0001826671

false

0001826671

2023-11-09

2023-11-09

0001826671

NIR:CommonStockParValue0.0001PerShareMember

2023-11-09

2023-11-09

0001826671

NIR:WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchatnge Act of 1934

Date of Report (Date of earliest event reported): November 9, 2023

Near Intelligence, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39843 |

|

85-3187857 |

| (State or other jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer |

| incorporation) |

|

|

|

Identification No.) |

100

W Walnut St., Suite A-4 Pasadena

California 91124 |

|

91124 |

| (Address of principal executive offices) |

|

(Zip Code) |

(628) 889-7680

(Registrant’s

telephone number, including area code)

Not Applicable

(Former name or former address, if changed since

last report)

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbols |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

NIR |

|

The

Nasdaq Global Market |

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

NIRWW |

|

The

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

November 9, 2023, Near Intelligence, Inc. (the “Company”, and together with its subsidiaries “we”,

“us” or “our”) received a letter from the Listing Qualifications Department of the Nasdaq Stock Market LLC

(“Nasdaq”) indicating that, as a result of the previously disclosed resignation of Mini Krishnamoorthy from the

Company’s Board of Directors on October 24, 2023, the Company is not in compliance with Nasdaq Listing Rule 5605(c)(2), which

requires that the Audit Committee of the Board of Directors of the Company be comprised of at least three independent directors. The

letter also indicated that the Company will be afforded until the earlier of its next annual shareholders’ meeting or

October 24, 2024 (or if the next annual shareholders' meeting is held prior to April 22, 2024, then April 22, 2024) to replace the

member on the Audit Committee in order to regain compliance pursuant to Nasdaq Listing Rule 5605(c)(4).

Item 8.01 Other Events.

We finance our operations

primarily through cash generated from operations, cash from the sale of debt and equity securities and borrowings under secured financing

arrangements. As previously disclosed, in order to continue as a going concern, we need to raise

additional capital to fund our operating and investing cash flow needs and to avoid a default under our credit facility, which requires

us to maintain a certain minimum liquidity.

Also, as previously disclosed,

in connection with the ongoing investigation into allegations of financial mismanagement and potential fraudulent actions taken by our

former chief executive officer and former chief financial officer, we determined that our previously issued financial statements should

not be relied upon. The investigation is still ongoing and we will not be able to publish revised historical financial statements or financial

statements covering current periods until it is completed, which we do not anticipate will be in the near future.

As a result of the public

uncertainty over our financial condition and business prospects created by these recent announcements, our ability to raise capital to

fund our operations is severely challenged. Our liquidity is limited and will not be sufficient to fund our current operating plan beyond

the next couple of months. As previously disclosed, we are exploring various strategic alternatives. We have retained restructuring and

other financial advisors, including GLC Advisors & Co., LLC as our investment banker, to assist us with exploring, reviewing and evaluating

our options to address our liquidity, capital structure and cash flows from operations, including disposition of assets, strategic partnerships,

access to capital, cost saving measures, including workforce reductions, and other transactions. There can be no assurance of completion

of any particular transaction or course of action or a defined timeline for completion or that any of these measures alone or in combination

would be sufficient to raise sufficient capital or improve our liquidity position in order to continue as a going concern. We are also

in discussions with our current lenders on additional forbearances, financing possibilities and other strategic options.

It appears increasingly unlikely

that we will be able to implement one or more of the aforementioned strategic options outside of a court supervised reorganization process,

at least with respect to the Company and our U.S. operations, which may also be the best path to preserve the value of our business and

assets for the benefit of our stakeholders. Such a filing would subject us to the risks and uncertainties associated with bankruptcy proceedings

and may place holders of our equity securities and junior debt at significant risk of losing all of their investment in us.

Cautionary Statements Regarding Trading in the Company’s Securities.

Our securityholders are cautioned

that trading in our securities, especially during this highly uncertain time, is highly speculative and poses substantial risks.

Accordingly, we urge extreme caution with respect to existing and future investments in our securities.

Cautionary Note Regarding Forward-Looking Statements.

This Current Report on Form

8-K includes statements that are, or may be deemed, “forward-looking statements.” In some cases, these forward-looking statements

can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,”

“expects,” “plans,” “intends,” “may,” “could,” “might,” “will,”

“should,” “approximately” or, in each case, their negative or other variations thereon or comparable terminology,

although not all forward-looking statements contain these words. These forward-looking statements reflect the current beliefs and expectations

of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We caution you that

forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and

liquidity and the development of the industry in which we operate may differ materially from the forward-looking statements contained

herein. Any forward-looking statements that we make in this Form 8-K speak only as of the date of such statement, and we undertake no

obligation to update such statements to reflect events or circumstances after the date of this Form 8-K or to reflect the occurrence of

unanticipated events. Our forward-looking statements in this Form 8-K include, but are not limited to, statements about our evaluation

of our strategic options, the potential consequences of not being able to raise additional liquidity, our ability to continue as a going

concern and other statements regarding our strategy and future operations, performance and prospects, among others. These forward-looking

statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance

that future developments affecting us will be those anticipated. These forward-looking statements involve a number of risks, uncertainties

(some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from

those expressed or implied by these forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 9, 2023 |

|

| |

|

| |

NEAR INTELLIGENCE, INC. |

| |

|

| |

By: |

/s/ John Faieta |

| |

|

John Faieta |

| |

|

Interim Chief Financial Officer |

- 3 -

v3.23.3

Cover

|

Nov. 09, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity File Number |

001-39843

|

| Entity Registrant Name |

Near Intelligence, Inc.

|

| Entity Central Index Key |

0001826671

|

| Entity Tax Identification Number |

85-3187857

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100

W Walnut St.

|

| Entity Address, City or Town |

Suite A-4 Pasadena

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91124

|

| City Area Code |

(628)

|

| Local Phone Number |

889-7680

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

NIR

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of Common Stock for $11.50 per share

|

| Trading Symbol |

NIRWW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NIR_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NIR_WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

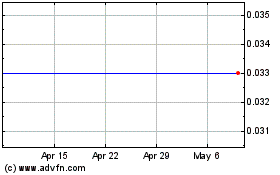

Near Intelligence (NASDAQ:NIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Near Intelligence (NASDAQ:NIR)

Historical Stock Chart

From Jul 2023 to Jul 2024