Mitcham Industries - Aggressive Growth

July 20 2011 - 8:00PM

Zacks

Mitcham Industries, Inc. (MIND) is coming off of a

record-setting quarter that has estimates darting higher. They did

issue more shares, but that has actually moved estimates even

higher.

Valuations look as pretty solid, especially considering earnings

are expecting to grow by more than 4 fold over the next 2

years.

Company Description

Mitcham Industries, Inc. supplies geophysical equipment for the

oil and gas industry, environmental agencies, universities and

other organizations. They have offices around the world and their

products are used in both land and marine projects.

Record Quarter

The first quarter for fiscal 2012 broke some company records

when results came out on Jun 6. Revenues jumped 61% to all-time

high of $26.5 million. That led to a 155% surge in net income.

Earnings per share came in at $0.58, which was an impressive 26

cents higher than the Zacks Consensus Estimate. Mitcham has now

surprised in 4 of the past 5 quarters.

Estimates Look Great

Normally when a company issues additional shares, which Mitcham

did in late June, you would see estimates trickle lower due to the

dilution. But, analysts have been raising estimates, viewing the

additional capital as a bigger positive than the additional shares

are a negative.

Full-year forecasts for this fiscal year are up 16 cents, to

$1.21 since the earnings release and subsequent stock offering.

Next year's projections jumped 58 cents, to $1.83.

Last year Mitcham made just 0.34 per share, which means earnings

should grow over 400% over the next 2 years.

Valuations are Cheap

On top of the aggressive growth story, shares are also showing

some very good valuations. The forward P/E is just 16 times right

now. MIND's price to sales looks high, above 2 times, but that is

about average for the industry. Shares are at 1.8 times book

value.

The Chart

Sure the shares of MIND have been on a surge, but take a look at

the earnings trend that has driven that move. Additionally,

estimates are at the highest level in 5 years, yet shares are still

well below the high points during that time. Looks like there is

plenty of upside for this Zacks #1 Rank (Stong Buy).

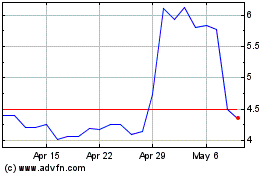

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From May 2024 to Jun 2024

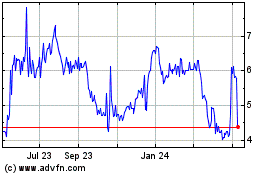

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From Jun 2023 to Jun 2024