0001826671

false

0001826671

2023-09-18

2023-09-18

0001826671

NIR:CommonStockParValue0.0001PerShareMember

2023-09-18

2023-09-18

0001826671

NIR:WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember

2023-09-18

2023-09-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 18, 2023

Near Intelligence, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39843 |

|

85-3187857 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

100 W Walnut St.,

Suite A-4

Pasadena, California 91124 |

|

91124 |

| (Address of principal executive offices) |

|

(Zip Code) |

(628) 889-7680

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

Title

of each class |

|

Trading

Symbols |

|

Name

of each exchange on

which registered |

| Common Stock, par value $0.0001 per share |

|

NIR |

|

The

Nasdaq Global Market |

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

NIRWW |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

Minimum Bid Price

On September 18, 2023, Near

Intelligence, Inc. (the “Company”) received a letter from the Listing Qualifications Department (the “Staff”)

of the Nasdaq Stock Market LLC (“Nasdaq”) indicating that, based upon the closing bid price of the Company’s

common stock for the 30 consecutive business day period from August 4, 2023 through September 15, 2023, the Company did not meet the minimum

bid price of $1.00 per share required for continued listing on the Nasdaq Global Market pursuant to Nasdaq Listing Rule 5450(a)(1). The

letter also indicated that the Company will be afforded a period of 180 calendar days, or until March 18, 2024 (the “Bid Price

Compliance Period”), in which to regain compliance pursuant to Nasdaq Listing Rule 5810(c)(3)(A).

In order to regain compliance

with Nasdaq’s minimum bid price requirement, the Company’s common stock must maintain a minimum closing bid price of $1.00

for at least ten consecutive business days during the Bid Price Compliance Period. In the event the Company does not regain compliance

by the end of the Bid Price Compliance Period, the Company may be eligible for additional time to regain compliance. To qualify for additional

time, the Company must (i) submit an application to transfer to the Nasdaq Capital Market, (ii) meet the continued listing requirement

for the market value of its publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception

of the bid price requirement, and (iii) provide written notice of its intention to cure the deficiency during the second compliance period

by effecting a reverse stock split, if necessary. If the Company meets these requirements, the Company may be granted an additional 180

calendar days to regain compliance. However, if it appears to Nasdaq that the Company will be unable to cure the deficiency, or if the

Company is not otherwise eligible for the additional cure period, Nasdaq will provide notice that the Company’s common stock will

be subject to delisting.

Minimum Market Value of Publicly Held Shares

On September 18, 2023, the

Company also received a letter from the Staff indicating that, based upon the Company’s market value of publicly held shares (“MVPHS”)

for the 30 consecutive business day period from August 4, 2023 through September 15, 2023, the Company did not maintain the minimum MVPHS

of $15,000,000 required for continued listing on the Nasdaq Global Market pursuant to Nasdaq Listing Rule 5450(b)(2)(C). The letter also

indicated that the Company will be afforded a period of 180 calendar days, or until March 18, 2024 (the “MVPHS Compliance

Period”), in which to regain compliance pursuant to Nasdaq Listing Rule 5810(c)(3)(D).

In order to regain compliance

with Nasdaq’s minimum MVPHS requirement, the minimum MVPHS of the Company’s common stock must meet or exceed $15,000,000 for

a minimum of ten consecutive business days during the MVPHS Compliance Period. In the event the Company does not regain compliance by

the end of the MVPHS Compliance Period, the Company will receive written notification that its securities are subject to delisting. Alternatively,

the Company may consider applying to transfer the Company’s securities to the Nasdaq Capital Market. The Company intends to monitor

the MVPHS of its common stock between now and March 18, 2024 and will consider the various options available to the Company if its common

stock does not trade at a level that is likely to regain compliance.

Minimum Market Value of Listed Securities

On September 19, 2023, the

Company received a letter from the Staff indicating that, based upon the Company’s market value of listed securities (“MVLS”)

for the 30 consecutive business day period from August 7, 2023 through September 18, 2023, the Company did not maintain the minimum MVLS

of $50,000,000 required for continued listing on the Nasdaq Global Market pursuant to Nasdaq Listing Rule 5450(b)(2)(A). The letter also

indicated that the Company will be afforded a period of 180 calendar days, or until March 18, 2024 (the “MVLS Compliance Period”),

in which to regain compliance pursuant to Nasdaq Listing Rule 5810(c)(3)(C).

In order to regain compliance

with Nasdaq’s minimum MVLS requirement, the minimum MVLS of the Company’s common stock must meet or exceed $50,000,000 for

a minimum of ten consecutive business days during the MVLS Compliance Period. In the event the Company does not regain compliance by the

end of the MVLS Compliance Period, the Company will receive written notification that its securities are subject to delisting. Alternatively,

the Company may consider applying to transfer the Company’s securities to the Nasdaq Capital Market. The Company intends to monitor

the MVLS of its common stock between now and March 18, 2024 and will consider the various options available to the Company if its common

stock does not trade at a level that is likely to regain compliance.

The foregoing letters received

from Nasdaq have no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on

the Nasdaq Global Market under the symbol “NIR”, subject to the Company’s compliance with the other listing requirements

of the Nasdaq Global Market.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Appointment of Class I Director

On September 19, 2023, the

Board of Directors (the “Board”) of the Company appointed Sherman Edmiston III to serve as a Class I director

of the Company, effective immediately.

Mr. Edmiston, age 61, has

served as the Managing Member of HI CapM Advisors, Ltd, a firm providing strategic and financial advice to corporations, private equity

firms and credit funds, since August 2016. In addition to serving on the Company’s Board, Mr. Edmiston is currently serving on the

board of directors of ARKO Corp. (Nasdaq: ARKO), one of the largest operators of convenience stores and wholesalers of fuel in the United

States. Mr. Edmiston formerly served on the board of directors of Arch Resources (NYSE: ARCH) and Harvey Gulf International Marine and

is also a director on several private company boards, including GTT Communications, Inc., a multinational provider of telecommunications

and internet services; Key Energy Services, Inc., a leading provider of oilfield services in the Permian Basin and California; and Real

Alloy, the market leader in third party aluminum recycling and specification alloy production. From November 2009 through December 2015,

Mr. Edmiston served as managing director of Zolfo Cooper LLC (now Alix Partners), where he provided financial and operational advisory

services to corporations and investment funds. Mr. Edmiston holds a B.S. in Mechanical Engineering from Arizona State University and an

M.B.A. from the University of Michigan.

As compensation for his service

on the Board, Mr. Edmiston will receive the Company’s standard compensation for non-employee directors, consisting of: (i) an annual

cash retainer of $96,000, payable in monthly installments; and (ii) an award of time-based restricted stock units (“RSUs”)

for a number of shares of the Company’s common stock with an aggregate value equal to $90,000, which award shall vest in full on

March 27, 2024. The value of Mr. Edmiston’s RSU award reflects a prorated amount, based on the timing of his appointment.

Appointment of Class III Director

On September 19, 2023, the

Board also appointed Richard J. Salute to serve as a Class III director of the Company, effective immediately. Additionally, Mr. Salute

has been appointed to serve as chairperson of the Audit Committee of the Board (the “Audit Committee”).

Mr. Salute, age 77, served

as Capital Markets and SEC Practice Director at J.H. Cohn and CohnReznick LLP from 2004 to 2014. Prior to that, he spent 29 years, from

1972 to 2001, at Arthur Andersen managing complex audits for public and private companies. During his tenure, he was responsible for providing

clients with strategic planning services as well as consulting on corporate finance, mergers and acquisitions, and process evaluation.

His clients included large multinational companies and entrepreneurial start-ups. In addition to his client responsibilities, he started

three business lines for Arthur Andersen: the Enterprise Group (New York Metropolitan area), the Technology Practice (New York office)

and the Bankruptcy and Corporate Recovery Practice (nationwide). More recently, Mr. Salute served as Chief Financial Officer of PAVmed

Inc. from June 2014 to September 2015. Mr. Salute also served as a director of Walker Innovation Inc. from 2015 through 2018. He currently

serves on the board of directors, the governance and compensation committees, and as chair of the audit committee and audit committee

financial expert for Newtek One, Inc. (NASDAQ: NEWT) and is a member of the American Institute of Certified Public Accountants and The

New York Society of Certified Public Accountants. Mr. Salute has more than 39 years of audit, accounting, and tax experience. Mr. Salute

holds a Bachelor of Business Administration, Accounting from Adelphi University and is a Certified Public Accountant in the State of New

York.

As compensation for his service

on the Board, Mr. Salute will receive the Company’s standard compensation for non-employee directors and committee chairs, consisting

of: (i) an annual cash retainer of $96,000, payable in monthly installments and (ii) an award of time-based RSUs for a number of shares

of the Company’s common stock with an aggregate value equal to $102,500, which award shall vest in full on March 27, 2024. The value

of Mr. Salute’s RSU award reflects a prorated amount, based on the timing of his appointment. In addition, to compensate Mr. Salute

for the extraordinary time and effort required for onboarding and his future services as the chairperson of the Audit Committee, Mr. Salute

will receive an additional $20,000 of cash compensation, payable in ten equal monthly installments, with the first payment to be made

in October 2023.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: September

22, 2023 |

|

|

| |

|

|

| |

NEAR

INTELLIGENCE, INC. |

| |

|

|

| |

By: |

/s/

Rahul Agarwal |

| |

|

Rahul

Agarwal |

| |

|

Chief

Financial Officer |

3

v3.23.3

Cover

|

Sep. 18, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 18, 2023

|

| Entity File Number |

001-39843

|

| Entity Registrant Name |

Near Intelligence, Inc.

|

| Entity Central Index Key |

0001826671

|

| Entity Tax Identification Number |

85-3187857

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100 W Walnut St.

|

| Entity Address, Address Line Two |

Suite A-4

|

| Entity Address, City or Town |

Pasadena

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91124

|

| City Area Code |

(628)

|

| Local Phone Number |

889-7680

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

NIR

|

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of Common Stock for $11.50 per share

|

| Trading Symbol |

NIRWW

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NIR_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NIR_WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

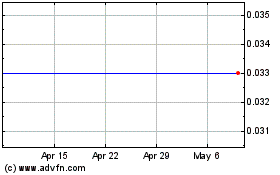

Near Intelligence (NASDAQ:NIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Near Intelligence (NASDAQ:NIR)

Historical Stock Chart

From Jul 2023 to Jul 2024