,051 SHAREHOLDERS' EQUITY Ordinary shares 46 46

Additional paid-in capital 73,636 73,333 Accumulated other

comprehensive income (18) 8 Accumulated deficit (50,220) (41,806)

Total shareholders' equity 23,444 31,581 Total liabilities and

shareholders' equity 42,339 49,966 Company Contact: Dror David,

Chief Financial Officer Nova Measuring Instruments Ltd. Tel:

+972-8-938-7505 E-mail: http://www.nova.co.il/ Investor relations

Contacts: Ehud Helft / Kenny Green GK Investor Relations Tel:

+1-866-704-6710 E-mail: DATASOURCE: Nova Measuring Instruments, Ltd

CONTACT: Company Contact: Dror David, Chief Financial Officer, Nova

Measuring Instruments Ltd., Tel: +972-8-938-7505, E-mail: .

Investor relations Contacts: Ehud Helft / Kenny Green, GK Investor

Relations, Tel: +1-866-704-6710, E-mail: ,

Copyright

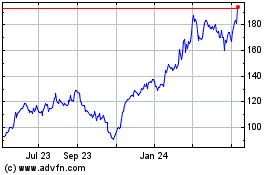

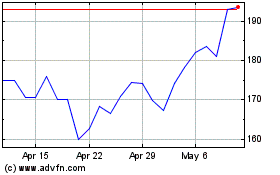

Nova (NASDAQ:NVMI)

Historical Stock Chart

From May 2024 to Jun 2024

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Jun 2023 to Jun 2024